3rd Quarter 2021 Letter to Investors

October 25th, 2021September 30, 2021

“Quiet people have the loudest minds.” – Stephen Hawking

After five consecutive quarters of robust performance for equities in general (domestic consistently outperformed international and growth stocks led most of the way), the third quarter ended with near flat performance (S&P 500 +0.6%) after giving up 4.7% in the month of September. Additionally, value outperformed growth in September, but growth still outperformed for the third quarter. September is typically a soft month for stocks (average decline of 0.5% over the past 70+ years), but this year’s decline reflected a lot of serious issues as well as some noise including a potential government shutdown, a very questionable exit strategy from Afghanistan, genuine concerns about growing national debt and inflation, and concerns about when the Federal Reserve will start to taper its asset buying program (known as quantitative easing). Of course, the Delta variant, COVID infection rates, and mask and vaccine mandates brought into question the pace of our economic and emotional recoveries from this pandemic.

On top of all of the above, attempts by the Biden administration to pass two major spending bills, possibly aggregating almost $5 trillion, have been the daily headlines. Progressives want more social engineering and steps to address climate change, while conservatives worry about debt, inflation, and higher taxes on both corporations and high-net-worth individuals. As of this writing, these legislative initiatives (including traditional infrastructure with bipartisan support) have yet to be passed. These matters seem to be held hostage by a group of progressive Democrats on the left and two centrist Democrat Senators who are adamantly against the passage of a $3.5 trillion social infrastructure package and who want to limit the spending to no more than $1.5 trillion. (These appear to be gross numbers, not taking into consideration any potential offset of revenue generated by tax increases.) Furthermore, several moderate Democrat Congresspeople have suggested they would not vote in favor of the larger bill unless it includes a repeal of the cap on the State and Local Tax deduction (SALT) which is vehemently opposed by progressives who think it is a gift to the rich. The moderates believe the progressives are failing to realize the wealthy are fleeing high-tax states leaving state revenues somewhat depressed.

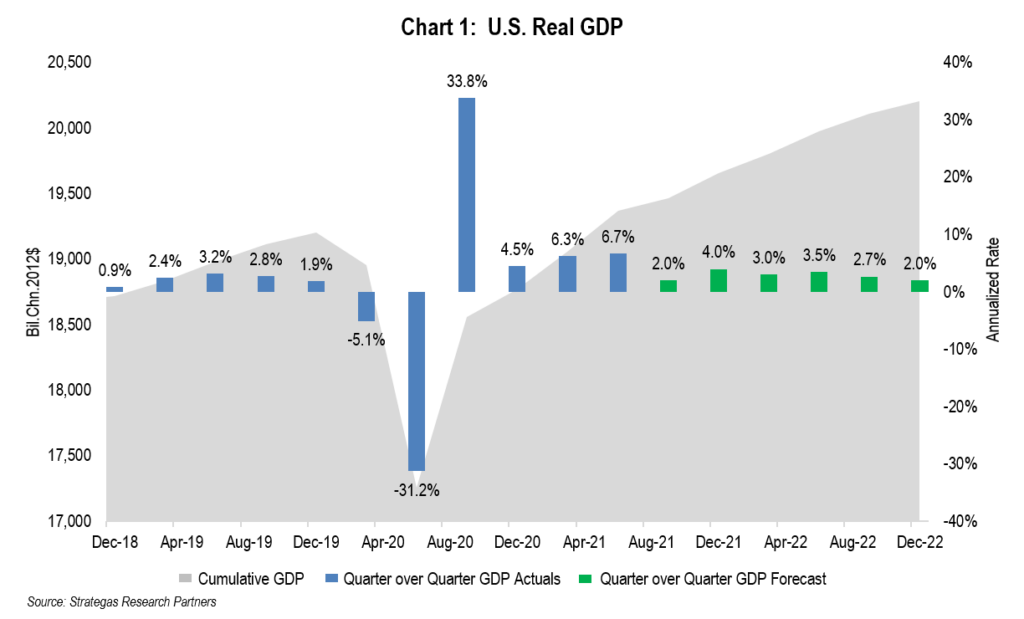

With all of the above consuming investors, it is time to be the “quiet people with the loudest minds.” In other words, let us quietly dive into the fundamentals that should drive investment strategy instead of getting caught up in the loud noise surrounding various issues. At our recent web seminar, we presented the following chart which shows GDP growth for recent years with projections for next year:

Certainly these actual and projected results indicate a relatively strong domestic economy rising from the government imposed recession due to the pandemic. Consumers (both domestic and European) meanwhile have been hoarding cash since the beginning of the pandemic. This suggests that domestic consumers remain in a very strong financial position and could increase spending when supply shortages abate and the Delta variant is brought under more control. Certainly this could support the aforementioned GDP growth and possibly support financial markets as well.

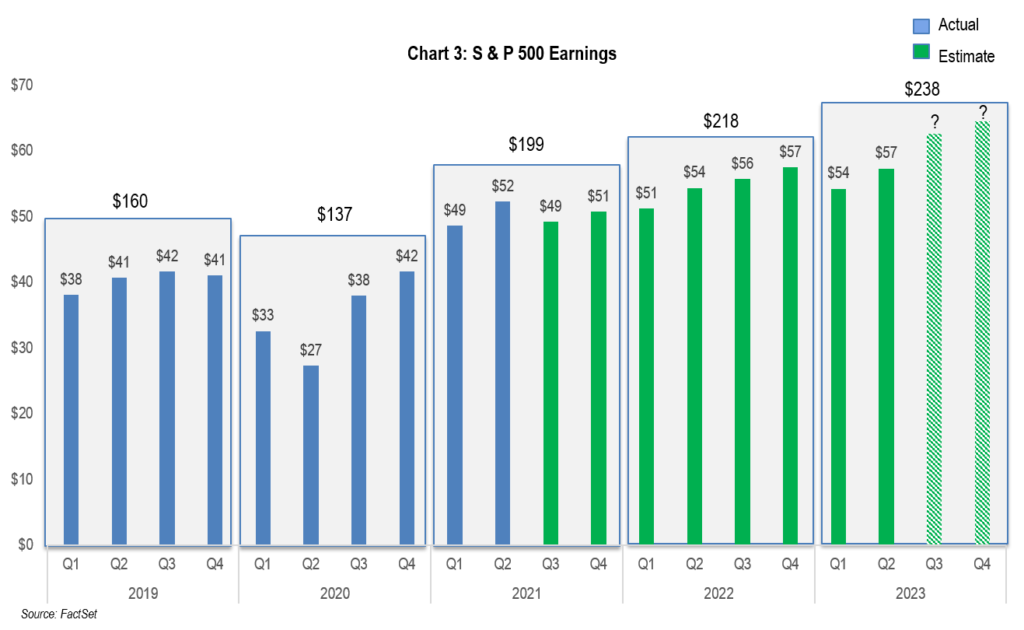

In addition, the actual earnings growth for this same period also presents a positive picture:

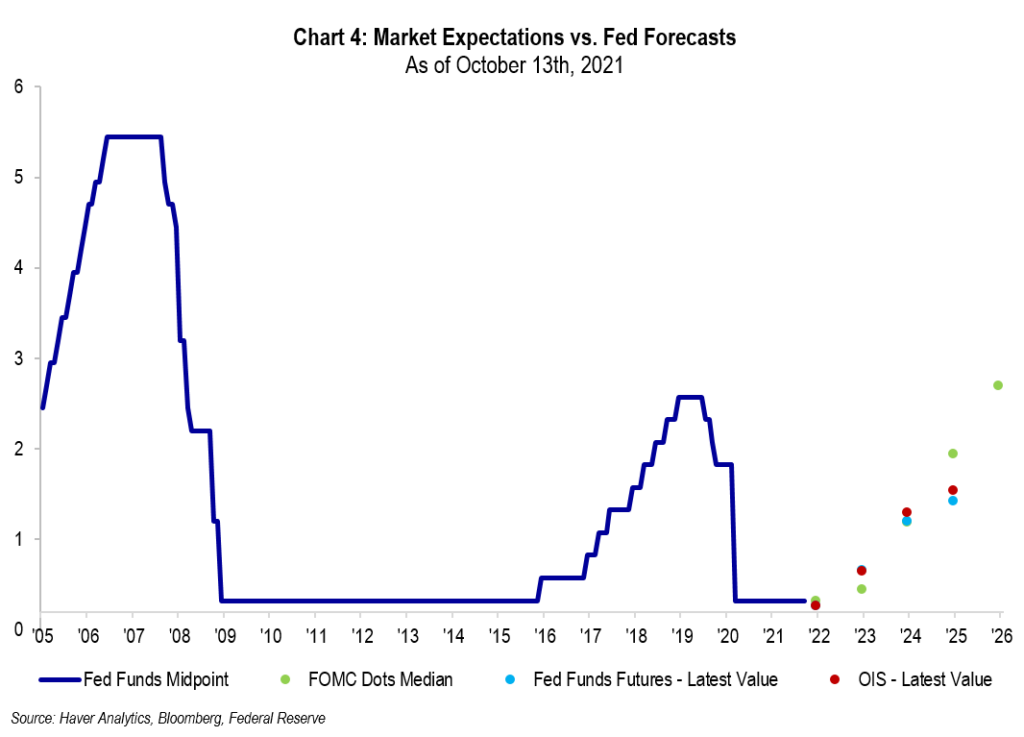

These actual and projected results (note: projections do not incorporate the potential impact of a corporate tax increase) also reflect a strong showing from the S&P 500. Strong GDP growth coupled with growing earnings should be supportive of a strong stock market and thus far it has been. However, valuation has to be considered and in order to gauge the reasonableness of valuation it is our view one must look at current interest rates and where they might go. This is because we have always believed that interest rates impact valuation of most financial and hard assets. Accordingly, we offer the following to show just where rates have been and where the Fed projects they are going:

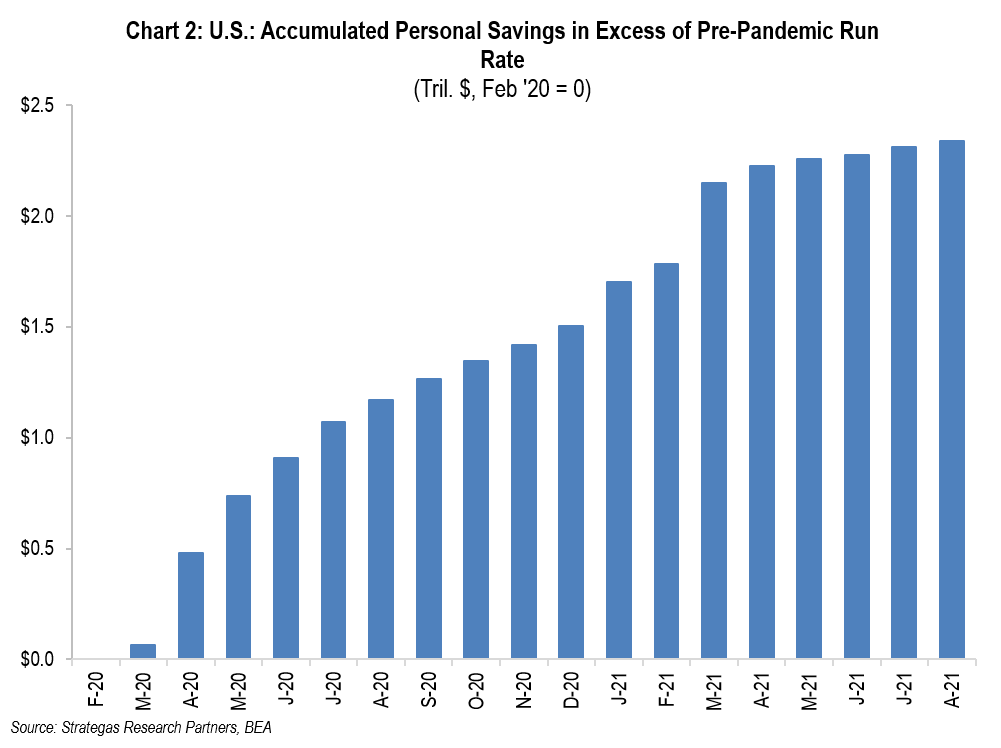

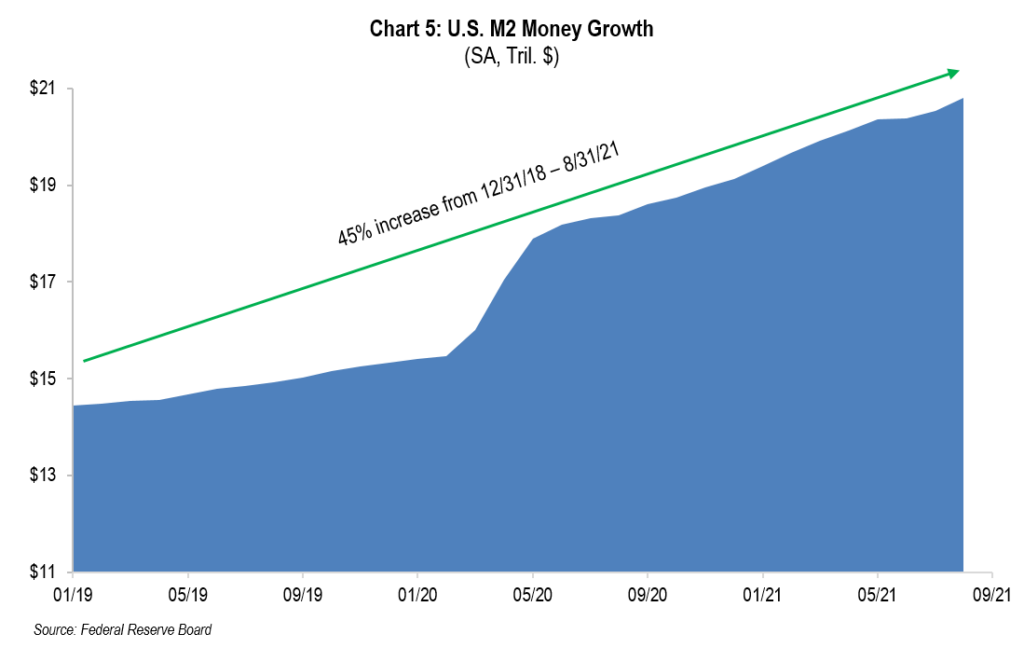

In our opinion, these low interest rates coupled with growing earnings supported by a robust economy are important reasons why stock prices as well as private equity deal volume and real estate values have risen. Another factor supporting rising prices in financial assets is the huge liquidity that has been pumped into the U.S. economy:

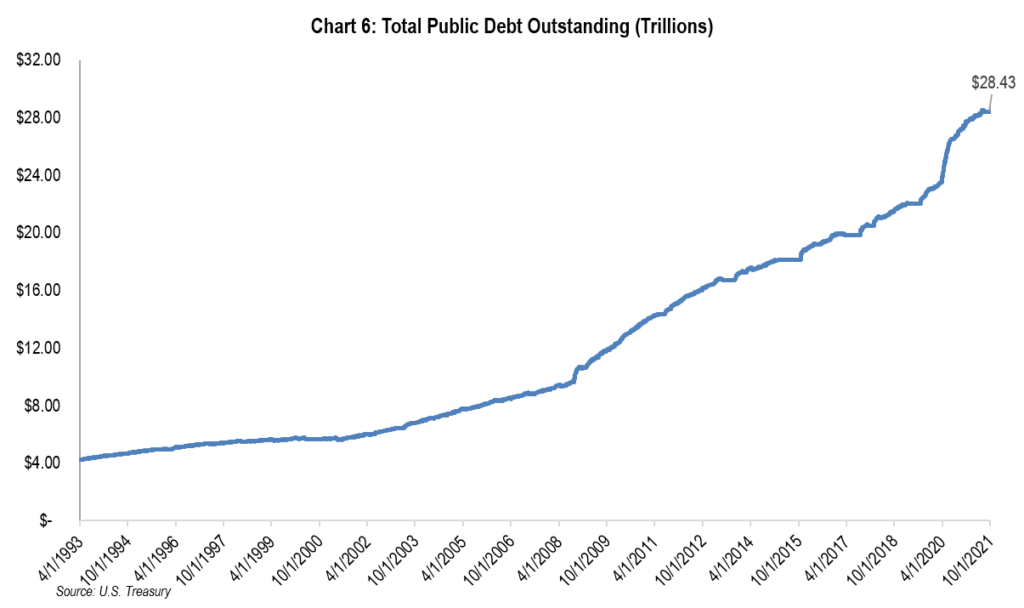

Now we can add to the analysis of why we have enjoyed stock market appreciation this additional factor of so much liquidity looking for a home. Additionally, given the Fed’s concern about getting back to full employment, its appetite to raise interest rates and commence tapering is tempered by a number of factors. It does not want to strangle an economy rebounding from a pandemic, and it also may consider the impact of higher rates on servicing our national debt. Every 100 basis point increase in the average cost of our debt would, by definition, increase our deficit by $283 billion a year! This analysis comes from one of our outside economic consultants Strategas Research Partners, and is supported by the following chart:

Taking stock in all of these points: the growing economy, robust earnings, very low but somewhat rising interest rates, and abundant liquidity, what must we really worry about that could derail this seemingly strong environment for investors?

The first is inflation. There is no question that supply constraints are at fault for some inflation, although the Federal Reserve believes that currently inflation is transitory. Our research indicates that inflation will somewhat abate, but over time. So, some inflation is here for the shorter term. In addition, oil prices have risen over 50% this year and that is reflected in both gasoline and heating oil costs. This too adds to short-term inflation and possibly longer term. It remains to be seen whether the Fed is right and inflation is transitory. If true the Fed should not have to raise interest rates in order to curtail inflation. If inflation is longer term in nature there would be greater pressure on the Fed to taper and ultimately raise rates. The pace and magnitude of any such rate increases could affect pricing of financial assets. The market’s current expectations were shown earlier in chart 4 on page 3.

Another factor weighing on investors is the current debate on spending in Washington, D.C., If the progressives get their way and new (not including the COVID relief programs which equaled nearly $7 trillion) spending programs of $3 trillion to $5 trillion are passed, this too could lead to even higher national debt, higher interest rates, and inflation. The higher taxes that are proposed at both the corporate and individual levels could somewhat depress corporate earnings as well dampen consumer spending. Of course, these are our opinions and I’m sure some would differ. Centrist Democrat Senator Joe Manchin has called this potential spending “fiscal insanity.”

Where does this leave us as investors?

Growing GDP, higher forecasted corporate earnings, historically low interest rates, a strong consumer, and the current abatement of COVID infections are factors that would lead us to some optimism for the balance of the year and into 2022. On the other hand, we must watch the rate of inflation, the ultimate outcome of the current spending and tax debates in Washington, D.C., and what preemptive actions the Fed takes, if any, if inflation proves not to be transitory. Also, and not to be forgotten, is that equity markets do correct (declines of at least 10%) from time to time. We have not had such a correction this year, although in September we experienced the first drawdown of approximately 5% from the recent market high. In past years since 2009 the average number of 5% drawdowns has been approximately two per year, with only 2017 not having such a drawdown. (That is not unprecedented, but it is unusual.) For the record, the fourth quarter is typically a strong quarter for equity markets having risen on average 2.7% during the quarter when looking back historically to 1928.

Exercising caution and taking into consideration valuation of stocks and bond yields, we remain underweighted fixed income as a negative real yield (absolute yield minus the inflation rate) on an after-tax basis for treasuries as well as investment grade corporates and municipals is not something we can ignore. Compounding a negative real return is a prescription for loss of purchasing power. We do not see a recession in the near term thus we do not believe interest rates will decline. Additionally, trying to reach for yield by buying longer-term bonds will cause mark-to-market losses if rates tick up. We continue to suggest an overweight to our in-house defensive strategies which have performed well for many years and include both large-cap growth and value companies which in our opinion, provide opportunities regardless of how the economy performs based on what Washington, D.C. decides to do, if they can decide to do anything. Each of our defensive strategies aim to protect on the downside, which should help if we encounter greater volatility. We remain modestly underweight traditional equities given fairly robust valuations which somewhat corrected in September. Please keep in mind that neither the traditional nor social infrastructure spending bills are an immediate positive catalyst to the economy. Those funds, if approved, will be deployed over a number of years.

In summary, we remain committed to being fully invested with a modest cash buffer depending on each client’s personal financial situation. Our strategies give both growth and value ample exposure (in both our defensive and traditional equity baskets) to reward long-term secular growth while also having exposure to some cyclical strength and dependable dividend streams. Fine-tuning asset allocations can be done once we see where Washington, D.C. sorts out its current battles, how transitory inflation really is, and when we can anticipate the Fed starting to taper asset purchases and ultimately raising interest rates. At this time we see the Fed beginning to taper later in the year or early in 2022 and completing that process sometime in the second half of 2022. Based on recent statements by Fed Chair Powell (who is up for re-nomination in February of 2022), he does not expect rates to rise until after tapering has concluded. Of course, everything is data-dependent.

These are certainly interesting times for investors given the confluence of a pandemic, excess liquidity, a growing economy, cash-strong consumers, rising inflation, and political battles not just between the Republicans and Democrats, but within the Democrat Party. As our quote suggests, now is the time to be quiet, think, focus on fundamentals, and let our minds, not the noise, direct our long-term investing.

Enjoy the fall and upcoming holiday season. Please do not hesitate to call or meet with us.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S. We will be putting out a piece on any significant tax changes if they occur from the current legislative debates and our view on any investment impact.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending October 22, 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2021 by First Long Island Investors, LLC. All rights reserved.