1st Quarter 2023 Letter to Investors

March 31st, 2023March 31, 2023

“Out of intense complexities intense simplicities emerge.”

– Winston Churchill

The first quarter of 2023 was highlighted by positive results for the major indices despite significant volatility and what we will call, at this point, a mini banking crisis. This crisis, in our opinion, was brought on by the meteoric rise in interest rates over the past twelve months and resulted in a depositor run on two regional banks that led to their closure; the forced acquisition of Credit Suisse by its neighbor UBS; and the closure of a smaller bank brought on by its exposure to cryptocurrency. To say the least, this first quarter compressed good news, bad news, uncertainty, continuation of a war, and the coming together of a new potential axis of evil (Russia, China, and Iran).

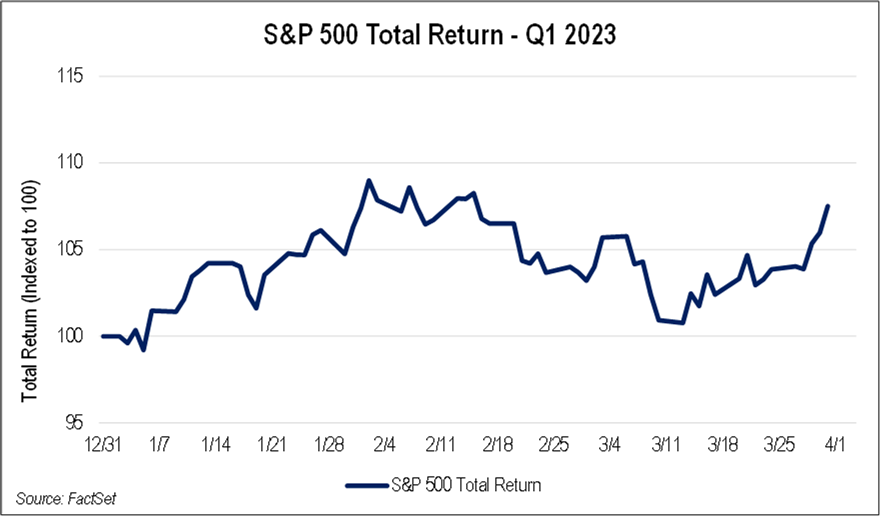

After a terrible 2022, equity markets started strongly in January only to be derailed in February by stronger (worse) than expected inflation news; strident rhetoric by the Fed along with two 25 basis point interest rate increases; fears of a recession; and then the unthinkable closing of both Silicon Valley Bank and Signature Bank. The following chart depicts the gyrations in Q1 for the S&P 500:

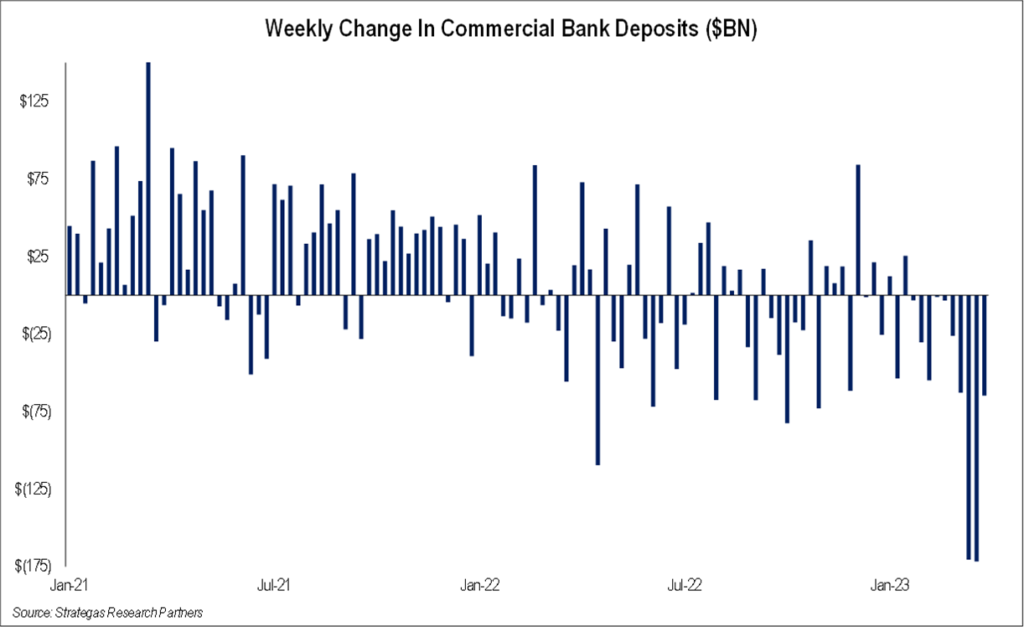

At the same time, while this dreary set of financial events occurred, many investors sought cover in U.S. Treasury Bills, Notes, and Bonds where short-term yields even reached a bit above 5% for a period of time. Short-term yields reached the highest levels in over a decade and turned out to be a very attractive asset class to hide out in. The following chart shows the significant outflow of funds from bank deposits, much of which found its way to U.S. Treasuries and money market funds:

What came into focus was the lack of deposit insurance above the FDIC limit ($250,000 for individuals as an example). Despite the overall strength of our banking system, as evidenced by last summer’s stress test of the 34 largest banks, panic and fear started to prevail. This impacted the stocks of all banks but in particular, regional and super-regional banks. Meanwhile, growth shares outperformed value-oriented stocks in an about-face from last year when growth shares were trounced as an asset class category. The concerns about the strength of our banking system led many investors to believe that the Fed would be forced to cut rates to stem this banking crisis, which brought back the horrible memories of the Global Financial Crisis of 2008/2009. Treasury Secretary Janet Yellen, after consultation with other government officials, stepped in with an FDIC plan to insure all deposits above the FDIC threshold for these two regional banks. At the same time, a number of large banks stepped in with thirty billion dollars of temporary deposits to bolster another bank facing massive outflows, First Republic Bank. Secretary Yellen has been unclear as to whether this guaranty of all deposits above FDIC limits will be available should any other banks fail.

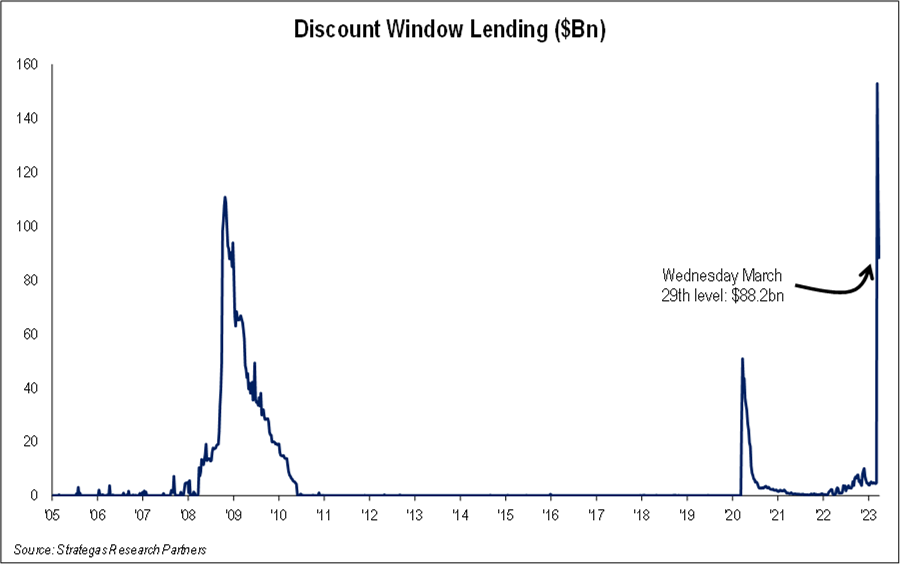

As of this writing, it appears that this mini bank crisis has been contained. The trouble caused by rapidly rising interest rates, combined with some banks mismanaging their balance sheets by purchasing long-dated U.S. Treasuries while paying depositors paltry interest rates, however, has not gone away. This situation could result in more restrictive lending policies as banks try to manage the temporary paper losses they have from long-dated bonds purchased during a much lower interest rate environment. To help minimize this mini bank crisis and in addition to the Fed affording banks the opportunity to avail themselves of using the Federal Reserve discount window, the Fed introduced a new program called the Bank Term Funding Program where banks can borrow at face value against the U.S. Treasuries, agency debt, and mortgage-backed securities they own, many of which are underwater (a scary picture in the chart on the top of the next page). The government infused about $300 billion into the financial system in the last weeks of the quarter.

The cost of insulating depositors from this crisis will probably be borne by other banks through increased fees, as was the case after the 2008/2009 Global Financial Crisis. Another factor to be watched is the impact this will all have on commercial real estate. Rates to refinance have more than doubled, and cash flow for real estate borrowers in some cases has declined as utilization of office space has remained poor post the COVID-19 pandemic. Another crisis could emerge and must be watched carefully while banks will likely increase loan loss reserves in anticipation of this problem.

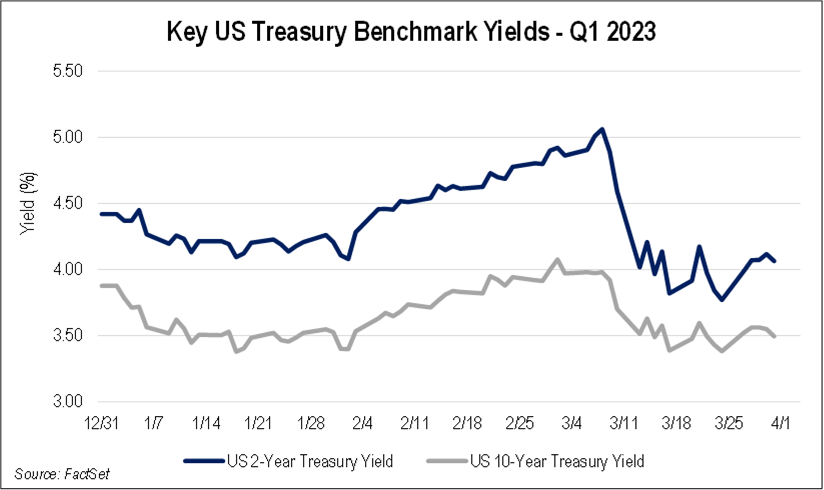

On the brighter side, towards the very end of the quarter, inflation started to moderate once again. This is key to the future path of interest rates and will guide the Fed’s interest rate policy. It was also reflected in the bond market with weaker short-term yields, at least for now. The chart below shows how shorter-term rates rose during the quarter, only to fall as the mini banking crisis emerged and the quarter came to an end. With the decrease in short-term rates, equity markets (and in particular, the growth-oriented NASDAQ Composite) rallied.

It is our view that in the very short term, interest rates will fluctuate with monthly data on inflation as well as if there are any additional bank closures. It is well known that economic activity will be impacted by the past rise in interest rates with a delay of anywhere from six months to a year. As a result, economic activity, including employment, should moderate in the near future if not eventually lead to what we believe will be a modest recession. This should reduce inflation and, at the least, cause the Fed to stop increasing interest rates and possibly lead to rate cuts (we believe the Fed will pause at this point). This is likely to be good for the equity markets and ease pressure on commercial real estate.

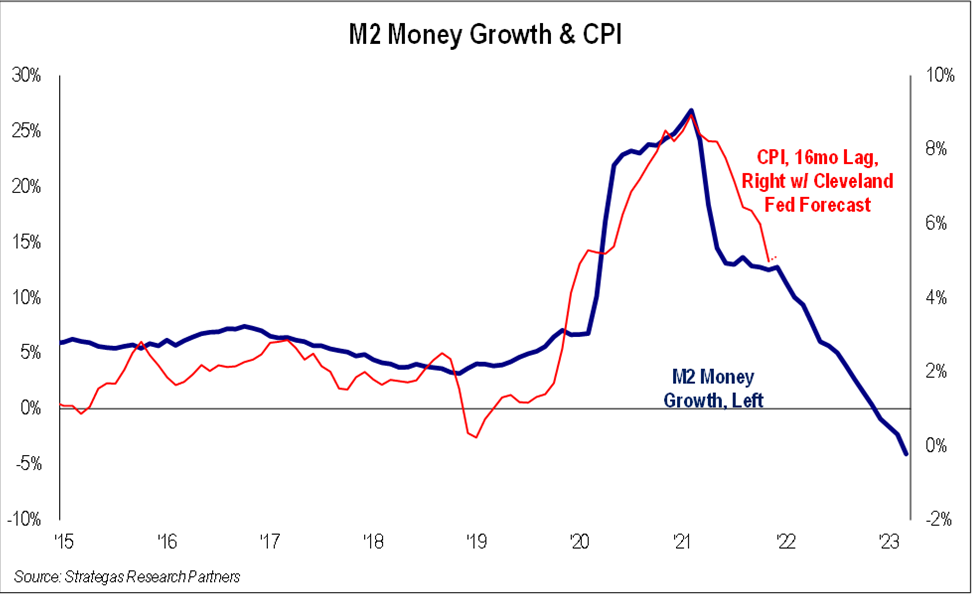

The chart above is one that we believe demonstrates that the growth in money supply (M2) has been a reliable forecaster, with a lag, of inflation as measured by the CPI. The enormous monetary growth caused by the government stimulus in response to the COVID-19 pandemic resulted in a large spike in inflation. Now that the stimulus programs have ended, M2 growth has collapsed. We are optimistic that inflation will fall as M2 growth is now negative on an annual basis for the first time that I can remember or for that matter in history.

In our opinion, it appears that inflation will be tamed by the meteoric rise in interest rates; the improvement in supply chain issues; continued layoffs, especially in the tech sector, which should lessen wage inflation; and the reduced excess savings that consumers have at their disposal.

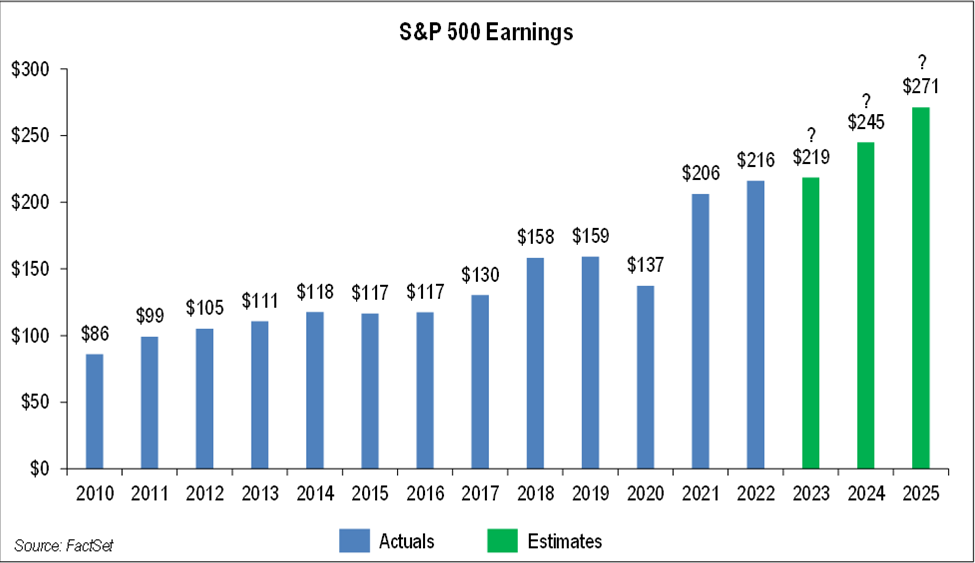

That leaves only two major issues for us as investors to be concerned with as we try to build on the improved equity market performance of the first quarter, those being earnings and the other being the alarming geopolitical situation. As for earnings, the impact on banks’ results due to the confluence of cash sorting (moving from deposits to money market funds and U.S. Treasuries) and additional fees, as well as stricter regulations, will impact the industry’s profitability going forward. A general slowdown in the economy caused by the ultimate impact of higher interest rates will also impact earnings for some companies. Oil prices have declined since the beginning of the year, which should also reduce oil company profits. Geopolitical factors (the growing closeness of Saudi Arabia and Iran) and the improvement in the Chinese economy, however, could bolster prices at some point. Finally, the resilience of the consumer will be tested as their excess savings dwindle with government handouts to many having ended. Thus, the earnings picture for the S&P 500 Index and many smaller companies will probably slow and could decline from 2022 levels this year.

As earnings may turn down for some companies, it will be a stock pickers market. We will, as always, look to companies with growing earnings, despite the economic slowdown, as well as companies that can continue to grow their cash dividends above inflation (dividend growth in 2022 was 11.8% on average for our Dividend Growth strategy and thus far is averaging 8.4% in 2023 with more than half the portfolio not yet scheduled to announce dividend increases). The outside managers we work and counsel with remain steadfast in their belief that their portfolio companies will grow their earnings in 2023. Should the Fed pause and inflation trend down, we believe those companies we invest in that can continue to prosper will be rewarded with higher share prices. We also expect dividend growers that can outpace inflation to be rewarded as they have in the past.

Summary

To paraphrase our quote, significant complexity demands intense simplicities. To us at FLI, simplicity is a prudent, diversified allocation to short- and medium-term, high-quality fixed income; a continued overweight to our defensive strategies (where we have concentrated exposure to both quality growth and value companies as well as certain hedged credit opportunities); and a continued allocation to traditional equities where high-quality, undervalued companies with consistently growing earnings will reward long-term investors seeking comfort in uncertain times. We continue to underweight international exposure while also reducing our exposure to banks. To us, the current risks overseas, as well as what legislative and regulatory burdens will impact banks is too hard to handicap, including the possible severity of commercial real estate problems (mainly office buildings).

We are pleased that the choppy and volatile first quarter ended in positive fashion, while U.S. Treasury Bonds (longer term) eked out a positive return after their worst year in over 90 years. Uncertainty and complexity remain, both economically and geopolitically. We remain vigilant as we seek high-quality investments that are intensely simple solutions to the current complex investment environment. We continue to have conviction in our four investment baskets over the long term.

We are proud to announce that Dylan Klein, Assistant Vice President—Private Wealth Management, has passed level three of the CFA® exam and is now a CFA® charterholder.

Please call upon us with any of your investment and wealth management needs.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

PS: It is premature to discuss the approaching 2024 election cycle, as well as the historic criminal indictment of a former President who is also an announced candidate for the Presidency in 2024 and ongoing investigations of the family of the current administration. Both situations can and will likely add to volatility. More to say in the future.

CFA® is a registered trademark owned by CFA Institute.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of April 27, 2023 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of March 31, 2023, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2023 by First Long Island Investors, LLC. All rights reserved.