3rd Quarter 2023 Letter to Investors

September 30th, 2023September 30, 2023

“If there’s one thing that’s certain in business, it’s uncertainty.”

– Stephen Covey, Author, Educator and Businessperson

The third quarter ended with many of our strategies flat to somewhat down for the quarter despite a good start in July, which was washed away by seasonally poor September performance (September was a very rainy month in the Northeast to boot). September is historically the weakest month of the year for equity markets (excluding dividends, the S&P 500 Index has been negative in September 56% of the time over the past 50 years). However, equity performance measured by the S&P 500 Index for the more important year-to-date remains very positive with a gain of 13.1%, yet virtually all of that gain was driven by seven growth-oriented companies while the S&P 500 Equal Weighted Index is up 1.8%. As a matter of fact, growth-oriented shares continued to trounce value-oriented shares for the year, with growth outperforming by 2,319 basis points. This pattern has been the case for most of this year although some broadening of the market occurred in the third quarter.

It is fair to say that greater uncertainty has developed as the year has progressed. The following examples of uncertainty weighed on investors in this most recent quarter and will continue to do so:

1. Will the Fed continue to raise rates? How long will rates remain elevated? When will higher rates impact both consumers and businesses?

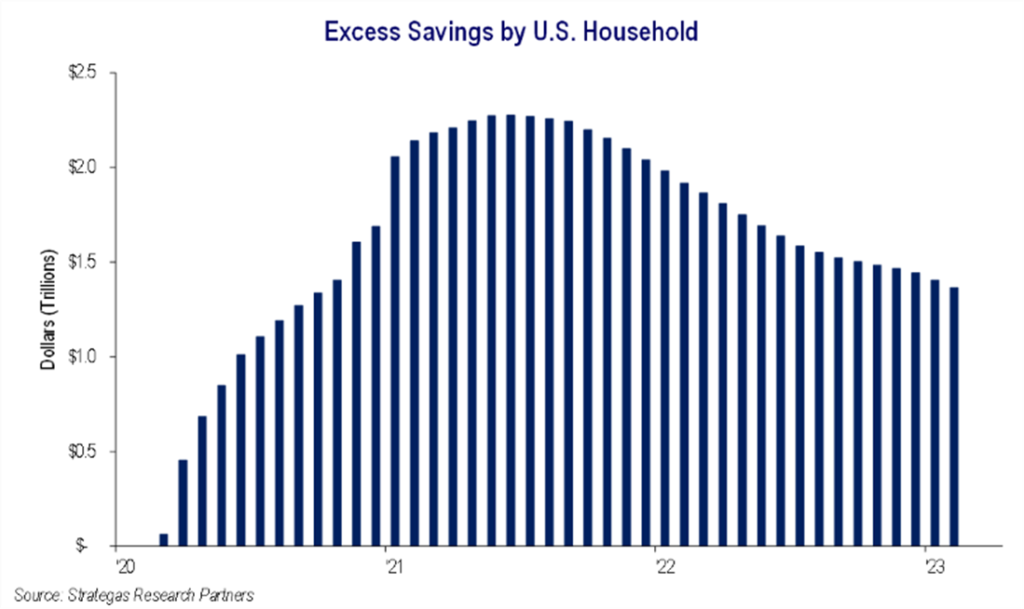

2. When does the consumer run out of excess savings, accumulated from government stimulus during the COVID-19 pandemic? Consumer credit card defaults are already on the rise.

3. 30-year mortgage rates hit a 20-year high at 7.3%, doubling from early 2022 levels.

4. The government just barely avoided a shut down as extreme conservatives demanded major budget cutbacks and more. Last minute bipartisan bills in the House and Senate will defer the shutdown for 45 days, but what then?

5. The Russian war with Ukraine continues with no end in sight.

6. A cold war with China seems to be getting colder while China’s economy has slowed.

7. Oil prices are over $90 a barrel, making the cost of gasoline and heating oil taxing on consumers and businesses.

8. Labor strikes hitting automakers and Hollywood are modestly impacting the economy.

9. The kickoff of the presidential election cycle of 2024 is upon us with the two leading candidates facing multiple indictments or allegations of corruption.

10. Are we facing an imminent recession? Is commercial real estate facing deep distress, especially in the office space market? Will the recommencement of student loan payments slow our economy?

11. Domestic debt has hit $33 trillion dollars and projected annual deficits are high despite robust employment.

The above clearly sets the table for investor uncertainty and trepidation, however, the current economic facts and projections must be weighed against these uncertainties. The following factors must be considered by investors:

1. The employment picture remains strong with unemployment at only 3.8% and the participation rate inching up. This is a positive picture for now but could weaken in the future.

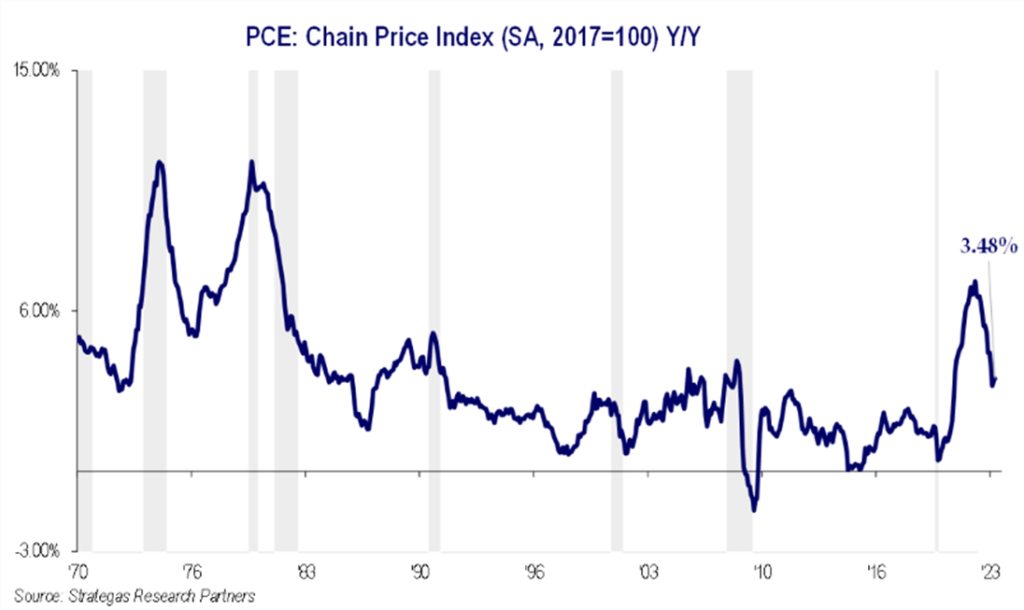

2. Inflation as measured by the PCE has fallen to 3.5% from 7.1% over the last 14 months. This continues to follow tight monetary policy and falling M2, which suggests to us a continued decline in inflation in the future.

3. U.S. GDP growth for the third and fourth quarters are estimated at 3.8% and 0.3%, respectively. This is a far cry from the recession predicted by many major banks (we did not project a recession would occur in 2023).

4. The government has passed three spending bills over the last two years (the CHIPS and Science Act; the Infrastructure Investment and Jobs Act; and the Inflation Reduction Act) that total $1.7 trillion, which will add to economic activity in the next few years.

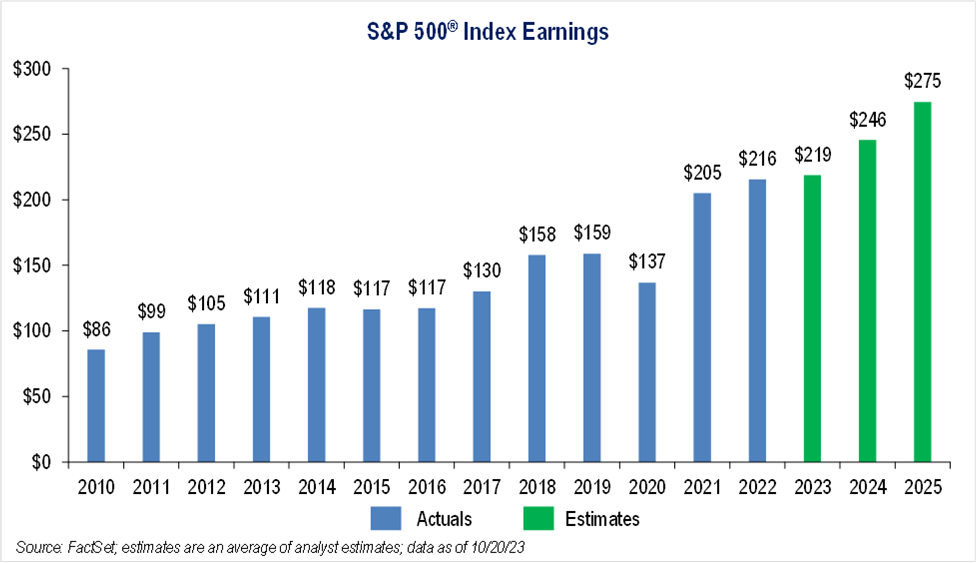

5. Equity valuations for the cap-weighted S&P 500 Index as measured by the price-earnings ratio on 2024 projected earnings seem reasonable at 17.4x including the mega tech companies, and 13.9x earnings for the S&P 500 Equal Weighted Index. Far from nose bleed when considering the current level of long-term interest rates.

6. Historically speaking, current interest rates are near the historical average despite spiking to a 15-year high.

7. The advent of artificial intelligence is upon us and will be disruptive while likely enhancing productivity.

Here are some charts to consider that shine a somewhat positive light on current and projected economic conditions. These should be viewed with cautious optimism:

These charts demonstrate, based on current economic data and consensus estimates, that the economy remains relatively resilient and valuations are certainly reasonable. This assumes no recession, however we believe that it could come later in 2024. It also suggests that the numerous uncertainties listed earlier can be navigated as past uncertainties have been. Earnings are projected to increase and inflation appears likely to continue to decline as liquidity is drained by the Fed. Interest rates have normalized from post COVID-19 pandemic lows. Finally, consumers are still in decent shape as higher wages, near full employment, and some excess savings remain available to consumers facing higher costs from food and energy. It should not be overlooked that many homeowners locked in low mortgage rates in recent years (more than 62% of residential mortgages have an interest rate at 4% or less), and many corporate borrowers took advantage of historically low interest rates until the spike beginning a year ago. This lessens the impact of higher current rates, which are just starting to be felt (in our opinion).

So What Do We Advise?

As our quote states, uncertainty has virtually always been a condition that investors and businesses have had to navigate. We live with the fears of higher inflation and then escalating interest rates. Our analysis suggests that we will continue to see tamer inflation. The Fed will probably maintain rates higher for longer after possibly one more 25 basis point increase, but current rates are about average over history. Stock market gains are achievable in an interest rate environment where the yield on the 10-year U.S. Treasury is greater than 4%. As a matter of fact, the S&P 500 Index produced significant gains while the 10-year U.S. Treasury yielded more than 4%. Of course, in our opinion, companies with growing earnings and increasing dividends are needed to drive that appreciation.

Meanwhile, as we navigate uncertainty, higher short-term yields near current levels are available for the first time in over 15 years. This is a good place to hide out with excess monies, however, history demonstrates that cash is not the best wealth building asset class over the long term. For now, it is a prudent asset allocation for a modest percentage of one’s liquid net worth and a greater allocation for investors more fearful of possible volatility from the long list of uncertainties spelled out earlier. The amount to be held in short-term instruments (U.S. Treasury Bills, etc.) or modest duration bonds is an individual investment allocation decision.

Although value-oriented, including dividend-growing, equities have not been very rewarding thus far this year (our value strategies have appreciated 0% to 6% net*), they remain underappreciated in our opinion. Growth-oriented companies might require patience from this point as they grow their future earnings into their higher valuations (these strategies have appreciated 3% to 13% net*). Real estate investments that are high yielding hold promise when well located, although not currently within the office market.

Final Thoughts

Having lived through a financial crisis (2008-2009), a once-in-a-hundred-year pandemic (2020-2022), and then 40-year high inflation (2022-2023) remedied by an unprecedented compressed rise in interest rates from about 0% leaves us with a continuing period of economic and investment digestion. For investors, this can be an uncomfortable period. The good news is that we have lived through uncertainties before. Inflation, higher interest rates, possible recession, and domestic political uncertainty/dysfunction are conditions we have navigated and successfully overcome in the past, but patience is required!

An individualized asset allocation that weighs your risk tolerance and investment goals deployed among our investment strategies will get you through the current “wall of worry” and we stand ready to assist you. Bottom line, we remain cautiously optimistic for the longer term while recognizing the near-term uncertainty and volatility. Owning high-quality bonds; financially-strong companies, both growth- and value-oriented; and well-located real-estate-type investments over the long term will be the answer to the inevitable investor uncertainty.

Enjoy the Fall and upcoming holiday season. Also, we hope to see you at our upcoming Thought Leadership Breakfast Seminar on November 8th discussing Long Island’s current and future economy.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S.: As the horrific attacks by Hamas on Israeli citizens occurred after the date of this report (September 30, 2023), this report does not include any commentary on the impact of this atrocity and will be discussed in the future.

DISCLAIMERS

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of October 26, 2023 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of September 30, 2023, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2023 by First Long Island Investors, LLC. All rights reserved.