2nd Quarter 2021 Letter to Investors

July 29th, 2021June 30, 2021

“With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” – Carlos Slim Helu

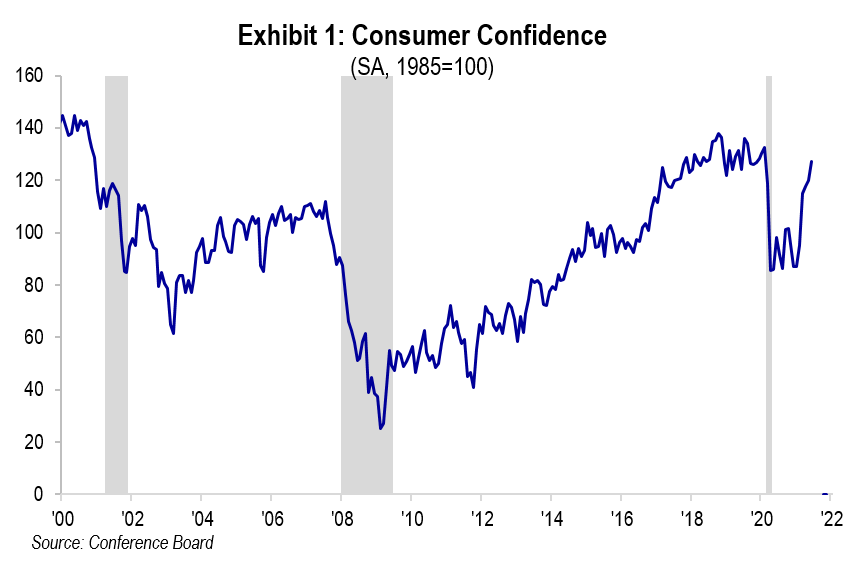

We are pleased to report that the second quarter, and for that matter year-to-date, have been very good for investors, the domestic economy, and the fight against the coronavirus at home. All of our strategies in our defensive and traditional equity baskets ended the quarter having produced substantial absolute returns following the robust economic recovery from nearly shut down domestic and global economies a year ago, while combatting the COVID-19 virus. Massive fiscal (five trillion dollars resulting in M2 growth of 32% since the start of the pandemic) and monetary policies (zero interest rates and asset purchases by the Fed) coupled with strong domestic consumer confidence led to a strong reopening of the domestic economy.

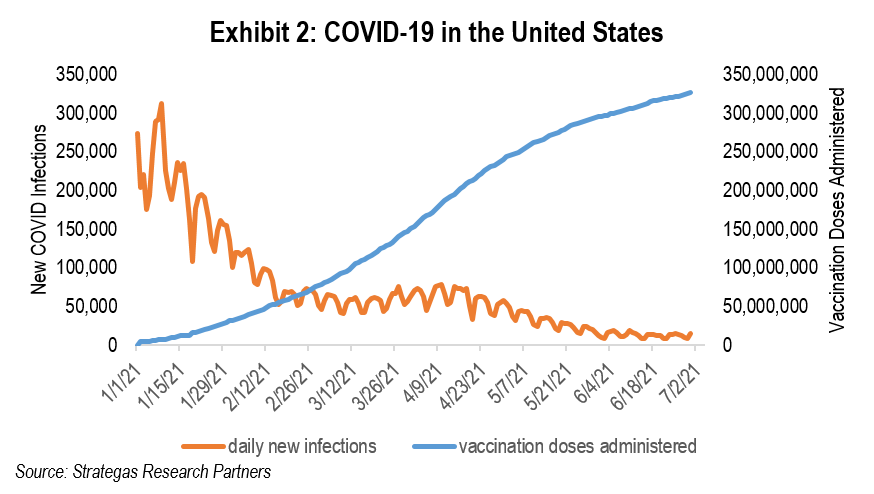

Examples of some positives in fighting the pandemic and the reopening of the economy can be seen in the exhibits here:

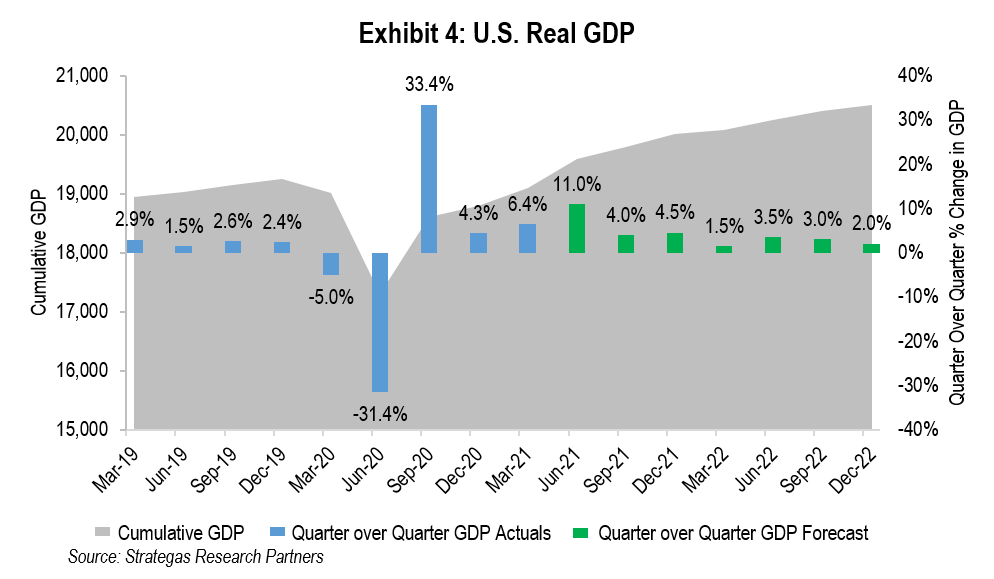

The essence of the above demonstrates the success of the vaccination rollout by the current administration using the three vaccines created during the previous administration, and the corresponding reopening of our economy. Strong GDP growth prior to the pandemic contributed to the robust reopening of the economy as a result of pent up consumer demand, as shown in Exhibit 4.

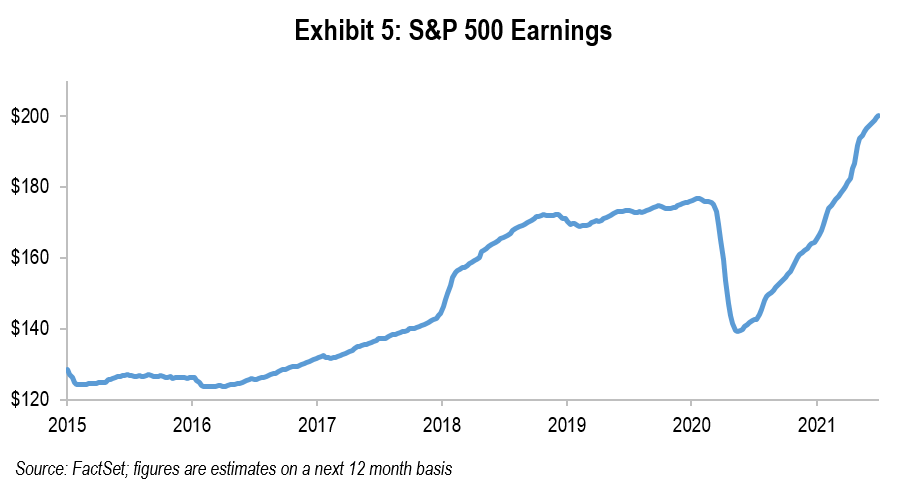

Meanwhile, the S&P 500 Index (as well as other key domestic indices) and the earnings of those companies have both achieved record levels:

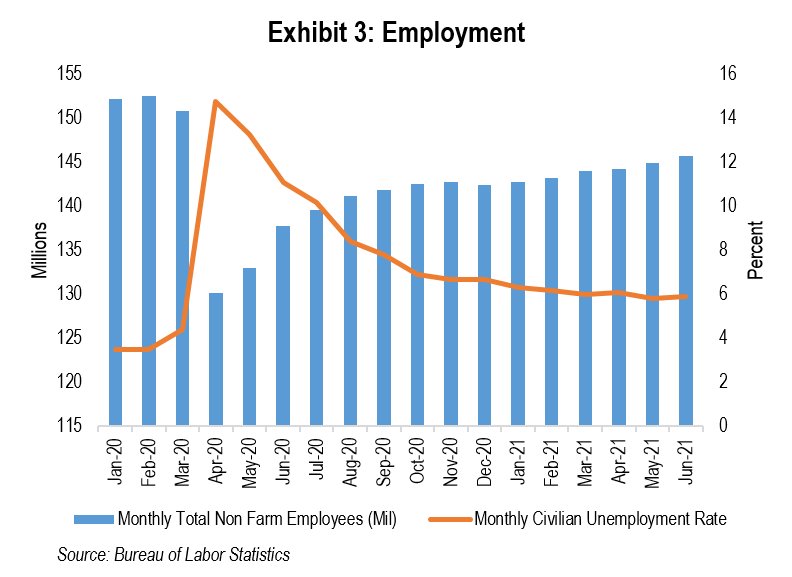

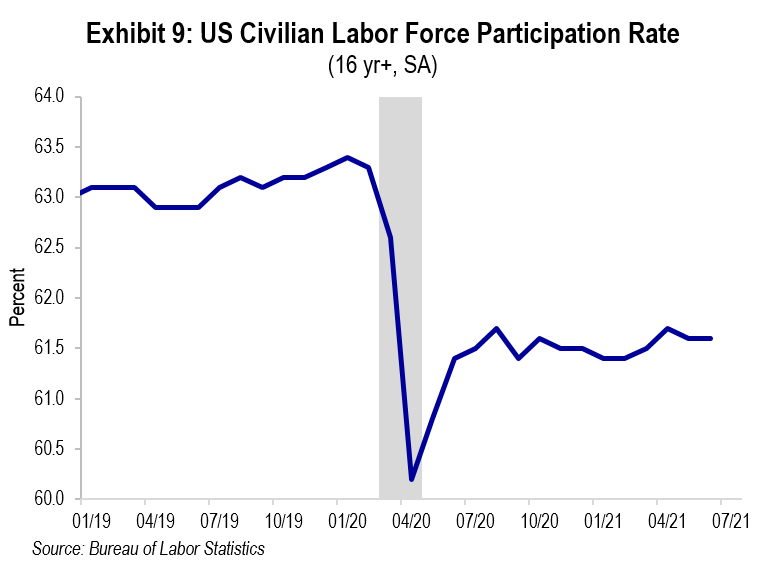

All of the above exhibits attempt to give substance to the thought that understanding history as well as the present can help us visualize the future. (Albeit, we know that history is only a guide and past performance is not a guarantee of future results.) The above strongly suggests that through a robust vaccination rollout the economy has reopened with velocity. The velocity is reflected in the economic growth led by the strong consumer and the growing employment evidenced by the declining unemployment rate. What we can observe is that there was a very strong economy prior to the pandemic; then that economy virtually shut down; employment and economic growth cratered; and with the rollout of the vaccination program and a strong (and pent-up) consumer, the economy has bounced back sharply!

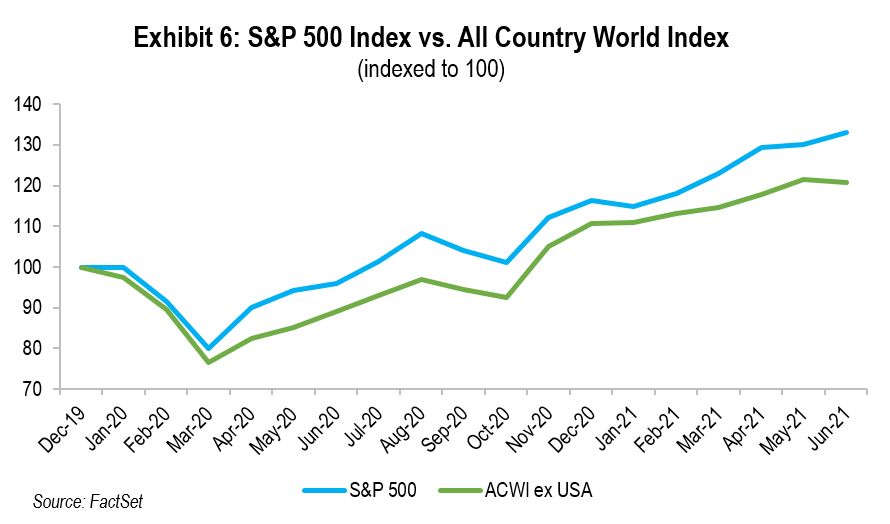

As shown above, domestic continues to outperform international. Additionally, we believe that depressed segments of real estate have also seen a recovery. (We witnessed this with the rebound in both apartment and hotel occupancy rates and performance in various markets throughout the country.) So all seems very good. With a pandemic on the run (except for the Delta variant and areas with low vaccination levels), stock markets at record levels, strong employment gains, robust earnings gains for the S&P 500 Index, still very low interest rates, and major banks having just passed their stress tests (and now permitted to raise dividends and buy back shares) where is the worry?

The Worry

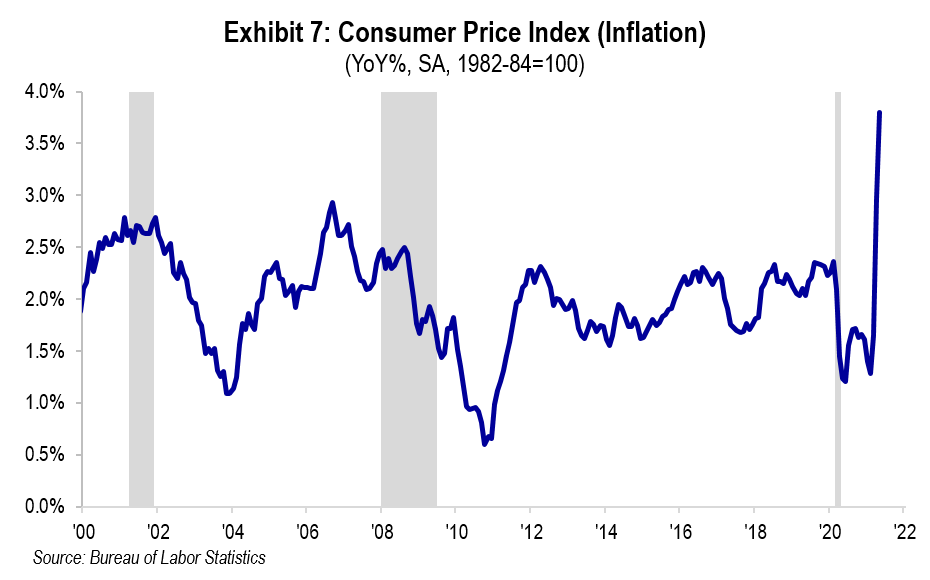

It would be imprudent for us not to worry when things appear so good and in many instances they are very good. However, the specter of higher inflation is a current worry, and one that is being felt by most (i.e. food, gas, home prices).

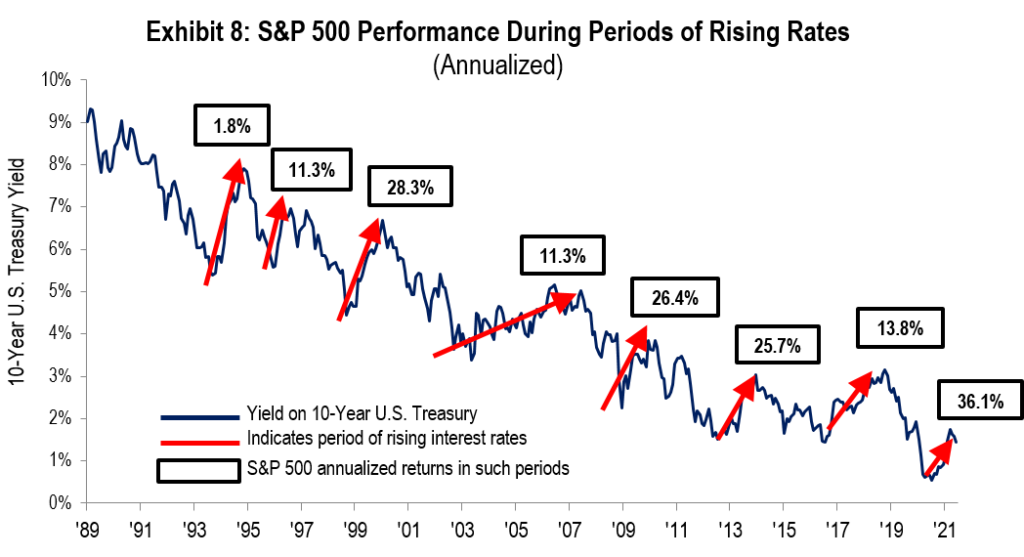

The concern about inflation has many suggesting that the Fed should act sooner rather than later to stem what could be higher inflation by raising interest rates and tapering its asset purchases (another worry). History tells us that should the Fed raise interest rates quickly it could result in a lower stock market through contracting P/Es (for example, when the Fed raised rates in the fourth quarter of 2018, the stock market fell sharply), and lower earnings resulting from higher interest costs for certain businesses. Others suggest that a moderate rise in interest rates over time does not disrupt equity markets. Exhibit 8 below depicts how the stock market has reacted to rising 10-Year U.S. Treasury yields.

The pace of potentially higher interest rates could derail some of our happiness. However, there is another factor to consider and that is the current debate on yet more government spending through both “traditional” infrastructure legislation (suggested at $1.2 trillion) and the other possibility of the President’s proposed American Families Plan (suggested at nearly $1.8 trillion). These are mere estimates being bandied about (extreme progressives in the Democrat Party would like even higher spending). But what is also being proposed are significant tax increases on both business and high-net-worth individuals. These possible tax changes would apply to ordinary and investment income, corporate income, and estates. These potential changes could slow our economy and negatively impact corporate earnings as well as investor behavior. Our existing bloated debt of $28 trillion most likely will increase with infrastructure spending (some of which both parties deem necessary). Bottom line, there are numerous serious factors to worry about which constitute the current “wall of worry.” Given these and other worries, unabashed optimism among investors is not a worry for us at this point, as it does not exist from what we can see and hear.

Summary and How to Invest

We enjoyed a great quarter and the year-to-date is most satisfying, especially after a robust 2020 despite the ravages of the pandemic. When Warren Buffett once said never bet against America, he was right. We closed down, worked to combat the virus with three vaccines, rolled them out with much success, and reopened our economy with vigor and at what many would consider “warp speed.” This recovery in the economy will continue into 2022 in our opinion.

Yet, the prospects of inflation and the eventuality of higher interest rates (in our opinion) are causing some to consider partially hitting the exits. Also, the unknowns revolving around infrastructure spending and tax increases are making many queasy. Addressing what is a fair amount to pay in taxes and how do we close the income and wealth gap is also on many minds in ones’ kitchens as well in Washington, DC among our lawmakers. How do we accomplish tax increases and social engineering without negatively impacting our economy in the long term? That is the ongoing debate.

We know from history (fourth quarter of 2018) that missteps by the Fed in announcing monetary policy changes can hurt the stock market. Our view is that the Fed is watching the high number of people still unemployed and the low labor force participation rate.

Given the above and the Fed’s dual mandate of employment and price stability, we expect the Fed will continue to be accommodative while maintaining (until data suggests otherwise) that much of the inflation we are currently experiencing is probably “transitory.” Accordingly, we believe the Fed will err on the side of keeping rates low until mid to late 2022 while watching inflation closely and expecting employment to continue to rebound. A 2% 10-Year U.S. Treasury (it ended the quarter at 1.45%) by year end would not be disruptive in our opinion to equity markets and investing in general. We would expect rates to continue to moderately rise in 2022 driven by market forces in anticipation of some Fed change in policy.

Given our concern about current valuations being on the somewhat high side (but not for all companies), and the potential impact of higher rates, we remain with a somewhat defensive tilt (our clients certainly did not suffer as our defensive basket of strategies made meaningful gains in the quarter and thus far in 2021). Traditional value strategies, typically more cyclical in nature, ended 2020 and started this year trouncing growth strategies for the first time in years but the second quarter was more about growth (large-cap growth advanced 1,193 basis points while large-cap value advanced 521 basis points). Thus, our view of having long-term allocations to both remains our conviction. It is also generally part of our investment process to seek out companies that have pricing power should input costs need to be passed through. Short duration bonds (despite their pitiful returns) are also part of our current conviction given our belief that the longer-term bias will be to somewhat higher interest rates and thus more attractive yields will present themselves at a later point (which would adversely affect the values of longer maturities). We continue to underweight allocations to fixed income as the real return after inflation for many bonds is still negative.

Finally, we all must remain vigilant against COVID-19. I would very strongly encourage those not vaccinated, other than for medical or religious reasons, to discuss their decision with their doctor as the CDC has repeatedly reported that the reward of being vaccinated vastly outweighs the risks. Of course this is not medical advice – so we urge anyone that is not vaccinated to consult with their doctor to make an informed decision. We should all feel more secure if we go through the next six months with limited outbreaks. With continued vaccine adoption there should continue to be a decline in infection rates and furthermore we will not have to worry about the economic impact from another shut down.

Always think long term with reasonable diversification when creating or altering one’s investment plan and consider maintaining a modest cash buffer for the inevitable volatility that has always characterized an investing environment with the predictable but unpredictable “wall of worry.” History would suggest that the long-term investor has been rewarded by taking prudent risk among proven asset classes characterized by quality and financial strength while avoiding areas of speculation, leverage, and too much cash (especially with rates as low as they are). We constantly monitor our clients’ asset allocations to reflect long-term thinking while having a view of the future.

Please enjoy the summer and feel free to call upon us at FLI for any of your wealth management needs. We remain available, and will certainly reach out to you with updates, seminars, and webinars, including a commentary on changes in tax legislation to both businesses and high-net-worth individuals should they become reality.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S. Sorry for the length and number of exhibits, but given what we as investors have had to navigate this thorough explanation should be helpful as we view the future.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending April 26, 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2021 by First Long Island Investors, LLC. All rights reserved.