2nd Quarter 2018 Report to Investors

July 31st, 2018“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” Warren Buffett, Chairman and Chief Executive Officer, Berkshire Hathaway

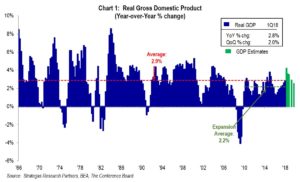

In our opinion, the second quarter was characterized by accelerating domestic economic growth while also reflecting angst over an aggressive trade posture taken by President Trump as well as a Federal Reserve Board intent on raising interest rates. This tug of war between the reality of economic/profit growth (please see Charts 1 and 2), versus the potential fallout from threats of tariffs by the U.S. as well as threats by trading partners, impacted investors thus far by way of increased volatility. Adding to this “wall of worry” (which may have gotten a bit lower from the seemingly civil North Korean Summit), the Fed raised interest rates by 25 basis points in June and hinted that we could have two more increases later this year. This also added to investor concern as the easy monetary policy of the past eight years is coming to an end. Serious trade concerns with allies and non-allies alike, as well as higher interest rates reflecting a strong economy, presented a new environment for investors to digest. Add in some political and economic uncertainty in the European Union from Italy and the pace of Brexit, and investors were distracted from focusing on fundamentals. Meanwhile, the two charts below show the underlying strength of the domestic economy and extremely strong corporate earnings:

The strong domestic GDP growth of 2.0% in the first quarter along with the projected growth of somewhat greater than 3% for the second quarter, coupled with accelerating earnings growth for the average large company (S&P 500 earnings were up 27% for the first quarter) supported the general equity market appreciating in the second quarter in the face of the growing trade concerns and somewhat higher interest rates. The fundamentals won out in the second quarter led by small-cap companies (strong earnings growth, lower taxes, and less concern about potential tariffs) and large-cap growth companies that reflected above-average earnings growth during the quarter (examples include companies such as Amazon.com, Netflix, and Mastercard). Large-cap value companies, while appreciating overall, did not keep pace with large-cap growth companies despite growing dividends from a number of them. The Russell 1000 Growth Index appreciated by 5.8% during the quarter while the Russell 1000 Value Index only advanced by 1.2% for the quarter. Year-to-date, the difference in performance for large-cap growth versus large cap value is almost 900 basis points or nine percent. (This follows last year’s pattern where large-cap growth outpaced large-cap value by nearly 1700 basis points or 17%!) Fortunately, in almost all cases our clients have adequate exposure to growth companies in several of our investment strategies populating our defensive and traditional equity baskets.

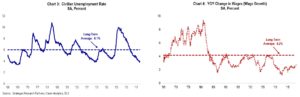

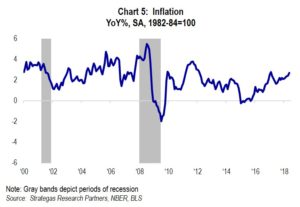

In addition to the aforementioned trade concerns and increasing interest rates, other economic factors must be watched carefully including the tight labor market, increasing wages, and inflation. The very low unemployment rate potentially indicates a tight labor market, which coupled with wages that are trending higher, has the potential to drive inflation higher.

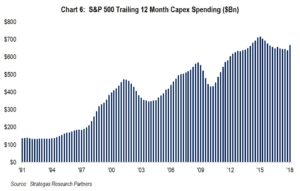

Besides the tight labor market, we believe that the new, lower corporate tax rate is also driving wages up. A tighter labor market can lead to higher inflation unless productivity mitigates the higher wages. That would require, in our opinion, greater corporate investment in equipment and infrastructure that will lead to enhanced productivity down the road. Capital expenditures (incentivized by changes to the tax law and less regulation) by business seem to be picking up as seen in Chart 6 below.

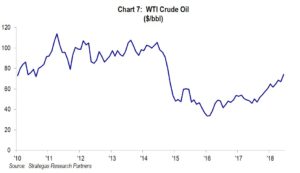

Additionally, higher energy costs facing both consumers and business could result in rising inflation. The price of crude oil has increased and, in our opinion, seems to be the result of a number of factors including a growing global economy and new sanctions on Iran (see Chart 7):

We, as investors, are trying to make sense of growing domestic and global economies with strong corporate earnings while facing trade issues, a Fed raising interest rates, a tight domestic labor market, higher energy costs, and some geopolitical issues let alone a mid-term election confronting us in November (mid-term elections have in the past led to positive results in equity markets following election day). Not an easy picture for investors, and that just might be the reason we have experienced much more volatility than in 2017.

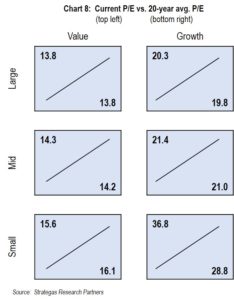

Another critical factor is the very important question of VALUATION. As we are in what many believe to be the later innings of this bull market (despite growing earnings and fiscal growth initiatives through deregulation and tax reform), we at FLI are always using the lens of valuation to adjust our asset allocations. The chart below gives us some comfort that most asset classes ARE NOT in “nose bleed” territory from a price-earnings multiple standpoint.

It is our opinion that the chart above demonstrates that valuations, while not cheap by any measure, are not stretched for the vast majority of asset class categories that we invest in and are trading at price/earnings multiples consistent with those for the last twenty years. The one exception is small-cap growth where we have appropriately adjusted our allocation downward to this segment in our diversified strategy. In addition, we believe that earnings growth for many companies, on average, will continue to increase in 2019, suggesting that valuations will continue to be reasonable.

Summary

Our clients weathered the second quarter volatility and on balance did reasonably well with modest gains for the most part (Our strategies were about flat to plus 4% for the quarter). This resulted from asset allocations that included exposure to growth, which continues to outpace value. Our value exposure should benefit from companies paying higher dividends (dividends have increased, on average by 12% so far this year in our Dividend Growth strategy) despite lackluster stock performance thus far.

The asset allocations we recommend to clients continue to trend towards a more defensive bias based on our belief that earnings growth will eventually slow in 2019, and we might face a modest recession, perhaps sometime in 2020. However, until then we believe that gains can be made through our defensive and traditional equity baskets, while underweighting fixed income as we still believe that interest rates will continue to trend up based on the Fed’s guidance of interest rate increases and the continued rising of inflation. As for private investments, we believe that investing in the mezzanine real estate lending area continues to make sense.

As the quote from Warren Buffett indicates, volatility should not be a cause for losing sight of or faith in prudent and diversified long-term investing. Volatility should be viewed as an opportunity to add to sound long-term investments within a well thought out asset allocation.

Please call upon us with any questions you might have as to your wealth and money management needs. We hope you have a great summer and look forward to you joining us on our next webinar in September.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending July 24, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.