2nd Quarter 2017 Report to Investors

July 27th, 2017June 30, 2017

“The future has a way of arriving unannounced.”

-George Will, Journalist

We are pleased to report that our clients enjoyed another very successful quarter. The majority of our investment strategies exceeded the performance of their respective benchmarks. This is particularly gratifying as our bias is to less risk and higher quality. That combination typically lags in good markets and outperforms in more difficult markets. Given our outperformance this quarter in some defensive as well as traditional equity strategies, we are quite pleased. However the one sour note, our investments with a deep-value manager, continue to be frustrating.

As the above quote suggests, the future comes upon us unannounced. Those who continued to be skeptical about equity markets because of the financial crisis of 2008/2009 missed a significant rally having not invested looking forward to a future of higher earnings and continued low interest rates. Some investors who participated in this rally are leery because of market highs being reached during the quarter. We know that at some point, probably when a recession hits, equity markets will suffer for a period of time. When this future recession and subsequent lower markets will occur is unknown. Thus future events, good or bad, do not ring a bell that they are about to occur. We urge prudent and diversified asset allocations with a defensive bias because market shifts (positive and negative) often come upon us without too much notice and in some instances unexpectedly.

Good performance and good markets happen for specific reasons. At least in the longer term there are many factors that form the foundation of companies and real estate increasing in value. Given the solid gains made in the quarter and thus far this year, we need to focus on some of them to explain why performance has been strong for many of our strategies and many market indices are at record levels. It will also explain why we believe, while still being cautious and defensive, that there might be more happiness to come.

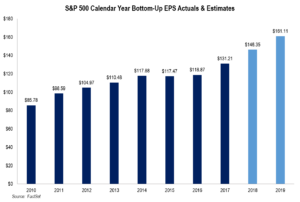

First, equity markets continue to climb the wall of worry as earnings for the S&P 500 Index continue to grow. To be even more specific, the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index all hit record highs during the quarter. We believe one of the major reasons for this was the earnings growth recorded in the first quarter (announced during the second quarter). The chart below shows the recent increase in S&P 500 earnings and the consensus forecast for the next two years:

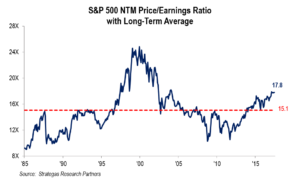

As you can see, the acceleration in earnings which began in the third quarter of 2016 is continuing. In our opinion, this in part supported the gain of 3.1% for the S&P 500 Index during the quarter (The other main indices, Dow and NASDAQ gained 3.3% and 3.9% respectively). Now, we would be unwise not to consider valuation to see if markets are overheated. We turn to the price earnings (P/E) multiple on the next twelve months projected earnings to see how it stacks up to the historical average. (This is a guide and not an exact measure of fair valuation, nor does it time when the markets will revert to “fair” value.) As you can see from the following chart, the P/E appears a bit high as compared to the historical average:

lthough it appears from this chart that the S&P 500 price earnings multiple is somewhat high, we must also consider interest rates, which in our opinion are a key component to valuation. In valuing businesses we have always used the 10-year Treasury as a value input for two reasons. One, in part we value businesses by discounting back the earnings in out years using the 10-year Treasury plus an equity risk premium. The lower the interest rate the less those future earnings are discounted. Two, that 10-year rate is what we can get as a return from buying the 10-year Treasury bond as an alternative to equity (stock) investments. The following chart suggests something quite important. Interest rates remain quite low by historical standards:

So, when considering that we believe interest rates will remain relatively low as compared to the last 71 years as shown on this chart (our projection is that the 10-year Treasury will remain below 4% for several years), the value of equities continues to be somewhat attractive despite P/E’s being above the historical average. Another way of looking at this is to take the earnings yield (EY) (divide the projected earnings of the S&P 500 for 2018 by the current price of the S&P 500) and compare it to the current 10-year Treasury bond yield. In our opinion, this earnings yield of 6.0% remains attractive versus a projected 10-year Treasury yield of even 3%. We also believe that these earnings will continue to grow as we do not see a recession through 2018 (GDP growth should continue at the current 2% rate, at least), the dollar has declined in value during the quarter leading to higher earnings for multi-national companies, and Congress and the President may cut the corporate tax rate which would benefit earnings for U.S. companies paying an effective tax rate above a newly legislated rate.

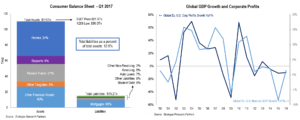

If you bundle growing corporate earnings, low unemployment rate (4.3% as of June 30, 2017), modest inflation (still forecasted at around 2%), low interest rates (10-year Treasury at 2.3% as of June 30, 2017), strong banks (all 34 major banks passed their stress tests and thus can distribute more capital to shareholders), a strong consumer (low levels of debt on their balance sheets, see left chart below), cheap oil (currently around $46 per barrel), and growing GDP in certain foreign economies (see right chart below), we have the makings of a good economy with earnings growth and the potential for more gains in global equity markets (we have increased our international equity weighting in several of our strategies for the second quarter in a row).

Despite our enthusiastic outlook mentioned above, we must consider what could derail our positive picture for equity markets. Perhaps, interest rates go higher sooner than expected. Unlikely, but it could happen. The President could decide to attack North Korea. It is becoming more of a distinct possibility as North Korea’s renegade regime gets closer to nuclear strike capability. The hoped for Congressional fiscal policy growth initiatives (tax cuts and repatriation of foreign earnings) do not happen. The Fed’s suggested decision to taper its quantitative easing of the past eight years brings much higher and unexpected volatility. Real estate values, particularly commercial real estate, decline as the result of low interest rates having led to overbuilding. All of these factors could contribute to a future that is not as rosy. These and other factors that we cannot project could come unannounced.

Our view remains that we are in a sweet spot for equity investing. Many of the traditional factors that typically mark the end of a bull market because of an impending recession have not happened yet (inverted yield curve, weakening upward earnings revisions, widening credit spreads, and several others). However, because the “future has a way of arriving unannounced,” and when coupled with the major gains we have made over the past eight years, we maintain our view that clients’ asset allocations should continue to be more defensively postured with an overweight to our defensive basket. Two of our three defensive strategies have been strong performers over the past two years despite being defensive. Also, we continue to underweight fixed income given low yields for quality bonds and slowly rising interest rates which could cause losses in longer-maturity bond portfolios. We are maintaining a modest underweight to our traditional equity strategies given somewhat stretched valuations. By the way, the second quarter witnessed another significant quarter for growth-oriented companies versus their value brothers and sisters. Again, diversification pays off.

In summary, we had a very good quarter for our clients. We believe in a prudent and diversified asset allocation which has paid off as we had good performance from both our growth and value equity strategies. Also, our modest increase in our international allocation within several of our strategies seems to be paying off. However, we recognize that the future can arrive unannounced and we need to prepare for this, even if we are somewhat premature. This requires attention to prudent asset allocation and going where the puck is going to be, not where it is right now. As you know, we review our clients’ asset allocations on a quarterly basis and will recommend changes where we believe they are appropriate.

In addition to good results for the quarter, the year-to-date results are gratifying as well. However, we must remain vigilant given the world we live in. As stated above, most if not all markets are not as cheap as they were. However, earnings are higher and interest rates remain low. We remain cautiously optimistic, but with an eye looking for the unannounced while maintaining a long-term perspective.

Have a wonderful summer and please do not hesitate to call any of us on the investment committee to discuss this letter, your asset allocation, estate, tax, and insurance planning, or any other wealth management matter.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending July 26, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2017 by First Long Island Investors, LLC. All rights reserved.