Colliding economic policies. Positive equity returns in 2025. More to come?

“The individual investor should act consistently as an investor and not as a speculator. This means … that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.” – Benjamin Graham

2025 absorbed a new political administration as well as seemingly colliding economic policies, bookended by unusually severe and unprecedented tariffs and major tax reform that passed by the slimmest of political majorities in the House of Representatives and Senate. At the same time, in 2025, inflation actually moderated versus expectations despite increasing tariffs, while interest rates continued to decline slowly. In addition, geopolitical strife led to the unprecedented U.S./Israeli attack on Iran’s nuclear capability, as well as an attempt at brokering peace in the Middle East along with isolating Iran and attenuating its terrorist activities both directly and indirectly through its proxies. Meanwhile, the brutal war between Russia and Ukraine continues despite efforts at achieving a peace accord or cease fire led by the Trump Administration. Adding fuel to this geopolitical uncertainty, the United States, through the military and FBI, took action, destroying alleged drug smuggling boats from Venezuela, undertaking a nighttime, large-scale attack on the country, and arresting Venezuelan President Nicolás Maduro and his wife, both of whom are under indictment in the United States for narco-terrorism, among other charges.

At the same time, an explosion of capital investment in and development of artificial intelligence (AI) created a massive wave of interest in sophisticated semiconductors, data centers, and related infrastructure. This led, in a disproportionate manner, to a significant increase in equity markets through the earnings biased performance of the Magnificent 7 plus one (Broadcom) over a two-year period.

Large-cap growth companies, followed by large-cap value companies, led domestic equity markets higher. International stocks rallied even more (as suggested in last year’s Annual Thought Piece) reflecting in part the weakening U.S. dollar and most prominent foreign central banks reducing interest rates, as well as some European countries increasing military budgets to confront the unabashed aggression of Russia’s continued war against Ukraine.

- Despite record highs on Wall Street, returns were concentrated in a small group of outperformers. Failure to hug the concentrated performance of the AI-oriented companies led to the vast majority of active equity managers trailing their respective benchmarks, but still delivering positive results to their clients. FLI falls into this category of positive returns across all strategies not achieving their benchmarks. We trailed the benchmarks as a direct result of our disciplined risk management: namely, our decisions to not be overexposed to the concentrated cohort of mega-cap AI-related businesses and to avoid companies with negative earnings or extreme valuations.

- Despite our Dividend Growth strategy appreciating by 10.7% net* while achieving average dividend growth of 9.8%, many dividend aristocrats trailed the S&P 500® Index significantly because the likes of the Magnificent 7 plus a few others, either pay NO dividend or de minimis dividends of less than one half of one percent.

As we enter the investment environment for 2026, we offer the following charts for reflection:

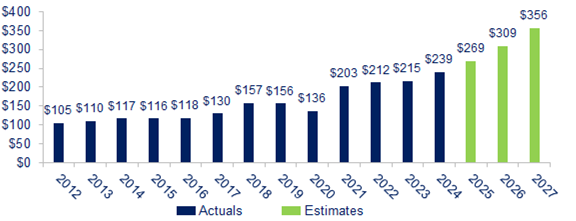

Exhibit 1: S&P 500® Index Earnings

Key Takeaway: 2026 Growth: Consensus points to approximately 15% earnings growth. 2027 Growth: Estimates suggest approximately 15% growth, potentially reaching $356.

Source: FactSet data as of 1/7/26

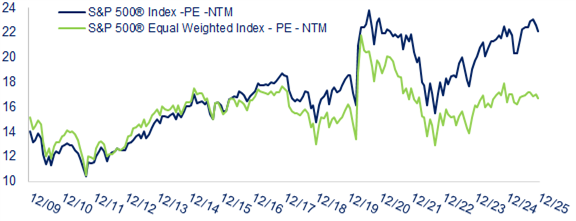

Exhibit 2: Price-to-Earnings Ratio

Key Takeaway: S&P 500® Index is trading at somewhat elevated levels (22x forward P/E although not extreme valuations), while the S&P 500® Equal Weighted Index (17x P/E) is much more reasonable.

Source: First Long Island Investors analysis, data as of 12/31/25

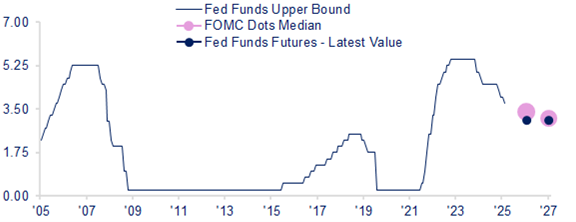

Exhibit 3: Market Expectations vs. Federal Reserve Forecasts

Key Takeaway: In 2026, the Federal Reserve forecasts fewer interest rate cuts compared to market expectations.

Source: Strategas Research Partners, Fed, Bloomberg, data as of 1/6/26

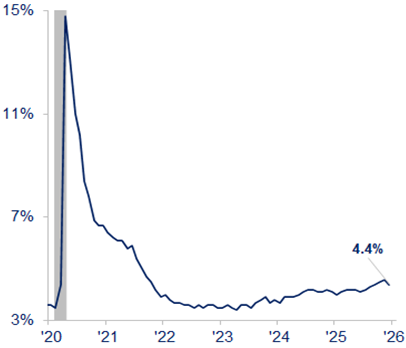

Exhibit 4: Civilian Unemployment Rate: 16 yr (Seasonally Adjusted, %)

Key Takeaway: The U.S. civilian unemployment rate (seasonally adjusted, 16 years and over) is currently 4.4% but still at historically normal levels.

Source: Strategas Research Partners, data as of 1/14/26

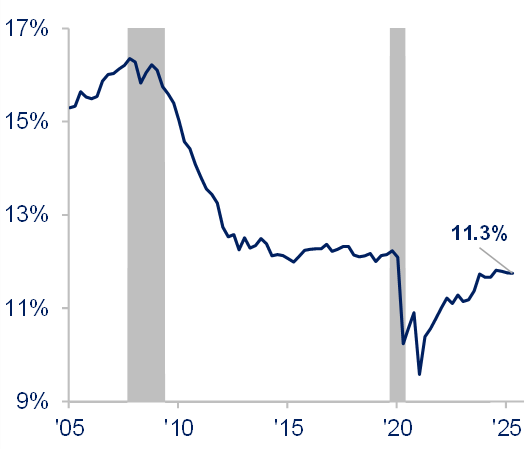

Exhibit 5: Household Debt Service Ratio (Seasonally Adjusted, %)

Key Takeaway: The Household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income. DSR was 11.3%, which is inline with the long-term average (11.3% between 1980 and 2004exlcuding the housing bubble). This indicates that, relative to disposable income, the aggregate household debt burden is not historically high, despite the record absolute level of debt.

Source: Strategas Research Partners, data as of 6/30/25

Exhibit 6: U.S. Consumer Assets & Liabilities, Q3 2025

Key Takeaway: In Q3 2025, U.S. consumer balance sheets remained strong overall with record net worth driven by equities and real estate, but pockets of weakness emerged, especially in subprime auto and student loan delinquencies, alongside rising credit card struggles for lower-income groups.

Source: Federal Reserve Bank B.101 Table, Strategas, data as of 1/12/26

Exhibit 7: Manufacturers’ Shipments: Nondefense Capital Goods excluding Aircraft (Seasonally Adjusted, Mil $)

Key Takeaway: This metric (often called “core capital goods”) is crucial for GDP forecasts, as it measures spending on equipment for businesses, excluding volatile transportation. The chart indicates strong business investment, with shipments and orders rising, suggesting healthy Q4 economic activity.

Source: Strategas Research Partners, data as of 10/31/25

The above, when taken as a whole, indicates a reasonably accommodative investment environment. This is especially the case when one considers the impact of the “Big beautiful/ugly tax bill” of 2025 (the One, Big, Beautiful Bill Act). We view it as a positive on balance given the tax relief to many consumers through the expanded SALT deduction; liberalization of tax policies on tips, overtime, and Social Security benefits; an increased child tax credit; and deductibility of car loan interest. These features should bolster consumers, particularly at the lower rungs of the economic ladder, while businesses should benefit from incentives through immediate depreciation of eligible capital expenditures and immediate expensing of domestic research and development, fueling efforts to onshore manufacturing and bolster AI investment.

Summarizing the above, despite the political acrimony and upcoming midterm elections, there appears to be economic prosperity on the horizon in 2026. We still do not see a recession for 2026 and would agree with notable economic forecasts of GDP growth of at least 2%!

Our cautionary note is that not all companies have attractive valuations. The law of “bigness” may dull the equity performance of some of the hyperscalers despite their continued earnings growth. We witnessed substantial volatility in 2025 where some companies that barely achieved lofty Wall Street estimates or even exceeded them, were still punished with significant drops in their stock prices.

The Fear/Greed Index, which we often cite, ended the year on the cusp of fear and neutral while gyrating between extreme fear and greed during the year. This is especially the case when several notable pundits and industry insiders cry “bubble” around AI and technology in general. These include some successful investors and certain respected measures of valuation like the CAPE (Cyclically Adjusted Price-to-Earnings), which we do not subscribe to as a reliable valuation measure.

Our view remains one of cautious optimism. Earnings are growing; consumer balance sheets are solid; inflation is reasonable; tariff damage is likely modest in general; and tax relief should be coming while price-to-earnings multipliers are not nosebleed. These factors should all support the possibility of growing our assets again in 2026. In addition, although we believe the labor market will somewhat weaken, it will permit the Fed to respond in an accommodative manner. Some publicly traded equities along with some, but not all, private equity as well as some segments of real estate should all be beneficiaries.

The positives outweigh the negatives in our opinion. Having said that, one must revisit their asset allocation and adjust where necessary when some allocations may have risen too far in pure growth assets to be prudent from a risk/reward standpoint. Our straightforward, but successful, “bookend” approach continues to deliver reasonable returns through different stages of the business cycle. Our four investment baskets (Security, Defensive, Traditional Equity, and Private Investments) must be reviewed as we enter 2026 to reflect your goals as well as fears. Compounding wealth over time requires a prudent asset allocation that limits the damage of unforeseen market drawdowns.

Despite coming through a strange and complex 2025, we enter 2026 having achieved meaningful investment gains. We face what appears to be a solid economy, although we have concerns over health insurance costs adding to inflation and consumer distress. Bipartisan legislation is needed to address a potential health insurance crisis. Additionally, wealth inequality needs to be confronted through wage gains above inflation as well as possible further tax reform. Reform that incentivizes investment and working needs to be a priority while also recognizing the need to safeguard both our Social Security and Medicare systems.

Most importantly, investors should counsel with us to review their asset allocations and explore wealth planning to weather what might be a volatile year given the midterm elections, the path of the Federal Reserve with a new Chair, continued geopolitical unrest in Europe and the Middle East, the simmering relationship between the U.S. and China, and questions about the U.S.’s future role in Venezuela.

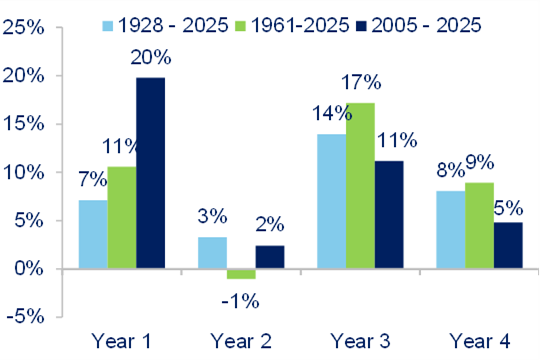

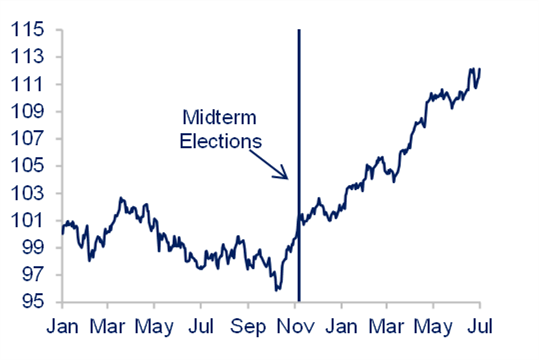

Historically, midterm election years have seen significant volatility prior to the election, followed by rising markets into the following year. Thus, patience, as an investor, is always required to let earnings and cash flow drive performance:

Exhibit 8: S&P 500® Index Average Annual Price Returns

by Presidential Cycle

Key Takeaway: Key takeaways from the S&P 500® Index presidential cycle chart shows that, while midterm election years have historically produced positive returns, on average, returns are typically more muted than other years in the cycle.

Source: Strategas Research Partners, data as of 1/6/25

Exhibit 9: Average S&P 500® Index Performance Before & Following Midterm Elections (1994, 1998, 2002, 2006, 2010, 2014, 2018, 2022)

Key Takeaway: Historical patterns suggest volatility is likely leading up to the November 2026 elections, which is typically followed by a strong rally into year-end and the following year.

Source: Strategas Research Partners, data as of 1/6/25

Our bottom line remains bookending growth-oriented companies with value-oriented, dividend-growing companies. Within equities, one should maintain some exposure to internationally-domiciled companies while small- and mid-cap companies that have real earnings might finally get rewarded as they have lagged. Clients should also maintain modest exposure to fixed income to provide income and for protection during turbulent times. Certain real estate, especially industrial, remains attractive as short-term interest rates continue to modestly decline and onshoring efforts reflect recent administration achievements while the AI boom continues. Reduced onerous tariffs on food, decreased oil prices (and who knows what further downward pressure will result from a revitalization of Venezuelan oil reserves), and pharma company agreements on drug pricing should help keep a lid on inflation. Of course, medical insurance premiums must be dealt with politically.

We view 2026 with some optimism as earnings and interest rates should support the progress of good companies, both public and private, and well-situated real estate. The consumer remains resilient and both fiscal and monetary policies appear not to be colliding. As mentioned earlier, given reasonably full equity valuations, quality individual stock picking with some diversified allocations (including some exposure to international and small/mid-cap) should pay off for the patient investor.

We, as investors, should approach 2026 with the understanding that after three solid years of results, a new political administration, serious geopolitical issues, a midterm election looming, the One, Big, Beautiful Bill Act offering wealthy investors some greater opportunity, and the advent of AI, it is a time for reflection on what is to come and what we should do while always being conscious of risk. Consider that gold, silver, and bitcoin have also risen dramatically in the last three years alongside equities and certain real estate. This surge in alternative assets likely reflects mounting concern over the U.S. national debt, which has now climbed to nearly $38 trillion. We should not take our wealth for granted, which is why we, at First Long Island Investors, offer a customized “bookend,” high-quality, almost exclusively unlevered approach to each of our clients. We do this to afford our clients the opportunity to grow assets while feeling some protection from the unknowns in the future investment landscape. As previously stated quite clearly, we remain cautiously optimistic.

Our unique approach was recognized this past year by InvestmentNews awarding First Long Island Investors a 5-Star rating as one of the top twenty-seven registered investment advisers in the United States in 2025. We were both flattered and humbled by this designation and take it very seriously. We accordingly must do even more for our clients to continue to earn their respect and confidence. Certainly, as we enter our 43rd year in business, our experiences, client-oriented culture, and team of talented and dedicated professionals puts us in a position to represent you going forward.

We look forward to working with each of you, our clients, this year and in the coming years to keep compounding your wealth while being best positioned for the future. Please call upon us with any of your wealth and money management needs, or just as someone you can speak with who has your back.

We look forward to working with you this year and thank you again for your continued confidence.

Healthy, happy and prosperous New Year!!

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of January 15, 2026 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of December 31, 2024, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2026 by First Long Island Investors, LLC. All rights reserved.