2nd Quarter 2015 Report to Investors

July 30th, 2015“An argument is made that there are just too many question marks about the near future; wouldn’t it be better to wait until things clear up a bit? You know the prose: ‘Maintain buying reserves until current uncertainties are resolved,’ etc. Before reaching for that crutch, face up to two unpleasant facts: The future is never clear and you pay a high price for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.”

-Warren Buffett

For the second quarter, our clients made money on balance among our security, defensive, and traditional investment baskets. The many question marks facing us as investors, including when the Fed will begin to raise rates, how Greece and Europe will deal with the Greek debt default, if a nuclear agreement can be reached with Iran, and whether the war with ISIS is escalating, will all have to wait until the third quarter or beyond. Meanwhile, as I stated, the second quarter ended higher for most of our investment strategies.

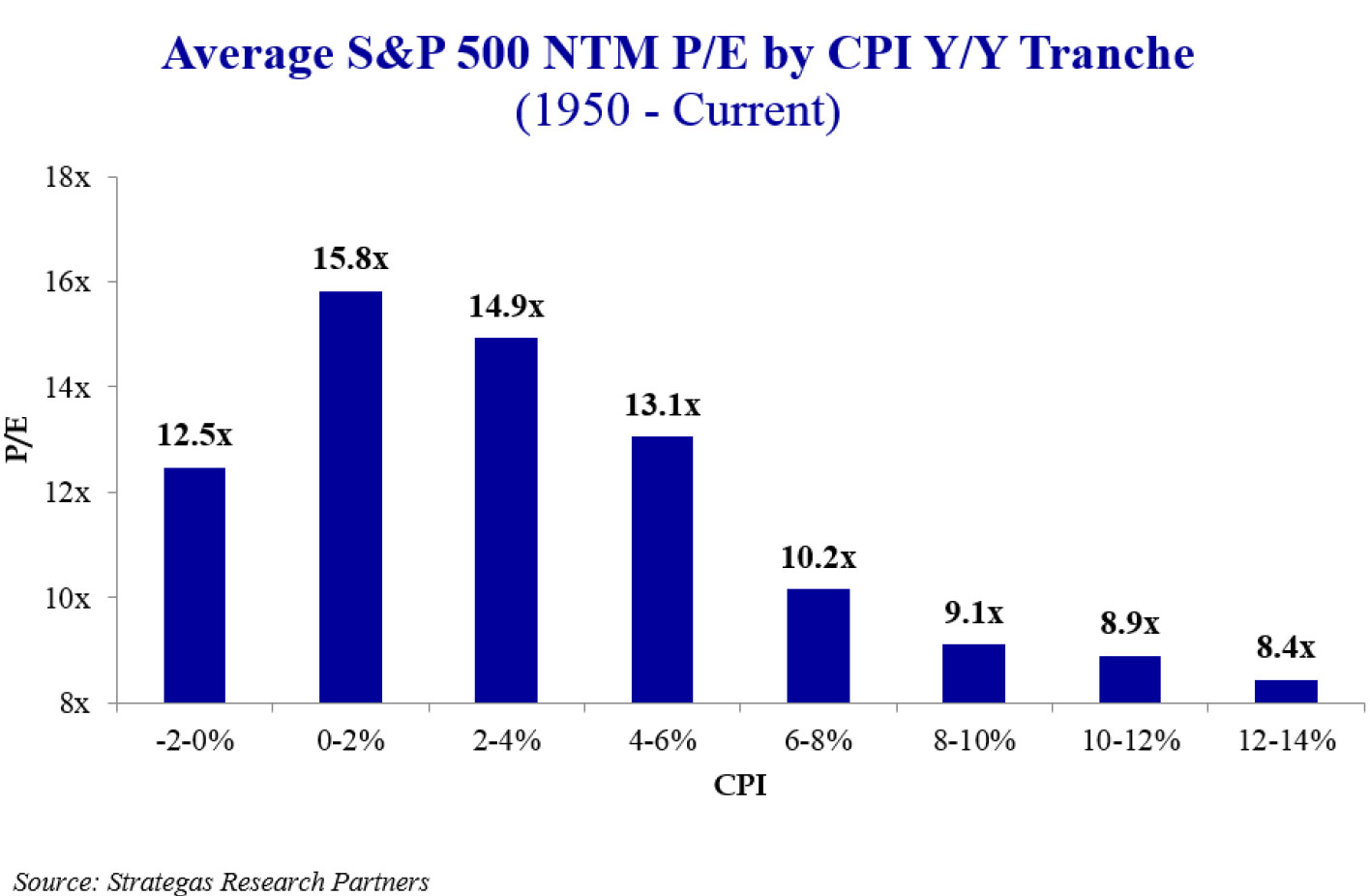

Uncertainty, to Buffett’s point, can be an opportunity if one attempts to focus on quality and reasonable valuations. Accordingly, we have spent significant time studying today’s valuation of the equity markets where interest rates remain very low, inflation is subdued, corporate earnings are growing slowly, and price earnings ratios for the S&P 500 Index are estimated to be between 15 and 16 times 2016 calendar year earnings. Our conclusion is that valuation is not a major headwind at this point for larger high-quality companies. This is confirmed by the best-of-breed outside managers we use in several of our investment strategies, who have been successfully investing over long periods of time. The following chart, in our opinion, demonstrates that, at least based on historical multiples, the current valuation for the equity market (the S&P 500 Index) is far from the nose bleed territory of 2000 when P/E’s were 25x earnings.

Based on the next 12-month price/earnings ratio of 16.5x and a low-interest-rate/low-inflation environment (CPI at 0.0% as of June 30, 2015), the equity market does not appear overvalued. These earnings are somewhat impacted from the rising dollar, which reduced the reported earnings of many multinational companies. Additionally, depressed oil prices are curtailing earnings and operations for many companies in the energy sector, which make up almost 8% of the S&P 500 Index. We focus our equity investing on highly concentrated portfolios across our defensive and traditional equity strategies. In other words, we try to invest selectively for the long term in companies that we believe will perform better than the average company; we do not invest in what we believe to be average companies. That gives us even greater confidence that hopefully our investments are undervalued and have greater potential for appreciation in the future.

Our cautious optimism is fueled by certain observations of the economy:

- The domestic economy continues to grow somewhat modestly between 2% and 3% per year (and one of our outside economic strategists suggests the potential for even higher growth through the end of next year).

- Employment continues to grow by 200,000+ jobs per month on average.

- Record corporate profits are expected to continue to grow, but at a slower pace in 2015 than in 2014.

- Very depressed energy prices, low interest rates, and the better employment picture mentioned above should continue to support growing consumer spending.

- The domestic housing market continues to improve, helping the consumer and the overall economy, through increased construction activity and improved consumer balance sheets

These economic positives do face some “question marks” or headwinds, which will result in some volatility going forward. In the immediate future, the world may have to deal with three events or situations that investors will have to digest:

- A possible exit from the Eurozone by Greece or the need for an onerous series of fiscal reforms for the people and businesses of Greece.

- A probable lift off by the Fed in raising interest rates in September.

- The debt problem facing Puerto Rico and the uncertainty related to its outstanding debt.

All of the above could lead to, in our opinion, short-term periods of indigestion or volatility that could last for months. Greece is a small economy (smaller than the economy of Connecticut) and Europe is well-equipped financially to deal with the Greek debt crisis. Unless there are unintended consequences that we do not currently anticipate, the Greek debt crisis should result in only short term volatility.

We view the fact that the Federal Reserve (“Fed”) is likely to raise rates as a positive. Our domestic economy is no longer in crisis! With expected record corporate earnings, many businesses flush with cash and carrying low levels of debt (for the most part), inflation low, and unemployment rates getting better with the most recent indication at 5.3% (although there is still a low level of participation), we believe the Fed should raise rates above zero percent. It is important to keep in mind that the fixed income market has already moved in anticipation of this. The 10-year Treasury, used as a benchmark for many mortgages, has moved from 1.9% at the start of the second quarter, to 2.3% on June 30th. This is still historically low and will probably move higher over the next few years. This should not materially impact the domestic economy in our opinion (it might help savers who will start to earn more than a nominal return on their cash investments) but it will hurt bond investors who have extended out maturities of their bond holdings (FLI fixed income portfolios have been purposely kept to shorter durations to avoid this). Prices of bonds with longer-term maturities will decline more than those with shorter-term maturities as interest rates go up. In our opinion, this could be fuel for the equity markets as burned bond investors may seek a liquid alternative in stocks, which are under owned by many retail and institutional investors. From a pure valuation standpoint, stocks remain cheap when compared to bonds based on an analysis of stocks earnings yield versus the yields of bonds. (Just compare the bond yield of the average corporate BBB+ bond to the probable growing earnings yield of the S&P 500 Index.) Bonds look very expensive on this basis and stocks look cheaper.

A restructuring of Puerto Rican bonds or the failure of insurance companies to make good on their insured Puerto Rican bonds could be disruptive to municipal bond markets. It also calls into question some of the fiscal issues confronting Puerto Rico that are festering in some of our states and local municipalities (such as unfunded pension liabilities). Accordingly, we focus on bond quality and purchase bonds with reasonable maturities for our clients.

On a global basis, we still have the European Central Bank in the early stages of its quantitative easing (bond buying) program which should modestly stimulate its economies. This assumes that Greece does not disrupt the economy and currency of the Eurozone. Additionally, China has just reduced its interest rates for the second time in the last few months. Meanwhile, its volatile stock market has declined 22% since the recent peak on June 12, 2015. Prior to that, it had increased 122% during the period from December 31, 2014 to June 12, 2015. This volatility is troubling. The fact that two large economies are trying to stimulate growth could be positive for many of the companies that we invest in. These central bank moves around the world should support a better level of global growth when coupled with improving economic activity in the U.S. Thus, in our opinion, we are not close to entering a recession. While we are encouraged by the progress in Europe and Asia, we still prefer the domestic equity market but have slightly increased our international allocation in certain FLI strategies while continuing to remain underweight.

Real estate markets are also prospering as both residential and business demand in the U.S. remains strong. Low interest rates, household formations at a robust level, employment growth, and wage increases are all helping residential housing appreciate. This helps confidence and bolsters consumer balance sheets. On the commercial front, the same low interest rates and business growth continue to support low cap rates/high valuations. The prospects of modestly higher interest rates could somewhat dampen this picture.

In summary, the investment environment has some real positives while facing at least three major “questions” (that we know of at this time), each of which could cause volatility and a possible market correction. Accordingly, since our mandate and mission is to first preserve our clients’ capital, we maintain a bias to our defensive basket. These strategies should offer some protection from the volatility that we expect from the problems in Greece, the uncertainty over the impact of the Fed finally raising rates, the debt crisis in Puerto Rico, and the ongoing conflicts in the Middle East with both the Iranian negotiation and the war against ISIS. At the same time, these strategies have the potential to appreciate once the volatility has subsided and the economic merits of each are realized.

Melding this quarter’s quote from Warren Buffett with last quarter’s quote from Daniel Kahneman, we see progress from an improving economy running head on into several “questions” that will give many investors pause. Buffett’s point is that this uncertainty (for thirty plus years we have called this the “wall of worry”) should not stop long-term investors from seeking out value, opportunity, and potential appreciation. We do not anticipate that these uncertainties will derail the improving economy or growth that we expect from the investments we have allocated our money to over the longer term. (Remember, we invest side by side with you.)

Our asset allocation recommendation remains pretty much the same. We are maintaining modest allocations to quality bonds with short- to medium-term maturities; we are continuing to recommend that clients overweight our defensive strategies; our commitment to traditional equity strategies is modestly underweighted; and where suitable, we are allocating some capital to a new mezzanine/mortgage lending investment strategy. This new strategy seeks to produce an above-average return from lending to real estate projects around the country and will result in a diversification of our current investments.

We see investment progress being made over the longer term. However, we most likely will have to weather some volatility from the current “questions” that are confronting us in the immediate future. We do not believe that sitting on the sidelines waiting for the “all clear” signal will make investment sense. As Buffett suggests, when everything seems rosy one will pay a very high price for stocks.

We are pleased to announce that Ebonie Hazle has joined the First Long Island Investors team as Assistant General Counsel. Among her other experience, Ebonie was an associate at Gibson, Dunn and Crutcher, LLP. She received her JD from Columbia University School of Law and a Bachelor of Arts from Harvard University. We will be sure to introduce you to Ebonie the next time you are in the office.

Please do not hesitate to call any of us on the investment committee should you have any questions. Also, by the way, enjoy the summer!

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

P.S. It looks like Greece and the European Union have a tentative agreement. However, this still might not be the last we hear of problems from Greece. Additionally, China continues to be very volatile.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending July 30, 2015, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2015 by First Long Island Investors, LLC. All rights reserved.