2024 Investment Outlook

January 19th, 20242024 and Beyond

“The big money is not in the buying and selling, but in the waiting.” – Charlie Munger

2023 turned out to be a very strong bounce back year for our clients with significant gains made across all equity-related strategies. Charlie Munger’s philosophy of “waiting,” shared by FLI, was key to this past year’s success and will continue to guide us in the future. This famous investor, who recently passed away at 99, was Warren Buffett’s closest partner. He believed in the power of compounding and the merits of long-term investing (waiting) in the best companies to generate real wealth over a longer time horizon. In our opinion, he believed that, rather than trying to determine the best entry point to make an investment, or to time one’s sale towards the market top, the more powerful way to create wealth was through “waiting.” In other words, buy and hold! Being a long-term, patient investor is a philosophy we at FLI have always preached since our inception 40 years ago. Nothing has changed. The concept of holding on to good investments over the long term permits their intrinsic value to unfold and compound. The challenge, however, is in having the discipline to exercise the patience to hold on, even if you have made a great deal of money with an investment in a stock or a piece of real estate where their fundamentals remain intact and valuations continue to be attractive. It also means not to sell, and to hold on, when a loss on paper is incurred, but careful analysis indicates that true long-term value and opportunity remains.

The last two years have been a lesson in when not to sell high-quality companies whose stock prices are beaten down because of monetary or fiscal policy changes, and the same holds true for real estate. In both cases, the dramatic change in monetary policy reflected in the unprecedented and stunning 525 basis point increase in the fed funds rate over 16 months from a near zero base led to substantial losses on paper for first-rate companies in which we were invested during 2022. It also led to valuation and timing issues with real estate, to which some of our clients have exposure.

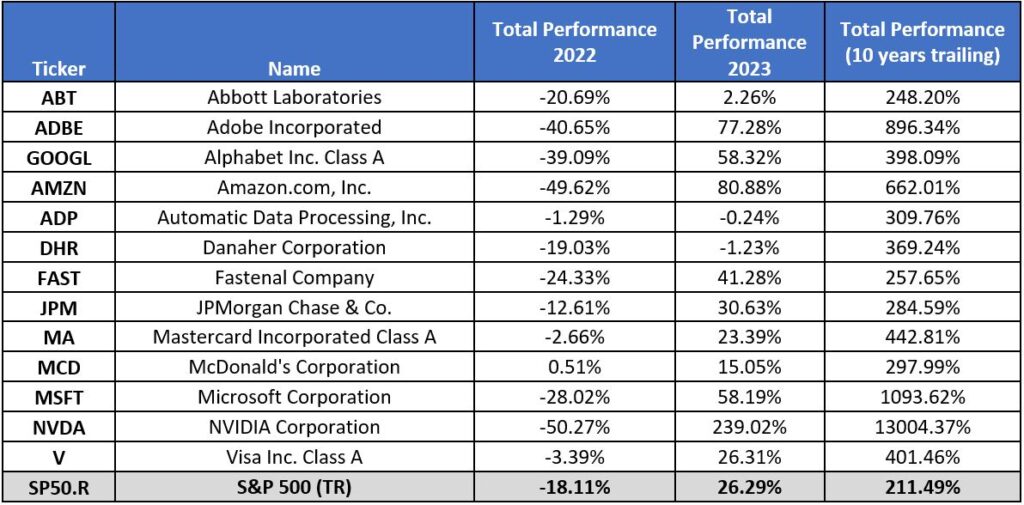

The following table demonstrates where in the short term (i.e., the last two years), holding on to these certain highly regarded companies paid off, whether in growth or value companies. The table also shows how holding on for the long term (i.e., the last ten years) also led to even greater wealth accumulation. Long-term investing requires not giving in to the emotion of taking a loss after a substantial decline, such as in 2022, and the fortitude to continue holding certain companies for many years even after achieving significant gains along the way:

The above table shows how one could have emotionally thrown in the towel with many of the companies listed above at the end of or during the extreme downturn of 2022. Having the gumption to hold on led to substantial gains in 2023. We at FLI, and the outside managers that we invest with, held on to most, if not all, of the companies listed above that had been owned in an FLI strategy before the downturn. In virtually all of the above instances, having held on for 10 years through 2023 would have yielded meaningful appreciation. Making the decision to continue holding, and not to sell, led to deferring the payment of income taxes as individual taxpayers, allowing returns to continue compounding. This is the essence of Charlie Munger’s philosophy, in our opinion: making money by waiting. In many of the above companies, we (along with many other investors) are still “waiting” as we recognize that superior fundamentals remain intact. Growth in earnings and/or growing dividends, as well as reasonable long-term valuations, are still available with these companies, as well as with others, in our opinion.

The characteristics of solid businesses include being among the market leaders, having strong balance sheets, and prudently allocating capital. Most, if not all, successfully navigated the recent adversity of the COVID-19 pandemic, high inflation, supply chain issues, and rapidly rising interest rates. Those investors with the courage not to sell when these stocks went down, or for that matter when substantial appreciation was achieved along the way over a 10-year period, again were rewarded handsomely by “waiting” over the long term. Just think about investor regret if they had sold Amazon.com or Mastercard several years ago even after realizing substantial gains. There was still much more to come. That patience continues to be tested as we are currently enduring two wars raging in Eastern Europe and the Middle East (which could become even more disruptive in early 2024), as well as having navigated a mini-banking crisis in early 2023, where four domestic banks failed and a mini-financial panic ensued.

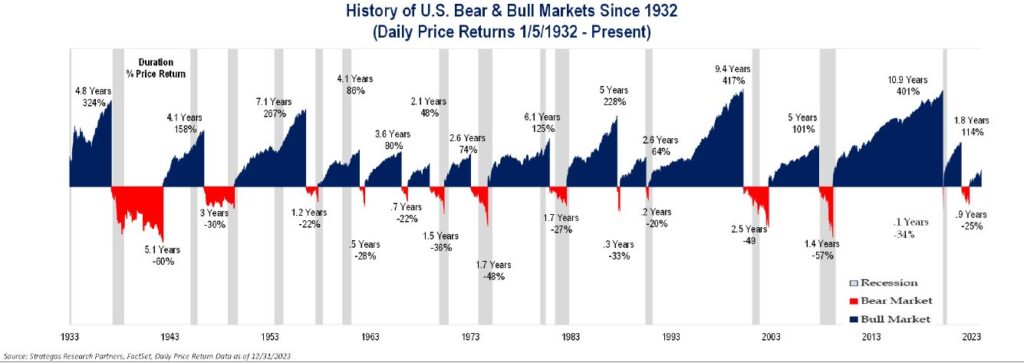

Nobody ever said being a long-term investor is easy and not painful at times. Over the 40 years we have been advising our clients, we have witnessed many difficult periods (the proverbial Wall of Worry), including domestic political uncertainty quite frequently, although this appears to be the worst political uncertainty we as a nation have faced in our lifetimes. Although bull markets feel wonderful, bear markets feel worse than bull markets feel good. Bull markets, however, typically last longer and more than compensate for bear markets, especially for the better-than-average companies we endeavor to own:

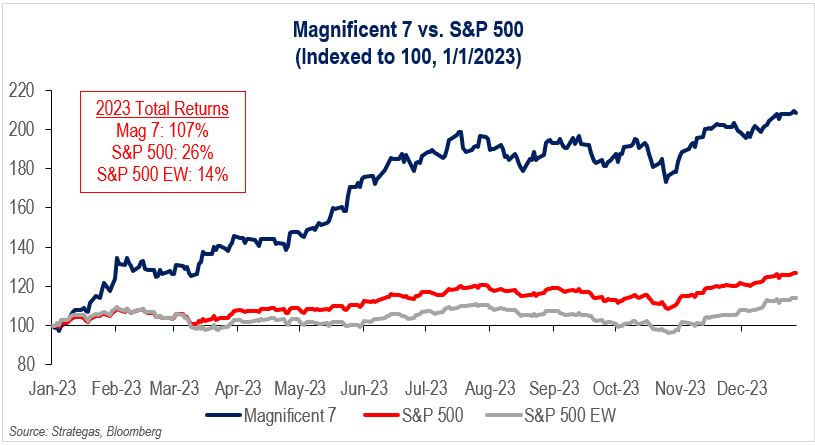

Now 2023 was an unusual year with the “Magnificent 7” leading the S&P 500 Index as the chart above shows. This chart shows that a small group of the largest Information Technology, Consumer Discretionary, and Communication Services growth companies dominated the S&P 500 Index, leaving the average large-cap company somewhat in the dust (actually large-cap growth companies outpaced large-cap value companies by a stunning 31.2%). Growth companies significantly outpacing value companies tends to happen from time to time, as has the opposite (including most recently in 2022). At FLI, we invest in both growth and value companies that meet our stringent investment criteria. A growth company typically has more rapidly growing earnings over a five-year time horizon or longer (following a secular growth trend), while a value company is typically financially strong with steady earnings growth that may pay a dividend and raise its dividend on an annual basis. Sound familiar? Of course, we preach having both as book ends to a prudent equity asset allocation. The companies in our Dividend Growth strategy have raised their dividends, on average, for 27 consecutive years (although there will be an occasional exception where a company will defer the raise for a short period based on sound corporate strategy). The strategy has a compound annual return of 10.9% net of all fees and expenses since inception despite being in our defensive basket.

The future, 2024 and beyond, to us is not very different from what the past has been except we hope there is no repeat of the once-in-100-year pandemic we just lived through. We continue to believe that current interest rates hovering around 4% and inflation dropping to around 3%-3.5% now is indicative of an investment environment where long-term appreciation is achievable through owning solid businesses or select real estate. In the future, however, rates could rise above 4%, perhaps to 5%, and inflation could surprise by trending back up (given the serious and uncertain geopolitical outlook, and oil as a component of inflation could surprise on the upside), which could lead to a more difficult investment environment over the short term. In either case, staying invested in the right companies or real estate requires continued thorough analysis of fundamentals and valuation. It also requires us to research and understand the disruptive nature of new technologies, such as artificial intelligence. Over the past three decades, the internet, cell phones, social media, cloud computing, and new medications have led to prosperity, increased productivity, and improved medical outlooks. They also led to the appreciation of many companies that we have held and continue to hold in our portfolios. Artificial intelligence is just beginning to benefit many companies. Just like with social media companies, however, some restraint and caution may be necessary. We believe this disruptive technology will continue to lead to investment gains for us in the future through productivity enhancements, margin improvement, and novel solutions to existing problems; however, it may also create problems that we have not thought of yet.

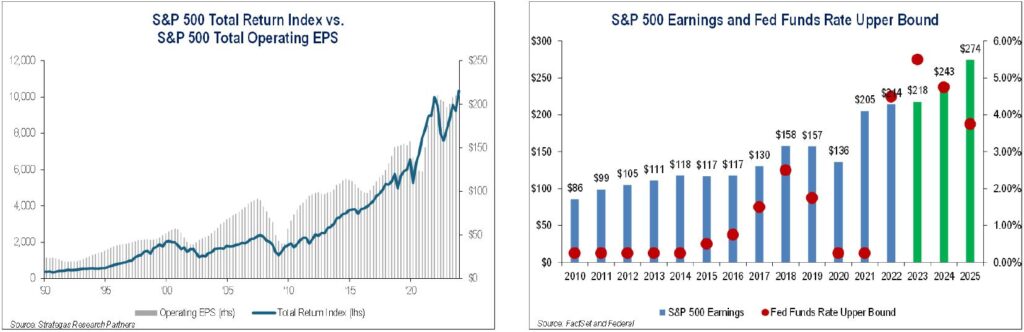

The following chart on the left shows that over many decades the stock market has appreciated (typically tracking increasing earnings) despite recessions and varying levels of inflation. We at FLI strongly suggested in our annual thought piece last January, and through our subsequent quarterly letters, that the U.S. economy was more resilient and would avoid recession in 2023. We still feel that way looking into 2024. With robust employment, wage growth above the level of inflation, COVID-19 behind us, most supply chain disruptions resolved, a strong banking system, and continued Federal spending (including previously enacted legislation that has not yet been spent as well as spending by the current administration leading up to the election later this year), we believe the United States economy will slow but not dip into recession until perhaps sometime in 2025, if not later. With that economic backdrop coupled with projections for lower rates and higher earnings for the S&P 500 Index this year and the following year (as seen in the chart below on the right), further stock market appreciation is quite possible in 2024.

We continue to remind our clients on a regular basis that they own pieces of businesses, not just stock symbols, or they are invested in what we believe is well-located industrial or residential real estate. Many of our clients own bonds as well, although we still recommend an underweight allocation to fixed income as the real return, after inflation, remains meager. If we have done our analysis correctly, each will throw off increased earnings and cash flow for growth-oriented companies, higher cash dividends or improved valuations for value companies, or a fixed rate of interest periodically paid on bonds and high-yielding real estate. Of course, the value of each of these can and will be subject to periodic fluctuations caused by greed, fear, and uncertainty in the shorter term. 2024 still has the potential for volatility especially early in the year given the run up in the “Magnificent 7,” a potential government shutdown, domestic political strife, and the potential for the wars in the Middle East and Eastern Europe to escalate. Over the longer term, however, we believe that wealth accumulation can prevail through having a prudent asset allocation that includes investments like these.

2024

There is no shortage of uncertainty for this coming year including the previously mentioned wars, a presidential election cycle with the two leading candidates appearing to be very unpopular, the growing U.S. debt, a slowing economy, a chilled relationship with China, and the probability of Iran developing a nuclear bomb, just to name several. On the other hand, we have yet to see the disruptive positive impact of artificial intelligence on many different companies (not just the Information Technology giants) as well as the benefits of the newly approved and efficacious weight loss drugs. Could a drug slowing Alzheimer’s disease be just around the corner? At long last, wage growth seems to be outpacing inflation leading to a healthier, almost fully-employed consumer after two years of inflation outpacing wage growth. In addition, rising home prices post-pandemic have given home owners a boost in wealth while the demand for new homes should continue to help the economy. With mortgage rates now declining from the recent high of 7.8% to 6.6%, home ownership will hopefully become more affordable, although still not nearly as affordable as it was only three years ago. Finally, some provisions of the Tax Cuts and Jobs Act of 2017 affecting estate planning, personal income tax rates, and deductions for state and local taxes will change on January 1, 2026 unless Congress acts before then. More to come from FLI on this as it relates to prudent wealth and estate planning.

As long-term investors, there is no free lunch, and there is no guaranty we will all live to the ripe old age of 99 as Charlie Munger did. So, our investing strategy is customized for each client to provide a prudent asset allocation that aims to meet their goals and needs. For most clients, a prudent asset allocation is one that is underweight fixed income with a healthier dose of FLI’s defensive strategies (led by our Dividend Growth strategy) as well as traditional equity exposure (both growth and value) to provide meaningful appreciation while hopefully smoothing out the inevitable volatility. Additionally, it may also include some exposure to real estate where appropriate. We also may utilize a multi-strategy hedged investment that is less correlated to the equity markets when warranted.

We offer as part of our equity exposure access to different equity asset class categories to recognize that over time large-cap domestic companies will not always carry the day as they did in 2023. There are opportunities within small- and mid-cap companies as well as the laggard international investing, where we have been underweight for more than a decade. Then again, having exposure to these different equity asset class categories can keep our clients in the investment game when the inevitable rotation from one category to another gets its day with investors. Some say this will happen in 2024 as it relates to small- and mid-cap stocks, especially if the U.S. economy does not enter a recession in 2024 (which is something we do not expect to happen). This rotation seems to have started in the last two months of 2023 as market performance broadened with small- and mid-caps as well as more traditional large-cap value stocks rallying. These two months also saw significant flows of capital into equities as the Fed pivoted to holding interest rates steady and predicted rate cuts in 2024 above what was originally projected as mentioned earlier.

Final Thoughts

We are experienced investors, not economists, although we do watch economic trends closely. We do not make formal economic forecasts but would prefer to guide you to a tailored, prudent asset allocation among our four baskets (Security, Defensive, Traditional Equity, and Private Investments) depending on your personal investment goals, risk tolerance, and other factors. We would rather focus our attention on selecting what we believe to be attractive investments in stocks, bonds, and real estate or other private investments. Our experience tells us that by doing this over the longer term, we can help grow your wealth. Not by predicting what month the next recession will hit, or which party will win this next election cycle. We really do not know exactly when the Fed will cut rates and how many times, other than we believe rate cuts will happen sometime in 2024.

Our goal this coming year and beyond will again be to help you continue to invest like Charlie Munger, where the ability to “wait” will make you more money than predicting the bottom or top of a market cycle. As we look back over our 40-year history as a company, we can say that “waiting” and letting our wealth compound while taking care of everyday financial needs for our clients has worked well. If you look at some of our portfolios you will see the wisdom behind “waiting.” Think Microsoft, Mastercard, Visa, Adobe, Automatic Data Processing, NVIDIA, Fastenal, JPMorgan Chase, and so many others.

On an organizational note, I am both happy and sad to announce that after 30 years with FLI, Steve Juchem, our Executive Vice President and CFO, will be retiring on June 30th to pursue personal goals. Steve, as a senior officer and partner, has been an important contributor to the growth and success of FLI. He has also provided great advice to our clients in many areas, especially concerning estate and tax planning. Of course, we wish Steve much success in his future personal endeavors.

Steve will be replaced by our current Senior Vice President, Tax and Accounting, Teri Vobis, who most of you know. Teri has been with FLI for 11 years and has done an outstanding job. We know she will accept her new responsibilities with the same energy and commitment she has always shown. Please join us in thanking Steve and wishing him a long, happy, and fulfilling retirement, and wishing Teri much success in her new position.

As we look forward to this new year, we remain available to all of you should you have any questions concerning our outlook. This new year, as with each of our last 40 years, has its own “Wall of Worry,” which we feel confident we can successfully climb on behalf of our clients and colleagues.

Wishing you a healthy, happy, and prosperous New Year!

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of January 19, 2024 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of December 31, 2023, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2024 by First Long Island Investors, LLC. All rights reserved.