2020 Investment Outlook

January 16th, 20202020—A New Year, A New Decade

Listen to the report.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

-Robert Kiyosaki

The above quote really sums up the mission of First Long Island investors in representing clients over the long term. It is how we view 2020 and beyond while having just experienced the ups of 2019 and the unexpected downturn in late 2018. To have a sense of what we should do as investors for this coming year and beyond, we should analyze what took place during these last two somewhat volatile years to gain insight for the future. The 2018 market took our breath away in a dramatic fourth quarter reversal, and the 2019 market seemingly experiencing a “melt-up” in most asset classes, despite a trade war and articles of impeachment passed by the U.S. House of Representatives for only the third time in history.

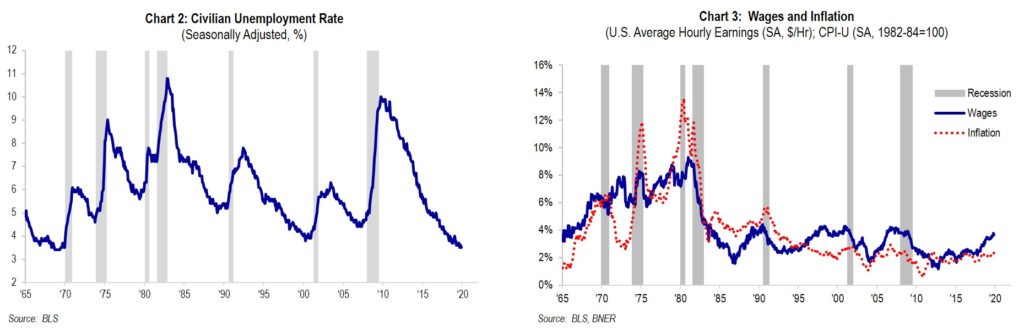

With a backdrop of significant de-regulation under the current administration coupled with major tax reform, our U.S. economy in 2018 was vibrant. Unemployment dropped throughout the year, corporate earnings rose (particularly from tax reform), wages started to grow above the rate of inflation, and consumer confidence was ebullient. However, in the fourth quarter equity markets tumbled and investors fled the equity markets seeking the safe havens of cash and bonds. In our opinion, the two catalysts that primarily caused this severe and unexpected drop in the fourth quarter of 2018 were unwelcome Federal Reserve statements and interest rate increases and President Trump’s declared trade war with China while the trade pact replacing NAFTA (between the U.S., Mexico, and Canada) had not been completed. These events led the 10-year U.S. Treasury to reach 2.7% as of December 31, 2018 and to a drop in the S&P 500 Index by -13.5% in the fourth quarter resulting in a modest full year loss (-4.4%), after having been positive most of the year.

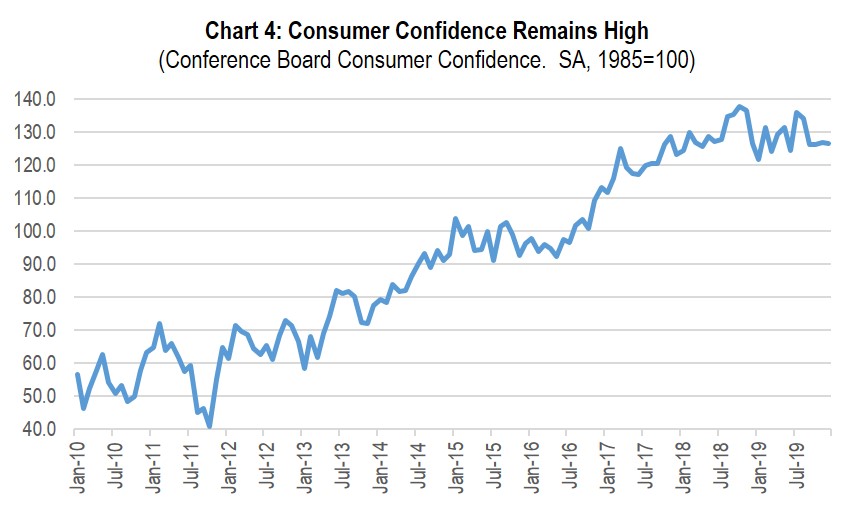

As 2019 began, fear of an imminent recession could be heard from pundits, however we at FLI (as we stated in our 2019 Investment Outlook), made it clear that we did NOT see a recession commencing anytime soon. At the same time, the newly appointed Fed Chair Powell, who pronounced a plan to raise interest rates in the fall of 2018, walked back off that plank in January 2019. Markets rallied sharply in 2019 while interest rates started to drop, with the 10-year U.S. Treasury ultimately closing 2019 at 1.9%. Plus, Washington and Beijing announced that Phase one of a trade agreement had been reached in December. Lower interest rates, a seemingly agreed to partial trade agreement, and the continued drop in unemployment to its lowest level in 51 years while inflation remained around 2% led to a dramatic increase in equity markets. Consumer confidence more than made up for sluggish business investment which we attribute to both the more than yearlong trade tiff with China and the leftist positions of certain well-polling Democratic presidential candidates who are proposing many potential policies that would be extremely difficult for the business community. These democratic socialist positions would not be well tolerated by most asset classes including the stock market in our opinion.

Those who fled the equity market in 2018 (and many prior to this) missed out on a gain in excess of 31% for the S&P 500 Index in 2019 (growth companies led the way for the 7th time in 10 years). Additionally, international continued to trail domestic returns for the second year in a row, making 2019 the 8th of the last 10 years where domestic bettered international. However, if they parked their dollars in longer-duration bonds, they did just fine but achieved nothing close to the gains in equity markets.

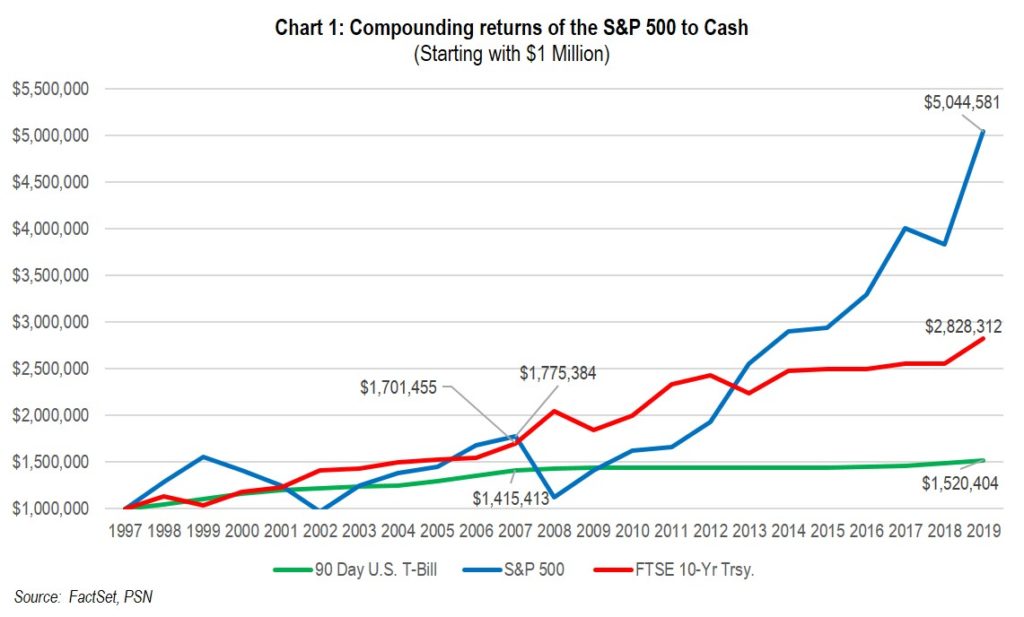

So, these oversized gains in 2019 for both bonds (8.7%, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index) and stocks (31.5%, as measured by the S&P 500 Index) should in our opinion be considered in connection with 2018’s lackluster market performance for an average return over this volatile two-year period. It is obvious that those whose asset allocation kept a meaningful exposure to equity markets did very well, and those overweight bonds and cash missed out significantly. Our asset allocation in both our defensive and traditional equity strategies over the long term will, in our opinion, make our monies work harder for us and provide better returns than cash or bonds. This has been proven to be the case over the long term. Cash and bonds have a place, but overweighting at current very low rates will rob investors over the long term in our opinion.

Our goal is to keep you from losing too much in any downturn, expected or not, while over the longer term keeping your capital working for you. Those that chose to hide out mostly in cash and bonds missed out on a two-year average gain that would have grown their capital in an economic environment that was vibrant despite the trade war, a vacillating Federal Reserve, and a domestic political environment of both impeachment and winds of democratic socialism. Acting based on fear without analyzing fundamentals is not a prudent way to invest, in our opinion.

From a longer-term perspective, if you had chosen to follow your advisors at FLI over the past decade (which virtually all clients have), you would be in very good financial shape as we enter this new decade. But what is the current investment environment, and how do we protect our capital while still letting it work for us and future generations? We cannot assume that history will repeat itself, especially after a decade of gains.

One major factor to analyze remains the employment picture which is excellent as evidenced by both the unemployment rate and wage growth (Charts 2 and 3 at the top of the next page) that depicts a rate of growth above inflation.

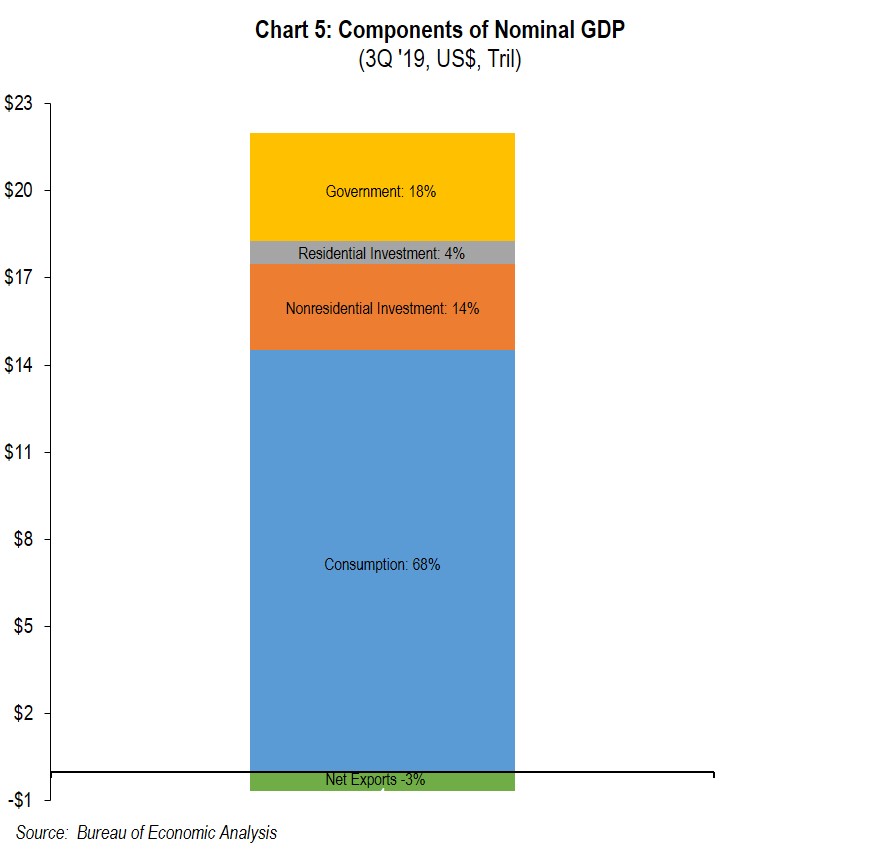

The consumer, who is benefitted by both of the above charts, continues to be robust and is a major driver of our economy. Consumer confidence remains quite high (Chart 4) and the consumer makes up 68% of our domestic economy (Chart 5).

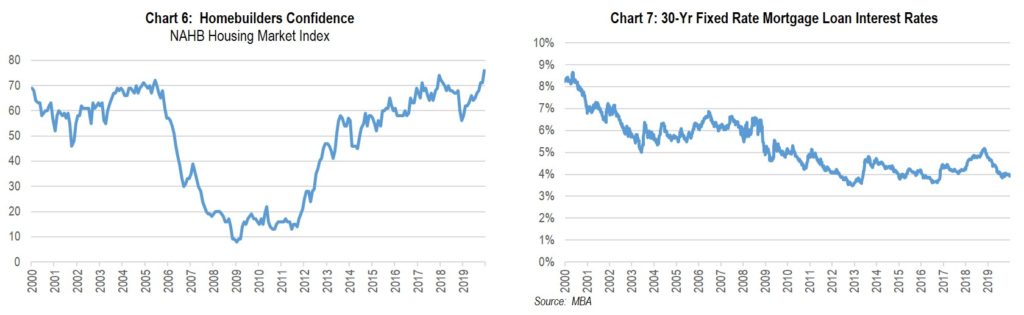

The healthy consumer also is a critical component to our robust housing market (and a contributor to our economy) along with low interest/mortgage rates (as seen in Charts 6 and 7).

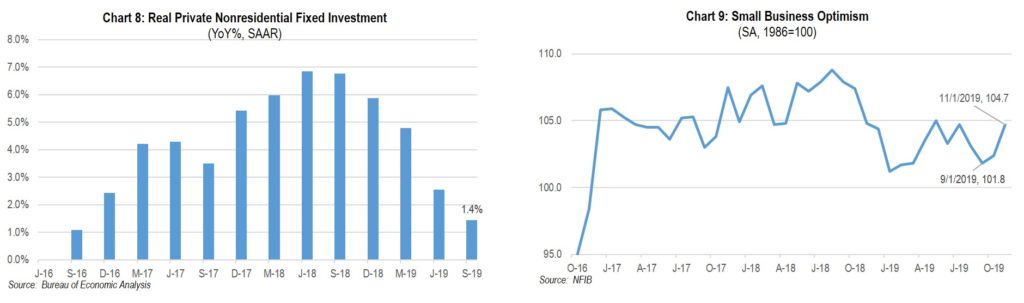

On the other side of the coin, business investment (Chart 8) which is critical to productivity and important to job creation in the future remains disappointing. We believe that for businesses to increase their investments they really need to see the positive effects of both Phase one of a China trade deal and the newly approved trade pact with both Mexico and Canada. Chart 9 depicts, in our humble opinion, the muted small business optimism resulting from the trade wars, fears of higher interest rates and recession, as well as the political turmoil from this past summer, which just started to rise in the fourth quarter:

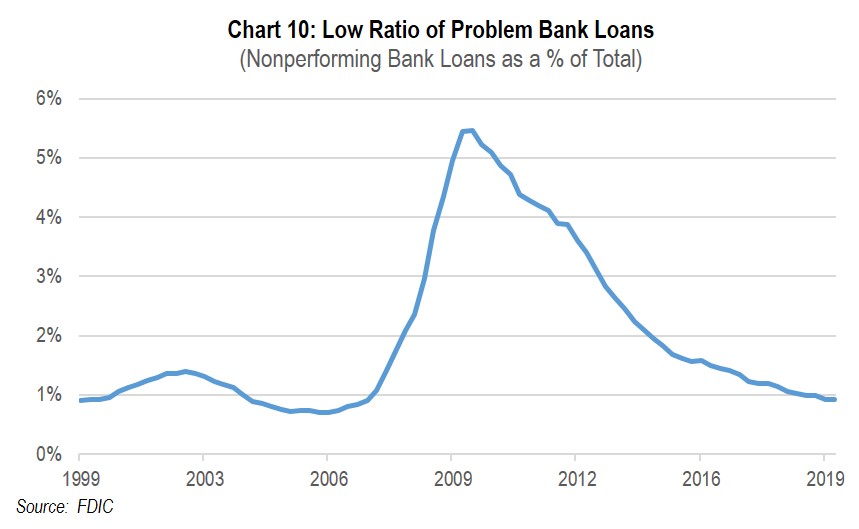

Our view continues to be that, barring an unforeseeable exogenous event, we will NOT experience a recession in 2020. We expect that having some of the trade issues being resolved, coupled with a strong consumer, will lead to another year of GDP growth of 2% or more. It is possible that with an accommodative Fed helping our domestic economy, as well as foreign central banks stimulating China and Japan, the global economy could also pick up steam. In addition, our strong banking system (as evidenced by all major banks having recently passed their stress tests and the ratio of delinquencies to total bank loans currently being at the lowest level in 25 years, as shown in Chart 10) enabled by a modestly positive yield curve will support our growing economy. Several of our strategies hold high-quality banks whose earnings and dividends are growing. However, not all companies will be winners in terms of growing earnings, and not all real estate will benefit from either business investment or robust residential activity. Thus, selectivity will be crucial in choosing our holdings for long-term investment. With long-term investment we are biased to companies whose earnings and/or dividend growth have durable qualities and we need well-located real-estate related investments in areas of growing population and job growth.

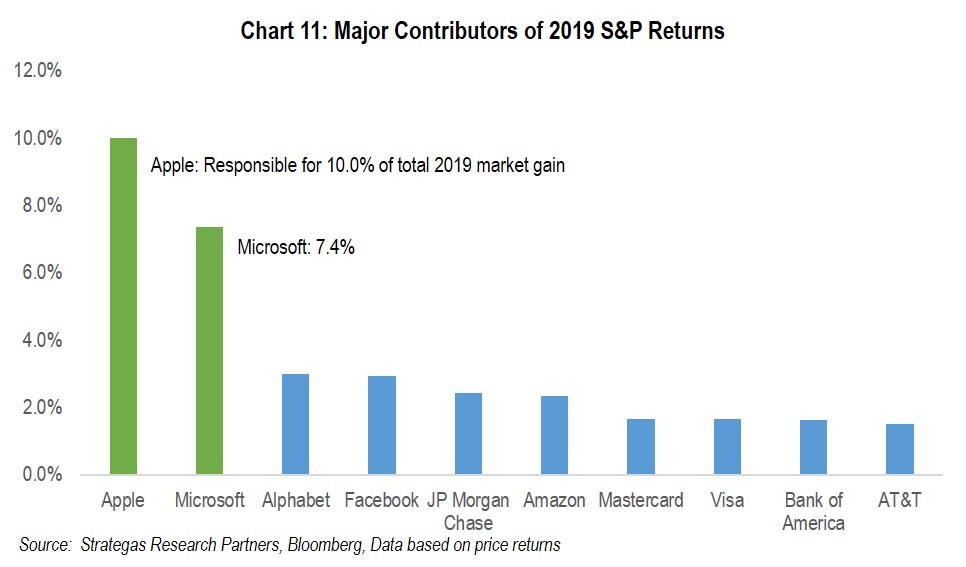

In 2019, equity market gains were skewed to “big winners,” including Apple and Microsoft. Those two companies contributed more than 17% to this year’s rise in the S&P 500 along with some other notable growth companies: (Some of the companies in the chart below are held in various FLI strategies.)

Valuation Matters

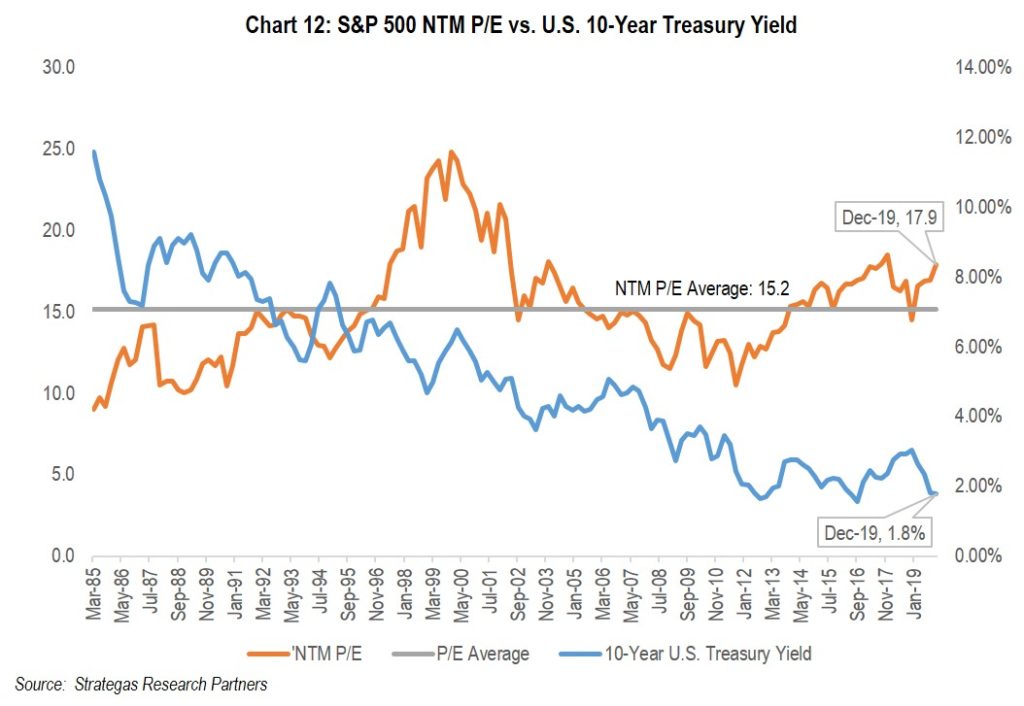

After such a strong 2019, we must visit valuation for the markets in general and of course for our strategies. All three well-known indices: the S&P 500 Index, The Dow Jones Industrial Average, and the NASDAQ achieved record levels. Let’s look at the current valuation of the S&P 500 Index from the lens of the price-earnings ratio and the yield on the 10-year U.S. Treasury which we believe is critical when looking at valuation:

Chart 12 (previous page) demonstrates that while the market is not cheap, it is not very expensive as long as the earnings projections for 2020 are met, after flattish earnings growth in 2019, given the current low interest rate environment.

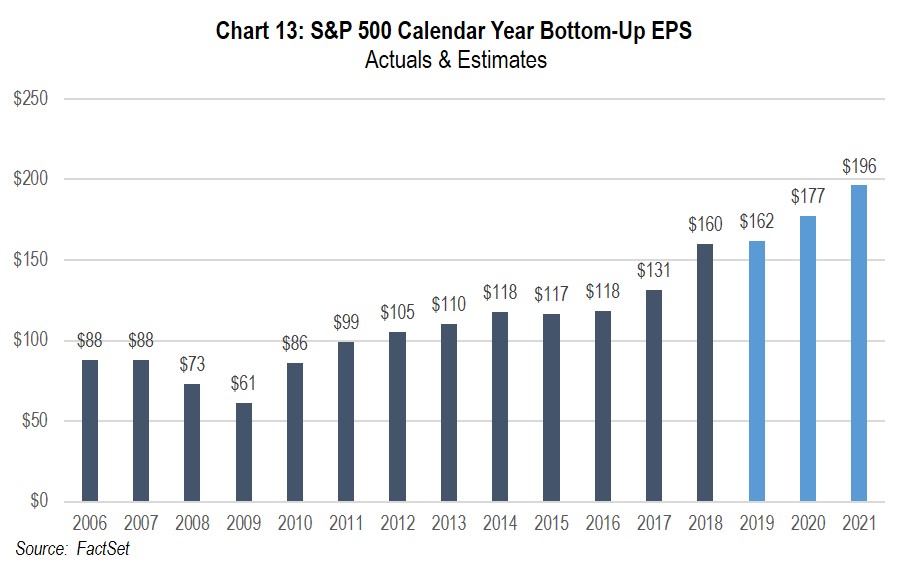

FactSet’s consensus estimates currently point to earnings growth for 2020 of about 9.6%. Despite this projection, picking the right companies to invest in is critical as evidenced by Chart 11 on the previous page. We do not believe that all companies will achieve the same level of positive results, so our continued bias, for the most part, of either investing in high-quality companies with growing earnings and/or financially strong quality companies with above-average dividend growth fueled by growing cash flow is essential. These types of companies when reasonably valued should not only protect one’s capital over the long term, but will provide what we believe will be a reasonable return above inflation (while also being superior to cash and bonds at prevailing interest rates). The same goes for real estate and private equity investments. Earnings, rent roll, or acceptable mezzanine interest rates with underlying quality properties or private companies are imperative in today’s investment environment, where there is still plenty of uncertainty both economically and politically.

Political and Geopolitical Environment

Normally we do not focus on the short-term impact of the political and geopolitical environment as long-term investors. However, our domestic political environment is imbued with extreme divisiveness resulting in a partisan impeachment, and with a Presidential election in roughly ten months, it most likely will provide volatility and fear. In addition, for the first time in my memory, the winds of democratic socialism are real as some segments of our population and politicians attempt to deal with the growing issues of wealth and income inequality. We at FLI do not believe that democratic socialism is the answer to the issues, but some potential candidates for President believe it, or something close to it, is called for. We believe the unintended and possibly even some of the intended consequences could hamper our economy and most, if not all of the various asset classes we invest in. We will be watching this carefully, for if a democratic socialist leaning candidate wins the Presidential election, along with Senate composition changing, major tax, regulatory, and social reforms might have to be reckoned with. In any case, there are tough decisions ahead for our elected officials in dealing with the cost of health care, the funding of Social Security and Medicare, climate change, legal immigration, and our mushrooming debt along with border security and geopolitical threats (wow, quite a wall of worry).

As mentioned earlier, increased free trade and a stronger global economy should be the result of a Phase one deal with China, the newly signed trade arrangement with Mexico and Canada when implemented, as well as a possible deal with Great Britain once it exits from the Eurozone. If these should not happen there could be a negative impact to our economy, but we do not believe that will be the case.

Domestic politics and trade arrangements around the world will play a role in how strong or weak the U.S. economy will be. The resulting GDP growth will be an underlying factor in how many companies prosper in the years to come.

What to Do Going Forward

As investors we must be guided by the principles espoused in Mr. Kiyosaki’s quote. It is not just how much money we make this year, but how much can we hold onto together with gains from the past, and how much we can grow our assets for the future without taking undue risk. There is always uncertainty and we have just come through a two-year period where if one had the proper customized asset allocation (with a bias to growth and a bias to FLI’s Dividend Growth Strategy in the value space) one did quite well. In our view, we remain “skeptically optimistic” such that we would continue to remain overweighted to our defensive equity strategies (made up of both growth and value-oriented companies) that can appreciate, slightly underweight traditional equities (with some exposure to internationally domiciled companies), and underweight fixed income which had a great run in 2019 that we believe will not be repeated in 2020. Also, we will continue to selectively invest in quality, real-estate-based investments with targeted higher yields.

We continue to believe that concentration and selectivity in one’s investments will pay off in the years to come as it has in years past. There is no excuse for not sticking to high quality in all of one’s investments. We have always believed that is the best prescription for avoiding any oversized losses in the long run. In the short run anything can happen, but in the long run quality, long duration earnings growth, and growing dividends will lead in our opinion, to growing one’s net worth. At FLI we offer our clients numerous ways to participate in that formula.

We believe that 2020 can be a successful year for our clients notwithstanding a potential increase in volatility from politics and geopolitical hotspots (including Iran/Iraq, Russia, and North Korea) that will inundate us with rhetoric and fear as well as the ups and downs of our various trade negotiations. Given the news bombardment all investors face, we will continue to focus on the long-term fundamentals of each of our investments. We will also continue to invest in secular growth trends through quality and dominant companies as well as stalwarts that reward shareholders with growing dividends for the foreseeable future. As stated several times, we do not anticipate a recession in 2020!

Most importantly, have a healthy and happy New Year. We hope you will join us for our web seminar on February 13, 2020 at 2PM EST where we will dig deeper into many of the items covered here as well as taking questions from attendees.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. The views expressed are the views of Robert D. Rosenthal through the period ending January 14, 2020, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

FLI average performance figures are dollar weighted based on assets.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocation through or as of December 31, 2019, as the case may be, unless otherwise noted.

FLI believes the information contained herein to be reliable as of the date hereof, but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2020 by First Long Island Investors, LLC. All rights reserved.