4th Quarter 2019 Report to Investors

January 30th, 2020December 31, 2019

Listen to the report.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Robert Kiyosaki

(First, I would urge all of our clients and centers of influence to read our 2020 Investment Outlook which was distributed earlier this month, as it provides additional details on many of the thoughts that will be reflected in this abbreviated Investment Perspective.)

The fourth quarter and 2019 overall rewarded long-term investors with a robust equity market as well as gains in fixed income. All of our equity-based defensive and traditional equity strategies gained between 20% and 37% for the year, on a net basis. The Dow Jones Industrial Average, the S&P 500 Index, and the NASDAQ all reached record highs in the fourth quarter reflecting several significant factors. First, the Federal Reserve maintained reduced interest rates and suggested that it would not raise rates in 2020 unless inflation picked up significantly. Second, the President and his trade team announced, along with the Chinese that a Phase One trade arrangement with China had been agreed upon. This had the immediate effect of proposed tariff increases not taking place in mid-December as well as a partial roll back on already imposed tariffs. The equity markets greeted this news with significant gains throughout the month of December. Also, Congress agreed to the new U.S./Mexico/Canada trade deal replacing NAFTA. This too bodes well for our domestic economy and when coupled with the Chinese trade deal should relieve businesses that had held back on investments given the uncertainty regarding global trade.

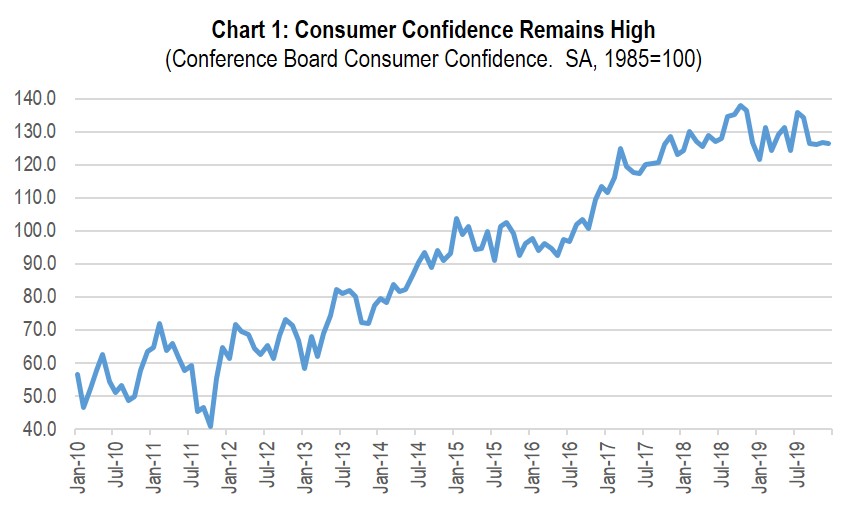

In addition to the above, the strength of the consumer was a major factor positively impacting the fourth quarter, and for that matter, the entire year. The consumer accounts for nearly 70% of our economic activity and has been strengthened by a very low unemployment rate of 3.5%, which is the lowest in 51 years. This, combined with wage growth now achieving 3%+, was reflected in a high level of consumer confidence (Chart 1).

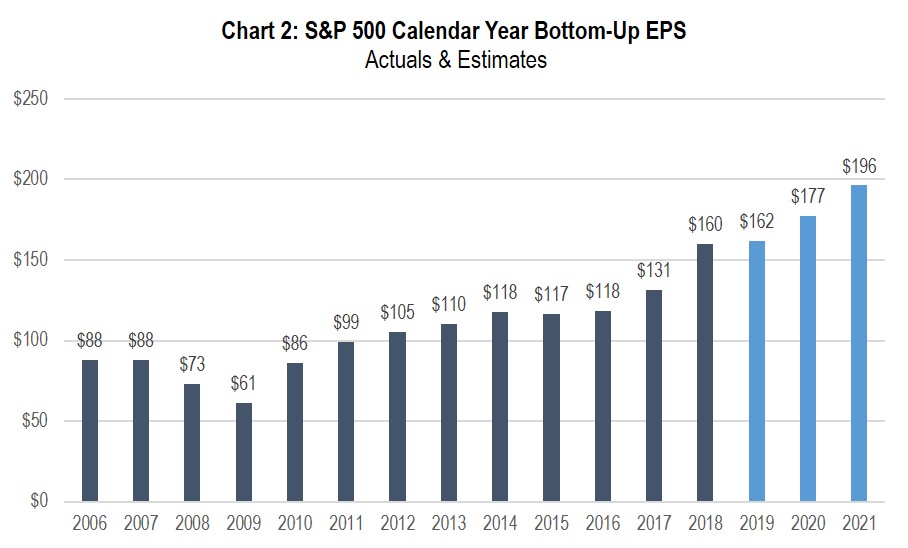

This high level of consumer confidence, a strong holiday season for retail sales, low inflation and continued low interest rates resulted in a strong fourth quarter. The S&P 500 Index, for example, increased by 9.1%! This is contrasted with the significant decline in the fourth quarter of 2018 (-13.5%) resulting from, in our view, the Fed’s premature policy to raise rates and the declaration of a trade war with China by President Trump. The 2018 decline was despite a significant rise in earnings for the S&P 500 (Chart 2).

Chart 2 shows that earnings increased (in large part from tax reform) in 2018 and were flattish for 2019. However, the stock market did the opposite of what one would have expected. 2018 resulted in a modest decline caused by the big drop in the fourth quarter, while in 2019 the markets rallied while earnings do not appear to have grown significantly. (2019 earnings are still yet to be reported for most companies.) Fundamentals in terms of valuation and other factors made us stay the course in terms of being exposed to the equity markets over this two-year period. We also “faced down” the suggestion that recession was imminent. (We stated a year ago that we did not believe that was the case and we turned out to be right). We maintain that a recession is not imminent and we do not believe that there will be a recession in 2020, barring some unexpected external event. With trade somewhat resolved and a very strong consumer, we continue to believe that our domestic economy will grow by at least 2% in 2020. This should bode well for corporate earnings in 2020.

Of course, we currently face both political and geopolitical risks. The President has been impeached by the House and the trial has begun in the Senate. This coupled with a Presidential election (as well as all seats in the House of Representatives and one-third in the Senate being up for reelection) less than ten months away could cause volatility in terms of potential policies espoused by both sides of the aisle. One could say there is a real battle developing between capitalism and potential democratic socialism if one looks at the extreme positions being bandied about. We doubt that either capitalism will go away or that democratic socialism as we see elsewhere in the world will take its place. However, real issues in terms of wealth inequality, the future funding of our social safety nets, and both annual deficits and accumulated debt will have to be dealt with one day by our elected officials.

Geopolitical hot spots, which have just gotten hotter, are also of concern. The situation with Iran is front and center given the President’s decision to take out Iranian general Qassem Soleimani, who was known as Iran’s “shadow commander” and viewed as a ruthless killer. There seems to be no argument that he was a terrible person responsible for many American deaths and maimings, as well as the slaughter of thousands in his own country and other countries around the Middle East. However, what this killing leads to is causing great concern and could result in stock market volatility. Plus, we cannot forget the issues with North Korea as well as Russia.

We always focus on valuation when evaluating a company, or other investment opportunity. The fourth quarter reflected investor optimism despite the fact that earnings did not grow much for the year, as shown in Chart 2. However, with interest rates as low as they are and global trade issues seeming to be at least partially resolved, share prices rose in the fourth quarter. With no recession in sight and the prospects for a growing economy and growing earnings, we remain “skeptically optimistic.” However, not all companies, all real estate, nor all investments will prosper in the year to come. So, selectivity remains our mission again this year. (Please refer to our 2020 Investment Outlook for additional information.) Companies with long-duration earnings growth and financially strong companies able to increase their dividends from year to year based on growing cash flows are the places to be in our opinion. It worked last year and we expect it will work again this year.

The fourth quarter gains were again biased to growth (as were many of our strategies), large-cap, and U.S. domiciled companies. Other asset classes did well, but not as well. Our underweight to international worked once again in 2019. We are watching this closely as the better trade environment and monetary/fiscal stimuli being introduced by China and Japan might make international investing more attractive going forward. A resolution to the Brexit situation should help as well. However, we would rather be a bit late to that party. Our approach to international has worked, on average, over the past 10 years.

We had a great fourth quarter led by our defensive equity and traditional equity strategies. We believe that our mezzanine real estate investments continue to do quite well. Given the political and geopolitical risks we have mentioned, we will remain with a tilt towards the defensive and still believe that will result in reasonable gains for the year. As well, we continue to underweight fixed income and cash where returns remain in some cases below the rate of inflation. As stated in our introductory quote, we need to have our capital working for us over the long term.

We hope you will join us for our web seminar on February 13, 2020 at 2 PM EST where we will review our 2020 outlook and approach to long-term investing.

Happy and healthy New Year!

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending January 24, 2020, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2020 by First Long Island Investors, LLC. All rights reserved.