2021 Investment Outlook

January 19th, 20212021: Our Thoughtful View – January 14, 2021

“Invest for the long haul. Don’t get too greedy and don’t get too scared.”

-Shelby M.C. Davis

2019-2020

In assessing the future, one can learn from the immediate past. 2019 was a year of financial optimism fueled by improving earnings, in part due to ongoing benefits of recent tax reform, low unemployment, low interest rates, and deregulation. The result was a strong year in most traditional asset classes with the laggard being the average hedge fund investment. Our clients did well following a diversified asset allocation tailored to their individual goals, but in all cases with an underweight to fixed income and heavier allocations to our defensive and traditional equity strategies. Meanwhile, beneath the surface, wealth and income inequality simmered.

2020 was a year to never forget. It started with great optimism based on record low unemployment, low interest rates, rising personal incomes, an accommodative Fed, and a rising stock market. However, early on, commencing in March, we and the entire world were confronted with a global pandemic emanating from a region in China that has foisted on us sickness and is approaching a death toll not seen for the last hundred years (other than HIV/AIDS), as well as the economic impacts of such. As the extent of this pandemic became better known lockdowns forced business closures; hospitals became inundated; and unabashed fear led to unimaginable number of deaths and a downward spiral of global stock markets (e.g. the S&P 500 Index fell 34% from its peak just prior to the pandemic). A recession/near depression was forced on our economy and others around the world as governments and medical professionals struggled to find treatments and vaccines for this unknown virus.

Enter the words “warp speed.” With accelerating speed our equity markets declined in the February-March period. Office real estate and many retail and restaurant locations became empty, planes and hotels had utilization drop by upwards of 90%. Unemployment rose to almost 15% at the peak. Oil usage plummeted and spot oil pricing at one point was negative! The key thing to remember with all of these disastrous circumstances is that they were self-inflicted by our federal and state governments, trying to deal with this unknown and hideous virus. The financial crisis of 2008/09 was dwarfed by the economic and human despair caused by this pandemic.

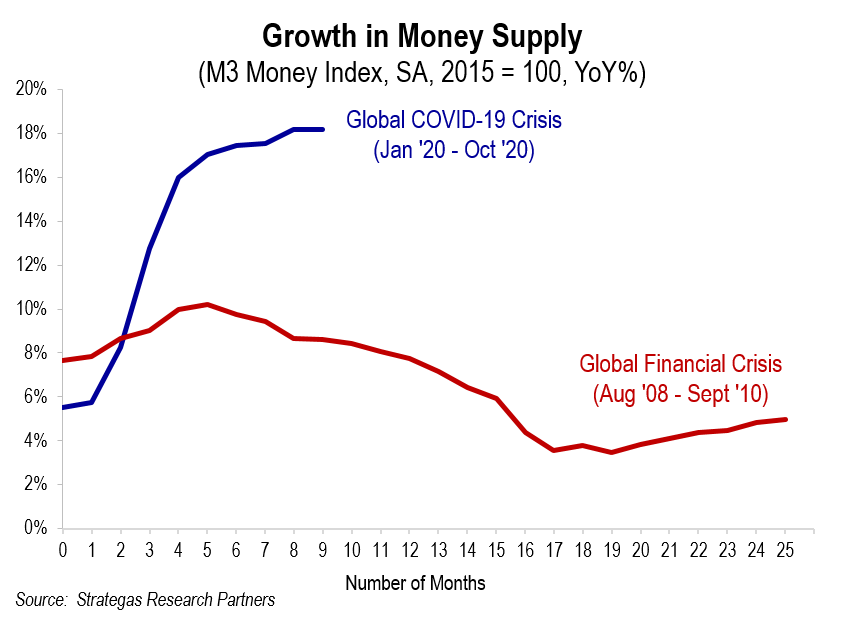

Enter the words “warp speed” yet again. In the spring, the Federal Reserve and the Federal Government took unprecedented and bold actions to bolster the financial system through monetary policy (expanded the balance sheet by three trillion dollars) and the government (in a bipartisan manner) acted to pass the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and other programs which infused more than three trillion dollars to individuals, businesses, hospitals, and local governments. This was followed up in very late December with another nine hundred billion dollars which has yet to be distributed. These monetary and fiscal actions dwarf the actions taken by the Fed and the Federal Government during the financial crisis of 2008/09.

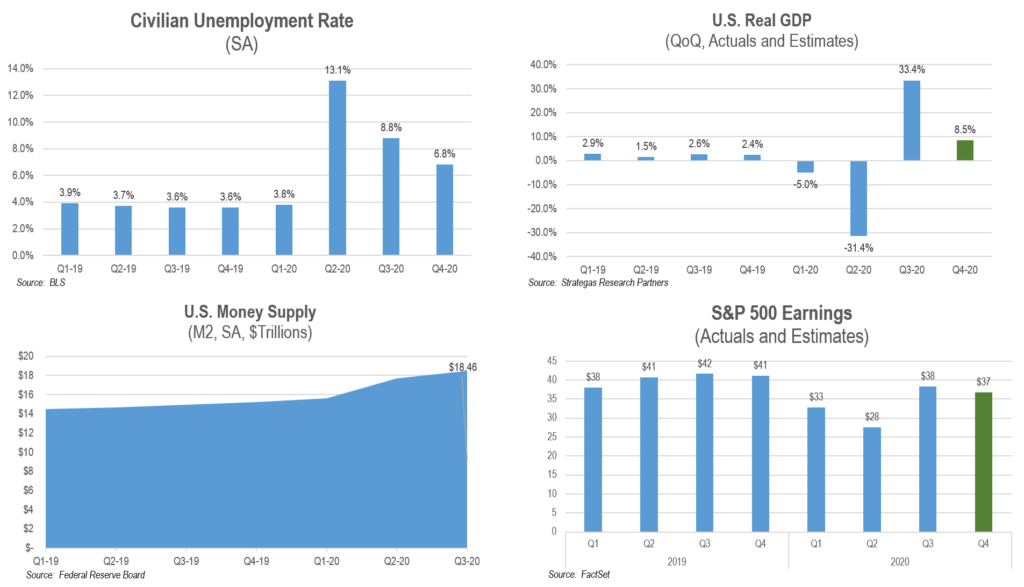

The U.S. government also initiated a ambitious partnership between government and private businesses called “Operation Warp Speed” to provide for the seeding of pharmaceutical companies to create therapies and vaccines to conquer this virus as well as other public-private sector partnerships to develop and administer new methods of testing, domestically manufacture personal protective equipment (PPE), build temporary hospitals, add ventilators, etc. The intention was great but something of this magnitude was bound to have inefficiencies and political discourse, both of which were experienced. But hope sprang eternal and a vaccine was developed through Operation Warp Speed by year-end (an unimaginable record) and the development of certain therapies gave both our citizens and businesses hope for the future. The following charts depict the course of employment, gross domestic product (GDP), monetary growth, and the S&P 500 during 2019-2020 which demonstrates the violent downturn and miraculous economic recovery:

These charts demonstrate both the economic volatility as well as the unprecedented resilience of the domestic stock market and our economy. Of course, not all stocks reacted with such a rebound as growth-oriented shares led the market by a wide margin (given our bias to growth, almost all of our strategies delivered double digit appreciation). Certain sectors of the equity markets (Energy and Financials) were significant laggards. Interest rates dropped to record lows, so today cash and quality bonds offer little or virtually no return — in most cases (money markets and U.S. 10-year Treasuries) provide a negative return after inflation. 2020 ended with the S&P 500, Dow Jones Industrial Average, and NASDAQ setting new records. Who would ever have thought that was possible? But the prospects of vaccines, therapies, record amounts of monetary relief and stimulus from the government, and the Fed’s expanding balance sheet provided the impetus for these mind boggling results.

However, during the course of the year, political division, an upcoming Presidential election, and civil unrest prompted by the heinous murder of George Floyd in Minneapolis led to numerous peaceful and many tumultuously violent protests throughout the country. Cries for a political solution to wealth inequality were important to many of the Democratic candidates for various offices. The fear of socialism became the common fear of those on the right of the political spectrum. Finally, in a Presidential election besieged with controversy, former Vice President Joe Biden was elected President. The President-elect has promised a more progressive approach to many of the country’s challenges.

What Do We Know As We Commence 2021?

The horrors of COVID-19 remain with death counts being a daily reminder. The infection rate in certain parts of the country is growing coming out of the holiday season. Yet there is reason for optimism based on:

1. The emergency use authorization of two vaccines, as of this writing, with an efficacy of 94 and 95%. Operation Warp Speed is delivering on its promise of 300 million vaccine doses with the first delivered by January 2021. In fact, they beat that initial delivery target and vaccines started being given out in December 2020. However, the administering of the vaccines has been disappointing based on both federal and state inefficiencies.

2. The flood of liquidity from the Fed and stimulus from Congress continues to bolster financial markets. Stock markets hit records, IPO’s achieved incredible valuations (unreasonable to us), Special Purpose Acquisition Companies (SPACs) achieved record “blank check” sums of money, and cryptocurrency appreciated by over 300%! (Not our cup of tea.)

3. Unemployment continues to come down (albeit some people have left the workforce) and businesses have adapted to these draconian circumstances by innovating products and delivery systems. We expect this will boost profits and profit margins for many companies. S&P 500 earnings are projected to achieve pre-pandemic levels this year and exceed them in 2022.

4. The latest round of relief, $900 billion just approved and reluctantly signed by President Trump (who at the last minute sought higher direct payments), should be a bridge to struggling individuals and businesses while vaccines help to return our economy to normal.

5. The Fed has promised to let the economy run “hot” until full employment is achieved through low interest rates and Fed purchases of debt instruments.

Where Does This Leave Us?

There is much optimism that lies in the hope that the virus will succumb to massive numbers of people being vaccinated sometime this year. A “new normalcy” will evolve during the course of the year and we believe that our economy will continue to recover robustly. Many market pundits are optimistic that another positive year for the stock market is possible. This is based on increasing corporate earnings, GDP growth, improved employment, continued low interest rates, and new business startups to replace many of those that failed through no fault of their own. In addition, the Fed just conducted another surprise stress test for major banks and they all passed! It is quite possible that loan loss reserves taken in prior quarters will be returned as higher profits in 2021. We believe that all of these factors will in time take place.

Yet another characteristic of the last several years that has not been focused on — our national debt which will now approach a concerning level of $28 trillion dollars. At least eight trillion resulting from the tax cuts of 2017 and roughly three trillion in additional debt for the needed relief and stimulus from the pandemic. This is a reality that needs to be thought out and brought under control. Our best guess is that both tax increases in the future and inflation will be needed to stem the tide and reduce the effective cost of this level of debt.

We would be remiss in not again mentioning our concerns regarding the speculation that seems to be surrounding IPO’s, SPACs, P/E’s for certain public companies not supported by earnings or earnings growth, home price appreciation, and the overall market optimism that prevails despite the suffering that continues to plague us. Additionally the big unknown, which could impact these assets and other asset classes is the new policies of President-elect Biden and his progressive agenda.

The run offs in Georgia earlier this month resulted in a slim margin in which the two Democrat candidates were elected in what has been a red state for quite some time. The consequence of these two elections results in a tie in the Senate. When there is a deadlock on votes the tie is broken by the vote of the President of the Senate, the Vice President of the United States. In this case, that will be Vice President elect Kamala Harris, a Democrat. This could lead to a more progressive changes resulting in higher corporate and individual taxes as well as possible expensive policies on climate change (the Green New Deal) could impact corporate earnings and consumer spending. Infrastructure and immigration changes could also be possible. Additionally possible major changes to our medical delivery system could take place leading to fears of a single payer system. However, a moderate Democrat Senator, Senator Joe Manchin of West Virginia, has indicated that he will not support such transformational moves by progressive Democrats. This situation requires close scrutiny by us if this should lead to major tax and regulatory changes impacting investors.

Additionally, less consequential from a financial standpoint, but more shocking from a political and moral standpoint, was the riot and breaching of our Capitol last week after a speech/rally led by President Trump. This mass gathering boiled over and attempted to stop the constitutional congressional vote to confirm the states certification of the election of Joe Biden as President and Kamala Harris as Vice President. The Capitol was ransacked, congressional members were moved to secure locations and/or hidden for protection, and five people died. Fortunately, later that day, the business was completed and the election was certified.

However, it is alleged that President Trump fomented the rally that led to this atrocity. Democrats have impeached the President as the Vice President refused to remove him from office under the 25th Amendment (which would have required a vote of at least half of the President’s cabinet) and the President has not resigned. Now (as of January 14, 2021) we await a trial in the Senate, likely after President Biden is sworn into office. If this plays out, the divided country will continue to suffer from extreme political discourse.

The impeachment in the House of Representatives and subsequent trial in the Senate as well as how an evenly split Senate will impact the legislative agenda (amongst COVID and other things) hangs over us as Americans and investors. We will be watching all of this closely and will report to you as it impacts our approach and advice as your wealth manager.

Where Do We Stand?

After two years of robust gains for our clients’ portfolios, despite most recently a horrific global pandemic, civil unrest, and a politically divided country, it is hard for us to be too optimistic about gains this year despite the many positive factors outlined throughout this lengthy writing. We do believe that corporate America will be more efficient; consumers are more adept at how they purchase goods; there is pent up desire to return to normalcy and all that goes with it. This could lead to increased velocity of money from pent up savings by consumers. The declining dollar will benefit some of our multi-national companies leading to an earnings tail wind that has not existed for several years and can somewhat mitigate proposed corporate tax increases like those being suggested by the incoming administration.

So, it is fair to say there are a lot of moving parts to this investment puzzle. For those reasons we cite our opening quote. Invest for the long haul while not being too greedy or too fearful as set-backs in equity markets and real estate are common factors of long-term investing. Collectibles might be a safe haven while offering appreciation opportunity (Google “art returns during recessions”). This time is no different for hoping for reasonable returns over a five-year time frame driven by earnings and dividend growth. The obvious “below inflation” returns from cash and bonds make us shy away from them other than as a buffer for each client to keep them sleeping at night. Appropriate levels of cash and bonds of shorter duration will be client dependent. Our defensive and traditional strategies still, in our opinion, offer long-term appeal tailored to each client’s risk appetite. We continue to think high quality in every asset class we invest in. Our preference for U.S. investing remains with modest allocations to other parts of the world. This bias to quality and the U.S. is what has helped us to achieve meaningful appreciation for our clients last year, despite what turned out to be the “exogenous event” that we cited in last year’s thought piece that could derail the best of investment plans as the result of some unknown event.

Stay safe, wear a mask, get vaccinated (consult your own physician as I am only a JD not an MD), socially distance, and wash your hands. We appreciate your loyalty and confidence in our team. We look forward to when we can meet in person again! However, we remain available to you by phone, email, video call, etc. to always guide you in your wealth management needs.

We hope you will join us for our web seminar on February 11, 2021 at 11AM EST where we will dig deeper into many of the items covered here as well as take questions from attendees.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. The views expressed are the views of Robert D. Rosenthal through the period ending January 14, 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

FLI average performance figures are dollar weighted based on assets.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocation through or as of December 31, 2020, as the case may be, unless otherwise noted.

FLI believes the information contained herein to be reliable as of the date hereof, but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2021 by First Long Island Investors, LLC. All rights reserved.