2nd Quarter 2013 Report to Investors

August 1st, 2013“By three methods we may learn wisdom:

First, by reflection, which is noblest;

Second, by imitation, which is easiest;

and third by experience, which is the bitterest.”

Confucius

Summary Review

The second quarter was a modestly positive experience for several asset classes led by equities. This is a continuation of a very strong first quarter where equities surprised most on the upside. On the other hand, bond yields increased, resulting in price declines and paper losses for many investors who were exposed to interest rate risk by extending out maturities to try to achieve modestly higher yields. There is probably more of that coming as the economy makes some progress and the Fed makes the smart but tough decision to somewhat taper bond purchases (this might well be perceived negatively in the short term but we believe is quite positive in the long run). Residential real estate also continued its rebound reflecting somewhat better employment as well as wealth gains in the stock market which have fueled consumer confidence.

Our strategies at First Long Island continued to make progress and most added to the large gains achieved in the first quarter (led by W.P. Stewart, Dividend Growth, FLI Select Equity, Value and Growth Funds). The strategy that did not appreciate was essentially flat (FLI Partners Fund) for the quarter, holding onto its significant gains recognized earlier in the year. Our bond portfolios were slightly down as we have kept maturities on the shorter side having been worried about the potential for rising rates. So, all in all, our second quarter was quite good.

Now we believe it is time for some reflection on investment wisdom and that is the reason for the above quote. We all know that our world has become more complex as the investment landscape has become truly global and, the “wall of worry” that we must reckon with extends beyond our borders. We think about geopolitical events in Syria, Egypt, North Korea, Iran and elsewhere. Economic issues in the Eurozone and emerging countries (e.g., China) as well as the pace of growth in the U.S. require intense consideration. The impact of policy changes (Affordable Care Act) as well as potential policy changes (tax reform and immigration) must also be put in the mix. And of course, finally, how does all of that affect the businesses, real estate, and bonds we invest in as well as their worth?

As Confucius has suggested, if we reflect, consider the thoughts of smart people we have access to, and then tap into our experiences of thirty years in this business, we should be able to derive a sound strategy for our clients. Our investment committee meets weekly (as do our strategy- specific subcommittees) and we counsel with several investors and strategists that we believe are smarter than we are (great investors like Bill Stewart and Bruce Berkowitz to name two, and strategists including Jason Trennert at Strategas Research Partners, LLC and Robert F. DeLucia, CFA, Consulting Economist for Prudential Retirement). We continue to think about the businesses we invest in, the conditions they face globally, the healing of our banking system, our politicians in Washington, stubborn unemployment, and consumers who make up 70% of our economy. We also think a lot about the future and see greater energy independence for America. We struggle with, but try to gain a perspective on, a world gripped by terrorism as well as the public defiance by people who are repressed in countries like Syria and Egypt. We remain strongly committed to domestic-equity investing while we continue to worry about the lack of real rates of return on bonds and cash. We believe that inflation will be tame; interest rates will slowly rise but remain “repressed” for the next few years; real estate will continue to appreciate although higher mortgage rates (albeit historically very low) could temper that somewhat; and other private investments (private equity) will also trend higher, following equity markets. Of course, unemployment and significant part-time employment (the U6 rate of 14.3% combining both) will likely remain stubbornly high as our country digests the impact of the new Affordable Care Act as well as uncertainty in policy from Washington. These will tend to moderate the potential growth we could achieve.

Where does all of this leave us after reflection, counseling with others and adopting many of their conclusions, and drawing upon our collective experiences being in this business for more than thirty years? First, keep to a prudent and diversified asset allocation that continues to give you exposure to asset classes that work over the long term. We continue to overweight both defensive and traditional equities; we are underweighting bonds and keeping maturities on the shorter side; and we believe that private investments (private equity, special situations, and real assets) are worth pursuing for patient investors who can tolerate illiquidity. (This is evidenced by our most recent creation of our partnership investing with Bruce Berkowitz’s Fairholme Investment Management for suitable investors.) Alternative investments, including many long/short hedge funds, on average have underperformed our traditional and defensive equities the last several years. We believe that will continue as volatility remains low and only seems, for now, to spike for short periods of time. So why do we remain so constructive on long-term defensive and traditional equities?

Over the past several years (see our past quarterly letters) we have urged our clients to commit to the equity markets. This reflected our contrarian view versus many equity market naysayers. This under-loved asset class has had significant outflows versus bonds; corporate balance sheets are strong; dividends are higher; global growth continues albeit at a slower rate; valuations to us have been and remain attractive as corporate earnings continue to grow; and individuals, institutions and corporations have mountains of cash on the sidelines. Contrast this with the most obvious alternative for all investors, bonds. Bond yields are terribly low and starting what we predict will be a slow rise. Not a good prescription for bond investors. So, where do we stand today?

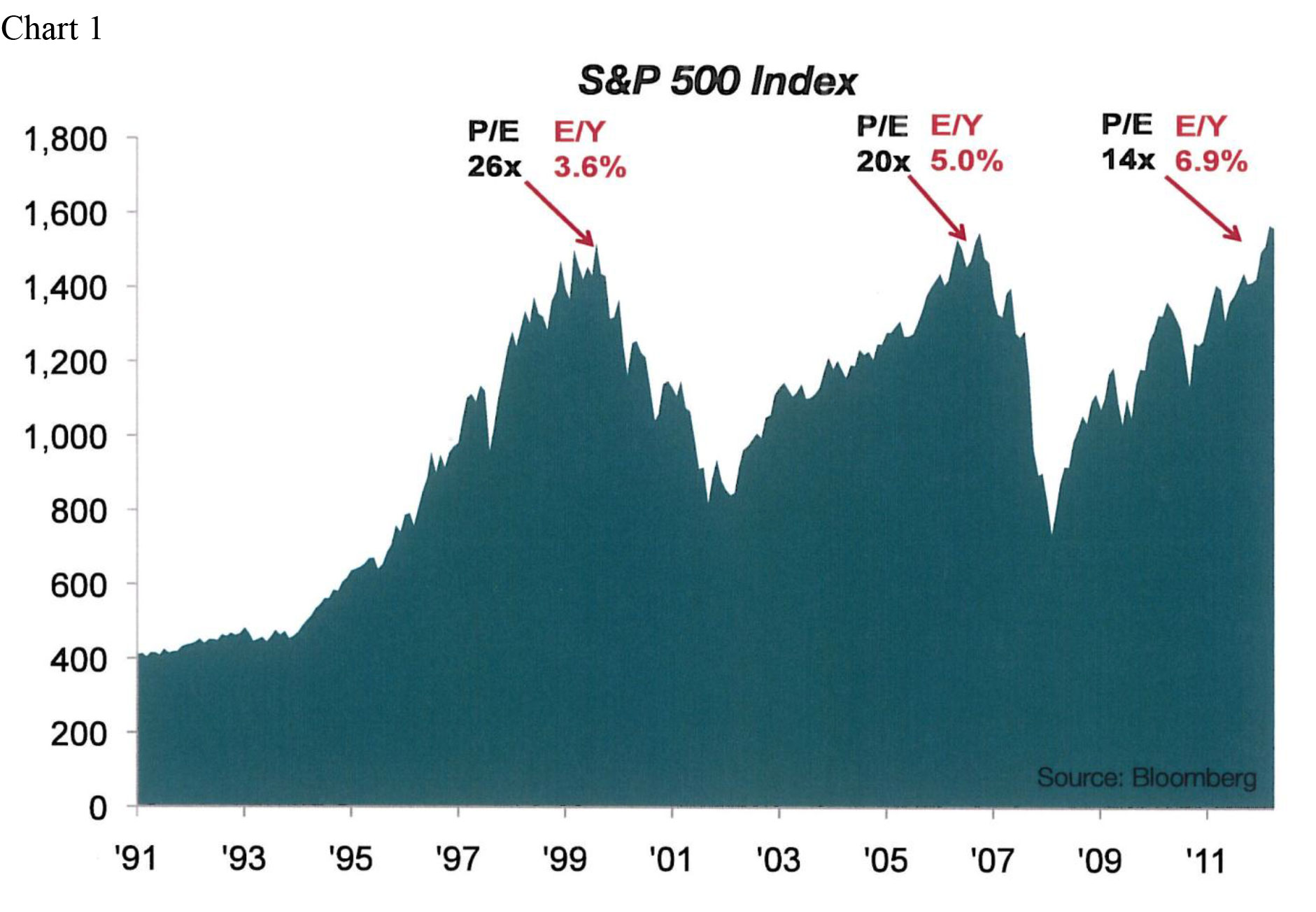

We believe that the average large-cap stock is somewhat undervalued despite the S&P 500 near a record high. The chart (Chart 1) below shows that despite the S&P 500 being slightly above the prior record highs recorded in 2000 and 2007, earnings are much higher, p/e’s are therefore much lower, and the highest quality investment alternative, the 10-year U.S. Treasury has a much lower yield.

In our view, unless earnings were to drop due to a recession, large-cap stocks are relatively cheap! Even if we were to normalize the 10-year U.S Treasury to a 4% rate (up from the current 2.5%) we believe the S&P 500 level today would still be attractive. Additionally, we do not see a recession on the horizon. We believe our economy is still growing between 2% and 3% per year; employment is getting somewhat better; and global growth from emerging economies is still more than offsetting weakness in Europe and Japan. Add to this the pain that bond investors are now feeling from paper losses and perhaps this next chart will change direction:

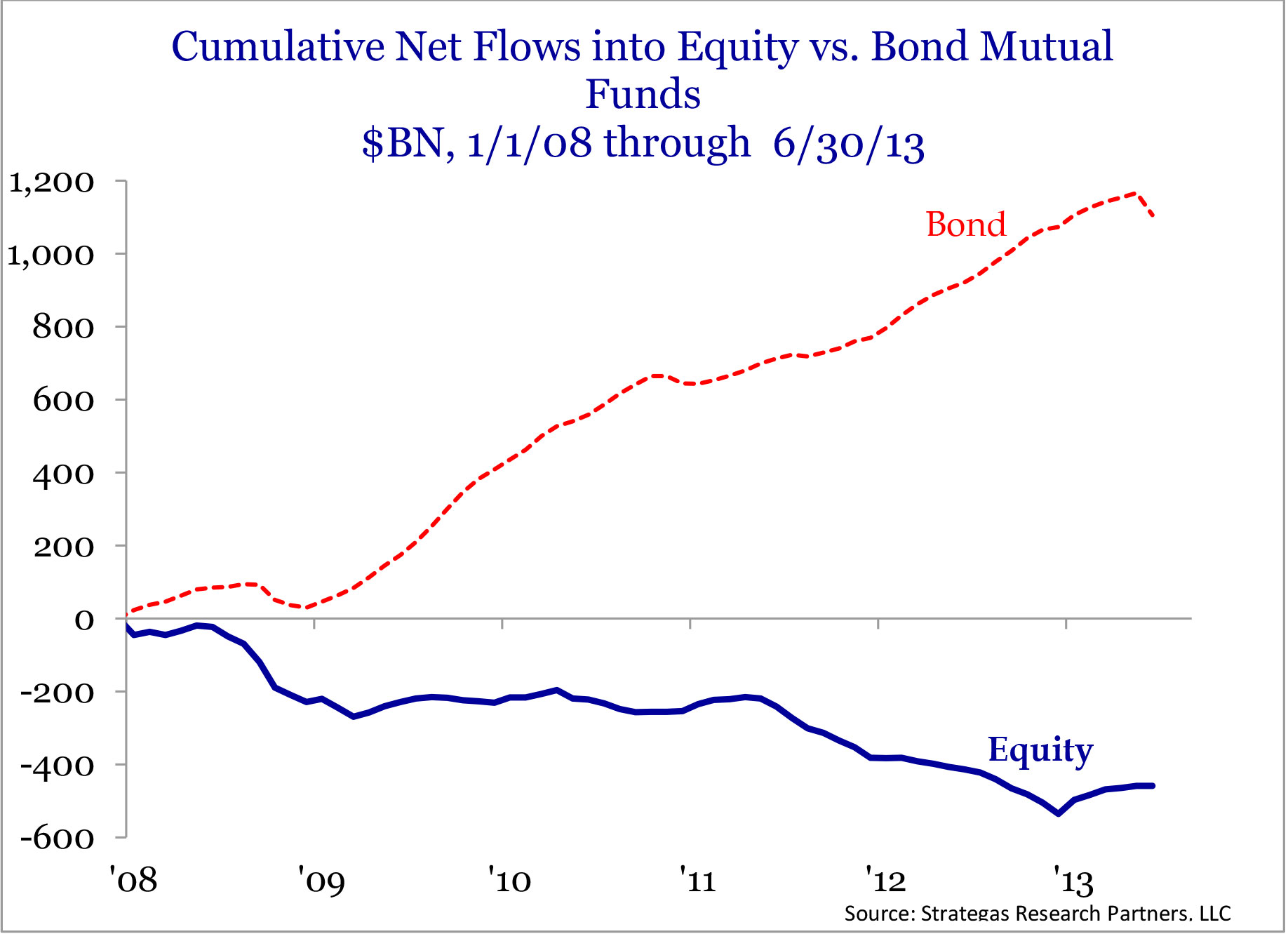

Chart 2

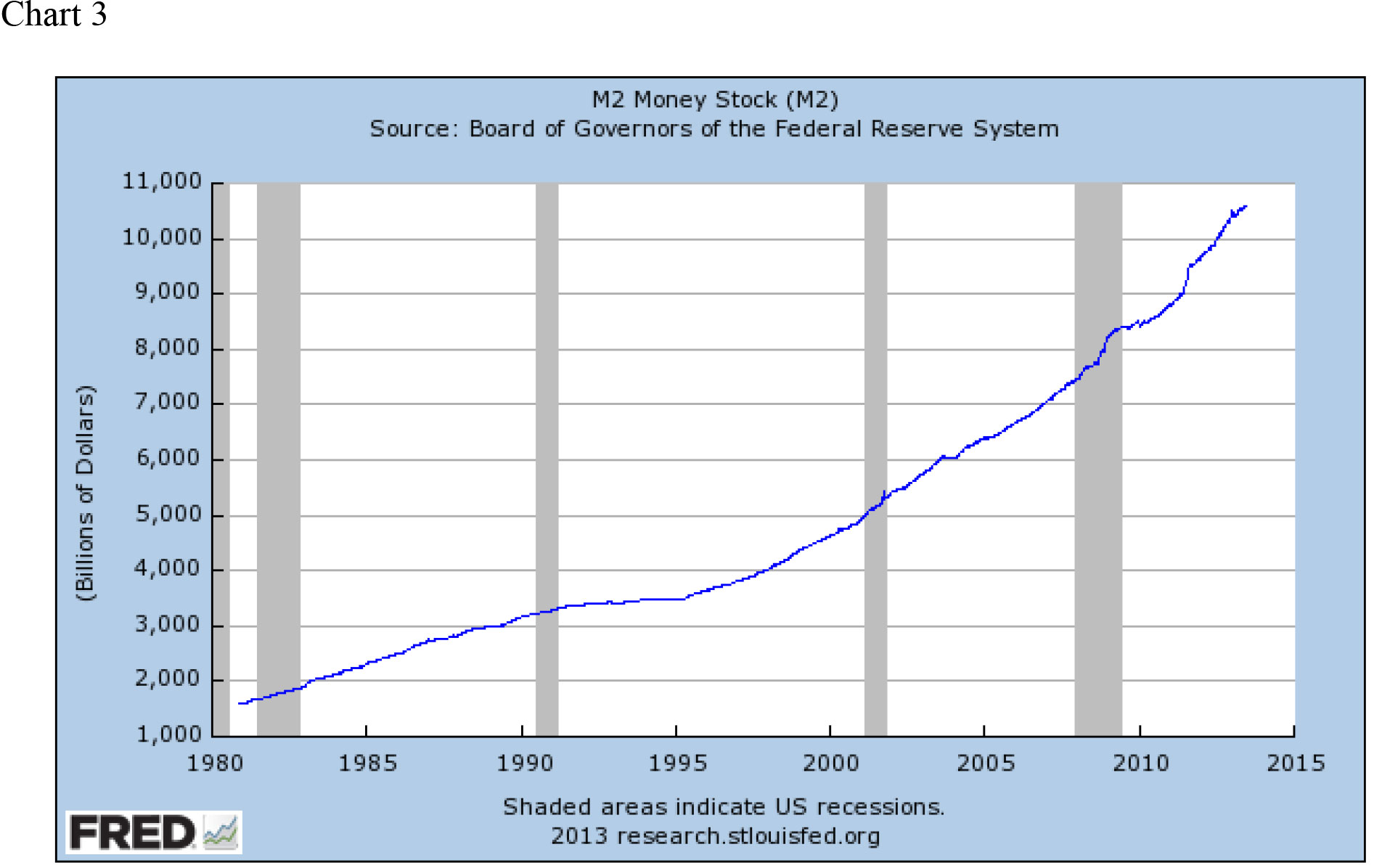

This chart (Chart 2) shows that despite the run up in stocks (following earnings growth) there has been an outflow from stock funds into bond funds. This herd mentality has the average investor chasing a bond market that is now in retreat. If some of the money in the following chart (Chart 3) plus some disillusioned bond investors were to move funds into equities, the appreciation in equities could continue for the foreseeable future in part from this increased demand. Of course, we don’t have a crystal ball, so we continue to preach asset allocation and diversification. We do not believe that the S&P 500 is overvalued when you consider that it is trading at what we believe to be a reasonable 14 times next year’s earnings. (By the way, there is a theory called the Rule of 20 that suggests a reasonable p/e is 20 minus the level of inflation. This would put us at a 17 to 18 multiple while we believe the market is at 14 times next year’s earnings.) While not all gurus believe p/e’s are as reasonable as we do, we are sticking to our belief.

Summary

We had a reasonable second quarter following a great first quarter. Many investors are worried that stock market advances cannot continue while they witness paper losses in their bond portfolios. We believe that prudent investors are starting to recognize that you can be a long-term investor in the equity markets as part of one’s overall asset allocation. Some have taken their profits only to watch the markets keep rising. Others are paralyzed in cash and over-allocations to bonds wondering if it is too late to add to or initiate equity investments. We continue to believe that there is more to come and the greed factor that typically takes equity markets to new heights is not even a factor yet. (Has your taxi-cab driver given you a stock tip lately?) Bond portfolios could be facing more losses on paper and stashing away cash, earning less than the rate of inflation, will only serve to deplete one’s purchasing power over time. (We are not suggesting eliminating one’s bond portfolio or having no cash cushion. We are just stating that these allocations should be underweighted or one must accept less potential appreciation and potential paper losses as well as a loss of purchasing power.)

Confucius speaks of reflection, imitation of smarter people, and use of experience in crafting a direction. We continue to do that for you from an investment standpoint. If one looks back at our quarterly letters for the past several years, you will see that our direction, so far, has been on the money (no pun intended). However, modesty gets us back to where we always preach diversification in one’s asset allocation to prepare for the unknown. We conclude with our quote from our last letter:

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.” Peter Lynch

Believe in America’s future as a global leader and, when properly advised, let your asset allocation work for you over the long term.

Have a great summer, and please call with any questions, comments or concerns.

Best regards,

Robert D. Rosenthal

Chairman and

Chief Executive Officer

Ralph F. Palleschi

President and

Chief Operating Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results.

Disclaimer: The views expressed are the views of Robert D. Rosenthal and Ralph F. Palleschi through the period ending June 30, 2013, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Content may not be reproduced, distributed or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC . Copyright © 2013 by First Long Island Investors, LLC. All rights reserved.