3rd Quarter 2022 Letter to Investors

October 31st, 2022September 30, 2022

“The desire to perform all the time is usually a barrier to performing over time.”

– Robert Olstein (Respected Value Investor)

The third quarter continued investors’ misery with numerous markets suffering meaningful declines. Equities and bonds showed distress while housing weakened due to the Fed’s battle against inflation, as well as a risk-off investor temperament also reflecting fear from the war in the Ukraine. On a positive note, during the quarter oil prices declined 25% while certain other commodities also declined, including lumber, which fell in price by 36% (and has fallen by 63% year-to-date).

The Fed, reacting to 40-year high inflation, responded by increasing the federal funds rate by 150 basis points during the quarter. In addition, Federal Reserve Chair Jerome Powell’s rhetoric was extremely strident, promising to beat inflation even if it puts the domestic economy into recession, although he is hoping this will not be the case. This despite the fact that since 1929 there has NEVER been a recession in the third year of a Presidential term. Meanwhile, the economy has already suffered minor declines in GDP for the past two quarters. Some consider this a technical recession. It is our opinion that the Fed was late to respond to increasing inflation and the federal government has continued to add fuel to the inflation fire by continuing to spend on what some may argue are unnecessary and inflationary programs. The most recent significant program, a partial elimination of student debt, is estimated to be worth $400 billion of potential relief and could possibly be inflationary. This is being legally challenged as unlawful.

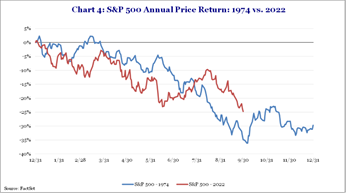

Year-over-year money supply growth has dropped precipitously, as opposed to the huge growth in money supply during the pandemic, which saw M2 grow by 41%:

The slowing of monetary growth occurred while demand velocity increased slightly from people escaping the grip of the COVID-19 pandemic. Add in the rise in interest rates along with the Fed shrinking its balance sheet by letting bonds run off as they mature and it has all contributed to severe tightening of financial conditions amidst elevated inflation. These developments are also adding to stress in financial markets, which has led to a bear market in equities and substantial weakness in bonds (especially longer-term bonds) that did not let up in the third quarter. Growth shares were particularly negatively impacted yet again by higher interest rates.

History versus Current Conditions

As indicated in Chart 2, a historical analysis of equity market behavior during midterm election years (second year) and the third year of a Presidential term offers perhaps some hope against the misery we are currently facing. On average in midterm election years dating back to 1962, equity markets swooned at some point during the year by an average of 19%. Subsequent to these declines, the equity markets increased by an astounding 32% on average over the year following the bottom of the correction.

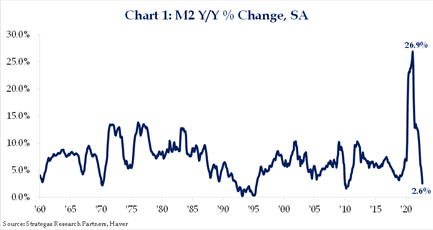

Chart 2 offers a glimmer of hope to investors if history is a guide (though it certainly is not a guarantee). In at least two periods, 1970 and 1974, the CPI registered elevated levels somewhat similar to current conditions. In 1970 (Chart 3), “happiness” commenced with the midterm election, while in 1974 (Chart 4), the “happiness” was delayed to the ensuing calendar year where there was a significant rise in the S&P 500 Index.

Although not a guarantee of future performance, the history of midterm election years makes a strong statement about the historical resiliency of equity markets. At this point, we seem to have a battle between a compelling history of the returns of equity markets and the current conditions we face as investors.

Inflation may have started to roll over as certain inputs are beginning to recede (gasoline and lumber). The Fed continues to raise rates with a dot plan indicating the fed funds rate is expected to reach 4.4% by the end of this year. The impact of several spending programs recently enacted by Congress has yet to run through the economy, while the threat of Russia using tactical nuclear weapons in Europe remains another fear factor.

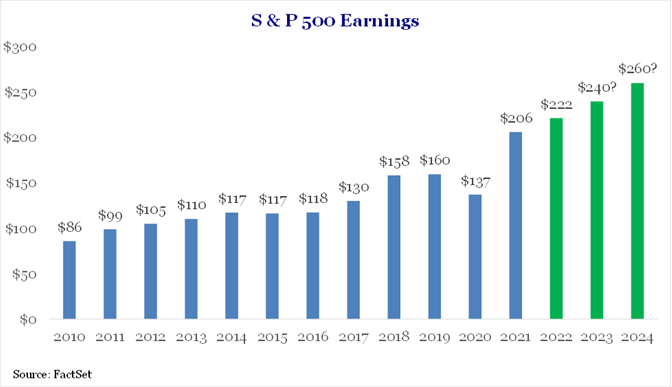

Of course, perhaps the most significant consideration over the long term is earnings. This is a critical factor that is projected to be positive for the market in general but remains a question mark, as depicted below.

Our opinion is that, in the short term, the current factors of higher interest rates, the hawkish rhetoric from the Federal Reserve, sticky inflation, the midterm election on November 8th, and the continuing conflict in the Ukraine are dictating the current market decline and volatility. We believe the need for resilience in earnings, a divided government resulting from the midterm election, and the history of equity market behavior should ultimately result in better market returns. Divided government, with the current likelihood of Republicans gaining control of the House and possibly the Senate, should result in less inflationary spending and business choking regulation. It also might lead to compromise in the areas of fossil fuel exploration as an “all of the above” solution to our energy needs and possible “legal immigration” reform, which should help alleviate the disaster on our Southern border. In our opinion, compromise in both areas should help bolster economic growth and ease fears in the market that are currently clouding future prospects.

Long-Term Investing

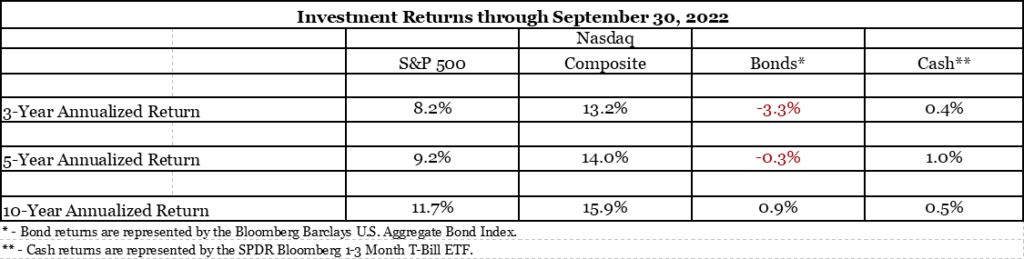

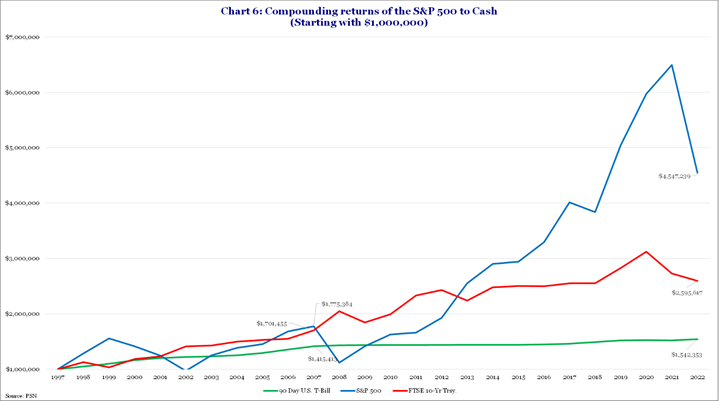

We recently presented a webinar for our clients and friends. The following chart demonstrates that long-term investing, despite this significant downturn, has rewarded investors with meaningful returns in the equity space:

Chart 6 shows that there are occasional significant drawdowns in equity markets. The reasons for each drawdown have varied over the years, from the COVID-19 pandemic, to a banking crisis, to currency crises, to tech meltdowns, wars, and so on. Thus far however, in each case, long-term investors who were able to weather the volatility were rewarded. This confirms the sentiment in our opening quote: good performance occurs “over time,” not “all the time.”

Earnings and Dividends

We have always believed that growing earnings, market dominance, strong balance sheets, prudent allocation of capital, and dividend growth have all been factors in growing our clients’ net worths over the long term, along with a prudently diversified asset allocation among growth and value equities, fixed income, real estate (where suitable), and other alternatives (where suitable).

This year, despite these miserable market conditions, our internally managed, equity-based strategies have thus far delivered earnings and/or dividend growth. The average dividend growth this year for our Dividend Growth strategy is 11.2%, which has even exceeded the high levels of inflation impacting all of us this year.

From a valuation standpoint looking forward, we do not believe we are in a bubble especially as the S&P 500 Index has dropped 23.9% thus far this year (growth shares have been impacted even more) while earnings still are expected to grow this year and next. Given the higher interest rates impacting consumers, businesses, and home buyers, it is possible that earnings estimates for 2023 will come down as fears of a real recession continue. In this environment, the baby gets thrown out with the bath water. This could be a function of the rise in passive investing where selling ETF’s and other indexed products results in indiscriminate selling of all companies, including the better companies, rather than just the weaker ones. We see numerous companies with market dominance, growing earnings, or growing dividends trading at what we believe to be very attractive prices if one has a longer-term perspective.

Given these volatile conditions, we are attempting to take tax losses where prudent and are making portfolio adjustments where we see better opportunities. Volatility, in our opinion, can be an opportunistic investor’s friend.

Our Approach

It remains to be seen if 2022 and 2023 rhyme with history. We are hopeful it will. However, investing in fine American companies has, in the past, been rewarding despite occasional market drawdowns that can be the painful price (at times) of long-term investing. Current short-term interest rates on a pre-inflation basis are more attractive than they have been since 2007 and a cash buffer still makes sense given current volatility. We believe, however, that beyond a reasonable, individualized cash buffer (invested smartly in short-term instruments), there are long-term opportunities in both value and growth equities. Equity market volatility and investor bearishness has created an opportunity in select companies that we believe have been overly punished. In many cases, these profitable company shares have declined by more than 25%.

Our bias remains defensive given the previously cited challenging conditions. An individualized cash buffer, modest underweight to fixed income, overweight to our defensive strategies, and continued modest underweight to traditional equities makes sense for most investors. Opportunistic additions to select traditional and defensive strategies will be recommended to individual clients with additional liquidity as well as alternatives and select real-estate opportunities.

On a personal note, these periodic bear markets are never pleasant. We invest side-by-side with you, and this is painful for all of us. However, as history has shown, we will endure by continuing to focus on fundamentals including quality, earnings, dividend growth, financial strength, and prudent management teams. We believe as investors our patience over time will lead to solid returns.

I am both happy and sad to announce that our partner and Executive Vice President and General Counsel, Bruce Siegel, will be retiring early next year after 33 dedicated years with FLI. Bruce has been invaluable in helping to build our company. He has provided great counsel to our clients in many areas, especially concerning estate and insurance planning. He also helped us in the investment arena, where he led our alternatives subcommittee. Bruce directed us in a thorough search that culminated in selecting Jonathan Golub as our new Senior Vice President – Legal, who will succeed Bruce as General Counsel upon his retirement. Jonathan was educated at the University of Virginia and UCLA School of Law. Jonathan has been practicing law in New York for over 20 years, most recently as the Chair of the Fund Formation and Investment Management practice group and a corporate partner at a leading law firm in its New York City office. Jonathan joined FLI on October 3rd, and will work side by side with Bruce until his retirement. Please join us in thanking Bruce and wishing him a long, happy, and fulfilling retirement, and wishing Jonathan much success in his new position.

We remain committed to helping our clients navigate this difficult investment environment, and seeing over the valley to better times. Know that you can always contact any of us on our investment committee and/or our wealth management team.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending October 28, 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2022 by First Long Island Investors, LLC. All rights reserved.