2019 Market Outlook

January 10th, 20192019 and Beyond

“Patience can be bitter, but its fruit is sweet.” – Aristotle

As we focus on the outlook and issues confronting us as long-term investors, it is appropriate to first say thank you. We at FLI have just celebrated our 35th anniversary in representing you, our clients, some of whom have been with us from our very inception. Without you, we would not be writing this note. I mention this because during that period we have been through much and have gained invaluable experience from many good and some perilous periods for our clients (where patience was always required). We now seem to be confronted by a sharply declining and volatile market with some predicting an imminent recession (we are not). Thus after a nine year period of positive results have we either hit a big bump in the road or worse are in a bear market, where many still remember and are influenced by the “decession” of 2008/2009; where many are fretting over the current occupant of the White House and our government in general; where we have a new Fed Chair seemingly mechanically intent on raising short-term interest rates while unwinding its balance sheet; and where the likes of China, Iran, and Russia threaten our way of life and that of many allies? We have a big “wall of worry” to understand and overcome! We must determine how much, if any, of this market decline is based on fundamentals versus investor fear from this imposing wall of worry. Is this a correction, or a transition to a bear market? In either case, we must be patient investors.

For many years FLI held annual seminars where I presented a yearly outlook leading off with the current and seemingly insurmountable wall of worry (now instead I write this thought piece and we hold a web seminar in February). In every outlook and web seminar I have always listed major worries AND the other side of the coin. The flip side being some positives which always included the resourcefulness of American business and American workers, as well as our free enterprise way of life supported by the best, but not perfect, form of government in the world. Our situation seems very much the same today.

I have listed many of the elements contributing to today’s wall of worry in the first paragraph above. A quickly and fiercely declining stock market signifies something, but the real economic factors suggest a disconnect with the recent market volatility (mostly declining).

– Corporate earnings continue to rise (See Chart 1)

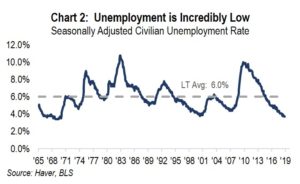

– Unemployment is incredibly low (See Chart 2)

– Inflation is under control (See Chart 3)

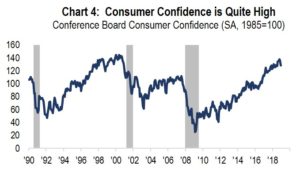

– Consumer confidence is quite high (See Chart 4)

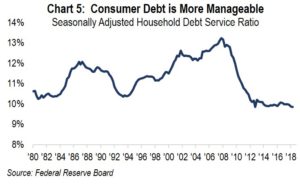

– Consumer debt is more manageable (See Chart 5)

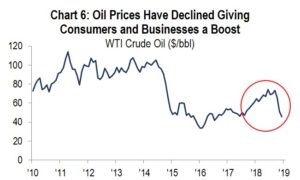

– Oil prices have declined, giving both consumers and businesses a boost (See Chart 6)

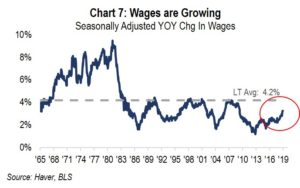

– Wages are growing (See Chart 7)

– And interest rates, despite recent increases, remain historically low (See Chart 8)

Therefore, unless some exogenous event occurs, our domestic economy appears to be reasonably strong. The many charts shown above mostly describe our current fundamentals and characteristics.

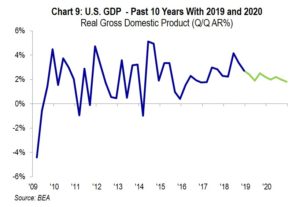

U.S. corporate earnings grew in 2018, in part from the change in tax law as well as from growth in gross domestic product. Looking forward to 2019, U.S. corporate earnings and gross domestic product are both projected to grow (See Chart 1 and Chart 9) although slower than they did in 2018. Notwithstanding this somewhat slower GDP growth, the political uncertainty across the globe and a strengthening dollar leads us to continue to underweight foreign stocks.

But can we be sure these positive economic and fundamental factors will remain in 2019?

In the last six weeks we have spoken with fourteen outside, among best-of-breed, equity investment managers, our partners in our real estate mezzanine loan strategy ,and two highly regarded economic consultants. Generally, their opinions remain positive as to the continuing but slowing growth of the U.S. economy, while the vast majority of companies in which they invest appear to be poised for continued success in 2019 and in many cases beyond.

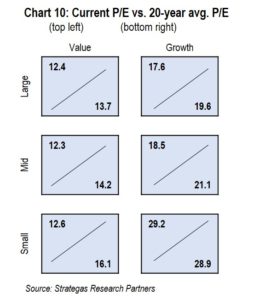

So, what gives? Certainly earnings growth will slow and eventually we will face a recession (as defined by two consecutive quarters of negative GDP growth). We do not see that for at least the next eighteen months and in our opinion, it should not resemble the “decession” of 2008/2009, which is still fresh in the minds of many investors. The fear of a repeat drove their outflows from equity markets in the past two months. As a matter of fact, these outflows are at record levels, which makes no sense to us given the current positive state of our economy. By the way, we as professional investors, where we have managed wealth for the past 35 years, have weathered many recessions. For now, we do not see significant asset bubbles or an overstretched banking system, the main drivers of the pain and near disaster in 2008/2009. Today’s landscape is quite to the contrary, and we believe the overall contraction in price-earnings multiples, for the most part, is overdone.

However, our national debt continues to increase and that is a concern down the road that must be dealt with by our elected Federal officials. This growing debt is not stalling our economy at this time and with interest rates reasonably low now and for the immediate future, it is not an issue at this point. Inflation, which caused severe economic distress in the late 70’s and early 80’s is below 2% and there do not appear to be signs of increasing inflation. Thus, hyper-inflation which caused poor equity markets in the late 70’s and early 80’s is not in our view. As a matter of fact, until mid-2018 there was more concern about deflation than inflation.

History tells us that bull markets do not typically die of old age, but rather usually end when valuations become too stretched or meet a recession, amongst other factors. Today, in part based on the recent sharp equity decline, equities are somewhat cheap at roughly 14.5 times 2019’s growing earnings. GDP growth for the third quarter of 2018 was 3.4% and the fourth quarter is projected at 2.7% growth. Not even close to a recession. Additionally, the consumer remains buoyant as evidenced by holiday sales increasing by a robust 5.1% over the prior year according to Mastercard. That same consumer is now also benefitting from a significant drop in the price of oil (seems to be supply-driven and not from a decrease in demand). This will give consumers more dollars to spend, save, and/or de-lever.

So what gives and how should we act as investors? BE PATIENT!

Selling into a panicked market where the exits are crowded (record outflows) makes no sense to us especially since there are some pretty positive economic indicators and strong company fundamentals.

We would suggest plain old-fashioned patience and reflection on one’s asset allocation. From our perspective we believe fear and uncertainty have gripped investors who still remember the pain of 2008/2009. We have a new dynamic adding to this pain — the current erratic state in Washington D.C. With the mid-terms resulting in the Democrats taking the House and Republicans remaining in control of the Senate, we have a split government. In addition, we have a President whose policies and demeanor are giving no comfort to many on either side of the aisle. Despite a pro-growth tax bill, deregulation, and criminal justice reform as positives (although some rightfully are concerned about growing deficits), our President has lost several key cabinet members (including Haley and Mattis) and has become inconsistent, in my opinion, on trade with China as well as policy in Syria, while he, his campaign, and other entities remain under serious investigation. These are legitimate worries with little end in sight that could add to greater volatility.

In our opinion, the uncertainty about our President, his trade war with China (yes, both sides of the aisle agree they engage in unfair trade practices), a partial government shutdown, and a Fed Chair who is new in his role (and has not made many investor friends with his statements and increased interest rates) have driven many investors into fear mode irrespective of the many economic and company-specific positives listed above. This negative sentiment is a real worry but should the growing economy and improved company fundamentals prevail (which we believe will be the case), the tug of war should favor patient long-term investors.

In our view, we still seem to have growing earnings and historically cheap to reasonable valuations (See Chart 10) in a period of stubbornly low interest rates with a modestly growing economy, which would normally suggest higher asset prices for quality companies and quality real estate.

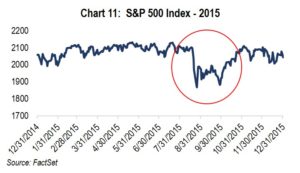

In 2015 we faced a similar conundrum of steep equity losses which turned out to be a correction, and NOT a bear market (See Chart 11). Recently, further steep declines had us at the classic definition of a bear market having dropped 20% from recently achieved highs until a record 1,000 point advance in the Dow and 116.6 point advance in the S&P 500 snatched us from the jaws of the bear.

Summary

None of us have a crystal ball, so we must evaluate all of the above. Relatively strong fundamentals go unnoticed by many investors who are panicked. Could the panic and uncertainty cripple consumer confidence (consumers make up almost 70% of our economy)? Maybe, but we do not think so based on recent holiday sales and dropping oil prices (along with many benefitting from the tax reform). Is the uncertainty enough to completely derail business growth despite pro-growth tax reform and deregulation helping many businesses? Again, we do not think so. Can our erratic government drive investors to more than temporarily accept low cash and bond returns? Again, we do not think so especially as Americans can change the makeup of two branches of government in less than two years.

We think the selling is overdone and equity valuations, in most cases, have gotten more attractive, creating opportunity. Furthermore, we believe that growing passive investing (through ETFs and index funds) which does not differentiate between high-quality and lesser-quality companies has exacerbated the decline. Will we face a recession at some point? Yes, but we do not believe it will be in 2019.

So, stay the course with a prudent asset allocation. We continue to urge our clients to take a defensive posture which overweights our defensive basket while still underweighting fixed income and modestly underweighting traditional equities. Private investments make sense for those qualified.

A defensive asset allocation (including a modest amount of cash to weather this uncertainty) can still provide some appreciation while better weathering the ultimate recession or exogenous event no one can predict. We should all consider rebalancing our asset allocations to take into account the current volatility which has made the valuations of even traditional equities more attractive. We are here to help with all of this and any other wealth management needs of you and your family.

Most of all, be patient. As the quote suggests, the fruit of that patience is an opportunity to earn an overall better return than that of bonds or cash and that better return compounds over time. But we must be patient and endure the bitterness of both corrections and bear markets. It is the price we pay for better returns over long periods of time.

As always, we welcome your questions. We hope you will join us on Thursday, February 7th at 2 PM EST for our web seminar where we will discuss the topics mentioned here in more detail and answer your questions.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. The views expressed are the views of Robert D. Rosenthal through the period ending January 8, 2019, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

FLI average performance figures are dollar weighted based on assets.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocation through or as of December 31, 2018, as the case may be, unless otherwise noted.

FLI believes the information contained herein to be reliable as of the date hereof, but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2019 by First Long Island Investors, LLC. All rights reserved.