2nd Quarter 2022 Letter to Investors

August 15th, 2022June 30, 2022

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.”

-Peter Lynch (renowned investor)

Equity, bond, and some commodity markets suffered sharp declines adding to woes from the first quarter. The Dow Jones Industrial Average, S&P 500 Index, and NASDAQ Composite declined 11.3%, 16.1%, and 22.3% for the second quarter, respectively, and for the first half, declined 15.3%, 20.0%, and 29.2%, respectively. This marked the biggest drawdown for equity markets since 1970 (also a midterm election year). There was little shelter in bond markets where intermediate term U.S. Treasuries declined 11%. Surprisingly, with inflation running at 9%, even lumber and copper declined 42% and 17%, respectively. Bitcoin dropped a precipitous 58%. (We have not invested in cryptocurrencies nor are we inclined to.)

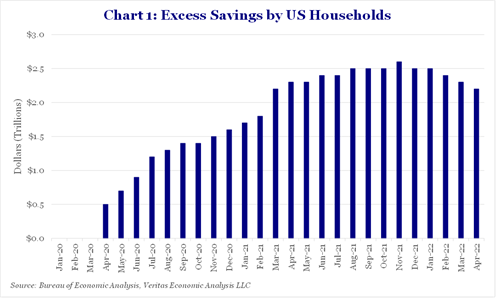

These market results seem exaggerated and unexpected when one considers that we are experiencing strong domestic employment, projected S&P 500 earnings growth of 10% for 2022, robust consumer balance sheets (see Chart 1 below), and a strong banking system evidenced by all major commercial banks just having passed their federal stress tests. Add to this list a residential housing shortage, which should help support home values.

However, fears of rising interest rates, inflation at levels not seen in 41 years, a continuing brutal war in Ukraine, depressed consumer confidence, and divisive Supreme Court decisions make virtually all investors and non-investors trepidatious of what lies ahead, including a possible recession, especially when there is little confidence in our elected officials in Washington, D.C. crafting any solutions to these issues. Let us not forget the continued, diminished, but still prevalent COVID-19 pandemic while scattered lockdowns in China continue to impact both the Chinese and global economies.

Perhaps the most troublesome issue facing American consumers and businesses is the pervasive inflation (not transitory as suggested by the Fed and Treasury officials last year) including rising food and energy prices along with housing costs. The shock of gasoline averaging $5 per gallon, representing a 59% increase from a year ago, and food prices rising 12% over the past year has impacted consumer spending and consumer sentiment. This inflation, in major part occurred due to supply/demand shocks caused by the COVID-19 pandemic and the new Administration’s policy changes regarding the promotion of green energy. A barrel of oil had actually increased by 74% from Biden’s inauguration to just prior to the Russian invasion of Ukraine, which led to a greater increase in energy costs. Thus, the perils of rising inflation have now been with us for more than a year.

The Federal Reserve’s belated response to rising inflation was to commence an aggressive series of rate increases as well as the onset of the shrinking of its bloated balance sheet, which in turn has led to a reduction of price-earnings multiples and thus a significant decline in the price of most equities, especially growth company shares. Fed “speak” has led to fears of continued aggressive interest rate increases, decreased liquidity, and demand destruction designed to quell economic activity in an attempt to reduce inflation. Both Fed monetary policy of continued historically low interest rates and government fiscal policy of printing money to buffer the economy from the effects of COVID-19 have led to too much loose and cheap money that the Fed is trying to purge from our economy without inducing a recession.

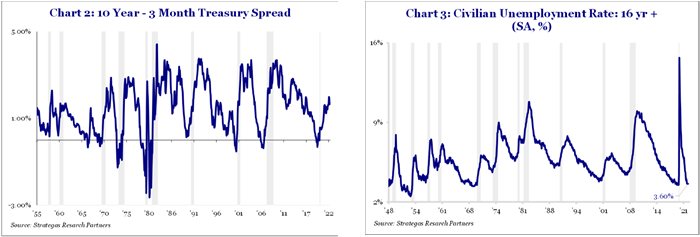

The traditional barometers that historically predict with decent precision impending recessions, however, are NOT flashing a warning at this point. A brief, modest inversion of the spread between the 2-year and 10-year U.S. Treasuries occurred in the beginning of the quarter while a slightly wider inversion occurred shortly after the end of the quarter. However, the Fed’s preferred spread is between the three-month and ten-year U.S. Treasuries, which is not inverted (see Chart 2). At the same time employment remains strong as seen in Chart 3 (although jobless claims have recently ticked up and hiring freezes have been announced by the likes of Meta Platforms, formerly Facebook).

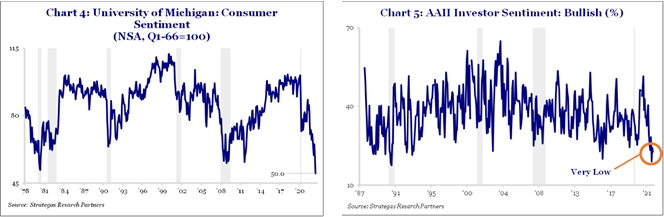

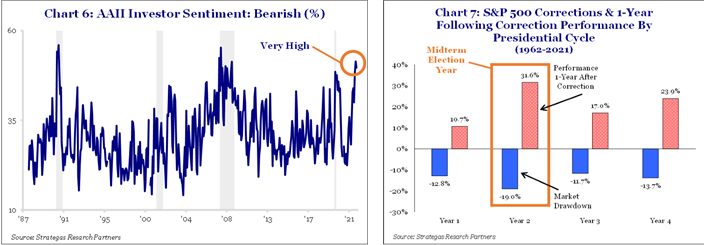

However, in our opinion, fear of impending interest rate increases, reduced demand/economic activity from inflation, worries about COVID-19, and concerns of a nuclear or other escalation by Russia in its war in Ukraine has pummeled consumer and investor sentiment to extremely low levels (see Charts 4, 5, and 6 below). This in turn has led to retail sales that have been impacted by the rate of inflation. While retail sales continue to be up in dollar terms, net of inflation, they are down slightly.

All of the above has resulted in caution in our consumer-driven economy and poor equity market performance in the first half of the year. Where does this leave us? In 1970, also a midterm election year, equity markets declined in the first half of the year by 21% while dramatically increasing in the second half of the year to end the year essentially flat, but that is not always the case. Meanwhile from a historical perspective, midterm election years have typically been impacted by significant market declines, followed by robust performance (see Chart 7).

We have always relied on earnings growth, dividend increases, and reasonable interest rates to generate returns from our investments. If earnings for the balance of the year (starting with second quarter results and guidance to be announced starting in mid-July) continue to grow in a fairly broad way, not just for energy companies (currently enjoying robust oil prices), we hope to enjoy a second half rebound even as the Fed increases interest rates to stifle inflation. If President Biden is successful in motivating the Saudis to increase oil output (so much for carbon and climate concerns), oil prices might drop enough to temper the Fed’s aggressive interest rate hikes. This could return investor focus to fundamentals, earnings, and dividend increases. Our Dividend Growth strategy continued to put up robust dividend growth in the first half (13.7% on average) as all of those companies expected to raise dividends during the first half of the year did so. This strategy outpaced the S&P 500 for the second quarter and year-to-date by several hundred basis points.

In our view, much depends on achieving projected earnings, reasonable guidance, and continued dividend growth to reverse the dire negative trend we have endured during the first six months of the year. In addition, any cessation of hostilities in Ukraine would remove a cloud that now exists and has added to the decline in market multiples experienced thus far this year. It is our view that price-earnings ratios suffer during periods of war or severe global crisis. However, our current view of this conflict is one of grave concern as Russia takes Ukrainian territory in the eastern part of the country, while the chances of a near-term negotiated cease fire appear remote. Couple this with poor relations with China and efforts to de-globalize parts of our economy and there is more to worry about for investors.

What to Do?

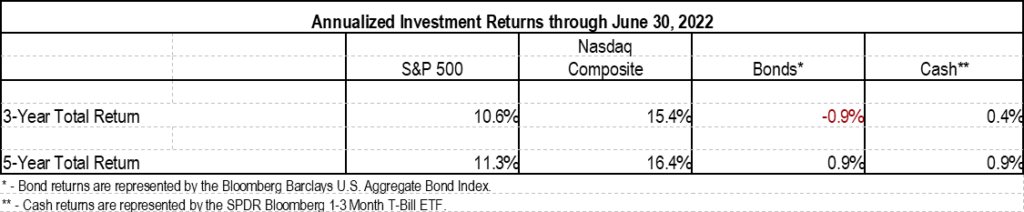

As our quote suggests, periodic stock market losses are part of the investment process, especially if one wants to achieve better returns over the longer term than those available from cash or bonds. Please keep in mind that equity returns over the last three and five years despite this serious downturn have been meaningful:

We would be remiss in suggesting we have reached a bottom in equity markets. If earnings do not continue to materialize or price-earnings multiples continue to contract further downside is possible. As of now however, with the S&P 500 Index trading at 15.4 times 2023 projected earnings and the 10-year U.S. Treasury yielding 3.0%, overall market valuations feel reasonable to attractive. This is especially the case when one looks at the number of fine companies that are down more than 20% year-to-date including Microsoft, Amazon.com, Walt Disney, Meta Platforms, Qualcomm, Abbott Laboratories, Home Depot, JPMorgan Chase, etc. These are profitable and dominant companies, not those that were trading at excessive multiples of sales with no profitability such as Peloton Interactive or Vroom, which are off at least 90% from their highs within the last year.

We believe that staying the course in our defensive and traditional equity strategies comprised of high-quality, financially strong, market dominant companies, other than having an appropriate cash buffer (which we have urged for quarter after quarter), continues to make sense for long-term investors. For those with excess cash above one’s necessary cash buffer, a program of dollar cost averaging to take advantage of what we believe are long-term opportunities would be prudent, even despite when we face a recession, now or later, which we believe would be shallow but could last a while.

Our paper losses to date from market highs have been painful for all of us. (Please remember we invest side by side with you.) Even though we have made significant investment gains over the last five years, these are troubling and uncertain times. Yet we are invested in companies that we believe have excellent futures and the current ugliness of investor sentiment does not impact the business models of these companies, many of which continue to ride secular growth trends such as cloud computing, the internet of things, conversion to electronic payments, medical breakthroughs, and the rise of e-commerce or are just great consumer companies like Starbucks and McDonald’s, which are durable, long-term franchises.

Heed what the great investor Peter Lynch said. To make decent gains over time, we must be willing to endure periodic losses, even those caused by unexpected events, whether a pandemic or a Russian war (both at the same time feels like a high wall of worry to climb). To some extent, this ugly downturn in equity markets in part has been caused by excessive cheap money in response to the COVID-19 pandemic. Call it long-term financial COVID. The global economy must digest the dramatic shut downs of economies, the horror of so many lives lost, the reopening causing both demand shocks and supply disruptions as well as the government’s loose and plentiful monetary medicine to address the pandemic. This has led in part to high inflation, fear, and declines in equity markets.

The Patient Investors

It is hard to recall an investing environment where one has to scale such a “wall of worry” encompassing both domestic and global economic, governmental, and social challenges (wealth disparities may be part of the cause for rampant crime). Despite these many challenges we remain cautiously optimistic that long-term investing in quality companies at reasonable valuations (for public and private companies’ equities and debt) as well as quality real estate will reward the long-term investor on an after-inflation basis. We believe those select opportunities (not all investments will qualify) still exist at what are far more attractive prices today than last year, but one must endure volatility along the way. As Warren Buffett said, “Never bet against America.” America remains resilient, innovative, and a leader, but with much work to be done to reunite us.

Please do not hesitate to call upon us with any questions or for any of your wealth management needs.

Best regards and have an enjoyable summer!

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

PS: It is with regret that we announce Ebonie Hazle, our Vice President and Deputy General Counsel, and Karen Weiskopf, our Vice President of Marketing, have been poached away based on their fine work at FLI. We wish them much success in their new endeavors. A search is in progress for high-quality replacements while their responsibilities are currently absorbed by our organization. On a positive note, we would like to share that Alexia Yaziciyan has been added to the Investment Committee and we have hired a new Junior Investment Analyst, Joseph Libretti. We are excited by what both bring to the table and look forward to their contributions.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending July 27, 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2022 by First Long Island Investors, LLC. All rights reserved.