Welcome Back Volatility 2015/2016 – Investment Outlook

January 19th, 2016“Anything is possible, and the unexpected is inevitable. Proceed accordingly.”

Jason Zweig (noted investment authority)

2015 proved to be a challenging year for many traditional and hedge fund investors. Most indices were down or only slightly positive (Dow 0.2%; S&P 500 1.4%; Russell 1000 Value -3.8%; Barclays Aggregate Bond Index 0.6%; MSCI EAFE -0.8%; High Yield Index -4.0%; the Alerian MLP -32.6% and the HFRX Equity Hedge Fund Index -2.3%). The one bright spot was a small group of large-cap growth companies that helped the Russell 1000 Growth Index and the NASDAQ Composite appreciate by 5.7% and 7.0%, respectively. This helped three of our strategies post solid gains in this challenging environment. Strong earnings and revenue growth from these larger companies paid off. More about that later. Meanwhile, concerns about when the Fed’s liftoff might occur, after seven years of “0%” interest rates (who would ever have thought that!), were finally answered in December. The uncertainty as to when the Fed would finally raise rates was a cloud over investors throughout 2015, contributing to stock price volatility. Also, the unexpected plummeting of oil prices by 30% in 2015 (almost 65% from its recent high!) also added to volatility and worries about global growth. The reduction in oil prices should be the ultimate tax decrease for consumers and many businesses. This contributed to a very positive December consumer sentiment indices both in the U.S. and Germany.

Meanwhile geopolitical concerns, including a mounting threat from ISIS, continue to be a concern, exemplified by recent senseless civilian deaths in both Paris, France and San Bernardino, California. The civilized way of life is being threatened by both Iran, with its nuclear ambitions, and the brutality of the Islamic terrorist caliphate growing in Iraq, Syria, and Libya. The response to this from the United States and its allies has been somewhat disheartening. The Obama administration has talked a strong game, but its desire to not commit ground troops, and to use a constrained air attack, has not sufficiently worked thus far in our opinion. In addition, inconsistent support from moderate Arab nations has also been disappointing. This has opened the door to Russia playing a more meaningful role in Syria, both bombing ISIS while at the same time supporting the brutal Syrian dictator Asad by attacking rebel forces. Our government’s underestimation of this threat, while signing what we believe to be a weak nuclear agreement with Iran, leaves a very troubling situation in the Middle East. This in turn creates the potential for more volatility and investor hesitancy to take on risk.

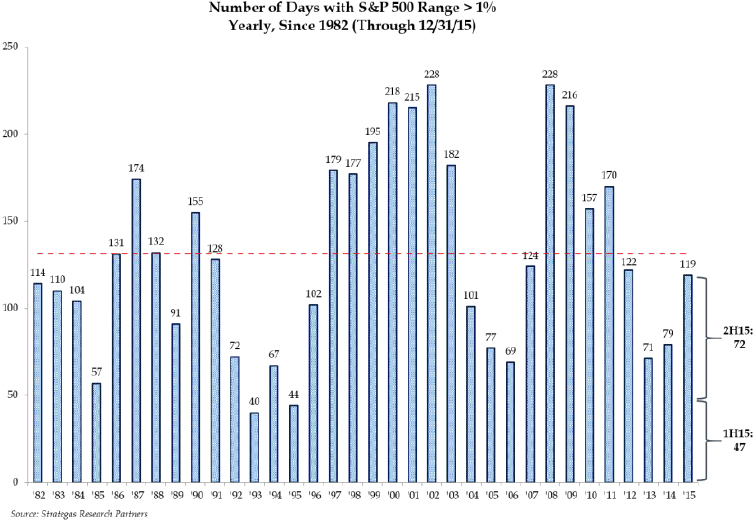

Our slow, but sustainable, growing domestic economy is reflected in stronger employment and modest GDP growth. Unemployment has dropped to 5% and wage growth has started to gain some traction, however the strengthening dollar over the past year has reduced the earnings of many of our U.S. domiciled multinational companies. Additionally, a weakening and transitioning (from infrastructure to consumer driven) economy in China and generally slow global growth are concerns for investors. These factors contributed to a sizable increase in volatility in both the third and fourth quarters of 2015. The following chart demonstrates this, and confirms our suggestions of forthcoming higher volatility made in both our third quarter report and mid-year web seminar:

This increased activity of one percent or more daily moves in the equity markets has been disconcerting to most investors. We expect more of the same in 2016 as the factors creating this volatility remain in the forefront. Although the Fed has suggested its interest rate increases will be moderate and gradual, there is still uncertainty and increases will be data dependent. Thus, the anticipated gradual increase in interest rates by the Fed makes us very cautious on fixed-income investing as increasing interest rates could result in meager bond returns, or possibly even losses. The threat of higher interest rates, distress within energy companies, and the failure of one high-yield mutual fund to deliver on daily liquidity led to exaggerated losses, which we believe may not have been necessarily based on fundamentals, in high-yield bonds, which overall had a very poor 2015. Thus, we believe this could represent an opportunity if one steers clear of most of the energy sector. (We are currently exploring an investment in this area and conducting thorough due diligence before presenting it to suitable clients.) Furthermore, virtually the entire panoply of commodities has plummeted. Copper, gold, oil, natural gas, and other commodities have suffered double-digit declines. Fortunately we at FLI have never been fans of investing in commodities, and avoided virtually all of this carnage. Many other wealth managers, as well as certain consultants, call for a modest allocation to commodities. We generally avoid the space.

Another potential catalyst for volatility will most likely be the Presidential election this November. With the ending of President Obama’s final term, the Presidential race appears to be one of very different opinions on taxes and social issues, as well as how to defeat ISIS and combat terror. At this point, at least on the Republican side, nothing seems clear. The eight remaining candidates seem to be in different camps ideologically: the very conservative, the more moderate, and the non-politicians. At the same time, while the House seems safe for the Republicans, the control of the Senate will be fiercely contested. Too much money will be spent on these elections. Perhaps one day there will be real election finance reform. The money could be better spent elsewhere, such as philanthropy. Of note, year-end compromises did lead to legislation funding the government, as well as certain tax breaks and social benefits without the typical acrimony. Perhaps things are changing for the better.

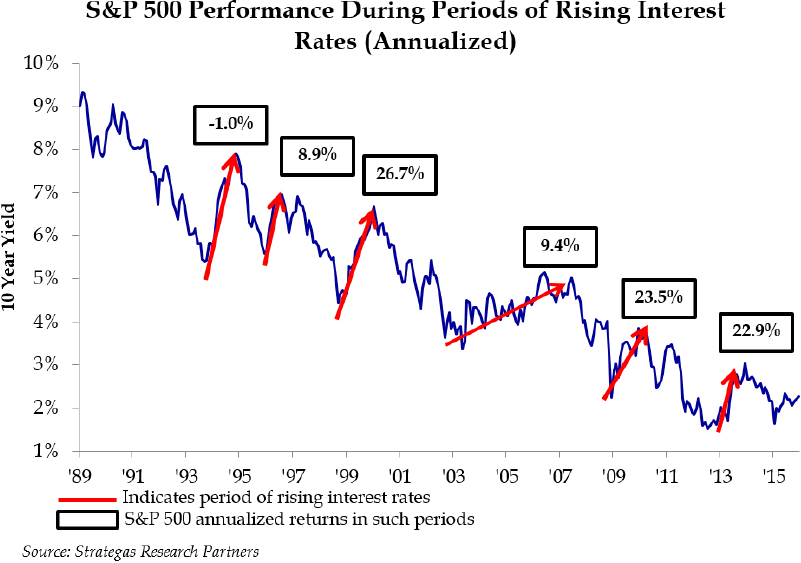

There is going to be volatility. That does not mean we cannot make money. We believe that a prudent and defensive asset allocation, one utilizing investment strategies with high active share and concentration in the best ideas, can result in decent investment gains. The following chart shows that in the past, periods of higher interest rates supported appreciating equity markets (and real estate is still taking advantage of low rates and a growing domestic economy).

The chart demonstrates that when interest rates rise because of a stronger economy, equity markets can appreciate. It should also be pointed out that historically a recession does not occur until about five years after the first interest rate increase. This certainly is cause for guarded optimism for equities and real estate in our opinion.

Before getting to what we believe is a prudent asset allocation for 2016, we must take a look at market valuations. This past year we suggested that valuations for U.S. equities were reasonable, but not cheap. (We are still underweight international companies based on valuation.) Despite this, investors pulled billions of dollars out of domestic equity markets, especially during the third quarter correction. As we shared in our third quarter report and maintain today, we believe that domestic equity markets are reasonably priced and provide select opportunities. Corporate earnings in 2015 for the S&P 500 are expected to be ever so slightly down. This pause in earnings growth can be attributed to a large degree to the strengthening dollar and to a lesser degree both a slowing global economy and declining oil prices. U.S. domiciled multinational companies whose operations may have prospered in local currencies were penalized when those foreign earnings were translated back to the U.S. dollar. The plummeting price of oil severely impacted energy companies, which make up approximately 6.5% of the S&P 500 (down from 8.4% as of 12/31/14) and lost 24% in 2015. The price of oil has now dropped about 65% over the last eighteen months.

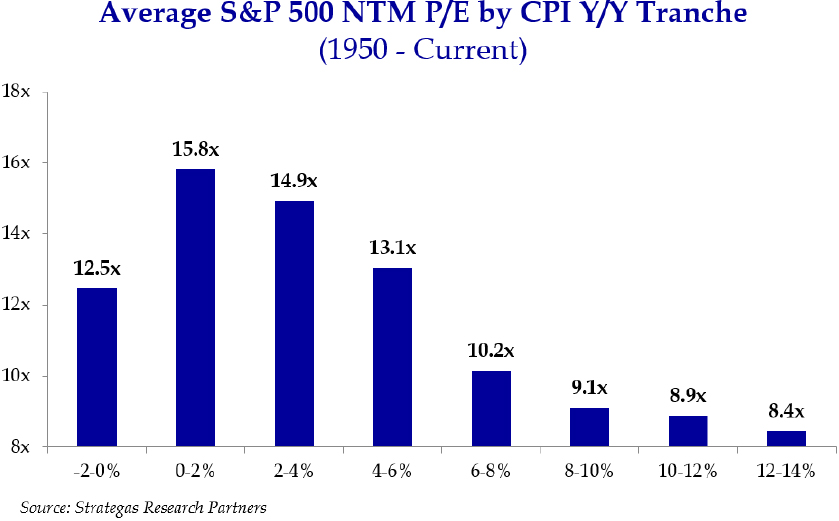

Oil has just about reached the same low point as at the depth of the 2008 financial crisis which I coined, the “Decession.” There is a bit more supply, but it seems as if things are just not that bad enough globally to warrant such a drop. Perhaps oil and oil-related companies might not be the same drag on S&P earnings in 2016. We believe that many companies continue to grow earnings and in general are trading at a reasonable P/E of approximately 16 on 2016 projected consensus earnings, which to us is fairly valued. The following chart supports our contention that this level of price earnings multiple is similar to other periods of time where low rates of inflation supported multiples in our projected range:

And, by the way, there are some glimmers of hope that the Eurozone economy will resume growing. Perhaps it will contribute to global earnings growth this year. We believe smart stock pickers can find opportunity in this investment landscape. Some companies will grow well above average and some provide solid values. Our job, and the job of our outside managers, is to find them. As indicated earlier, some large growth companies did well last year. We owned some of them across several of our strategies.

2016: What to expect and what to do

Let us start with what we expect. Interest rates will increase slowly this year. Bonds will provide little if any return and in some cases a negative return (high-yield could be the exception). Cash will continue to provide virtually no return. S&P 500 earnings will grow modestly, especially with the appreciating dollar being less of a factor (historical analysis actually shows the dollar declines in value after interest rates start to rise). Housing will remain robust and contribute to an expanding domestic economy. Oil will bottom out in our opinion at something close to current levels as we suggested earlier. Inflation will remain reasonable at about 2%. Congress will attempt to tackle tax reform with a view towards making our corporate tax rates more competitive globally. The fight against Islamic terror will intensify through a U.S. and moderate Arab-led coalition. Unfortunately there will be other terror attacks. A new President will be elected. The Chinese economy will continue to slow as it transitions from an infrastructure/industrial based economy to one that is more consumer/consumption driven. But nevertheless, the second largest economy growing between 4% and 5% per annum, is still constructive. Other emerging markets that are commodity-driven face recession. And yes, there will be more volatility!

In this type of environment, we will remain tilted to defensive strategies, growth companies, and quality investments. Sounds familiar? We expect to make money by using that bias while still being opportunistic. We will deploy capital to reasonably valued companies in our defensive, traditional and private investment baskets with above-average revenue and earnings growth, companies with strong dividend growth, deep value companies where catalysts exist to trigger appreciation, real estate oriented opportunities with high current yields, and potential private equity opportunities with among best of breed managers if we can gain access. We will underweight fixed income as the yield on high-quality municipal bonds and the after-tax yields on high-quality corporate bonds appear limited and barely above the expected rate inflation. We continue to explore high-yield debt in an opportunistic way seeking to take advantage of market disruptions as is the case now. For the most part, we will continue to avoid companies with direct exposure to commodities.

Many investors still are reluctant to stay the course in equities as evidenced by equity outflows in the third quarter correction and during the fourth quarter. (Fortunately not our clients as equity markets significantly rallied in the fourth quarter!) We believe reducing equity allocations (for properly allocated investors) was and continues to be a mistake. With equity valuations being reasonable and opportunities to own reasonably valued companies with strong earnings and revenue growth, long-term investors can be rewarded. The same can be said for larger companies that continue to raise cash dividends each year. (Companies in our Dividend Growth strategy have raised dividends for 26 consecutive years on average!) Financial companies, after years of significant litigation expense and government hyper-regulation, might just have some wind in their sails from modestly higher interest rates, dissipating litigation from actions that led to the financial crisis, and an improving economy (as long as the yield curve does not flatten too much). In our opinion, investor skepticism based on worries of these moderately higher interest rates is unfounded based on history. Equity markets have typically appreciated after initial rate increases by the Federal Reserve.

Be prepared for continued volatility. Despite this, we remain convinced that through careful and objective research there are ample investment opportunities for quality and defensive-minded long-term investors. We seek to accomplish long-term positive performance through our recommendation of a prudent, individualized asset allocation for each of our clients. A diversified asset allocation was key to most of our clients achieving reasonable relative 2015 performance in a difficult investment environment by having an exposure to large-cap growth companies, which outperformed large-cap value companies by almost 1000 basis points! As an example, the bastion of smart value investing, Berkshire Hathaway, suffered a 12% decline (We still like the company). Certain well known value-oriented hedge funds also suffered double-digit declines. Who would have thought? Again, a diversified and individualized asset allocation remains an important focus as we do not have the benefit of a robust global economy to lift all ships/asset classes. In addition to certain equity asset class sub-categories, real estate, with a proper valuation discipline, also represents opportunity. Finally, we must be prepared for the unexpected such as was the case with interest rates at “0%” for seven years or oil dropping by a whopping 65% over the past eighteen months. Being diversified but concentrated and tilted defensively, in our view, can help protect one from the unexpected, while not giving up the opportunity to prosper over the long term.

One last thought. It was not long ago that certain pundits suggested one could not be rewarded by being a long-term investor in equities. We believe that has been disproven and is nonsense. The key is to identify great businesses that are well managed and innovative with strong finances, vision, and reasonable valuations. We, and our outside managers, have been able identify and make investments in many of these great business over the long-term, benefitting several of our strategies. We believe there are a number of companies that meet this criteria and still represent sound investment opportunities as a significant part of one’s asset allocation. Just ask Warren Buffett, the iconic long-term investor. We will however, just have to endure the volatility and occasional company disappointments that go along with investing. This is nothing new and actually provides opportunity.

We at FLII wish you all a healthy, happy, and prosperous New Year. We are here to help you achieve each of those goals. We will be holding our 2016 Outlook web seminar on February 2, 2016 at 2:00 pm and encourage you to join us. You can register by emailing us at events@fliinvestors.com. Please do not hesitate to call me, Ralph, Phil, Ed, or any other member of our investment team if there is anything we can do to be of assistance.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending January 19, 2016, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.