1st Quarter 2021 Letter to Investors

April 27th, 2021March 31, 2021

“Investing money is the process of committing resources in a strategic way to accomplish a specific objective.” – Alan Gotthardt

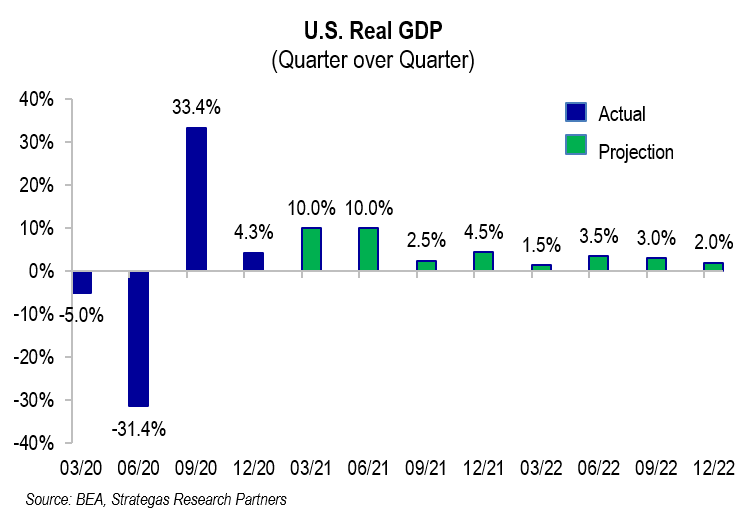

The first quarter’s stock market performance reflected optimism for recovery from the pandemic which in turn suggests hope for economic recovery. The rollout in the U.S. of three vaccines with high efficacy fueled investor interest in equity markets. This optimism was further stoked with the economic stimulus of the COVID-19 relief package passed in December 2020 infusing about $900 billion into the economy followed up by the new Administration’s American Rescue Plan, which promises to add another $1.9 trillion to our already recovering economy (see charts below).

Emboldened by positive reported earnings for the fourth quarter (reported during the first quarter) released by the vast majority of companies in the S&P 500 Index, that equity market index reacted with a 6.2% gain and set new records. The Dow Jones Industrial Average as well as the Russell 2000 Index (small-cap index) and the NASDAQ all made gains. All FLI equity strategies enjoyed gains during the first quarter following the gains in the fourth quarter. However, what was decisively different was the performance of value-oriented companies as opposed to growth-oriented companies (more on this later). The striking performance of cyclical, financial, and energy companies suggests that an already recovering economy (aided by record stimulus from Congress and a Fed adhering to its commitment to maintain low short term interest rates) was the fuel for higher equity markets and that investors are anticipating a significant economic recovery and a return to more “normal” conditions. (The 10-year U.S. Treasury yield increased to 1.74% and most FLI bond portfolios were flat or somewhat decreased in value.)

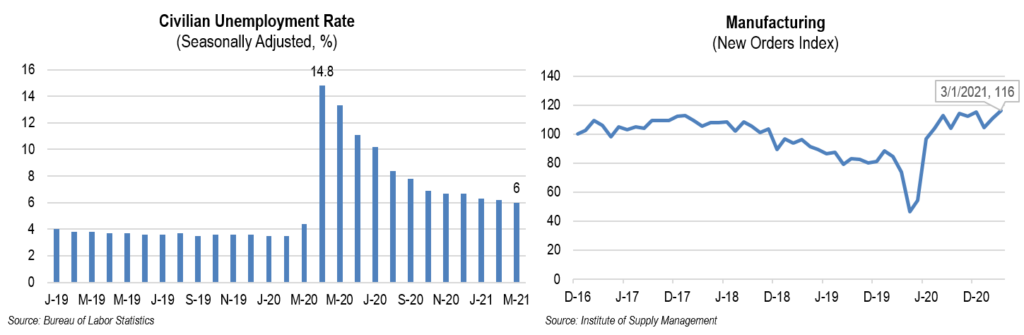

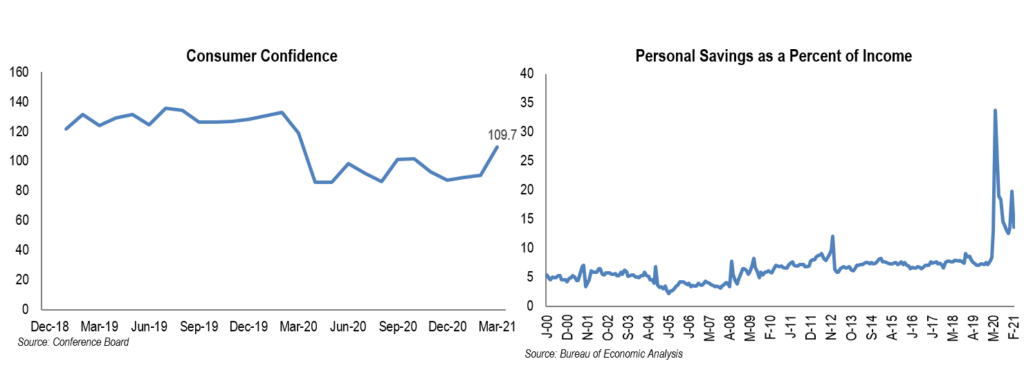

The charts on the following page depict some of the positive economic data for GDP growth, employment growth, manufacturing recovery, consumer confidence, and personal savings:

These charts suggest that between economic growth fueled by government stimuli, growing employment, a resurgence in manufacturing, and the strength of the consumer a robust economic recovery is underway! It should have legs given the support from Washington, D.C., which is now beginning to discuss a possible physical and social infrastructure bill earmarked at about $2 trillion. If passed, this could result in about $8 to $9 trillion dollars of government spending on COVID relief and infrastructure (physical, social, and green). An amazing but scary amount, representing more than 30% of GDP and pushing our national debt to more than $30 trillion.

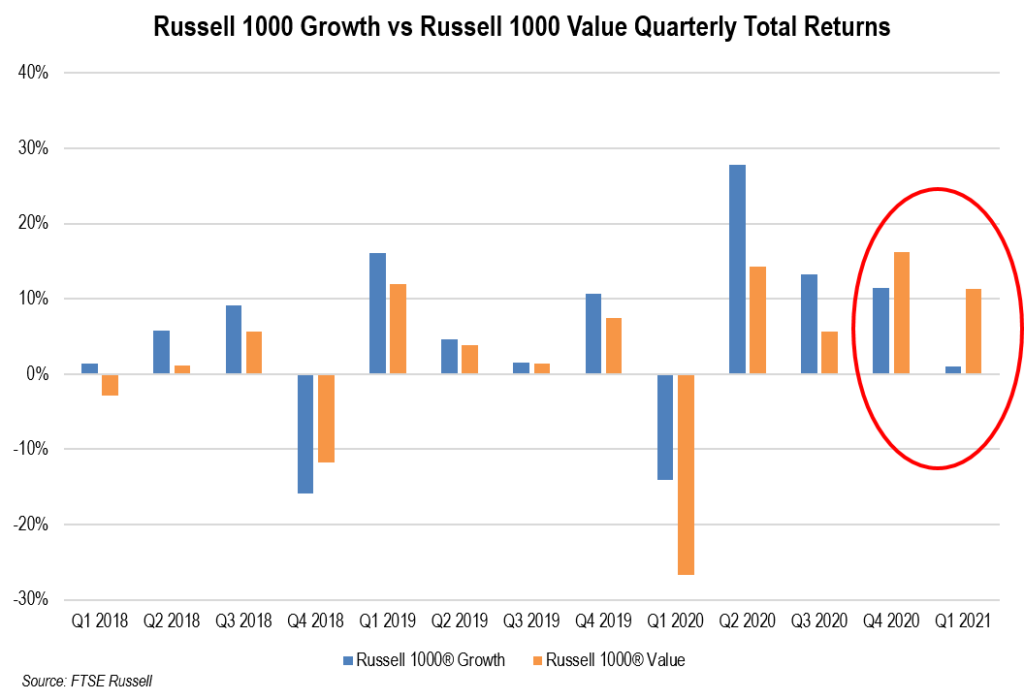

We believe it is for the reasons above, that value stocks are beginning to outperform growth stocks as depicted in the following chart:

Fortunately, we at FLI offer our clients both growth- and value-oriented equity strategies and recommend that each client have a diversified asset allocation including both styles of equity investing. In addition, modest changes were made to several of our strategies to incorporate more value and economically sensitive stocks (financials aided by a steepening yield curve in particular) to give our clients more exposure to this developing trend. This is not to say that growth companies such as Microsoft, Amazon.com, Mastercard, Facebook, Alphabet, Visa, and others will not continue to perform well. All of these companies reflect earnings growth from secular growth trends.

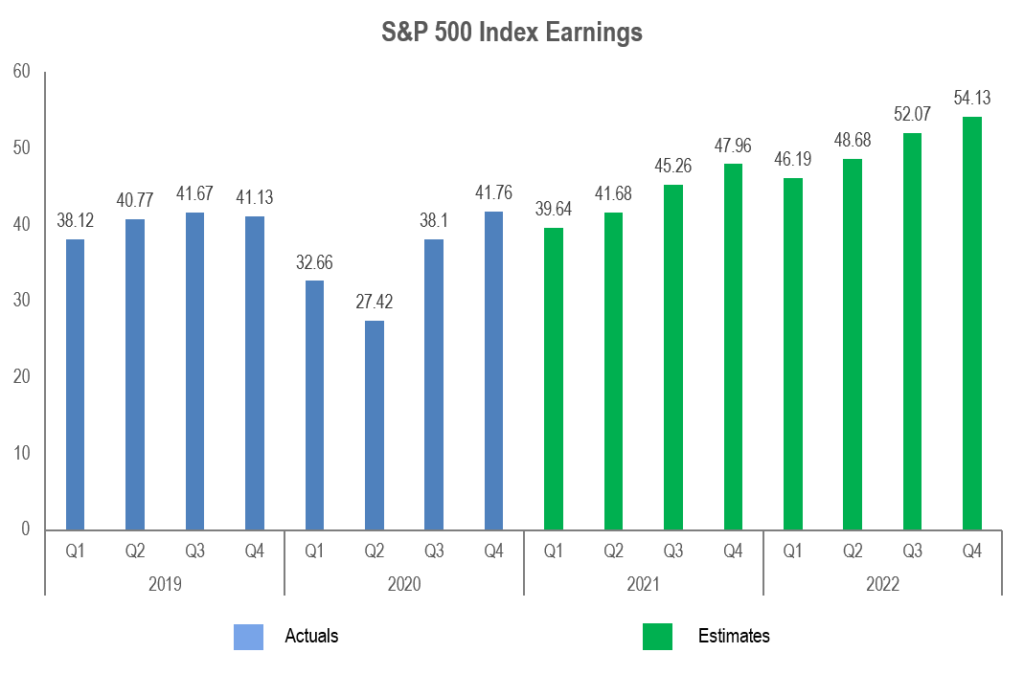

Of course, we continue to rely on growing earnings to be our beacon. The following chart projects earnings growth for the S&P 500 Index which should give some support to current and future valuations:

The above chart would suggest that earnings growth is on the rise given all of the factors that have already been mentioned led, in our opinion, by a reopening of much of the economy aided by the pent up needs of consumers, manufacturers rebuilding depleted inventories, fiscal stimuli from the government, increased liquidity (money growth), and the maintenance of low short-term interest rates by the Fed. However, one unknown factor that is being discussed by the current Administration is the raising of corporate income taxes to help pay for the various relief acts and the recommended infrastructure programs. One such proposed rate increase would raise the corporate tax rate from 21% to 28%. If this were to be enacted, it could reduce after tax earnings for the average company in the S&P 500 Index by an estimated 6% to 8%. This of course would hurt earnings and is not reflected in the chart above. This is far from law at this point, but it or something close to it is a distinct possibility. A potential negative at 28% is that it would make our corporate tax rate greater than that of China and many European countries.

Talking about tax increases, there is also the suggestion that high-net-worth individuals are not paying their fair share and numerous individual tax increases are being discussed. These could include increasing the maximum rate on ordinary income to 39.6%, increasing both the capital gains and dividend tax rates to the individual rate of 39.6% (plus the ACA tax of 3.8%), and various changes to the estate tax system. However, to be fair, some or all of these increases would only impact those households making $400,000 or more in some cases, and over $1,000,000 in others. Of course, this is all conjecture at this point, but it is what the current Administration is suggesting to Congress.

The road to passage of the above proposed both corporate and individual tax increases will not be easy. There is the slimmest majority in both the House and Senate. Already some Democrats in the House have gone on record that they will not agree to a tax package of increases unless there is the reinstatement of the full deduction for state and local taxes (SALT). In addition, the Minority Leader in the Senate, Mitch McConnell, has said the Republicans will fight this “every step of the way.” This lack of bipartisanship is nothing new. All we can do is wait and see.

On balance, we enjoyed a positive first quarter led by our flagship Dividend Growth strategy. Strategies that were more value-oriented did better than growth-oriented strategies, but all were positive. The uncertainty from a growing mountain of debt and the potential for inflation and the higher interest rates might result in some volatility at times. The worry about COVID-19 variants and infection rates are also some things we must watch carefully as they could delay a robust reopening of the economy. Additionally, the proposed tax increases, both corporate and individual, are something to be reckoned with if enacted as proposed.

There seems to be a lot to cheer with the first quarter’s market performance and the positive economic outlook going forward. However, as always, there are several areas of risk. We consider the impact of significant debt to be one, potentially higher interest rates needed to quell potentially higher inflation sooner than later, disruptive tax increases to be another, and the possible spiking of COVID-19 (should it happen) to be yet another major concern. So what do we do? As our quote states, investors, guided by FLI, are on a mission to allocate financial resources to diverse strategies designed to make a reasonable return over the long term by investing in solid companies characterized by durable earnings growth, a long-term stream of dividend increases, and/or reasonable valuations. Financial quality, strong management, competitive advantages, good governance, shareholder friendliness, and in many cases secular growth trends are characteristics that we look for in the companies that we own, either directly or through our outside managers. Our goal is to make reasonable appreciation over the long term while trying to somewhat mitigate risk. Of course, each client’s asset allocation is customized to reflect their individual situations.

As we enter this second quarter, I remind you to please continue practicing those habits that will keep COVID-19 at bay and get vaccinated if you have not already (please consult with your doctors as I am only a JD not an MD). Recognize that we are emerging from a horrible period of time because of COVID-19, but the companies and strategies (including real-estate related investments) that we invest in have done relatively well given the circumstances of these past twelve months.

Please call upon us for any of your wealth and investing needs. Enjoy the spring, we hope with more, but careful, personal freedom.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer