2023 Investment Outlook

January 20th, 20232023: Our Thoughtful View

“There are 60,000 economists in the U.S., many of them employed full-time trying to forecast recessions and interest rates, and if they could do it successfully twice in a row, they’d all be millionaires by now… But as far as I know, most of them are still gainfully employed, which ought to tell us something.” – Peter Lynch

“The true investor welcomes volatility… That’s true because a wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.” – Warren Buffett

2023 and Beyond

Each year at this time while on my year-end holiday, I contemplate the year that just ended and give great thought to what lies ahead. It is easy to describe 2022 as ugly. Major indices sharply declined: the Dow Jones Industrial Average declined 8.8% and, for the more meaningful indices, the S&P 500 Index was down 18.1% and the growth-oriented NASDAQ Composite declined by 32.5%! For virtually all equities, this was the worst year since 2008, but it was preceded by several years of meaningful gains. All three of the above indices still made compounded gains for the three- and five-year periods ended December 31, 2022; however, 2022’s disappointment for all of us as traditional equity investors was palpable. (I should mention some hedge funds did fare better.)

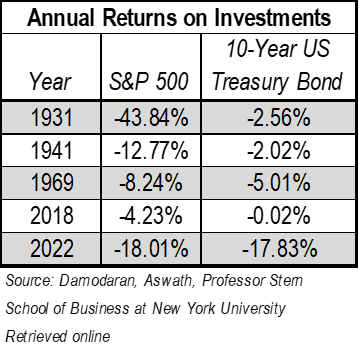

What made the year even more disappointing is that the normally safe haven of “risk-free” U.S. government bonds declined by 17.8% (as exemplified by the 10-year U.S. Treasury). In reviewing data going back to 1928, 2022 is the first and only time where both equity markets and U.S. Treasuries (as exemplified by the 10-year U.S. Treasury) were both down by double digits in the same year! This left virtually no place to hide except for cash, which had only a nominal return for much of the year. It is also too soon to tell how adversely affected both real estate and private equity will be by the conditions that caused such difficulty with publicly traded financial assets.

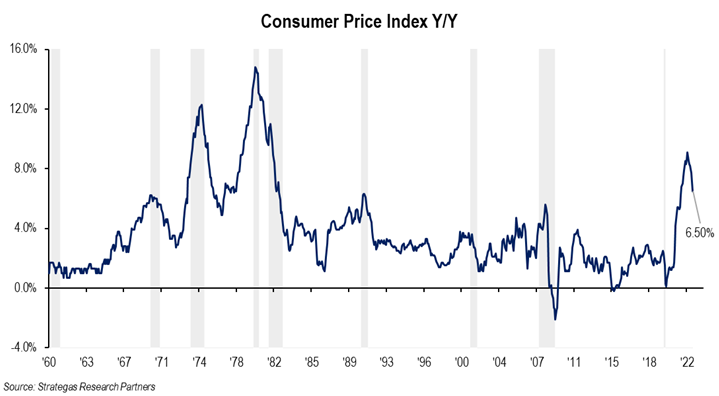

The rareness of the above was also accompanied by a crash in Bitcoin as well as the drying up of the hot SPAC market, both of which we have avoided. What was also so hurtful to consumers and businesses alike, however, was the increase in inflation, which reached a 40-year high. All of these troubling results caused a gloom among investors who attempted to make sense of the following:

1. The Fed raising rates at an unprecedented pace of 75 basis points for four consecutive meetings and most recently 50 basis points with more projected to come. In all there were seven rate increases in 2022!

2. A raging war in Ukraine resulting from an unprovoked invasion by Russia. The U.S. and other allies have contributed billions in defensive weaponry as well as humanitarian aid (and the vast majority of aid has come from the U.S.). Putin and his comrades have even threatened to use tactical nuclear weapons. (The potential for Russia to be a geopolitical hotspot was mentioned in last year’s thought piece, and this conflict was specifically referenced during our February 10, 2022 Market Update Webinar.)

3. The consensus of many economists that a recession will occur sometime in the next six to twenty-four months (see the first quote above). A leading sign of potential recession is the inversion of the yield curve where shorter-term interest rates are higher than longer-term interest rates. This is occurring now with the 3-month and 2-year U.S. Treasuries yielding more than the 10-year U.S. Treasury.

4. A newly divided government with a slim majority gained by Republicans in the House. The Republican agenda is intent on conducting political investigations as well as trying to bring an end to inflationary government spending and the immigration crisis on our southern border.

5. A housing market impacted by mortgage rates that have doubled over the past year, while sales of homes as well as rents are starting to drop in many areas.

6. Energy prices escalating where gasoline on average was 31% higher at year end. Food prices also rose 10% adding to consumer gloom.

7. The continuing impact of COVID-19 both here and abroad. China is experiencing new strains causing lock downs and economic turmoil.

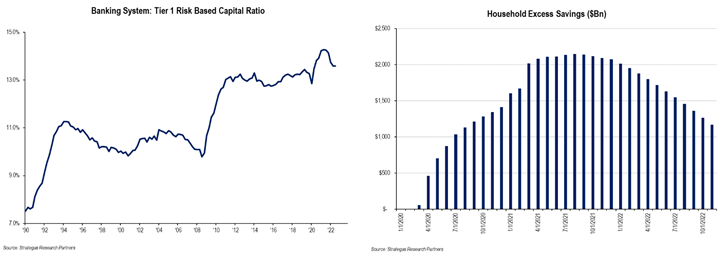

These troubling conditions impacting this past year contributed to declining price-earnings multiples, especially among growth stocks. Even dominant and financially strong companies including Microsoft, Apple, Alphabet, Meta Platforms, and Amazon.com (these may or may not be owned in various FLI strategies) did not escape the carnage, experiencing significant share price losses for the year. Not only are price-earnings multiples now pricing in higher interest rates, but, in our opinion, also the likelihood of an upcoming recession. However, the troubling factors listed above must also be balanced with our strong banking system, high level of employment, decent consumer confidence, and remaining excess savings held by many consumers:

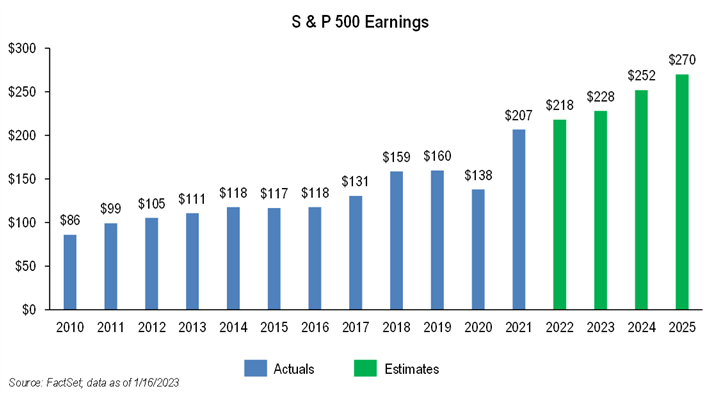

In addition, corporate earnings, aided by energy companies, rose for the S&P 500 Index in 2022 and are projected to increase modestly in 2023 based on consensus estimates. However, recent speculation suggests that earnings could decrease in 2023 if a recession should occur.

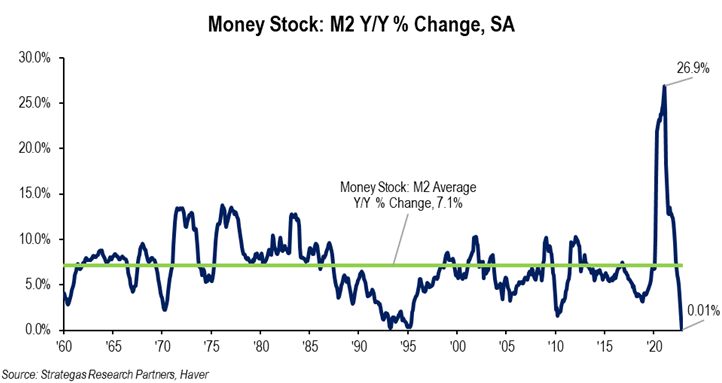

The strong earnings of recent years are facing headwinds from the rocket-like increase in interest rates (contributing to a stronger dollar, which hurts multinational companies’ earnings) as well as the Fed engaging in quantitative tightening (no longer buying U.S. Treasuries and allowing maturing bonds to roll off). Both are designed to slow the economy, increase unemployment, and reduce monetary growth, the latter of which we believe was the precursor to higher inflation. The following chart shows the upsurge in M2 growth, its recent collapse, and its average growth over many years.

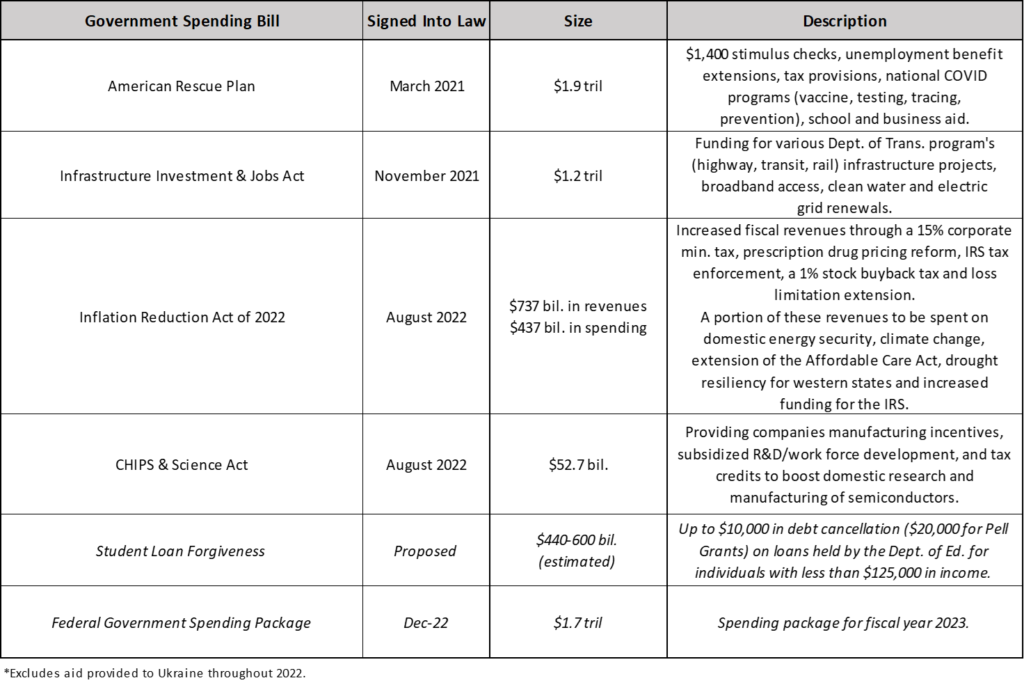

This dramatic growth in liquidity, which is inflationary by its nature (in our opinion), was caused by the monetary (the Fed) and fiscal (Congress) responses to the unprecedented COVID-19 pandemic. In addition, policy initiatives by the current administration, in our opinion, exacerbated the problem. It has been argued by economists on both sides of the aisle (notably Larry Summers who served in the Clinton and Obama administrations) that Congress went too far with excessive spending that went beyond the pandemic need for relief. We are still enduring additional recent spending bills. These bills are listed below to illuminate the sheer magnitude of the trillions in relief and other policy spending:

The COVID-19 Hangover and 2023

We strongly believe that the pandemic and its continuing impact have not only crippled investment performance in 2022, but will continue to be impactful in 2023. Call it a bad hangover as we battle persistent but weaker COVID-19 strains, conflicting government health advice, impact on our children’s learning and socialization, and continuing economic fallout (especially given the current unfolding situation in China). In 2019, the U.S. enjoyed a robust economy featuring above-average GDP growth, low inflation, and multi-decade low unemployment. The pandemic hit in early 2020 and global governments mandated shutdowns of numerous economies, which affected consumers and businesses alike. Many segments of the economy shut down and goods in many cases became hard to come by while e-commerce became an even larger portion of retail sales. Companies that benefit from people spending more time at home saw demand pulled forward and subsequently saw a significant, and in some cases unsustainable, improvement in financial results. Working from home transformed business practices. Consumers, both those who continued to work and those not able to work, some of whom received stimulus money from the government, accumulated savings as their spending patterns changed dramatically.

Excess savings are depicted in the chart above, but inflation near a 40-year high is eating away at it:

Now, from 2021 into 2022 and 2023 the barn door opened and the rush to spend on goods, travel, and other experiential desires are resulting in some shortages in availability, not just from supply disruptions and labor shortages but also from increased demand. We call this increased spending velocity. Insufficient supply of goods and labor to meet this demand leads to more inflation. As an example, the increase in the cost of jet and other fuels are just a part of the inflation problem as more people travel while also dealing with climate change that has led to record cold temperatures and storms in parts of the country. Meanwhile, the current administration’s bias against domestic fossil fuel exploration, coupled with other macroeconomic and political factors, has exacerbated energy shortages and elevated prices, while attempts to obtain additional foreign oil supplies have gone unrealized. This has forced our government to foolishly, in our opinion, deplete our strategic petroleum reserve. We believe this is a bad and dangerous policy given the global strife.

Investment Implications for 2023

This COVID-19 hangover coupled with the Fed playing catch-up (we believe it should have raised rates earlier) are a wicked combination. The Fed must bring down inflation (it is slowly beginning to happen) through rate increases resulting in higher interest rates than what we have been used to more recently, the latter of which Chairman Powell states will last longer than many had expected. At the same time, money supply, also known as M2, growth is abruptly decelerating and putting a strain on an economy that needs monetary growth, in our opinion, to grow at a reasonable rate. Right now, the Fed is dramatically reducing monetary growth in order to reduce inflation. In our opinion, it needs to constrain growth and subsequently force the increase of unemployment to stifle further wage inflation while also bringing down demand and overall inflation.

Short-term interest rates, as measured by the 3-month and 2-year U.S. Treasuries, are higher than the 10-year U.S. Treasury. This inversion has been a precursor to recessions in the past. The good news is that investors with dry powder or the cash buffer that we have urged for some time, can now achieve a pretax return of greater than 4% from U.S. Treasuries maturing in a year or two. The less than good news is that with the 10-year U.S. Treasury at 3.9%, mortgage rates have more than doubled from a year ago, putting pressure on housing prices and slowing demand for new homes. (Today’s 30-year fixed rate mortgage is still below the long-term average dating back to 1971.) This will, in our opinion, negatively impact the value of both residential and commercial real estate. Lending for real estate acquisitions or refinancings in our view will be more expensive; however, this increased cost of borrowing may present an opportunity for banks and some alternative investors (including certain FLI strategies), yet probably slow economic growth.

From an equity standpoint, last year demonstrated a big reversal where value stocks (still negative for the most part except for Energy and Utilities) vastly outperformed growth stocks that for several years prior had appreciated much more than value stocks. As a measure, since 2008, despite the terrible set back in 2022, growth stocks (the Russell 1000 Growth Index declined by 29.1%) have outpaced the Russell 1000 Value Index by a significant 274%. Companies like the growth darlings mentioned earlier suffered declines last year of anywhere from 25% to 65% despite being market dominant, financially strong, and profitable. More marginal (in some cases unprofitable) but hot growth stocks (i.e. Peloton Interactive and Beyond Meat) declined by upwards of 75%! Value oriented shares fared better and dividend growing stocks also performed relatively well, especially when compared to growth shares. Energy companies in general fared very well and as a sector were in positive territory (one of only two S&P 500 sectors to be in positive territory).

In our opinion, 2023 faces many of the same issues mentioned above that characterized 2022. Higher interest rates, high but slowly declining inflation, COVID-19 residuals, divided government, and worries about a recession that could reduce earnings for many companies all represent our wall of worry for 2023. And there is no end in sight to the war in Ukraine, which creates a level of fear for investors. I would also add that with the “death,” recently announced by President Biden, of a possible nuclear deal with Iran (in our opinion ill-conceived from the get go), the likelihood of an Israeli attack to attempt to eliminate a nuclear threat from Iran is a distinct possibility at some point. Newly elected Israeli Prime Minister Netanyahu has made it clear that in his opinion, a nuclear Iran is an existential threat to Israel and a threat to the “Great Satan,” the U.S. Also, we cannot ignore the growing hostility between the U.S. and China. Despite significant economic ties and dependence, relations between the two super-economies of the world are worrisome to say the least.

From an investment strategy standpoint, we believe significant tax loss selling was undertaken by many taxable investors over the last several months including in certain strategies we manage. This probably contributed to the lack of a Santa Claus rally typically seen at yearend. There may just be an opportunity now for some beaten down but financially strong and profitable companies, particularly in the growth space as our second quote suggests. These companies, some of which were mentioned earlier, in our opinion, can still grow their earnings this year even if the economy slows. Being able to defend margins (through possible cost cutting and layoffs) and grow profits in a slowing economy will stand out and could get rewarded! In addition, companies that consistently grew their dividends typically fared better than the overall equity market on a relative basis as they were somewhat insulated by higher yields and growing dividends. Our own Dividend Growth strategy saw the companies in the portfolio increase their dividends by an average of 11.8% in 2022 (well above the horrendous inflation rate of 8.0% last year). We believe dividend growth and an above-average yield will continue to be strong contributors to overall returns in the coming years. However, fair valuations based on earnings and interest rates must always be considered. We also do believe that some companies’ excessive share price drops may present an opportunity for the long-term investor!

The Bottom Line

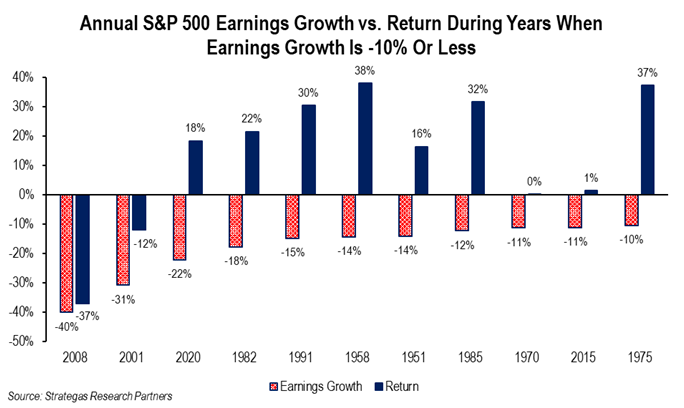

2022 was terrible. Both the Fed and Treasury Secretary mistook inflation to be transitory. The medicine to combat persistent inflation has been dramatically higher interest rates (a blast off) from the starting point of near zero. The fallout was collapsing price-earnings multiples especially for favored growth companies. Perhaps therein, selectively by individual company, lies the opportunity for longer-term investors. Higher-yielding dividend growers are the other side of this barbell approach to investing. Value-oriented companies, including dividend growers, coupled with fundamentally strong earnings growth companies make for a prudent, long-term asset allocation. Add to this mix a greater allocation to short- to medium-term U.S. Treasuries, municipal bonds, or high-grade corporate bonds as the absolute return on fixed-income investments is now more attractive than recently at least on a pre-inflation basis. We do, however, expect inflation to come down over the next year or so. At some point with a meaningful decline in inflation, the Fed will pause or even reverse course. We just do not know when. Interest rate increases take time to slow the economy and reduce inflation. If that were to happen (and we believe it will) both equities, especially profitable growth equities, and fixed income would respond in positive fashion, in our opinion. This can be the case even in the face of what we expect to be a mild recession in the next year or two. In the event of a recession and a reduction in S&P 500 earnings, share prices can still appreciate as evidenced in the chart below:

Make no mistake, we as investors are in a difficult environment both economically and geopolitically. As investors, we have been there before and will come out of this as we did after 2008, 2001-2002, 1973-1974, and many times before, but patience is required. A longer-term perspective is also needed and an adherence to owning high-quality, financially strong, cash flow generating, dividend growing, and market dominant companies in their space is a prescription, in our humble opinion, to get through this ugly period. That is a smarter approach rather than trying to discern the many different opinions from thousands of economists who are book smart, but typically do not invest anyone’s money. We do. Just as Buffett suggests, “wild” price fluctuations in strong businesses might just present the long-term investor with opportunities in select companies. We do not recommend index funds or industry ETFs at this point given the current difficult environment. We believe concentrated portfolios of quality, financially strong companies, or bonds, will provide positive results over time.

Additionally, this will serve as our Investment Perspective for our upcoming quarterly letter.

We at FLI hope your holiday season was pleasant and happy, despite an ugly year for us as investors. We wish you a healthy, happy, and more prosperous 2023. We remain committed to helping our clients navigate this difficult investment environment, and seeing over the valley to better times. Know that you can always contact any of us on our investment committee and/or our wealth management team.

Best Regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

PS: Given the current environment and the aftermath of 2022, we deviate from the norm of one thought-provoking quote, and used two. We believe both are relevant today.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of January 20, 2023 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of December 31, 2022, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2023 by First Long Island Investors, LLC. All rights reserved.