2nd Quarter 2019 Report to Investors

August 1st, 2019June 30, 2019

“The conventional view serves to protect us from the painful job of thinking.”

John Kenneth Galbraith

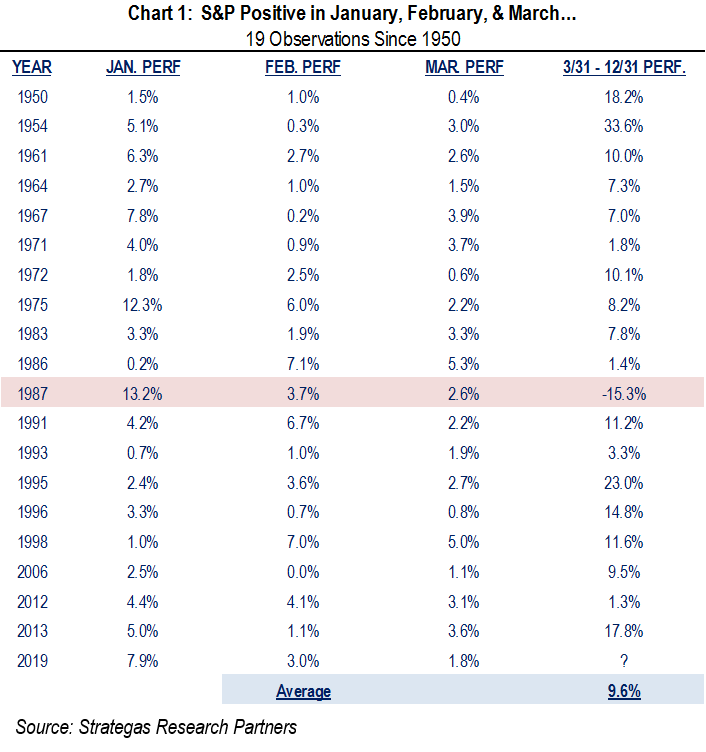

The second quarter of 2019 followed two quarters of significant volatility. The decisive decline in equity markets during the fourth quarter of 2018 in our opinion was the result of a Fed misstep as well as an acrimonious mid-term election and a trade war, all of which contrasted with a sound and fundamentally strong economy as well as signs of strength within many of the companies we invest in. The first quarter saw significant volatility but with sizable upside to equity markets reflecting a retreating Fed (altering its position from seeking to raise rates to holding rates unchanged, and now possibly cutting rates), better than expected earnings, and continued employment growth. At the conclusion of the first quarter we communicated that historically when the year begins with three positive months that has typically meant better results for the balance of the year, as you can see in Chart 1 below:

The historical record depicted above is very positive, albeit history is a guide and not a guarantee. It is important to keep in mind that in each of these years of positive performance there has been a drawdown at some point during the period from April to December.

The second quarter saw its share of volatility with the month of April yielding a somewhat higher stock market, followed by a poor May (the S&P 500 was down 6.4%) only to be bailed out by a higher June, leaving us with the S&P 500 up 4.3% for the quarter. Year-to-date the S&P 500 is up 18.5%, which is higher than where it stood at the end of the first quarter, thus following history as depicted in Chart 1. The robust increase was biased towards growth stocks, with the Russell 1000 Growth Index outpacing the Russell 1000 Value Index by 0.8% for the quarter and 5.3% for the year. This continues a pattern of the last two years. Thus, most of our clients, who have followed our guidance on diversification, fared well this quarter by having somewhat greater exposure to growth while still maintaining an appropriate value allocation.

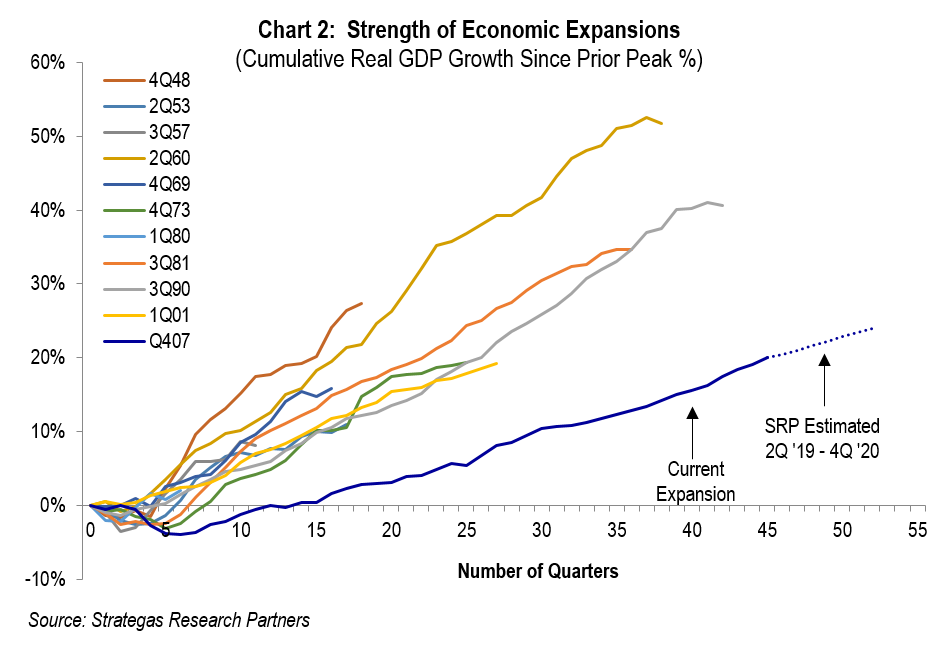

As evidenced by fourth quarter outflows from equities (not from our clients), it would appear that conventional wisdom suggested exiting equities and buying bonds. Cited reasons were that many believed recession was right around the corner (later this year) and that the trade war with China would damage our economy and result in higher inflation. Pundits also cited the length of the long bull market. Our analysis led us to take the contrarian view and with that we stayed the course in our equity investments among both our defensive and traditional equity baskets. Our view was that the economy would continue to grow, which was evident in the fourth quarter of last year and the first quarter of this year. Growing employment in both quarters also supported our thesis. In addition, we studied the strength of prior economic expansions post-recession. In other words, how robust has this current economic expansion been (not just how long has it lasted)? Thus we did the “painful” job of thinking as opposed to following the conventional thought of getting out of the equity markets. The following chart clearly shows that despite the age of this expansion, the cumulative growth in real GDP is still below the average of other such economic recoveries:

The dark blue line represents the current economic expansion and is below that of the others, clearly demonstrating that this economic expansion has not yet provided the annualized growth rate that all but one since 1948 has. In our opinion, given the low level of interest rates and inflation, continued strong employment growth (but slowing somewhat), moderate wage growth and a high level of consumer confidence plus recent tax cuts this expansion is not over and that recession is still a ways off!

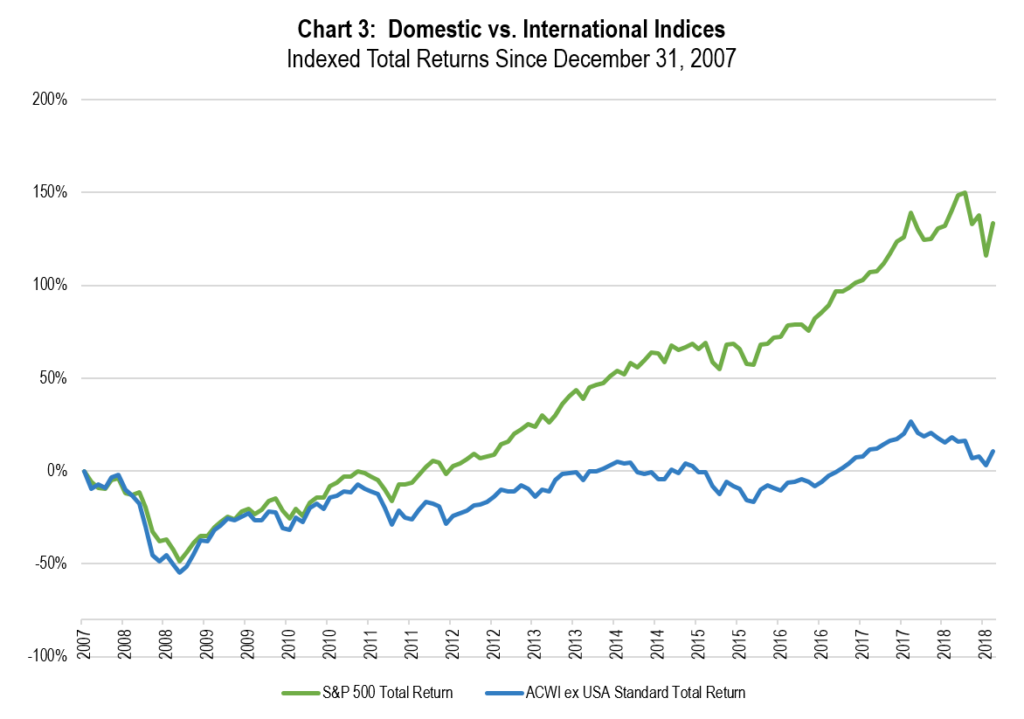

Additionally, we believed that the Fed would back track on the position it stated in late September that it would continue to raise rates. In fact, Chairman Powell stated in January that rates would be held steady, and in June more than hinted that rates just might be reduced (Fed futures are now pricing in multiple rate cuts). We believe that the current low interest rates (U.S. ten-Year Treasury is 2.0%, as of June 30, 2019) help equity valuations as well as the economy. We believe that low interest rates globally (German bund at –0.3% and Japan ten-year at -0.2%, both as of June 30, 2019) reflect low inflation and indicate that those governments are trying to induce investment and growth. GDP growth in certain European countries and Japan is near zero, leaving the United States and China as the primary drivers of the global economy. Accordingly, we continue to underweight international equities as we still see better investing opportunities through domestically domiciled companies (domestic equity indices have outpaced international indices for seven of the past ten years). Thus for now, our overweighting domestic equities has helped our clients:

Our advice has been something other than the conventional, based on our evaluation of fundamentals of companies and a study of the economy. We have over-weighted equities, both in our defensive and traditional baskets while underweighting fixed income and alternatives for most clients (hedge funds continue to lag equity markets in most cases). Our equity bias has been to U.S. domiciled companies with an underweight to international, including emerging markets. We do not see a recession for the next year or longer unless something out of the ordinary (such as a war) should befall us. The yield curve is puzzling with one widely followed measure suggesting a recession (the three month compared to the ten-year is inverted) while the comparison of the two-year Treasury with the ten-year Treasury is not inverted (suggesting no recession in the next year or so). Our banking system remains very strong (all major banks passed their most recent Dodd-Frank Act Stress Test) while we continue to see reasonable (2% to 3%) GDP growth in the U.S. with continued low interest rates and low inflation. This should favor equities, particularly growth stocks. If the economy should pick up steam towards the higher end of our range then we believe we would see more cyclical and industrial stocks start to outpace growth companies.

We believe, for now, that an overweight to our defensive equity strategies, a modest underweight to our traditional equity strategies (with a bias to growth stocks in both baskets for now), and an underweight to fixed income (yields remain very low and if there was an interest rate surprise to the upside, longer duration portfolios would be hurt) is the best course for most clients. In other words, there is a high degree of risk to bond values when the ten-year U.S. Treasury is trading in the 2.0% to 2.5% range (not as to quality of the U.S. Treasury, but as to price sensitivity to higher interest rates). We continue to recommend that suitable clients round out their asset allocation with some investments in the private equity and real estate space.

Summary

We have had strong absolute returns for all of our equity-based strategies for the year through June 30, 2019. Bond returns are more modest, and those outside of FLI who fled to bonds in the fourth quarter missed out on solid equity returns. The economy, as mentioned, continues to grow moderately despite some headwinds from the trade war with China and concerns about hot spots in the Middle East. The agreement to restart trade talks with the Chinese is positive but there is no guaranty that an agreement can be reached. The fact that President Trump has not put a deadline on an agreement is also positive, but will most likely result in the negotiations dragging out. The political situation in Washington remains murky at best with little or no collaboration between Republicans and Democrats (other than the most recent aid bill for the Southern border). This will only worsen, in our opinion, as the looming 2020 election cycle picks up steam. Valuations for average equities are obviously somewhat higher now than the beginning of the year and requires continued monitoring (the S&P 500 is trading at about 16x 2020 projected earnings (which is about average for the past ten years). In our opinion, active management with concentrated portfolios like ours should prove helpful as gains become somewhat more difficult.

However, the 180 degree turn by the Fed from raising rates (September 2018) to holding rates (January 2019) to possibly reducing rates (June 2019) is significant. If short term rates are cut (the next Fed meeting is July 30-31, 2019), it could bode well in elongating our economic expansion which in our opinion would lead to higher earnings for the companies we invest in. These rate reductions, if implemented by the Fed, would serve to possibly mitigate some of the economic upsets mentioned throughout this report (in particular negative consequences from a continuation of the trade war with China or a possible oil disruption in the Middle East).

With all of these factors to consider, we remain with a defensive tilt given the balance of uncertainty as well as the positive factors of a still growing economy and the prospects for lower short-term interest rates. We achieve this by recommending that clients overweight our defensive basket. We would not be too concerned if the economy slows somewhat in the short term as we believe it is human nature for businesses to somewhat pull back on their investing and hiring activities while trade talks with China and the potential greater tariffs cloud their vision of the future. Finally, there remains the potential for some escalation in hostilities between the U.S. and Iran. This in our opinion would also cause some short-term volatility especially if other countries join in.

We are pleased that thus far this year our clients are enjoying better than reasonable returns in all of our equity-based strategies (and reasonable returns in our multi-strategy hedged investment strategy). Modest gains thus far for our bond portfolios have been achieved, while keeping duration short. The risk of higher rates down the road could cause bond losses on paper for longer-duration bonds bought to achieve higher yields in this low rate environment. Our current real estate debt investments are progressing. However, we are mindful of the worries (and perhaps something that we cannot predict) that come from political, geopolitical, and economic factors which could derail our strong start six months into the year. We will watch the factors mentioned throughout this report very carefully and take action where appropriate (while being mindful of taxes for our taxable clients).

Please remember, the conventional view is easy to accept as it protects one from the painful job of thinking and doing homework. We at FLI will not succumb to this and will continue to do our homework on behalf of our clients, and ourselves, as we continue to invest side-by-side.

We hope that you have an enjoyable summer and please do not hesitate to call upon us for any of your wealth and investment management needs.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending July 19, 2019, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2019 by First Long Island Investors, LLC. All rights reserved.