1st Quarter 2022 Letter to Investors

April 26th, 2022March 31, 2022

“The most important quality for an investor is temperament, not intellect.”

-Warren Buffett

All major indices were negative for the quarter (including bond indices), ending the string of seven quarters of consecutive gains and leaving investors facing a complex environment to navigate Challenges, both economic and geopolitical, which were cited in our 2022 Market Outlook (published in January), abruptly confronted investors during the course of the quarter.

The Fed, recognizing the highest inflation rate in 40 years, finally started a course of increasing the short-term borrowing rate that will be implemented in 2022 and 2023 in addition to ending its asset purchase program. The pace and magnitude of the increases will be data dependent, but it appears at this point to suggest short term rates approximating 2.5%-3.0% by the middle of 2023. The first increase, announced in March, was 25 basis points. At least six more increases are forecasted between now and the end of 2022 given the current level of inflation (8.5% as of March 2022), which the Fed now realizes may only be in part transitory. Americans are facing significantly higher fuel and food costs which in and of itself represents a major tax on the average family. Although we believe certain supply shortages will abate by year end, they are no longer what constitutes the root cause of inflation, as once thought by many.

Short-term borrowing rate increases could lead to long-term rates increasing reflected in the 10-Year U.S. Treasury that will impact mortgage rates and consumers in general; and possibly reduce price earnings multiples on equities if the 10-Year U.S. Treasury rises to above 3.5% in our opinion (as of March 31, 2022, the 10-Year U.S. Treasury was 2.3%). Later in this report we will address the possibility of a recession in 2023, but for right now we do not see a recession in the near term.

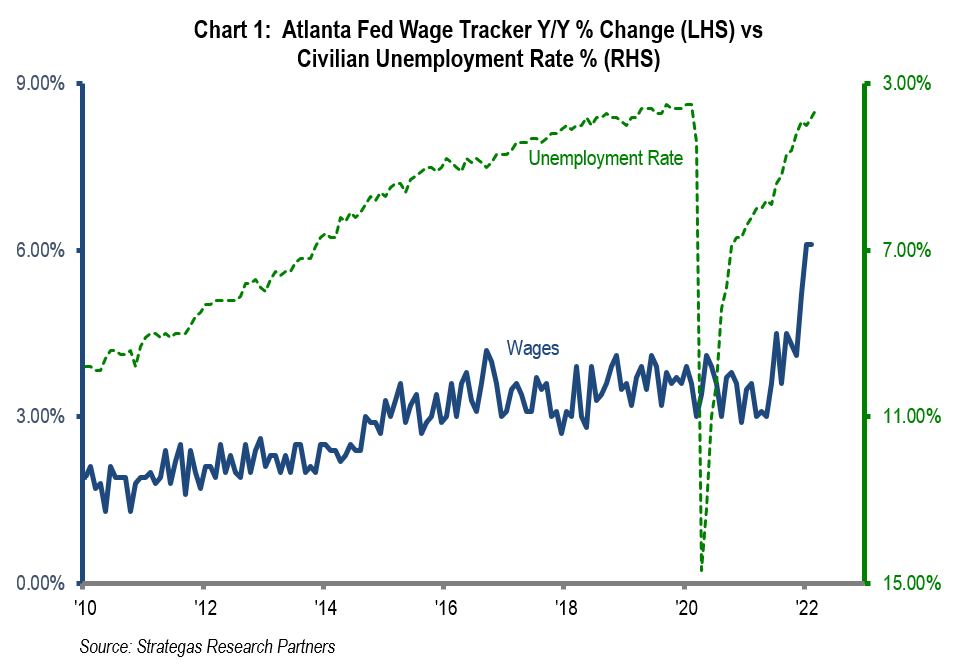

Long desired wage increases have finally made their way into our economy with increases approximating 5.6% most recently. This tracks a lower unemployment rate where labor is becoming scarce making wage increases for many a necessity to do business. Chart 1 shows average wage growth tracking the improvement in the unemployment rate. Of course, these trends follow the abatement of COVID-19 or perhaps our improved ability to navigate COVID-19 given vaccines, boosters, monoclonal antibody treatments, and the new drugs from both Pfizer and Merck. These provide relief for people contracting the virus and helps keep them out of the hospital. However, based on scientific opinion, variants of the coronavirus appear here to stay and boosters seem to be a preventive measure that we will all be receiving for quite a while.

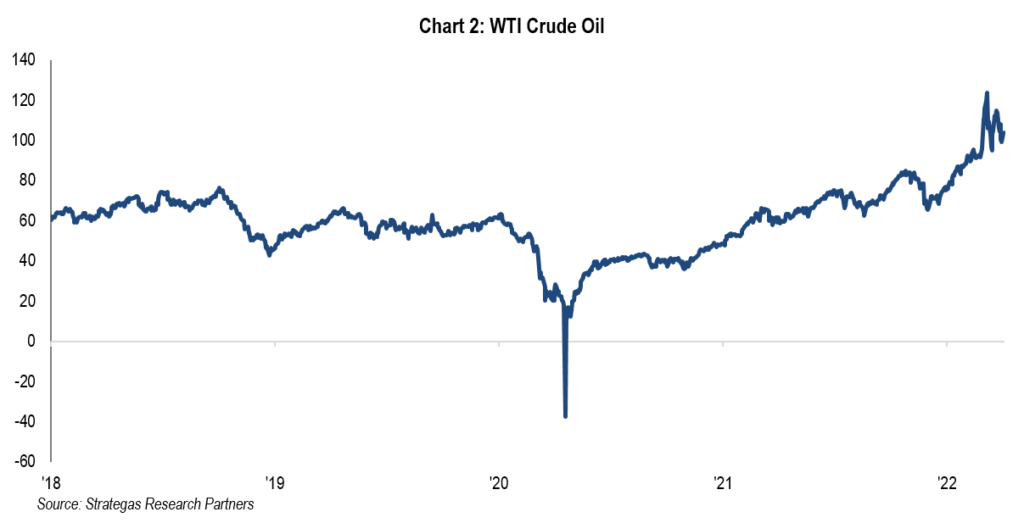

Besides wage increases, which we do not believe are transitory, fuel costs have soared. The increase in fuel costs (oil) seem to have been parallel to the Administration’s focus on alternative energy sources and a deemphasis on fossil fuels. Chart 2 shows the increase in the price of oil over the last several years. The initial surge began with the election of President Biden. The second surge has occurred with the Russian invasion of Ukraine and our government’s decision to stop importing some of our energy needs from Russia. At this time, the President has decided for the second time in the last six months to release oil from our Strategic Petroleum Reserve (a reserve that was created in 1975 to provide emergency protection given geopolitical strife in the Middle East). In our opinion, releasing oil from our Strategic Petroleum Reserve will not have a long-term positive impact on oil prices (the release of reserves is currently slated from now until the fall).

The current causes of the rising price of oil and natural gas are complex. Certain regulatory guidelines imposed by the new Administration limited the ability of U.S. production to meet the rising demand in 2021, driving oil and fuel prices higher. Add to that, the outrageous invasion of Ukraine has led to significant economic sanctions against Russia including scaling back energy purchases. This is forcing the U.S. and European nations to seek supplies elsewhere. An obvious partial solution would be to attempt to more aggressively increase oil production domestically, but the Biden administration is trying to balance the needs of domestic oil production and combating climate change. Middle Eastern countries have been urged to increase their production, but thus far this has not resulted in much success. Increased oil from such disreputable countries as Iran and Venezuela are also under consideration but bring geopolitical issues.

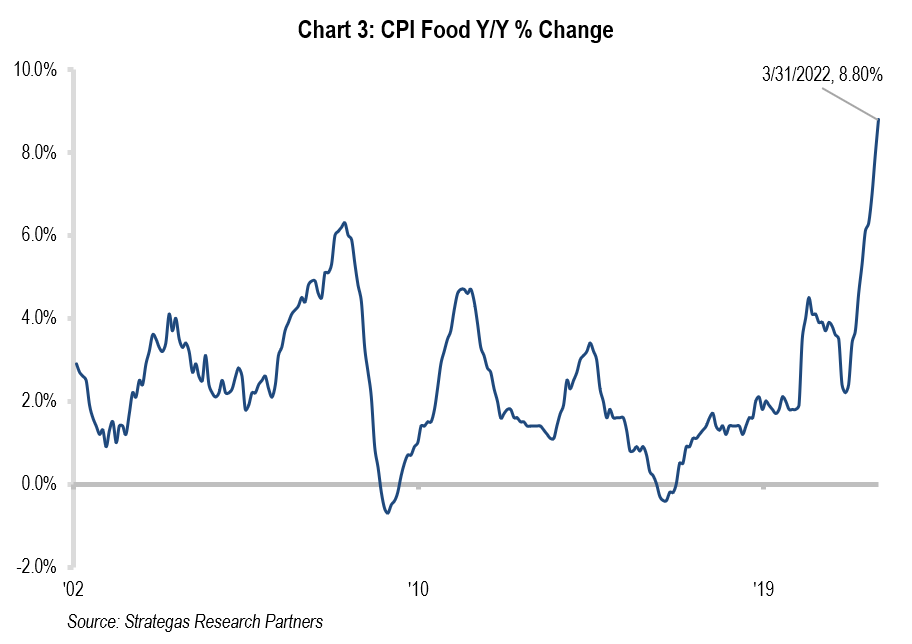

Another significant area of inflation is food prices (as depicted in Chart 3). Here wage growth as well as supply constraints have helped usher in a wave of inflation. However, this situation could get worse as Russia/Ukraine represent about 30% of the wheat (grains) produced globally. Given the ongoing war, we believe that supply will be constrained and this will further impact the price of certain foods going forward. Some countries are seeking to plant on government acreage as a way to increase supply, but this will take time.

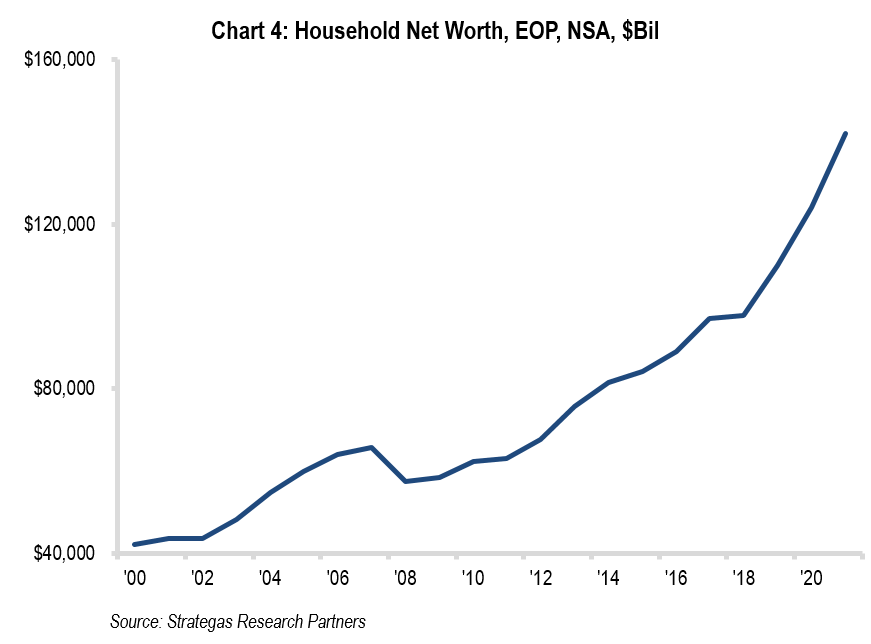

Several key areas including wages, oil, and food are stoking the rise of inflation confronting America. This could at some point lead consumers to reduce their purchases and contract economic growth. However, the consumer still appears very strong from a balance sheet standpoint, as you can see in Chart 4.

Our Complex Investment Environment

Despite starting from record lows, we are still facing higher interest rates for the first time in many years. These rate increases are designed to curtail the highest inflation in 40 years. Rising interest rates and higher inflation at the same time that we have a war raging in Ukraine makes for a pretty high wall of worry for investors. Profits for S&P 500 companies for this year are still projected to rise by 9% despite global concerns while the S&P 500 Index declined by 4.6% during the first quarter. This represents a modest reduction from the beginning of the year probably reflecting slower projected global GDP growth given the war in Ukraine as well as continued pockets of COVID-19 impacting various economies, including that of China. But a down market of 4.6% while still forecasting growth in earnings would seem to suggest some happiness by the end of the year. We believe this is a possibility and seems plausible to us as bond investors must digest negative real returns (absolute return minus the rate of inflation) that makes quality equity investing a better long-term option than investing in bonds (at this time, in our opinion).

Adding to this complex picture is the history of the equity markets appreciating after the first rate increase by the Fed as shown in Chart 5.

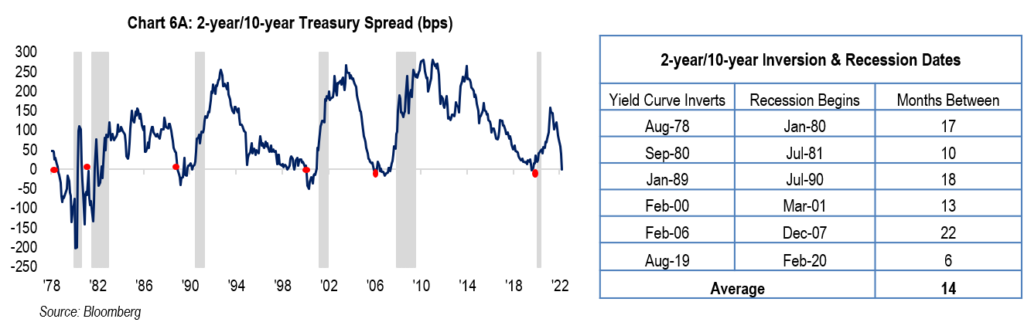

It appears that in times past the equity markets have been able to absorb Fed rate increases especially when earnings and GDP growth were still intact. Also, we must ponder the meaning of potential rate inversion where short-term rates exceed longer-term rates and the ensuing probability and timing of a possible recession. The spread between the 2-year and 10-year U.S. Treasuries slightly inverted for a brief period of time (less than one day) in the first quarter but is not currently inverted. The following charts show that meaningful inversion of the spread between the 2-year and 10-year U.S. Treasuries or that of the 3-month and 10-year U.S. Treasuries have typically been followed by a recession. As you can see in Charts 6A and 6B, recession has typically followed the inversion of the 2-year/10-year spread in the next twelve to eighteen months and of the 3-month/10-year by six to twelve months. We believe the spread between the 3-month and 10-year is more indicative of future economic growth and at this point it does not indicate an imminent recession.

This complex picture shows challenges to investors in the form of Fed rate hikes and possible recession; inflation and the potential impact on consumers and businesses; geopolitical strife with a war in Ukraine; and we still have to navigate the COVID-19 landscape but with many more tools (vaccines, boosters, and novel drugs).

Outlook for 2022

We believe that the complexity of investing right now is daunting, but the challenges are offset to a large extent by the strength of the consumer, our robust banking system, growing corporate profits, companies with pricing power, somewhat more reasonable valuations given the first quarter drop in stock prices, and growing dividends from many of the companies we invest in.

The current confluence of economic and geopolitical factors makes for investor anxiety and market volatility. From a contrarian standpoint, this negativity might be a positive. Our view remains that we should look over the valley of these factors with the expectation that over time, we as investors will continue to make gains. Proper temperament is now required so that we do not act emotionally to the first negative full quarter in two years. Whether one invests in public or private companies or real estate related opportunities quality, growth in cash flow, increasing dividends, and solid financial fundamentals will again be the keys to investment success. This, along with a prudent asset allocation among risk assets and a buffer of cash, is our prescription for weathering the complexity of the current investment environment. Over the longer term, never bet against America!

Please call upon any of us on our investment committee or wealth management team to discuss your asset allocations and/or wealth management needs.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S. President Biden recently proposed a federal budget. It includes an increase in spending as well as a host of tax increases similar to those proposed last year, but not enacted. It is premature to discuss any aspect of it at this time. We will include discussion on it when warranted.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending April 22, 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2022 by First Long Island Investors, LLC. All rights reserved.