2022 Investment Outlook

January 20th, 20222022: Our Thoughtful View

“There are two times in a man’s life when he should not speculate: when he can’t afford it and when he can.” -Mark Twain

A Tale of Two (Plus) Decades

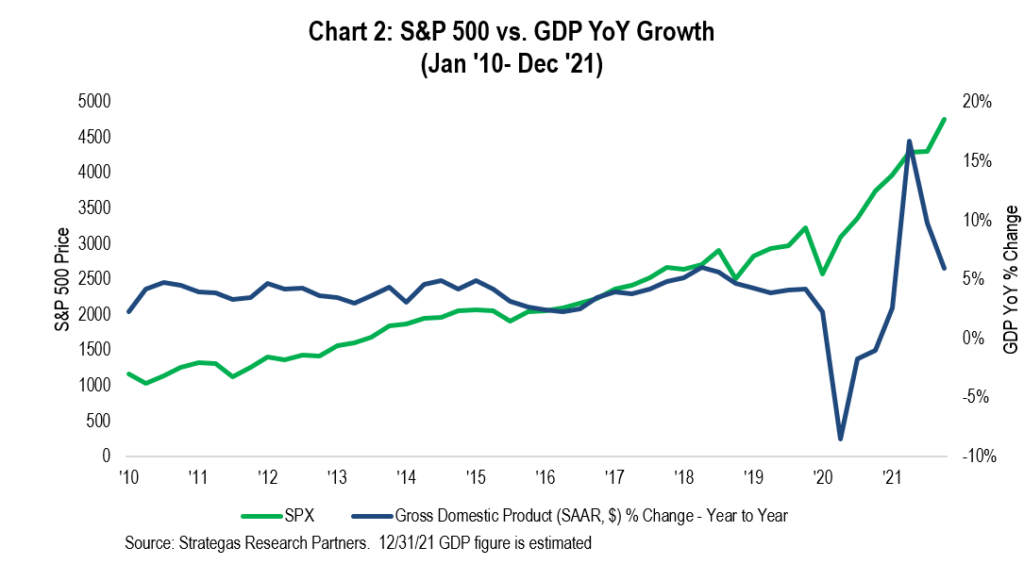

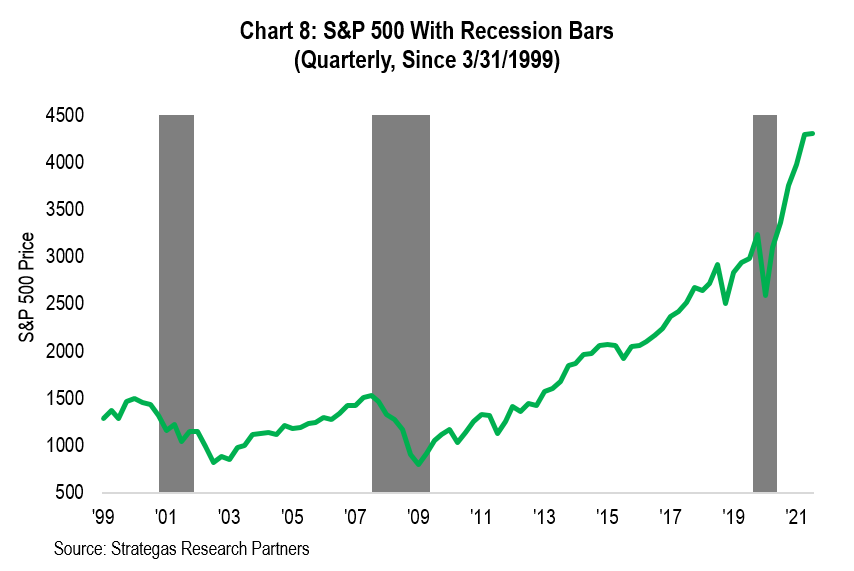

As we look towards 2022 and beyond, it is worth discussing each of the past two plus decades of stock market and economic performance. Two periods of time which brought about very different results for most investors. This review is to ensure that we have a fair perspective on both investment and economic achievement, or lack thereof. In the period beginning in 1999 and ending in 2009 (seems like a long time ago) both stock market performance, as evidenced by the S&P 500 Index, and economic growth were lackluster to say the least. We may not remember, but it was a frustrating time.

As can be seen in Chart 1 on the previous page, it was a period of time that most equity investors would prefer to forget. A tech boom ended in a bust (2000-2002), economic growth was choppy, and the “decession” of 2008/09 almost led to the collapse of our banking system. Annual returns for the S&P 500 Index during this period were a dreary 0.96%.

This contrasts greatly with the most recent twelve year period that just ended December 31, 2021. A period of time during which equity returns and economic growth were robust and made us forget the prior eleven year period despite the coronavirus pandemic and the virtual self-imposed depression in 2020.

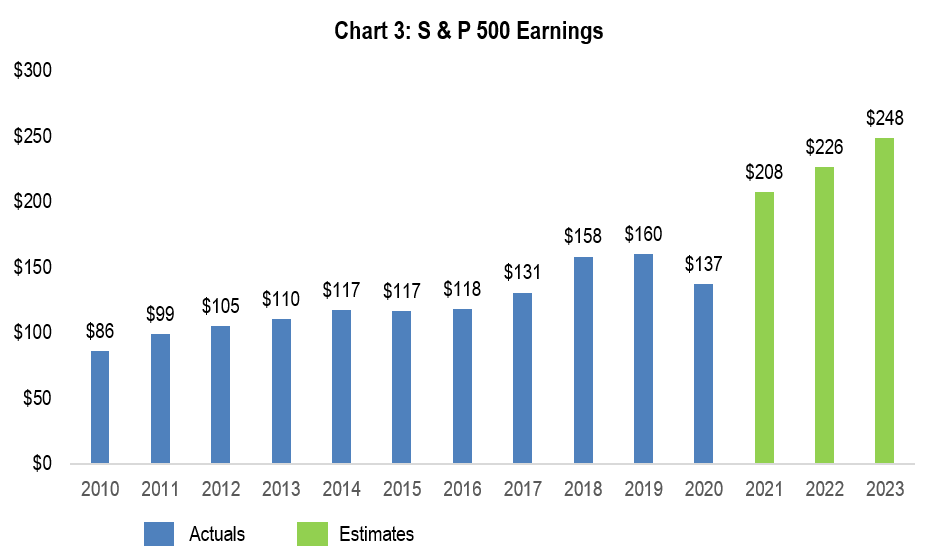

These charts demonstrate the tale of these two different periods of time. The past twelve years saw compounded stock market growth of 15.16% per year while economic growth was also quite impressive. Of significance, S&P 500 earnings growth over this period propelled, in our opinion, a good deal of the impressive stock market gains. The following chart shows consensus S&P 500 earnings growth historically and projected for 2022 and 2023. This continuation of earnings growth is typically essential for stock market appreciation.

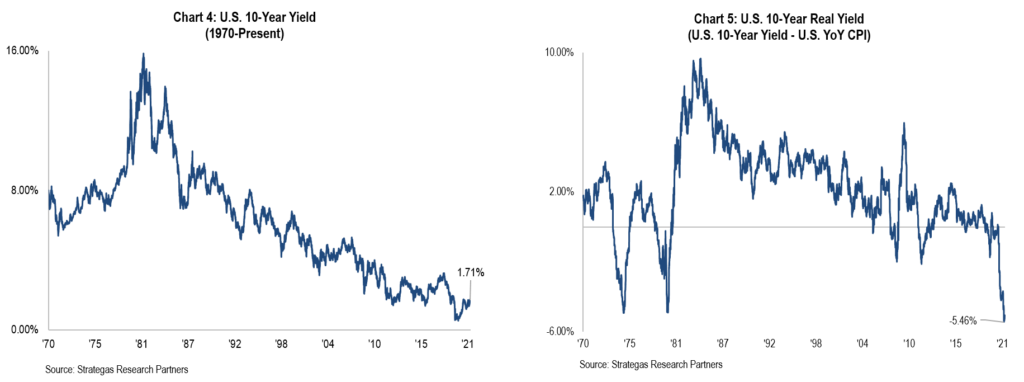

The powerful combination of earnings growth and growth of the economy is a part of the story of these significant financial gains. However, commencing with the financial crisis in 2008/09, and exacerbated by the Federal Reserve’s action to help combat the coronavirus pandemic, we have lived through a period of declining interest rates. This, combined with very low inflation, is another part of the plausible explanation for a much higher stock market in the last decade plus versus the previous one. As a matter of fact, we believe that equity markets have benefited from negative real interest rates (0% or below since January of 2020) for the 10-Year U.S. Treasury, which historically has occurred very infrequently (real interest rates are the nominal yield minus the inflation rate):

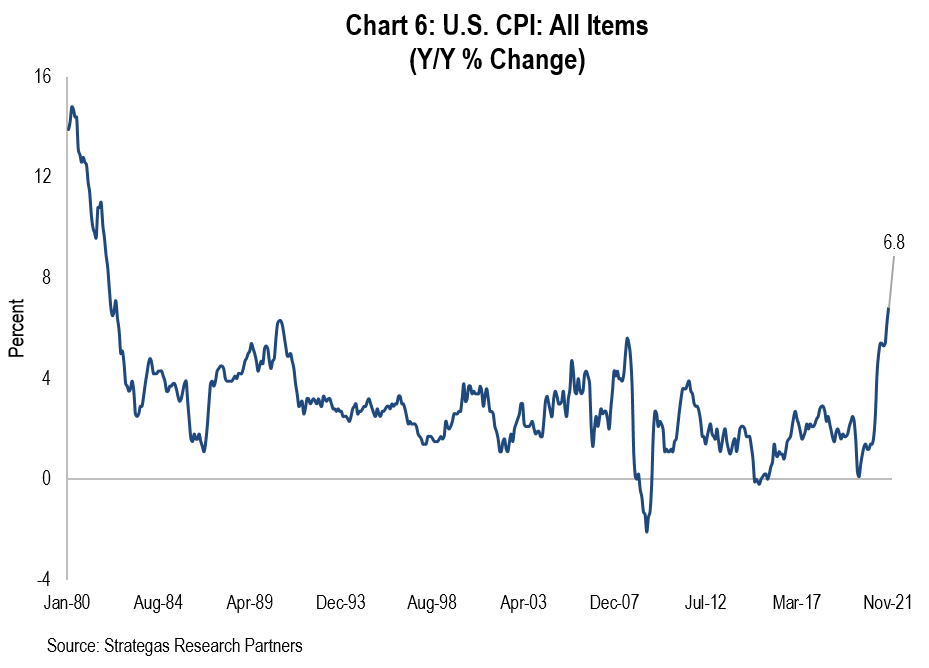

The charts above show just how low both nominal and real interest rates have been. Another factor in the rising stock market is, to some extent, TINA (an acronym for There Is No Alternative (to stocks)). Should investors accept a 10-Year U.S. Treasury yielding below zero on an after inflation basis (without even considering the fact that the interest is taxable, which reduces returns) or cash with an even worse real return? For the past few years the 10-Year U.S. Treasury has yielded between 0.5% and 2.8% with inflation at about the same rate, and most recently increasing to 6.8%. Even prior to the supply chain shortage and energy price increases of late, the real yield for the 10-Year U.S. Treasury has been 0% or worse since January 2020 and that rate is locked in for a ten-year period. It is no wonder our Dividend Growth strategy has fared so well. In fact its yield has generally been above that of the 10-Year U.S. Treasury since inception and for the past ten years dividend growth for our strategy has averaged greater than 8%.

Chart 6 shows the path of inflation over the past forty plus years. (We chose this time frame because that is the last time we suffered with inflation at very elevated levels.)

Fed Chair Jerome Powell has finally accepted that this rise in inflation is not just “transitory.” It is elevated in part due to supply shortages, increases in wages, and rising energy costs somewhat related to failed domestic policy, in our opinion. Additionally, housing costs have increased. These are real concerns especially for the average family. Inflation is the cruelest of tax increases (in our opinion).

How Do We Enter 2022?

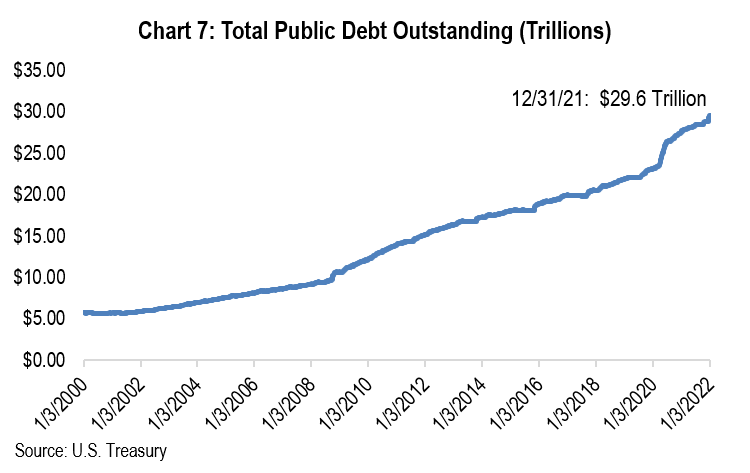

This analysis was designed to make us all think about the past two plus decades. The 2010-2021 period was financially rewarding for equity investors, despite COVID-19, but during the prior eleven years many investments and thereby investors failed to keep pace with inflation. Economic growth spurred by massive governmental relief programs, low interest rates, earnings growth, expanding multiples because of declining and low interest rates (in our opinion), and excess liquidity helped overcome the financial impacts of COVID-19 and the shut-down of the economy in 2020. However, there has been a price to pay. Both the Fed and the government have pumped trillions of dollars into our economy to help combat the pandemic and the economic hardships it created. The Fed kept short-term rates historically low while expanding its balance sheet and the federal government spent trillions of dollars between COVID-19 relief, and most recently, an infrastructure bill. This has led to record government debt.

The net result is that we can look forward to an economy in 2022 and possibly 2023 characterized by domestic economic growth, continued growing earnings, low but rising interest rates (the 10-Year U.S. Treasury in a range up to 2% to 3% in our opinion); and elevated inflation (which we believe will abate to an extent sometime in the second half of 2022 and level off in a range of 3% to 3.5%). There is no question in our minds that the Fed, as announced, will begin tapering and conclude its asset purchases while raising short-term interest rates over the next year. (Tapering could possibly induce long rates to also increase.) However, we think this will be in moderation, as suggested by our estimate on the 10-Year U.S. Treasury of no more than 2% to 3% (higher long-term rates could be difficult for equity and real estate markets to digest). Keep in mind that as a country we have to service debt that will soon exceed thirty trillion dollars, so interest rates matter.

How To Invest

Our discipline has always been to customize a prudent asset allocation for our clients. In recent years this has meant an under-allocation to bonds (with their low to negative real yields), and we will continue this. A similar under-allocation to internationally domiciled companies where we have been significantly underweight for quite some time (at least ten years) and that has benefited our clients and we believe will continue to. We will continue to barbell our allocations to both growth- and value-oriented strategies across market capitalizations. We remain focused on investments in strong companies which are dividend growers and/or earnings growers, have solid fundamentals, and have proven management teams. Given the significant wealth appreciation achieved over the past twelve years, we agree with Mark Twain. Why should our clients, who can afford to speculate, speculate? We do not believe they should (other than some non-core assets to have fun with, if that is of personal interest). Therefore, depending on age, income needs, estate planning for the next generation, and the appropriate cash buffer, we continue to stay the course with a long-term view of being fully invested aside from the aforementioned cash buffer. We will stick to high quality, dividend growing and or earnings growing companies, and quality real estate-oriented investments while avoiding areas of speculation or lack of understandable history.

In the last few years there have been areas of excess or speculation. An old concept called SPACS (Special Purpose Acquisition Companies) has become the recent rage; a reasonable concept that attracted huge amounts of capital in public pools looking to make acquisitions. We have avoided this area. There has been a surge of initial public offerings where valuations were well above what we could tolerate. Many were extreme multiples of sales, not earnings. Not for us. Finally, the surge in cryptocurrencies led by Bitcoin has attracted a lot of attention. I believe you might compare the concept of block chain or bitcoin to the internet of thirty some years ago. Perhaps it is the answer to our growing debt and possible debasement of our currency? It might just be a better hedge against inflation and poor fiscal and monetary policy of our government than gold. Perhaps more on this asset class in future writings. We continue to study it.

We do not expect the next ten years to create as much wealth as the last twelve years, but we expect it to generate more wealth than the previous decade (1999-2009). We will face a down year or two as we have in each of the past decades. These down years will most likely be brought about by a recession or two. We cannot predict when that will occur, and at least historically, recessions have coincided with declines in the stock market.

The good news is that, barring an unforeseen and unpredictable event, we do not see a recession on the horizon in the coming year or two.

Final Thoughts

The last twenty plus years have shown us that long term investing does pay off handsomely by staying the course. However, some periods are better than others and we have just fortunately experienced an excellent twelve year period. Long-term investing can entail different asset allocations tailored for each of us with a goal of growing our wealth above the level of inflation and after taxes. To do otherwise will mean a permanent loss of wealth if we give in to inflation or direct too much of an allocation to cash and fixed income with negative real yields. We can develop asset allocations, without speculation, that we believe can achieve our goal even with inflation at 3%.

Finally, we still face geopolitical hot spots and must stand up to oppressive regimes such as China, Russia, and Iran. Our own political divisiveness must be overcome to confront issues such as climate change, equality, and the needs of social security and Medicare, as well as ensuring productivity, innovation, and a strong economy and military. Perhaps 2022 and beyond will find more politicians thinking America and Americans first and party second. These factors, and others, can at times create volatility and while in the short term that is never enjoyable, having a prudent asset allocation and the appropriate cash buffer (both discussed above) provides for the ability to weather such volatility and focus on long-term investing.

Enjoy the New Year and let us hope that come this time next year COVID-19 will be in our rear view mirror. As always, know that you can call on any of us at First Long Island Investors to help with an asset allocation that allows you to sleep at night.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S. We hope that you will join us on February 10th at 11:00 a.m. EST for our market outlook web seminar. You can register here.

The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. The views expressed are the views of Robert D. Rosenthal through the period ending January 13, 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocation through or as of December 31, 2021, as the case may be, unless otherwise noted.

FLI believes the information contained herein to be reliable as of the date hereof, but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2022 by First Long Island Investors, LLC. All rights reserved.