2nd Quarter 2023 Letter to Investors

June 30th, 2023June 30, 2023

“You must force yourself to consider opposing arguments. Especially when they challenge your best loved ideas.”

– Charlie Munger

The second quarter and first half of the year, from an investment standpoint, offered many challenges, but resulted in bifurcated yet positive results. More growth-oriented companies saw a decisive comeback from last year’s challenges. More value-oriented companies witnessed moderate gains after outperforming on a relative basis last year. Stock market indices gained for the quarter and year-to-date, but the results of most companies varied significantly from the outsized gains of a very small number of growth companies. As discussed below, the S&P 500 Index, on its face, can be a misleading indicator of the market’s overall performance.

The S&P 500 Index has in some cases been renamed the S&P 493. On a traditional market-cap-weighted basis, the popular average gained 16.9%, while on an equal-weighted basis, the average gained only 7.0%. The seven largest companies, on average, gained 89%, while last year they lost 46%, on average. Using valuation as a significant metric to consider, the S&P 500 Index is trading at a price-earnings ratio of 18.2x on projected 2024 earnings, while on an equal weighted basis, it is trading at a price-earnings ratio of 14.3x on projected 2024 earnings. Certainly, the equal-weighted price-earnings ratio on projected 2024 earnings is not alarming and, if anything, appears attractive. Of course, that is with companies all equally weighted and dulls the effect of the seven companies leading the appreciation charge this year. Please remember, these are estimated price-earnings multiples based on projected 2024 earnings, which do not reflect the effect of a potential recession as of this date.

The cause of this strange performance bifurcation was the unprecedented spike in interest rates driven by the Fed over the past 16 months, in our humble opinion. Never in modern U.S. history have rates risen from near 0% to 5.25% in that short of a period. This crushed growth stocks (think Amazon.com, which declined 50% last year), with the Russell 1000 Growth Index dropping 29.1%, only to rebound thus far this year by 29.0% (with Amazon.com rising by 55% year-to-date). Meanwhile, value-oriented companies held up better than growth stocks last year with the Russell 1000 Value Index being down 7.5% (think Johnson & Johnson, which last year appreciated by 6%), while this year the index is up a modest 5.1% (with Johnson & Johnson down a modest 5%). So far, in our opinion, our strategy at FLI of having our clients maintain a prudently diversified asset allocation that includes both value and growth stocks has led to some happiness for virtually all of our clients.

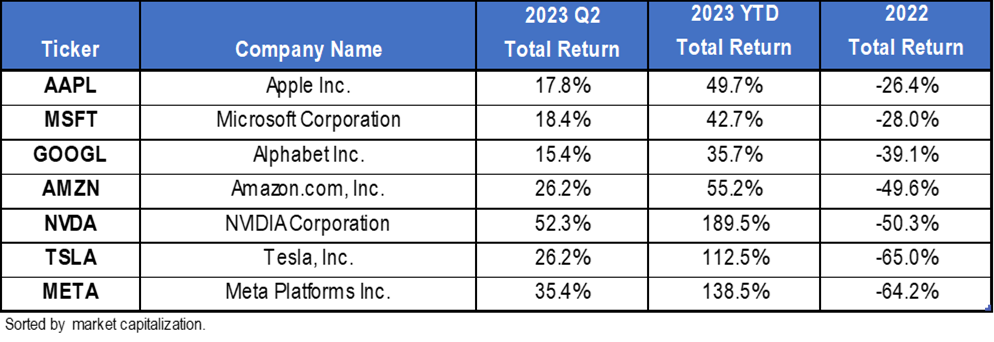

To give you some more specifics, here is a list of the seven S&P 500 Index companies leading the charge thus far this year versus how they fared in 2022: (We do not claim to have owned all of these companies but we do currently own the majority of them in a number of our strategies):

The above results demonstrate the crushing effect, in our opinion, that the spike in interest rates and supply chain disruptions had in 2022. It also portrays how the recovery stems from what most believe is the near end of interest rate increases, declining inflation, and the momentum caused by the recent focus on potential disruptive technology, particularly artificial intelligence (AI). If your portfolios contained these seven companies, you most likely have enjoyed huge gains. Of course, most portfolios are diversified and may own most of these seven companies (aggressive growth), some of these companies (growth-oriented strategies including core portfolios), or perhaps none of these companies if you are exposed to a highly value-oriented portfolio, which is likely in the last case as most of these companies pay no dividends or tiny ones that are not typical of value-type companies.

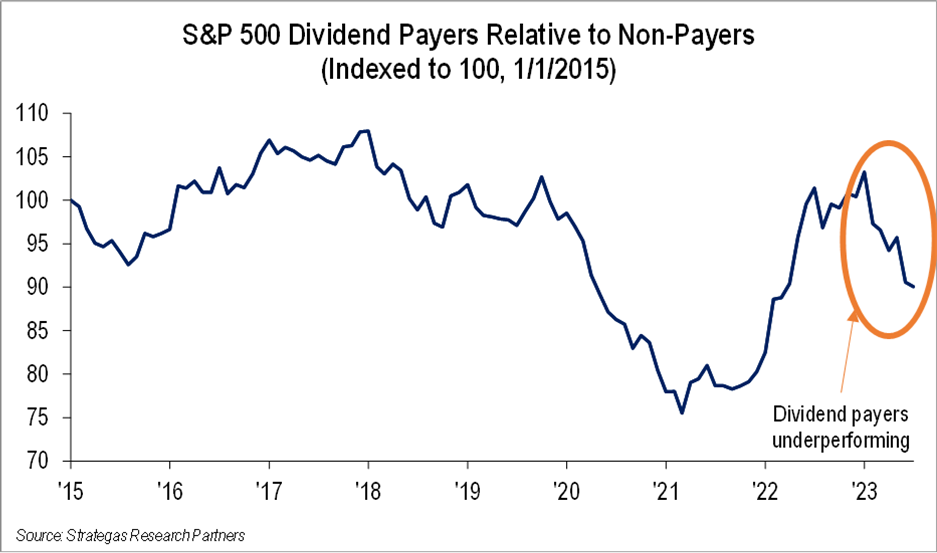

To boot, since I mentioned dividends, dividend paying stocks did not fare so well versus non-dividend-paying stocks for the first six months of this year as evidenced by the below chart. As you know, we offer a dividend growth strategy that has compounded at over 10% net* a year since its inception over 13 years ago, where an above-average dividend yield and dividend growth are paramount.

Our more growth-oriented strategies had a strong second quarter and year-to-date (gains of 7% to 18% net*) while our value-oriented strategies (both spanning our defensive and traditional baskets) had more modest gains (2% to 9% net*). The mix of both growth-oriented and value-oriented strategies has led to a good rebound from last year thus far for virtually all of our clients.

At the same time, our advice from March to have a buffer of short-term U.S. Treasury Bills to help weather the uncertainties we are facing (the proverbial “Wall of Worry”) has led to client’s earning current annualized yields of approximately 5% or more. Not so bad after U.S. Treasury Bills had yielded virtually nothing for many years and the 10-year U.S. Treasury was actually down 17.8% last year.

So, What Gives?

The referenced “Wall of Worry” consists of the following questions (that we know of), which are challenging and give us cause for pause and reflection:

· When will the Fed stop raising interest rates, and for how long will they remain elevated?

· Will inflation continue to abate?

· Will the recommencement of student loan repayments have a material effect on consumer spending?

· Is there a recession on the immediate horizon?

· If so, will the recession be a deep one?

· Will the geopolitical picture worsen?

· Will the political divisions plaguing our country get better or deteriorate even further?

· When will normality return from the COVID-19 hangover?

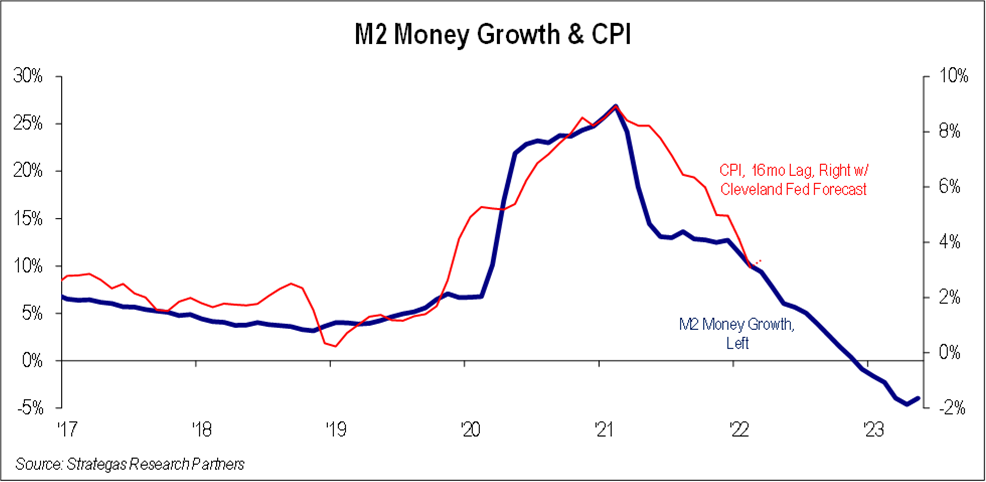

In answering the above, let us start with our view on interest rate increases and inflation. The following chart, which we have referenced in the past, shows that negative trending monetary growth is typically followed by a decline in inflation:

As you can see, as monetary growth declines, inflation typically follows within 16 months or so. Currently, we have negative monetary growth, which has not occurred since the Great Depression (except for one month of de minimis negative growth in 1958). In our opinion, this should lead to, and already is leading to, a decline in inflation, which should give the Fed the ability to pause its interest rate increases by the end of this year when we expect inflation to be in the 3% to 4% range or possibly even lower. This should be good for the equity markets, including both growth and value stocks. We could also see a broadening of performance within the S&P 500 Index, where quality value stocks make up some ground on growth stocks, which seem to have, in certain cases, somewhat stretched valuations, in our opinion. An improvement in the performance of value stocks would be healthy for diversified investors.

However, slowing inflation and declining monetary growth should also slow our economy. In a perfect world, maybe recession is avoided. In our view, it is inevitable and we hope it does not impact us as investors until sometime in 2024. The counter view to an imminent recession is stubbornly strong employment, despite these rate increases and quantitative tightening (shrinking of the Fed balance sheet). Renewed economic growth in China and federal spending prior to the 2024 presidential election cycle could also fend off recession. However, a war raging in Ukraine, a cold war with China, and certain Middle Eastern countries seemingly getting friendlier with the Communist Chinese also could contribute to what may be an inevitable recession and declining corporate profits, in our opinion.

In any event, we believe that a recession will be modest because of robust employment, even if that worsens somewhat, along with strong balance sheets for most companies including our major banks, which just passed a somewhat more stringent stress test. We are still keeping a careful eye on commercial real estate, particularly office buildings, where declines in value have occurred because of higher interest rates and the decline in office occupancy from the relatively recent phenomenon of “remote working” stemming from the COVID-19 pandemic. Additionally, geopolitical instability is something we must become more accustomed to. A near coup in Russia and a cold war brewing with China gives us pause and cause for concern. The resulting need for an even stronger U.S. military to counter these geopolitical stresses will also cause budget woes as our government must eventually deal with our growing debt and the cost of carrying that debt. Certainly, this will be an issue in the upcoming 2024 presidential election cycle along with many other economic and social issues.

Our Challenge: Invest for the long term in quality equities and real estate or hide out in cash?

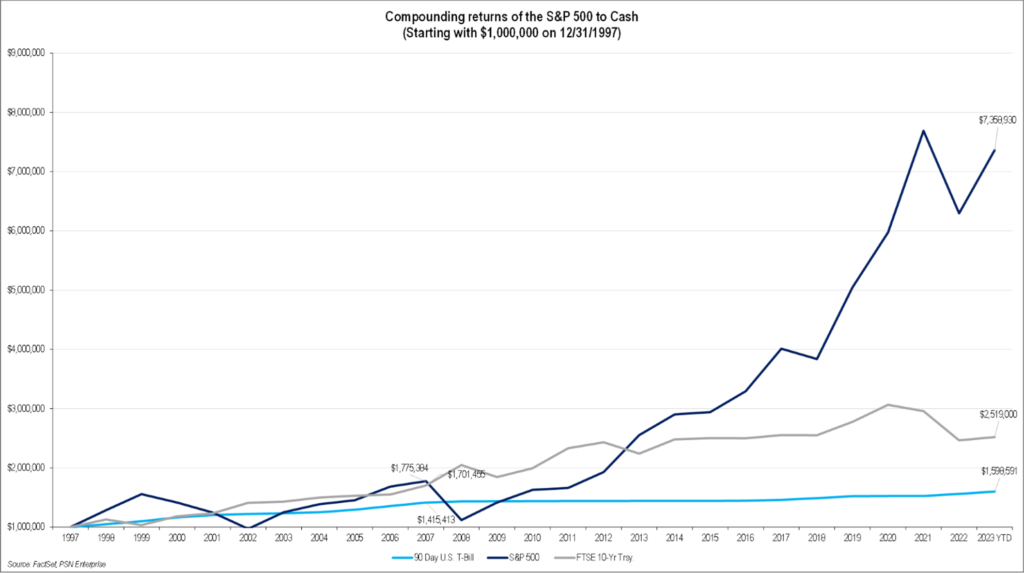

When times are fearful as now, it is typically a good time to invest for the patient long-term investor. U.S. Treasury Bill yields will ultimately come down, in our opinion, likely sometime over the next year or so. Over the long term, cash or short-term liquid investments (other than maintaining a prudent buffer) have been a relatively poor returning asset class despite feeling attractive at this time.

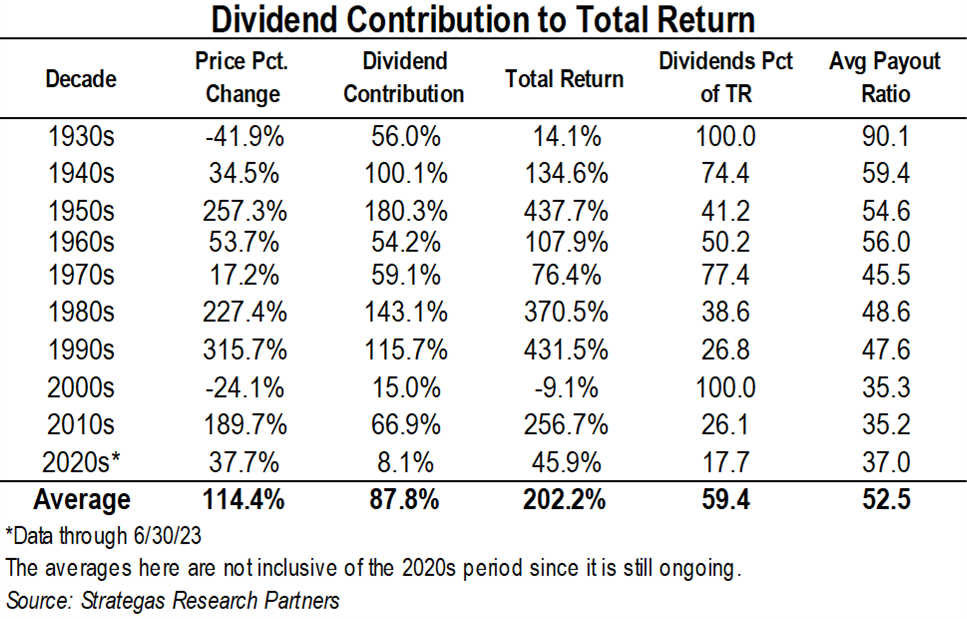

In spite of dividend paying stocks only moving modestly higher thus far this year, over the long run we believe dividends will contribute to meaningful appreciation as they have historically. We still believe in this beloved concept that requires patience but has rewarded investors over the long term:

A poor 2022 and a current “Wall of Worry” can make us challenge our own long-term assumptions about investing. But with any thought and reflection, common sense investing still means having a prudently diversified asset allocation among quality bonds and mostly companies generating earnings growth, free cash flow, and returning cash to shareholders through dividends and buybacks, all while utilizing a valuation filter. This should be our compass. The same goes for real-estate-type investments, where location and cash flow will reward investors. Of course, everyone’s asset allocation must reflect their individual life circumstances and the advice of trusted professionals like the investment team at First Long Island Investors.

So, our long-held ideas mentioned in the preceding sentences still resonate with us. Yesterday was the internet and today we look to the prospects of AI and blockchain being disruptive opportunities. We might have to be patient, absorb some volatility, and look over the valley of periodic investment setbacks. Wealth compounding is a long-term proposition. Wealth growth above inflation requires some measured risk taking. We believe that FLI is up to the task of navigating these uncertain waters. Having faced difficult investment environments over the past 40 years (FLI is celebrating its 40th anniversary this year), gives us confidence in our ability to sail these challenging investment waters. As we have often quoted Warren Buffett, “never bet against America”!

Please do not hesitate to contact anyone on our investment and wealth management teams should you need assistance or guidance in your wealth and money management needs.

Have a wonderful summer!

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of July 26, 2023 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of June 30, 2023, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2023 by First Long Island Investors, LLC. All rights reserved.