3rd Quarter 2020 Letter to Investors

October 27th, 2020September 30, 2020

“In the middle of every difficulty lies opportunity.” – Albert Einstein

We as investors face a complex investment environment as we seek to preserve and grow our capital. We maintained our commitment to long-term investing and it proved especially prescient as for nearly all of our strategies we have not only recovered all of our capital, but have created some meaningful gains for the year after navigating a shutdown of our economy with domestic GDP falling a stunning 31% in the second quarter. This economic collapse was caused by a global pandemic which initially baffled scientists — a pandemic which we are still struggling with, and nervously await a potential second wave. We hope a vaccine is on its way.

Adding to this uncertainty is an election in a few weeks pitting two warring Presidential candidates, in a very divided country. At stake are potential economic, tax, and regulatory actions that could transform not only our economy, but also our environment as well as our approach to society.

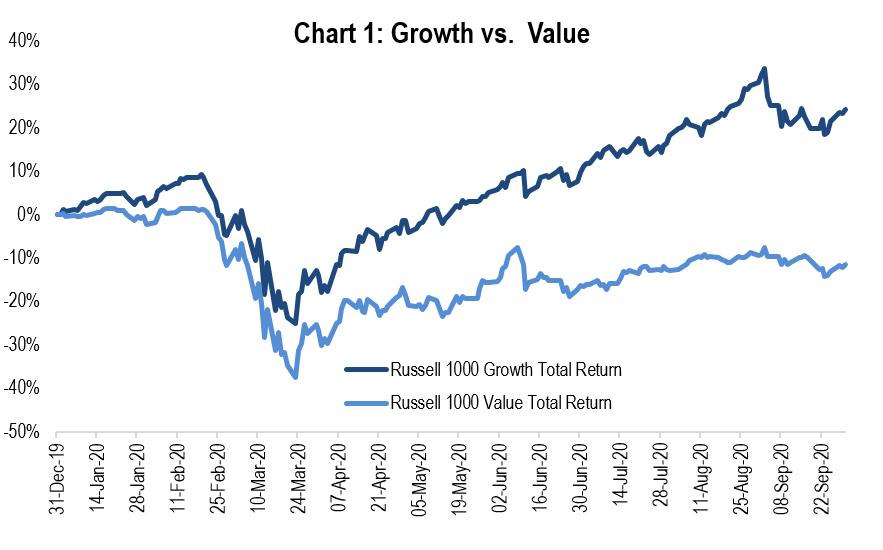

While we struggle with this deadly coronavirus, civil strife, and a contentious election, we face a historically unprecedented interest rate environment, a recovering economy, and valuations that seem stretched. Add to this picture that the record stock market, while emerging from a near depression, has been fueled by a small number of “growth stocks” while leaving most stocks, especially “value stocks” in the dust (see Chart 1).

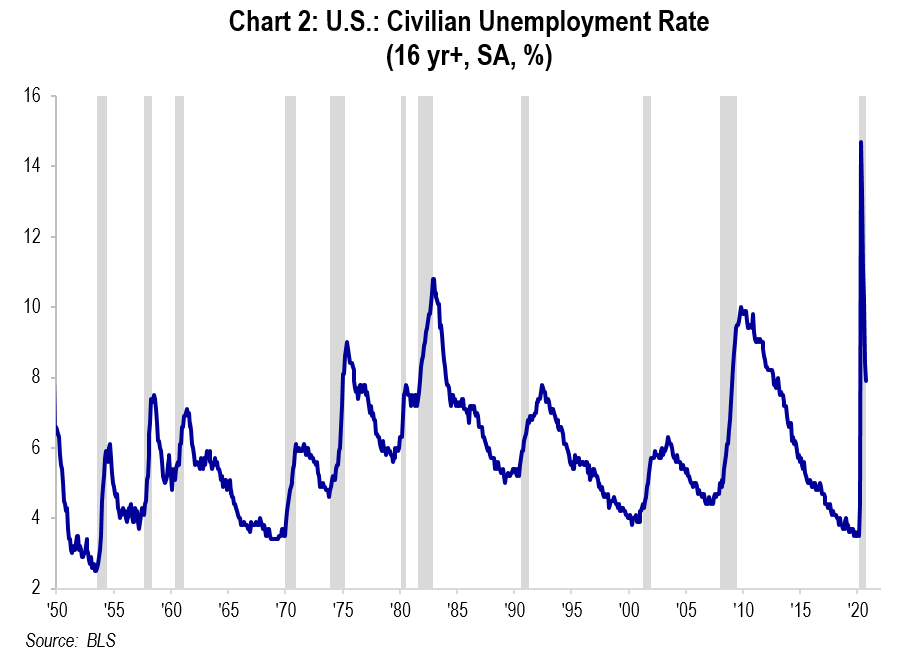

The companies fueling the appreciation in the Russell 1000 Growth Index have also led to the majority of the gains in the S&P 500. These companies include: NVIDIA, PayPal Holdings, Amazon.com, Apple, and Netflix. These gains were accomplished despite the COVID-19 pandemic. Meanwhile other asset classes including segments of commercial real estate have suffered from defaulting tenants, while some residential real estate suffers from the high levels of unemployment (record unemployment which is now recovering, as shown in Chart 2), and non-paying tenants. These real estate travails have also impacted many banks which hold increased reserves for potential loan losses.

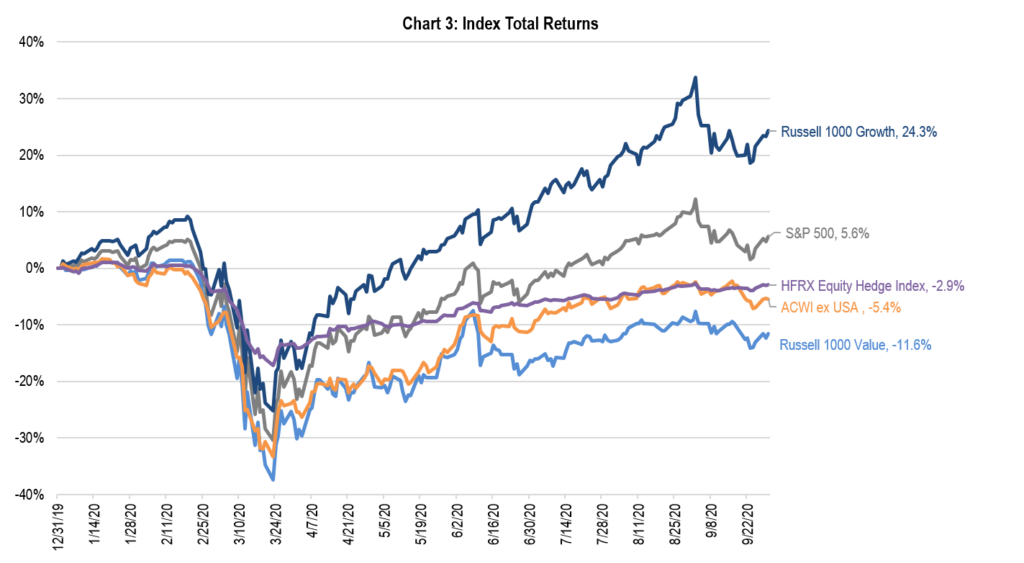

As we write this commentary, the following indices year-to-date through September 30, 2020 have achieved results:

As you can see, not all equity and hedge fund results are created equal. The good news is that the majority of our equity and hedged strategies exceeded their respective benchmarks for the quarter. All of our equity and hedged strategies had strong absolute results for the quarter. Good news indeed, but where do we go from here?

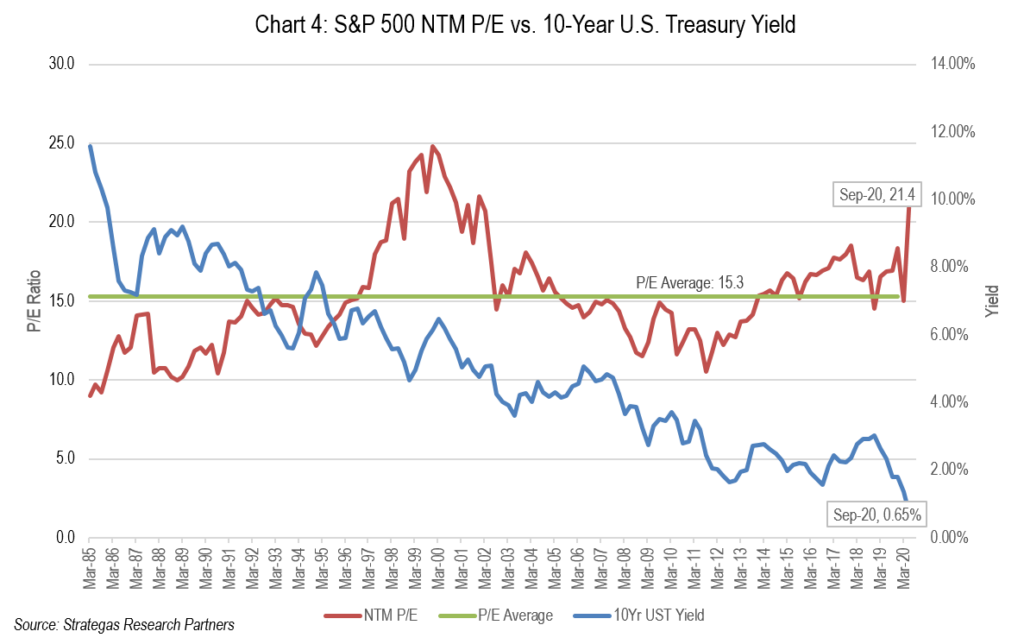

As stated earlier, valuations seem stretched for the S&P 500 Index but buttressed, in our opinion, by historically low interest rates (as shown in Chart 4):

As you can see from the chart above, the higher than average P/E ratio is accompanied by the lowest interest rates in my lifetime. We believe there is a direct relationship between the higher P/E and historically low interest rates. If we are to believe Fed Chair Powell, these very low interest rates will be with us for a number of years. We view that as good news for equity investors.

So, our environment is laced with fear of coronavirus, the pace of economic recovery (V shaped?), seemingly lofty stock market valuations, and an incredibly contentious election. All of this requires investors to really reflect on how to invest. This is no time for auto pilot investing. Preservation of capital and avoiding losses that detract from compounding of returns should always be paramount in the minds of prudent investors (and their wealth managers).

We believe that as our quote states, “in the middle of every difficulty lies opportunity.” Our job is to advise you in a way to find those opportunities overcoming the uncertainties enumerated in the paragraphs above.

The Path Forward

In our view, we cannot ignore in the short term the serious challenges we face. We believe that the economy is recovering. Some parts in a V shape, but others not nearly recovering without a vaccine or therapeutics to mitigate the effect of the deadly virus. Even if a vaccine or vaccines do materialize in the next few months, it will take upwards of a year for it to be administered to the majority of the U.S. population that is willing to take it.

The key is the companies that we continue to invest in— companies that reflect the core characteristics we require: quality, financial strength, dividends, secular earnings growth, and responsible and ethical managements. As for bonds, we only own investment grade, but yields are pitifully low. They are below the rate of inflation, so we remain underweight. Additionally in real estate, prime location and extreme patience are required.

Our current advice is to overweight our defensive strategies with continued, but somewhat below typical, exposure to traditional equities. While we have been biased to domestic large-cap growth we are starting to increase our value exposure, but slowly. Between FLI Dividend Growth, a defensive strategy of primarily value companies, and exposure to our growth-biased FLI Core strategy or other traditional equity strategies, we have a barbell approach giving clients exposure to both growth and value. Of course, we customize the asset allocation for each client.

Our bias to FLI Dividend Growth gives our clients a robust stream of absolute dividends (currently 2.6%) with the average dividend increase (over last year as of September 30th) of 7.4%! This vastly exceeds the S&P 500 Index which currently yields 1.7% and is projected to have very little dividend growth this year given the pandemic (by contrast, the 10-year U.S. Treasury only yields about seven tenths of one percent). In addition, most of our traditional equity strategies include leading growth companies which have fueled the appreciation in the S&P 500 Index this year.

Finally, given investor anxiety over fear of the coronavirus and a vicious political landscape, we urge clients to have some cash reserves, especially if one is not currently working or does not have an active business. This provides the ability to wait out any unforeseen volatility and to “sleep at night.” We will counsel you on what is an appropriate amount of cash to hold on a case by case basis. This should also reflect any liquid assets you might have outside of FLI.

We do believe that there is the ability for our clients to find opportunity to grow one’s capital notwithstanding the difficult environment we are currently navigating.

Also, we invite you to join us on Tuesday, October 27th at 1:30 PM for our online seminar in which Dan Clifton, a top Washington Analyst and the Head of Policy Research at Strategas Securities, will explore the upcoming election and the tax and regulatory changes that might occur if there are major political changes. A Democratic sweep, which is a possibility, will most likely lead to disadvantageous tax consequences, both income and estate tax, for high net worth investors (based on specific statements by the Democratic Presidential nominee, Joe Biden). Please email events@fliinvestors.com for registration information.

Please stay safe, wear masks, socially distance, and wash hands! Also, we at FLI are always available to discuss your asset allocation and wealth management needs. Given the uncertainty that we are currently navigating, it might be timely for us to have a conversation.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending October 22, 2020, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2020 by First Long Island Investors, LLC. All rights reserved.