2nd Quarter 2024 Letter to Investors

June 30th, 2024June 30, 2024

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

– Benjamin Graham

The first six months of the year have resulted in reasonable gains for our clients who adopted FLI’s philosophy of investing in different asset classes and having a prudent, customized asset allocation. This diversification permitted our typical client to be exposed to what worked in the first half of the year, which was predominantly “growth shares.” Many of our clients also benefitted from exposure to the disruptive technology of artificial intelligence (AI). Specifically, once again, equity market appreciation has been biased to large-cap growth shares led by several companies (predominantly NVIDIA). At the same time, large-cap value-oriented companies, many paying dividends, were somewhat left in the dust. This is a pattern that began last year, which rewarded investors in the large-cap growth index as it trounced the large-cap value index.

The phenomena of a handful of super large Information Technology, Communication Services, and Consumer Discretionary companies driving markets forward resulted in a bifurcation between the S&P 500 Index (market cap weighted) versus the S&P 500 Equal Weighted Index.

In other words, if you were exposed to NVIDIA, Microsoft, Alphabet, Eli Lilly, Meta Platforms, Amazon.com, and several others, you enjoyed significant returns for the past six months. In particular, Microsoft, Apple, NVIDIA, and Alphabet are responsible for over 52%of the S&P 500 Index return through the first half of the year. If you were predominantly exposed to value-type companies, those primarily paying and growing dividends, which were not talking up the AI phenomenon, your returns were meager or modestly down in the second quarter. Our discipline at FLI is to try to expose our clients to both styles through our defensive and traditional equity baskets. Both baskets include strategies that expose our clients to both NVIDIA and other technology-oriented companies, while bookending that exposure with more traditional value-oriented companies, particularly those that grow

dividends on an annual basis and have fundamental balance sheet strength. We typically also include a modest exposure to fixed income, which for our clients was modestly higher over the first six months but provided a reasonable rate of interest and ballast to our overall investment plans.

This approach takes into consideration numerous current factors including:

- We do not anticipate a recession in the next twelve months. GDP growth should be in the 2% range.

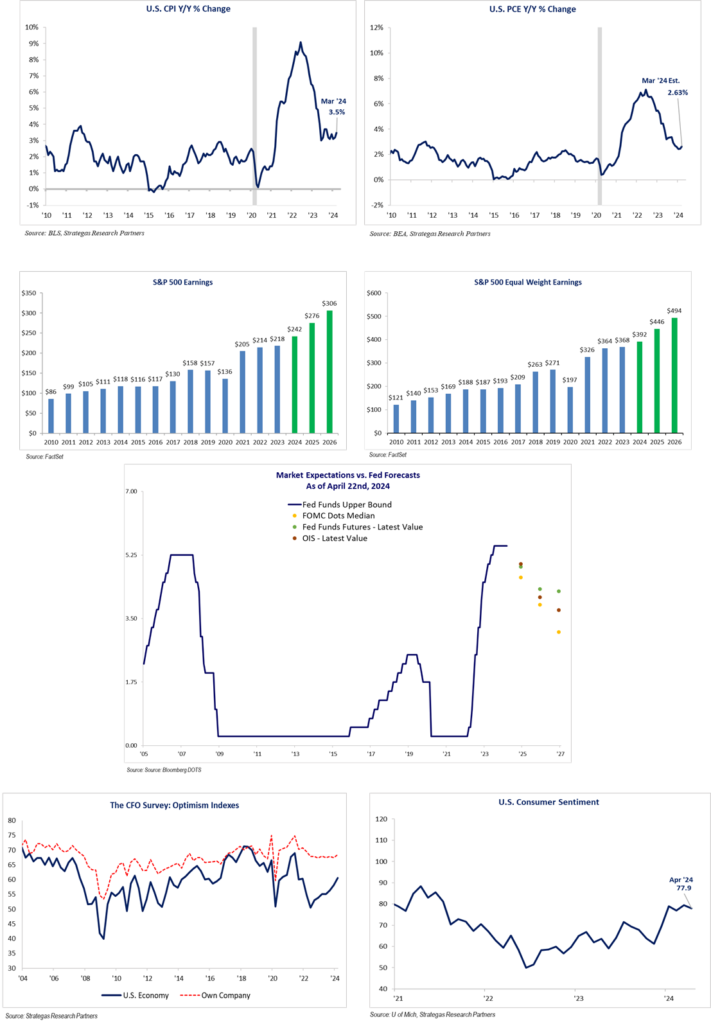

- We expect inflation to continue to modestly and slowly abate.

- We believe that the Federal Reserve will keep interest rates higher for longer, but do expect one interest rate reduction later this year or possibly two.

- Geopolitical turmoil will continue and could possibly get worse.

- Domestic political uncertainty has just increased with the first Presidential debate and President Biden deciding not to run for re-election. We could be in uncharted political waters, and we are in an important election cycle with significant economic policy consequences.

- Earnings for the S&P 500 Index companies remain reasonably good, led by technology-oriented companies.

- Employment remains robust with the unemployment rate around 4%.

- Embedded inflation from the last three years remains a headwind for a portion of the U.S. population. This is impacting consumer behavior and affecting a number of consumer-oriented companies, at least in the short term.

Given this mixed bag of economic and political factors, sticking with a long-term asset allocation that attempts to navigate these uncertain waters continues to make sense to us. Growth shares are trading at somewhat high multiples as evidenced by the cap weighted S&P 500 Index (however nothing like growth companies in 2000). Value companies, which drag down the S&P 500 Equal Weighted Index, seem like bargains but do not possess the growth in earnings that leading technology-oriented companies continue to demonstrate. Dividends and annual dividend growth seem to be out of favor for now, but we expect these types of companies will contribute decent performance over the long term as they have in the past. Small-cap companies have gone basically nowhere, either growth oriented or more value oriented (year-to-date the Russell 2000 Index is up a meager 1.7%). This area does present an opportunity as expressed by one of our small-cap outside managers in a recent meeting.

In the commercial real estate arena, higher interest rates and distress in office buildings has led to dismal results as measured by the REIT index. The exception probably is in real estate related to data centers, which are being gobbled up by large technology-oriented companies. The residential real estate market has been impacted by high mortgage rates and higher home prices, resulting in a lack of supply. (In our opinion, many do not want to give up a low mortgage rate on an existing home to move and secure a loan at a much higher rate.) Affordability is becoming an issue for some new home buyers.

As of this writing, the uncertainty and lack of popularity of the two apparent candidates for President may present some volatility going forward. This, coupled with two raging wars, provides for further uncertainty. On the other hand, growing earnings and high employment while inflation slows down provides some optimism. The ultimate impact in terms of earnings growth from the expansion of AI usage also represents a growth opportunity for corporate earnings. As stated, however, the happiness thus far in equity markets has not broadened out and seems to favor, for the most part, the leading large technology-oriented companies. Not the best situation for all investors. When this will change typically depends on when we face a recession; potential tax law changes impacting economic growth favorably or unfavorably; and, of course, the actions of the Federal Reserve.

All of our strategies in the defensive and traditional equity baskets have appreciated thus far this year. As stated previously, those with greater exposure to large technology-oriented companies fared decisively better. Having said that, it appears valuations favor a tilt towards more value-oriented companies. The growth bias can continue given the unknown horizon for AI-oriented companies. Whereas the prospective multiple on earnings for the S&P 500 Index for 2025 feels somewhat high, it should be remembered that the makeup of the S&P has changed dramatically over the past 35 years. There are more growth-oriented, innovative, technology-oriented companies and much less smoke stack or industrial companies. These, asset light and technology heavy companies trade at a higher price-to-earnings ratio.

We have shaved some of the big technology-oriented companies over the quarter. Most notably NVIDIA, which is still a major holding in several of our strategies as it has appreciated 150% year-to-date. Our dividend-oriented strategy, which has modestly appreciated for the first two quarters, has seen dividend growth on average of 7.3% so far this year with 67% of the companies

thus far reporting dividend increases (the strategy was slightly negative for the second quarter). This average dividend increase is more than twice the Personal Consumption Expenditures (PCE) inflation rate.

The second half of the year and beyond represents some challenges, but markets typically climb a wall of worry. The election is in November, and its outcome could affect tax policy in the coming years. The two wars present potential volatility given the uncertainty of possible escalation. The direction of inflation during the balance of the year will be instrumental in the interest rate policy of the Federal Reserve. Should inflation not abate sufficiently to move the Fed to decrease short term rates, this could result in equity market disappointment. Also, at some point both investors and the government should consider our federal debt as it approaches $35 trillion and the interest burden crowds out worthy government investment. Fiscal sanity needs to prevail going forward to stem annual deficits and our total debt.

Where does all of this leave us as investors? As the opening quote states, we need a plan not predicated on “beating” the markets, but a sane path to growing our wealth in a compounding way. This can only be achieved, in our opinion, by avoiding substantial losses through smart diversification, and bookending the majority of our asset allocation among growth and value-oriented equity strategies. In addition, quality fixed income, private real estate, and some possible alternative strategies can also contribute to the prudent diversification we feel is needed to navigate uncertainty over the longer term. Of course, we customize asset allocations for each client depending on their personal circumstances and long-term goals.

Enjoy the summer and feel free to contact me or anyone on our investment and wealth management teams to assist you.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

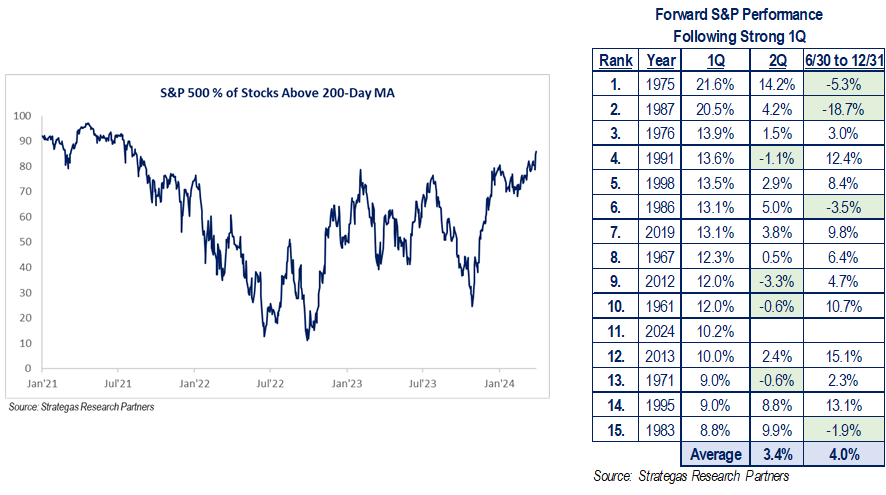

PS: From a historical standpoint, when the S&P 500 Index is up 12% or more in the first six months of the year, there is further happiness in the last six months of the year 79% of the time over the past 70 years! History is only a guide.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of July 25, 2024 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of June 30, 2024, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2024 by First Long Island Investors, LLC. All rights reserved.