“In investing, what is comfortable is rarely profitable.” Robert Arnott

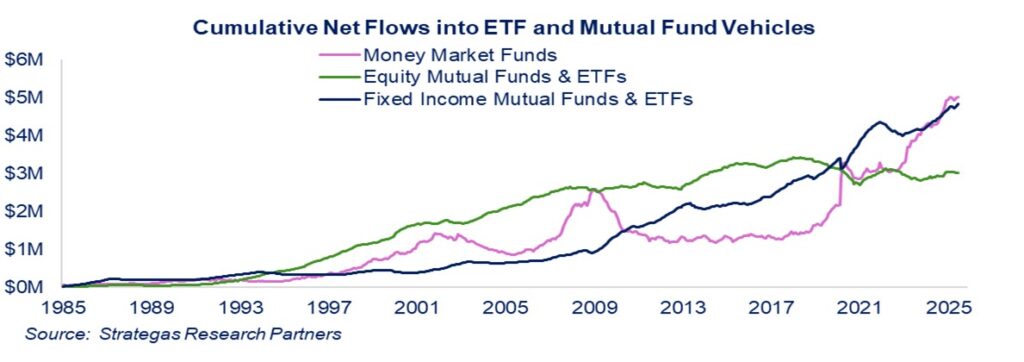

Reasonable gains were achieved across all of our strategies in the third quarter despite crosscurrents from tariffs, uncertainty about the number of Federal Reserve interest rate cuts, a weakening labor market, and continued geopolitical strife. Growing corporate earnings, modest increases in inflation, largely caused by significant tariff increases, and the trend toward lower short-term interest rates all played a part in the gains achieved across different asset classes as did the unfolding growth story of artificial intelligence (AI). Bonds, large-cap growth and value stocks, international equities, gold, Bitcoin, and segments of the real estate market all participated in what proved to be a good quarter from an investor’s standpoint. Positive money flows also impacted segments of the market, as the third quarter recorded the strongest inflows so far this year and the second strongest quarter since 2020.

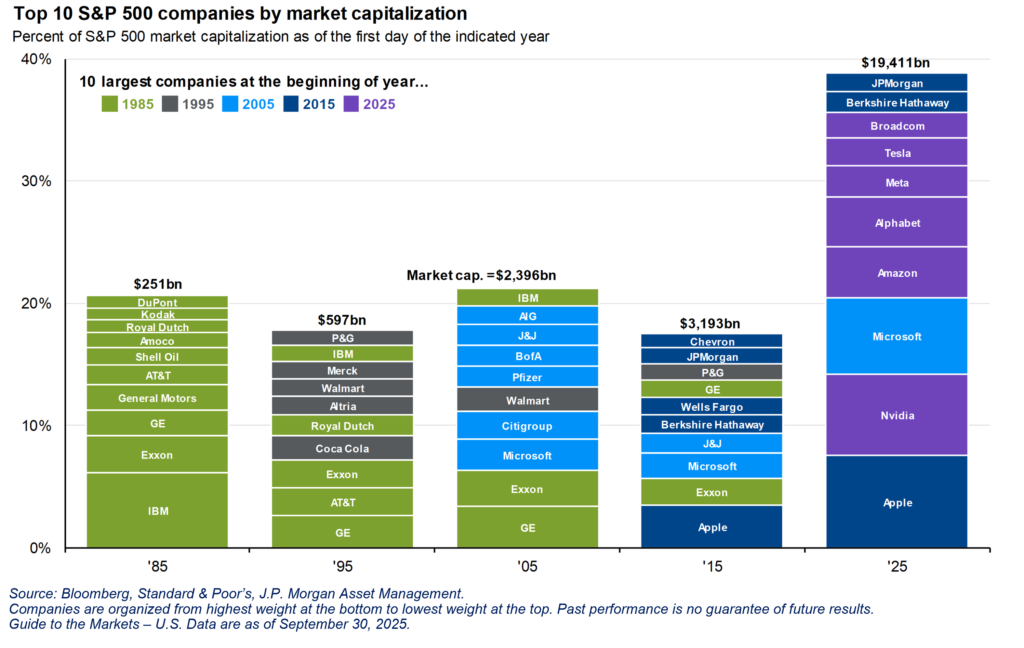

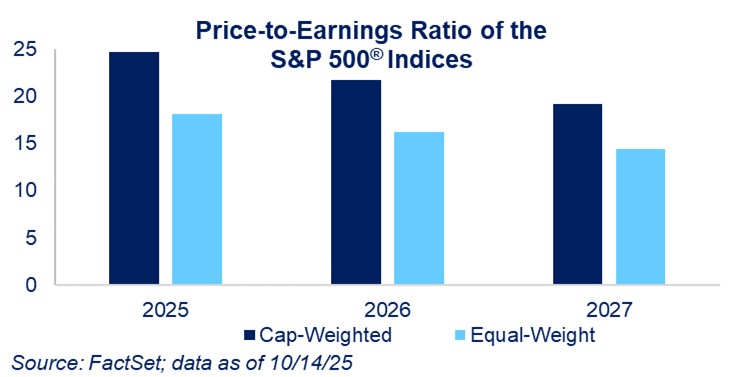

These gains for the quarter and year-to-date, however, do not come without a meaningful level of uncertainty. The continued narrowness of stock market gains (seven companies represent more than 35% of the S&P 500® Index), the depreciating dollar, seemingly high valuations for growth stocks, the full extent of inflationary forces from tariffs, and the potential economic return of the AI arms race are all contributing to an “unloved bull market” in investing. Gold and Bitcoin have achieved new record highs, making us wonder whether the growing national debt, new government policies, or a government shutdown are having a negative impact on our domestic currency. Historically, government shutdowns have not had a negative impact on equity markets. Add to this the continued political divide across our nation, which causes angst among investors.

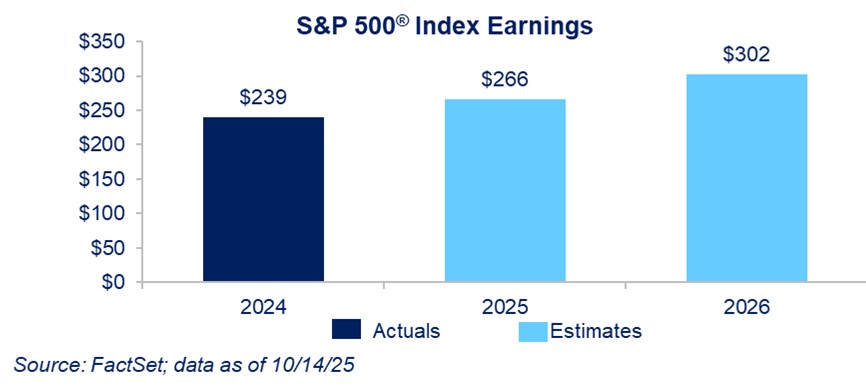

On the positive side, S&P 500® Index earnings continue to grow as profit margins expand:

As you know from reading our reports over our almost 42 years of being in business, we rely on earnings and cash flow growth to be the backbone of capital appreciation. Whether it is the earnings of a company or the cash flow of real estate, that growth is required for sustainable appreciation, in our opinion, along with a reasonable level of interest rates, a combination essential for capital appreciation. Additionally, money flows can affect which asset class performs better over shorter periods:

We believe that, over the past few years, investors globally have allocated capital to various asset classes in differing amounts. Certainly, the disruptive technology of AI has led to certain growth companies seeing huge buying interest. Chipmaker NVIDIA has appreciated almost fifteen-fold over the past few years, and other companies in the AI space have followed suit, including Oracle and Broadcom (up 70% and 43% this year, respectively). Companies with cloud capabilities, including Amazon.com and Microsoft, have also been part of this tech revolution. These and other companies in the Magnificent Seven plus have contributed to significant appreciation in certain FLI strategies over the past two-plus years. Most recently, as referenced in our Annual Thought Piece in January, international investing has also seen strong money flows, contributing to the MSCI ACWI ex USA Index appreciating 23% year-to-date. We believe this strong international performance can be attributed in part to valuation, our depreciating dollar, uncertain and often erratic U.S. government policies (such as tariffs), and declining interest rates abroad, while certain European countries increase their defense spending leading to local economic growth.

Now the uncertainty we reference includes the following:

- How many rate cuts will the Federal Reserve implement?

- What direction will the interest rate on the 10-year U.S. Treasury take?

- How much inflation will result from the ultimate tariff rates?

- How high will unemployment rise, reflecting some economic slowdown and uncertainty?

- What benefits will the economy derive from the recent tax legislation passed by Congress?

- How and when will the geopolitical hotspots in Europe and the Middle East be resolved?

- Are valuations stretched for certain segments of the equity market?

The uncertainty described above makes it difficult for investors to navigate the current investment landscape. We believe the Fed will continue to reduce short-term interest rates several times over the next year. At the same time, history suggests that does not mean the 10-year U.S. Treasury will decline, unless inflation really abates. The direction of the 10-year U.S. Treasury is very important to the housing market, as it is what the interest rates for mortgages are based on. It is our opinion that the Fed’s prediction of lower inflation in 2026 and 2027 (Personal Consumption Expenditures Price Index (PCE) advancing 2.6% and 2.1%, respectively) in large part depends on the accuracy of the Fed’s prediction of slower gross domestic product growth of 1.6% this year and 1.8% next year. The current Administration would expect somewhat higher growth and, perhaps, the recent tax bill will help achieve that. At the same time, the Fed expects unemployment to reach 4.5%, which would not be too harsh. In our view, the comprehensive tax bill of 2025 will benefit business by inducing investments in technology and manufacturing, given depreciation incentives. Perhaps this will aid employment, although the labor supply has diminished due to the country’s current immigration policies. We are sure both sides of the aisle would love to see legal immigration reform, but it has been elusive for decades.

Regarding the geopolitical turmoil in both the Middle East and Europe, despite President Trump’s attempts to seek peace, that too has been elusive. At this point, Russia’s President Putin seems uninterested in a cease-fire or peace deal with the country he illegally invaded. This assertion is based on the 1994 Budapest Memorandum on Security Assurances treaty signed by Russia, in which Ukraine gave up its nuclear weapons. This ongoing war has cost the U.S. significantly, while also boosting our exports of munitions. The other war, in the Middle East, has seen Iran’s nuclear ambitions set back by a joint American/Israeli attack and the severe weakening of two of Iran’s terrorist proxies, Hezbollah and Hamas. Meanwhile, innocent hostages remain captive; Israel remains at war with Hamas; and the people of Gaza continue to suffer. Neither of these two wars is good for the world. (See P.S. for update)

Given these positives (growing earnings, potentially lower short-term interest rates, no recession in sight, and favorable tax policy), we continue to see an economy growing but at a slower pace; positive S&P 500® Index earnings growth; inflation somewhat above the Federal Reserve’s goal of 2%; and, unfortunately, a continuation of geopolitical strife. Add to this our own political divisiveness and rising extremism, which shows no signs of abating and has most recently led to violence in the form of political attacks and assassinations across the political spectrum.

As investors, we remain cautiously optimistic as the AI revolution fuels not only certain growth companies, but much of our daily lives; international investing remains robust; more value-oriented companies, as reflected in our Dividend Growth strategy, remain a safer harbor in our opinion (+12.1% net* year-to-date); and we would not be surprised to see small- and mid-cap companies play catch-up to large-cap growth and value companies if interest rates moderate:

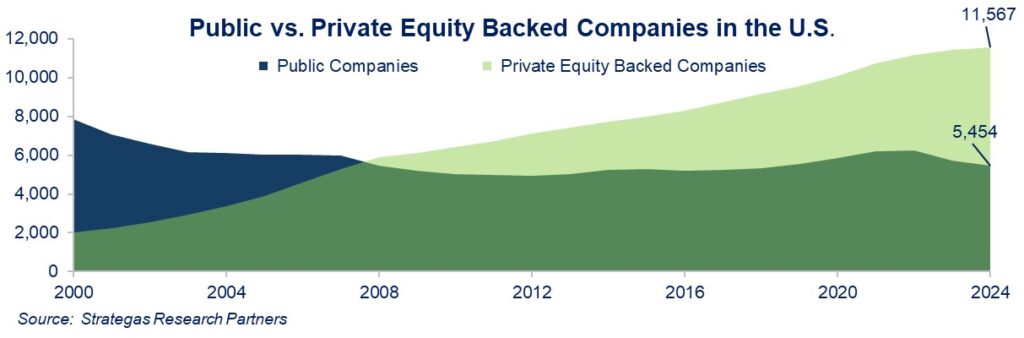

Another factor that we consider a positive from a long-term standpoint is the above chart showing the reduced number of public companies as compared to twenty years ago. At the same time, the proliferation of exchange-traded funds and index funds offer investors different ways to invest in the smaller pool of public companies. Private equity backed companies, on the other hand, have grown in number significantly. They are illiquid but might offer handsome returns.

The bottom line continues to be, in our view, maintaining our bias to high-quality, financially strong companies, through the book ends of both large-cap dividend growing companies along with large-cap growth companies, especially those participating in the cloud computing and booming AI trends. Having exposure to both quality international-domiciled companies and small- and mid-cap companies also makes sense as short-term interest rates are expected to decline. Of course, in this latest allocation, we emphasize companies with real earnings. We also believe that nearly every client should have some exposure to fixed income and alternatives (including real estate), especially as some believe equity valuations are stretched. It is this multifaceted asset allocation that will make investing, when it is somewhat uncomfortable given the enumerated uncertainties, profitable for the long term.

Our various investment strategies allow each of you to work with us to customize your asset allocations to achieve your long-term goals. Within the asset classes we have mentioned, we believe we can find quality opportunities with attractive earnings growth, cash flows, and reasonable valuations for the long-term investor.

We are pleased to announce two significant achievements. FLI has been awarded a 5-Star rating from InvestmentNews as one of the top 27 registered investment advisers in the United States in 2025! Additionally, we are proud to share that Thérèse C. Vobis, our Senior Vice President of Finance & Administration and Chief Financial Officer, has been selected as a recipient of the Long Island Business News Top 50 Women in Business award. Both honors reflect our dedication to you, our clients, and friends of the firm, as well as your confidence and loyalty, making this very special recognition possible.

Please enjoy the upcoming holiday season and stay healthy. Of course, do not hesitate to contact us should you or members of your family or friends have any wealth management needs, whether that includes investing, asset allocation, liquidity needs, insurance, tax or estate planning.

P.S. As of October 13, 2025, all living Israeli hostages have been returned to Israel, while only several of the deceased hostages have been repatriated. Approximately two-thousand Palestinian detainees have been emancipated, and a 20-point Trump peace plan is currently under consideration by a large number of Western and Middle Eastern countries. Whether this marks the end of the war between Hamas and Israel remains to be seen.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of October 24, 2025 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of September 30, 2025, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2025 by First Long Island Investors, LLC. All rights reserved.