“Only for short-term investors and market timers is a correction not an opportunity.”

-Warren Buffett, Chairman, Berkshire Hathaway

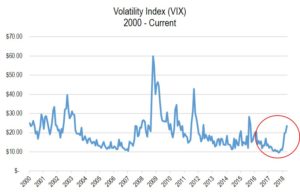

The first quarter witnessed the return of somewhat higher than normal volatility as compared to recent years (and certainly compared to the abnormally low volatility of 2017).

In addition to this increased level of volatility, both the S&P 500 Index and the Dow Jones Industrial Average recorded their first losses in ten quarters (-0.8% and -2.5%, respectively), while the technology driven NASDAQ rose by 2.3% (see chart below). Investors experienced the euphoria of the market hitting a number of highs in January only to be followed by sharp declines in February. In fact, the decline in early February resulted in the first correction (a decline of 10% or more) since the first quarter of 2016. However, markets sharply recovered in early March only to be followed by more declines leaving us with modest losses for the S&P and Dow for the first quarter. This roller coaster of ups and downs was disconcerting to many investors. However, we were not discouraged given the underlying strong economic fundamentals that we continue to observe, and because we realize that downturns and corrections are a part of long-term investing.

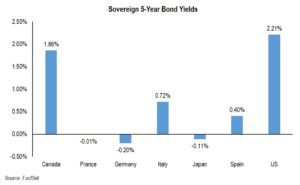

At the same time, the Federal Reserve, under the new stewardship of Chairman Powell, raised the federal Funds rate by an expected 25 basis points. In its official statement, the Federal Reserve pointed to a stronger economy and a continued strengthening in employment while inflation remains subdued at 2.4%. Accordingly, the Fed suggested that there would be an additional two, possibly three, more rate increases during 2018. Given the still historically low level of interest rates (see chart below), these projected rate increases do not suggest to us major headwinds for the equity or real estate markets. However, those with long-maturity bond portfolios could see modest losses. It is for these reasons (low yields and a bias to higher rates) that we continue to underweight fixed income as an asset class.

Given the above factors, we are pleased that all of our strategies1 for the quarter were either slightly positive or modestly negative. We view this as quite constructive given the significant absolute gains we enjoyed from all of our traditional and defensive strategies in 2017. In virtually all of our strategies we exceeded the respective benchmarks once again demonstrating the merit of active investing. We believe that given what we perceive to be positive drivers for the companies that we invest in, 2018 still should be somewhat of a positive year (although one should not expect returns to resemble those of last year).

In dissecting the positive drivers that we believe will provide these positive returns while outweighing some negatives, we point to the following:

- Profits for the companies that we invest in, and for many others, as seen in the chart to the right, should prosper in 2018 in part based on growing economies here and abroad.

- The Tax Cuts and Jobs Act of 2017 will reduce taxes for many of the companies we invest in, contributing to higher profits and increased cash flow.

- Repatriation of profits from overseas will also benefit many of the companies we invest in.

- Low interest rates and modest inflation, coupled with an increase in projected GDP growth, are constructive for equity markets.

- Consumer balance sheets remain in good shape supported by lower taxes, higher wages, and appreciating housing prices supported by an increase in housing formations.

- As stated in prior quarterly reports, synchronized global growth continues to support corporate earnings and business confidence around the world.

On the other side of the ledger, we do worry about these factors:

- A recession could occur (while we cannot time these, possibly in late 2019 or sometime in 2020). We are watching out for indicators including when the Treasury yield curve inverts, which is a harbinger of recession. A recession of the garden variety type (excess inventory) is not to be feared nearly as much as a “balance sheet” recession like 2008/9. Given the strength of most banks and consumers, we expect the “inventory” type of recession. However, equity averages typically decline no matter the type of recession.

- The extremism in Washington, D.C. resulting in an inability to compromise and effect reasonable change; the spending habits of Congress leading to a higher deficit (closing in on $22 trillion dollars); and the D.C. focus on political investigations, all create disruptions leading to greater volatility and investor confusion and concern.

- Geopolitical hot spots in Russia, the Middle East, and the Korean peninsula are top of mind. The immaturity of certain global leaders in dealing with these challenges is a significant concern. Election tampering, nuclear proliferation, and the multi-national war in Syria (Russia, Iran, the U.S., ISIS, Syria, and Turkey) continue to take Congress and the President’s time away from dealing with our growing deficit, the need for health care and immigration reform, and the ultimate need to restructure or rationalize both Social Security and Medicare, which are approaching financial crisis. These social safety nets must be preserved, but given the direction of demographics (more retirees requiring social benefits and less workers contributing to the system), some change is needed.

- From a purely economic standpoint, the potential of isolationism and trade war were major contributors to the uncertainty and volatility of the first quarter. We believe this will abate as time goes on. However, for the immediate future, it is a contributor to volatility and uncertainty along with some doubt over just how beneficial the recent tax legislation will be to our domestic economy.

- The Facebook data breach and misuse of personal information also riled the hot Information Technology sector. Disruptive technologies such as Facebook (a demonstration of American ingenuity and entrepreneurialism) will have growing pains and setbacks. However we do not believe this will derail Facebook, or any of our great tech companies including Alphabet and Amazon.com, which have transformed the way we communicate, gather information, and shop, as long as they do not break laws.

- Very low interest rates for such an extended period of time could have produced less obvious excesses, which as they are unwound could create volatility and dislocation of financial markets.

The above headwinds, which led to greater volatility and the first correction in major averages in more than two years, are a concern. In our opinion, this will not derail our equity-based strategies, which are concentrated and seek to invest in reasonably valued companies with solid financials, growing earnings, strong managements, and, in many cases, are beneficiaries of the recent tax law. Also, our bond portfolios remain typically short in duration so the creeping up of interest rates (thus far) should not be a major factor. Our current mezzanine real estate exposure continues to prosper with what appear to be good loans with equity kickers that have thus far resulted in solid returns. We anticipate recommending that suitable clients increase their allocation to this type of investment, when available.

Directionally, we continue to be biased to our defensive strategies. Our rational for this is the probability that a recession is getting closer, interest rates remain low so that bond investments will yield little better than inflation despite rates moving modestly higher, and some of the factors causing this recent spike in volatility have the potential to be more disruptive than might seem apparent. In addition, we still have to deal with the divisive and confrontational nature of Washington including the approaching midterm elections.

We continue to recommend an underweight to bonds (but have an allocation), an overweight our defensive strategies (all three), maintaining a modestly underweight allocation to traditional equities, and be selectively opportunistic in private investments, when and if they become available. Given a more challenging investing environment in the future, having a long-term view with a focus on quality remains paramount. In robust economies and markets, the tendency is for lower-quality equities or bonds to do better than they should. As economic and market circumstances become more challenging, these lesser-quality investments (typically weaker balance sheets) should not do as well as financially stronger companies in our opinion. We actually use periods of volatility to enhance portfolio characteristics where possible in our strategies.

We wish you a wonderful spring and hope to see you at our Thought Leadership Breakfast Seminar on May 23, 2018. The event will feature three prominent accountants who will share their perspective on the impact of the new tax law. We urge you not to hesitate to call upon us for any of your wealth management needs. It is a good time to focus on longer-term planning, including investments, estate planning, and insurance.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending April 20, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.

On February 7, 2018, Robert D. Rosenthal, CEO and Chief Investment Officer, Philip Malakoff, SVP, Wealth Management, and Edward C. Palleschi, SVP, Wealth Management, held a web seminar where they shared with clients and business colleagues of First Long Island Investors our perspective on the current market and economic indicators. They discussed what our Investment Committee is most focused on for 2018 as we continue to position client portfolios for long-term growth.

“Uncertainty will always be part of the taking charge process.”

– Harold Geneen, American Businessman, Former President and Chief Executive of ITT Corporation

2017 was an excellent year for our clients. All of our traditional and defensive strategies made significant absolute gains. Our traditional and defensive equity based strategies averaged 22.7% and 19.1%, for the year, respectively. These results surprised many investors, but were consistent with what we had suggested could be the outcome based on these factors:

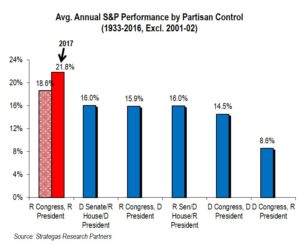

- Under Republican stewardship in all three branches of government in past years, equity markets averaged 19% per year. 2017 exceeded that.

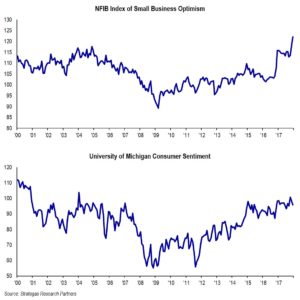

- Business optimism increased on account of, among other matters, deregulation by the Trump administration.

- Global growth surprised many with Europe, Japan, and Asia joining higher growth in the U.S. and China.

- Comprehensive tax reform was finally passed (on a partisan basis) resulting in major corporate tax reform as well as a reduction in personal income tax rates and a limit on the ability to deduct state and local income and real estate taxes (which will hurt taxpayers in high tax states like New York and California).

- Employment remained robust. The unemployment rate fell to 4.1%. This contributed to consumer optimism.

- Inflation remained below 2% for most of the year which is helpful to consumers and we believe supports higher than average price-earnings ratios.

- Additionally, corporate earnings rose by about 12% for the year.

Of course, the above factors had to overcome worries last year that included:

- Three interest rate increases by the Fed (with the last being in December). At the same time, the Fed began to taper its bloated balance sheet.

- Valuations appeared high to some investors leaving them on the sidelines. The investment mood of caution was palpable.

- Friction with North Korea was a constant concern, mostly in the last half of the year. The potential for an armed conflict weighed on investor sentiment. The battle against ISIS and other terrorist groups also made headlines and was a concern.

- Concerns about the demeanor of President Trump as well as ongoing controversy regarding his campaign, members of his family, and certain advisors were constant news items.

These and other factors mentioned in our Investment Outlook (which clients received earlier this month) impacted 2017 as well as provided some caution, and, yes, optimism for 2018. In the final analysis, we had an excellent quarter and year even while having a recommended asset allocation that was somewhat defensive. These results contributed to meaningful appreciation in the net worths of our clients.

If you have not had a chance to read our Investment Outlook, please do.

On the news front, we would like to share with you that Ann DeVault, our Vice President of Administration, has decided to retire. Ann has been with FLI for over 28 years and while we are very sad to see her go, we wish her all the best. Ann is very well known to many of our clients and has been an integral part of our team for so many years. Ann will be leaving at the end of February so there will be plenty of time to wish her the best of luck. Also, we will be transitioning Ann’s work and relationships to others within our company. We have been working diligently to make sure that this transition is as smooth as it can be. Any clients who work directly with Ann will be contacted to review the specifics of the transition as it relates to them.

Finally, we invite you to join our web seminar, which is scheduled for Wednesday, February 7th at 2 PM EST. If you would like to join, please register.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending January 25, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.

“Uncertainty will always be part of the taking charge process.” – Harold Geneen, American Businessman, Former President and Chief Executive of ITT Corporation

How quickly 2017 came and went with many positive surprises for our clients (our numerous defensive and traditional equity strategies delivered estimated performance of more than 20% net for the year*). But was our strategies achieving all-time year-end highs such a surprise?

As I looked back to last year’s thought piece, certain things jumped out after the surprise election of Donald Trump. From a historical standpoint, stock market returns when all three branches of government are controlled by Republicans have been decidedly positive (averaging 19%).

2017 did not disappoint as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite all hit records on a repeated basis despite fears of President Trump’s “unique” style, which many of us still need to get used to. As suggested last year, the President’s pro-growth/pro-business bias resulted in deregulation in numerous areas, which fostered business confidence. Congress and the President were set on achieving major tax reform, which was accomplished in December. This reform is very pro-business (big and small) and attempts to be pro-middle class, but that remains to be seen. In any event, the deregulation and tax reform has led to increased business optimism. Additionally, the average consumer confidence level in 2017 was the highest since 2000.

The economy no longer needs to depend solely on monetary policy on steroids (well-below-historical-average interest rates). A fiscal growth package is now reality, although the extent of its benefits require responsible actions by corporate America. What will CEO’s do with increased after tax profits and repatriated cash from overseas?

In addition to the above, between the easy monetary policy continued by Fed Chairperson Yellen (President Obama’s appointee) and the actions taken by the current Administration, our domestic economy broke out of its economic malaise, growing by an estimated 2.3% in 2017 after eight years of 1.5% subpar average annual growth.

Add to this domestic performance a global growth renewal from Europe and Asia (led by China) along with some unexpected growth from Japan and it is no surprise that both domestic and foreign companies on average had earnings growth which contributed to strong stock market performance on a global basis as new highs were reached.

So in spite of President Trump’s bluster and tweeting as well as continued heated exchanges with North Korea and ISIS inspired attacks, positive economic forces along with improving consumer and business sentiment contributed to an excellent year of asset gains in equity markets, housing, and certain commodities!

However, throughout the year investor uncertainty was palpable, unless one clearly had a handle on fundamentals and somewhat of a deafness to the political noise. 2018 will not be any different in terms of “things” to worry about, while also balancing this with some undeniable strong positive factors. So, let me put forth the proverbial “wall of worry” that we see this year (we will follow-up with the economic positives):

- The Fed is expected to raise interest rates three times in 2018 along with the tapering of its balance sheet. This could contribute to volatility, higher short and long-term interest rates, as well as reduced liquidity. In particular, reducing the Fed’s balance sheet from its bloated level of over four trillion dollars is unchartered waters.

- Much progress had been made by the Obama Administration and now the Trump Administration in reducing the unemployment rate to 4.1%, creating a tight labor market that could result in both labor shortages as well as wage inflation (something the middle class needs desperately). Wage inflation (along with possible commodity inflation) could lead to greater than expected overall inflation.

- Stock market valuations are a worry to many investors who are dizzy from the record highs of 2017. (We have a differing view on this.) There has not been a ten percent correction since the first quarter of 2016. These factors have kept some investors (many hedge funds) on the sidelines and not participating in much of last year’s strong gains.

- Potential geopolitical conflict with North Korea, which is intent on developing a nuclear bomb capable of hitting the U.S. mainland, is constantly a worry and some believe could lead to actual conflict. Sanctions thus far do not seem to be working. In addition, the continued war against ISIS brings with it terrorist attacks in the U.S., Europe, and the Middle East.

- Continued partisan politics in DC is no better. What the Democrats were accused of by Republicans during the Obama Presidency (lack of bipartisanship) just seems to be reversed under President Trump and the Republican House and Senate. America is yearning for some middle ground. Thus far it is not happening. In addition, the ongoing Russia controversy and the Special Counsel’s investigation surrounding President Trump and certain of his family members could lead to greater political uncertainty and increased market volatility (although that has not occurred thus far). Additionally, the mid-term elections this November could bring some surprises.

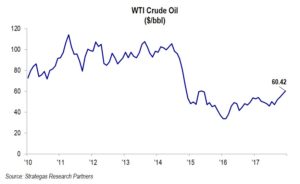

- Inflation could rise above 2% for the first time in years reducing consumer confidence. Wage inflation coupled with commodity inflation would be a surprise. Price-earnings multiples could suffer a bit if inflation, as measured by the CPI, gets much above 2%. Additionally, oil in particular is at a 30-month high:

- Negative aspects of the Tax Cuts and Jobs Act of 2017 could hurt the economy. In particular, the elimination of the state and local tax deductions could hurt the economies of powerful states like New York and California. This could include declines in values for residential and commercial real estate in those states, with some predicting a ten percent decline.

As stated earlier, investor concerns in 2017 were palpable. Now more and more pundits (David Tepper, famous hedge fund manager of Appaloosa as an example) are stating that markets are not that expensive, tax reform will help earnings, and the global economy is growing in sync! I liked it better when most were either negative or at least more cautious on the market.

There are less obvious worries that we can think of as well as those that can come as a surprise, but those noted above are sufficient to get our attention as investors. Now, let us counter this wall of worry with some obvious economic positives:

- The Tax Cuts and Jobs Act of 2017 brings with it these significant benefits (major ones in our opinion):

- Corporate tax rate reduction from 35% to 21%. This will not only increase the after tax cash flow of many companies, but will add almost $8 to $10 per share to S&P 500 earnings, which are now projected to be $148 per share. This certainly helps overall stock market valuations. In our dividend growth strategy (+20% in 2017), there are six companies that have had 35% or higher tax rates in the past that will now significantly benefit from increased after-tax earnings and cash flow.

- Small businesses (many, but not all) will see a reduction in tax rates as a result of a tax deduction for certain pass-through businesses. Small businesses are domestic economic drivers. This should help the economy.

- Immediate expensing of capital purchases for five years provides an incentive to invest in equipment of all types. This should be another economic positive.

- Individual tax rates are being reduced to help the middle class as well as most tax filers (not enough of a help in NY where the state and local tax deduction has been lost). It remains to be seen just how much of a net benefit this is to individuals/consumers as geography will play a large part in who will benefit from this individual tax benefit.

- The rolling back of a significant number of regulations previously placed on both large and small businesses. This has already led to a significant increase in small business confidence and should continue to benefit the economy. This, along with the continued improvement in employment, has also led to increased consumer confidence throughout the year.

- There is synchronized global growth, which has not occurred in years. The U.S. has been joined recently by Europe, Japan, and Asia, including of course a continuation of robust growth from China. This global growth should help both large and small U.S. businesses achieve higher profits, in our opinion, as long as labor and commodity costs do not spike. We believe labor costs will increase by a reasonable amount due in part to productivity gains from capital investment.

- There does not appear to be a recession in sight. Bull markets do not die of old age. They typically succumb to a number of factors including high inflation, restrictive monetary policy, worsening credit conditions and shortages which can lead to a recession. Evidence of a recession typically occurs when we have an inverted yield curve (short-term rates exceed longer-term rates). This is not the case at this time. Nor do we see ballooning inventory suggesting that supply is outpacing demand. Thus, it is our belief, especially if the new tax law reaches its potential in spurring economic activity, that a recession is still almost two years off.

- Housing remains strong in the U.S. Home prices, per the Case Schiller Home Price Index, suggest that demand and pricing remain strong. Although mortgage rates have ticked up a bit, they remain at low levels historically. This sector should continue to contribute to a growing economy. A reduction in mortgage interest deductibility included in the recent tax reform could have a modest impact in restraining purchases of more expensive homes.

- Interest rates for now remain low with five and ten-year U.S Treasury Bonds at 2.2% and 2.4%, respectively. Other sovereign bonds of lower quality are even more meager in yield as shown in the chart below. These low foreign sovereign bond rates make our bonds and equities that have a decent yield even more attractive. This coupled with what we believe to be a reduced number of public companies and available shares of public companies also is bullish for domestic higher-yielding domestic equities.

How to Invest

As the introductory quote suggests, we need to accept that investing, especially after a year of strong gains, will always come with some uncertainty (the wall of worry), but we can take charge by employing a prudent asset allocation. Those who have stayed on the sidelines are scratching their heads and missed out on a banner year for many investors. Our clients’ assets have been fully invested, for the most part, but with a definite bias to our defensive basket. This certainly has not hurt as our two internally managed defensive equity strategies averaged a 20%* net return for the year. Our traditional equity strategies fared somewhat better with an estimated average return for the year exceeding 22%* net. Assets in these two baskets (defensive and traditional equity) represent the vast majority of our client’s FLI-managed assets. Fixed income returns were of course much lower (low single digits) and our externally managed defensive strategy did reasonably well with an estimated net return of 8% for the year. While our private equity investments for the most part made progress, we suffered one casualty and have for the most part exited this investment (we did take some losses last year to be used as a partial offset to our gains in many other investments). Fortunately that investment is quite small (approximately 1% of the total assets we oversee).

For 2018, we are still defensively minded but believe our defensive and traditional equity strategies will outpace cash and fixed-income investments. The companies in these strategies should benefit from synchronized global growth, stronger corporate balance sheets, and tax reform, while having valuations in an acceptable range given the current rate of inflation and interest rates. This squarely puts the burden on us and the managers we work with to be selective and concentrated in our portfolios. As we expect some greater volatility going forward, strong fundamentals are needed to weather the occasional storm. Also, we believe that if the corporate tax reform is utilized in a pro-growth manner, value-oriented stocks may outpace growth stocks which would reverse 2017’s significant growth stock outperformance.

Also worth noting is the improved performance from international equities which since 2008 have lagged, on the whole, domestic stock indices. Finally in 2017 they awoke, outpacing the S&P 500 by 5.4%. (This is a significant rebound considering that the compounded annualized return since the start of 2008 has been 1.8% per annum versus the S&P 500 Index at 8.5% per annum.) With economic growth fueled by a combination of continued earnings recovery, multiple expansion, and generally accommodative monetary policy, international stock markets are gaining traction. We have noted in our quarterly letters over the last year. Accordingly we increased our international exposure during 2017 and continued that refinement at the end of the fourth quarter. International valuations appear somewhat more compelling than domestic indices. Of note, many European sovereign debt instruments have negative yields (short term) and below two percent yields for ten years, which makes high-quality European and U.S. stocks attractive on a relative basis with current and growing yields (in some cases) well above two percent.

There is a formidable “wall of worry.” This is not new and we as investors have faced it every year for as long as I can remember. Our first priority is to preserve capital and therefore it is critical to maintain a prudent asset allocation. That is why we continue to overweight our defensive strategies while somewhat underweighting traditional equities. We also continue to underweight fixed income as yields for five-year U.S. Treasury and AAA municipal bonds are below the current inflation rate, on an after-tax basis. Buying bonds below the rate of inflation compromises buying power and does not build wealth, in our opinion. We also continue to favor certain private equity investments including our participation in mezzanine real estate financing, which provides some current income and the potential for additional returns as investments are completed. This, along with exposure to leading alternative investment strategies, provides us with some diversification from stocks and bonds.

Investing always carries with it a certain level of uncertainty if one wants a reasonable return that exceeds the rate of inflation. We live in a world where people seem to generate much of the uncertainty, perhaps needlessly. Economic uncertainty coupled with geopolitical stresses (North Korea and ISIS) and our own political acrimony must be navigated with a view to the long term. Otherwise, too many investors over the long term will be on the sidelines scratching their heads and missing out on returns that exceed those from cash and most bond investments, but they will not be clients of First Long Island Investors.

Here is to a good 2018. Please call any of us on our investment committee for help with your asset allocation, questions about any of our strategies, or any wealth management needs.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*FLI average performance figures are dollar weighted based on assets.

The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. The views expressed are the views of Robert D. Rosenthal through the period ending January 11, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocation through or as of December 31, 2017, as the case may be, unless otherwise noted.

FLI believes the information contained herein to be reliable as of the date hereof, but does not warrant its accuracy or completeness. This communication is subject to modification, change or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.

Insights from the Chief Financial Officer of First Long Island Investors, LLC, Stephen J. Juchem, CPA

Yesterday, December 20, 2017, Congress passed sweeping tax reform and the President is expected to sign it into law shortly. You may be wondering how this will affect you and the amount of tax that you will pay. Are there any steps that you can take that will lower your federal income tax liability? The answer is probably yes. Effective tax planning can help reduce your tax bill, leaving you with more money to meet other financial obligations and pursue your goals. By taking certain steps now, before 2017 draws to a close, you may be able to maximize the benefits of expiring deductions and otherwise reduce the amount of taxes that will be due when you file your 2017 tax return. This update explores both traditional year-end planning techniques and also how the current tax reform legislation may impact current year-end tax planning. We encourage you to contact our office or your tax professional to discuss your specific situation.

In order to keep the cost of the tax reform bill within Senate budget rules, all of the changes affecting individuals would begin in 2018 and expire after 2025. At that time, if no future Congress acts to extend the bill’s provisions, the individual tax provisions would “sunset”, and the tax law would revert to its current state. Even though 2025 is a long way off, and a lot will surely change before then, we wanted you to know that the changes discussed below are temporary in nature, unless and until Congress extends or makes permanent some or all of the changes that would be implemented currently under the new law. The new tax law would permanently lower the corporate rate from 35% to 21%, and would encourage the repatriation of corporate earnings that are currently held overseas, among other things, but the remainder of this update will focus on the individual income tax provisions of the new tax law.

Tax rates: Under the tax law, tax rates for individuals would be lower for almost all taxpayers. Most taxpayers would see a reduction of about 2% in their tax rate. Those in the highest bracket would see their marginal rate go down from 39.6% to 37%. The 3.8% net investment income tax would also continue to affect higher income taxpayers. The current preferential tax treatment of capital gains and dividends would continue unchanged.

Alimony: The rules for taxability of alimony paid and received would change under the new law. For any divorce or separation agreement executed after Dec. 31, 2018, the new law provides that alimony payments are not deductible by the payor spouse. It would also repeal the provisions that provide that such payments are includible in income by the payee spouse.

Child tax credit: The new law would increase the amount of the child tax credit to $2,000 per qualifying child. The maximum refundable amount of the credit would be $1,400. The new law would also create a new nonrefundable $500 credit for qualifying dependents who are not qualifying children. The threshold at which the credit begins to phase out would be increased to $400,000 for married taxpayers filing a joint return and $200,000 for other taxpayers.

Standard deduction and personal exemptions: The new law would increase the standard deduction to $24,000 for married taxpayers filing jointly, $18,000 for heads of households, and $12,000 for all other individuals. The additional standard deduction for elderly and blind taxpayers would not be changed by the new law. Many taxpayers would see their savings from the lower tax rates given right back through the loss of many valuable tax deductions. The new law would also repeal all personal exemptions. Under the new law, many more taxpayers would file using the standard deduction instead of itemizing their deductions, since the new standard deduction would be much higher and many itemized deductions would be limited or eliminated completely under the new law, as detailed below. This is a simplification of the tax code and of the tax filing requirements for many Americans.

State and local taxes: Many of our clients are taxpayers in the alternative minimum tax (AMT) and do not derive any itemized deduction benefit from the payment of state and local income or property taxes. Under the new tax law, individuals who are not in the AMT would be allowed to deduct only up to $10,000 ($5,000 for married taxpayers filing separately) in state and local income and/or property taxes. As was the case under existing law, taxpayers in the AMT will not benefit from this deduction.

To mitigate the negative impact of this law change, there were some creative tax planning ideas being kicked around by tax professionals where additional tax benefits might be obtained by taking a deduction in 2017 for prepaid 2018 state income taxes. However, those ideas were too good to be true. Congress has decided, in the final text of the bill, that 2018 state estimated tax payments paid in 2017 will not be deductible in 2017.

In order to ensure that you take full advantage of the permitted state tax deduction in 2017, we recommend that you and your tax advisor discuss this topic and plan accordingly. First you should try to estimate whether you will be in AMT in 2017. If you believe you will not be in AMT and if you project that you will have a state and/or local income tax balance due for 2017, then you should pay this by December 31, 2017, and you should also prepay all assessed 2018 property taxes (including school taxes) by December 31, 2017, to maximize the state tax deduction in 2017 before it is limited to $10,000 in 2018.

For taxpayers subject to the AMT, and who are also subject to the net investment income tax (i.e. 3.8% tax on net investment income), consider paying the balance of your 2017 state and local income taxes by December 31, 2017. While these payments are not deductible for AMT purposes, they are a deduction against net investment income, which will reduce your net investment income tax.

Mortgage interest: The home mortgage interest deduction would be modified under the new law to reduce the limit of the deduction of interest on new acquisition indebtedness to $750,000 (from the current-law $1 million). Existing acquisition indebtedness mortgages are grandfathered at the $1 million limit. Also, the home equity loan interest deduction will be repealed under the new law (with no grandfathering).

Other itemized deductions: Under the new law, taxpayers would only be able to take a deduction for casualty losses if the loss is attributable to a presidentially declared disaster. The moving expense deduction would also be repealed, except for certain members of the armed forces on active duty who move. Additionally, all miscellaneous itemized deductions subject to the 2% floor under current law would be repealed by the new law. Lastly, since there were so many itemized deductions taken off the books, the new law would avoid adding insult to injury by repealing the overall limitation on itemized deductions.

Pass-through income deduction: Under the new law, individuals would be allowed to deduct 20% of “qualified business income” from a partnership, S corporation, or sole proprietorships, as well as 20% of qualified real estate investment trust (REIT) dividends, and qualified publicly traded partnership income. This means that income derived from a pass through entity may be taxed at an otherwise lower rate, unless one of the exclusions or phase outs described below applies.

A limitation on the deduction would be phased in based on W-2 wages. The deduction would also be disallowed for specified service trades or businesses with income above a threshold. “Qualified business income” would not include an S corporation shareholder’s reasonable compensation, guaranteed payments, or—to the extent provided in regulations—payments to a partner who is acting in a capacity other than his or her capacity as a partner. “Specified service trades or businesses” include any trade or business in the fields of accounting, health, law, consulting, athletics, financial services, brokerage services, or any business where the principal asset of the business is the reputation or skill of one or more of its employees. The exclusion from the definition of a qualified business for specified service trades or businesses would phase in for an individual taxpayer with taxable income in excess of $157,500 or $315,000 in the case of a joint return.

For each qualified trade or business, the taxpayer would be allowed to deduct 20% of the qualified business income with respect to such trade or business. Generally, the deduction would be limited to 50% of the W-2 wages paid with respect to the business. Alternatively, capital-intensive businesses may yield a higher benefit under a rule that takes into consideration 25% of wages paid plus a portion of the business’s basis in its tangible assets. However, if the taxpayer’s income is below the threshold amount, the deductible amount for each qualified trade or business would be equal to 20% of the qualified business income with respect to each respective trade or business.

Individual mandate: The new law would eliminate the penalty imposed on taxpayers who do not obtain insurance that provides at least minimum essential coverage, effective after 2018. Since it is anticipated that many healthy taxpayers will drop health insurance coverage once this new rule takes effect, many taxpayers may end up with increased out-of-pocket health care expenses. Accordingly, the new law would reduce the threshold for deduction of medical expenses to 7.5% of adjusted gross income retroactively for 2017 and also for 2018 to help mitigate the impact of these additional expenses.

Alternative minimum tax: Under the new law, the AMT would remain in place, but it would impact fewer taxpayers because the exemption amounts are increased. The AMT exemption amount would increase to $109,400 for married taxpayers filing a joint return (half this amount for married taxpayers filing a separate return) and $70,300 for all other taxpayers. The phase-out (gradual reduction of the exemption amount) thresholds would be increased to $1 million for married taxpayers filing a joint return and $500,000 for all other taxpayers. The exemption and threshold amounts would also be indexed for inflation.

Estate, gift, and generation-skipping transfer taxes: The new law would double the estate and gift tax exemption. The basic exclusion amount would increase from $5.49 million to approximately $11 million ($22 million for married couples). We recommend that those clients who have assets above $5.49 million evaluate doing additional estate planning in 2018 to reduce the size of their taxable estate at no gift tax cost especially because this doubling of the gift and estate tax exemptions is set to expire in 2026, such that the exemptions will revert back to the amounts under current law. Accordingly, planning now while the gift tax exemption is doubled for the next several years may prove to be quite valuable. We are happy to work with you and your advisors to implement creative estate planning techniques which could save your family millions of dollars.

Other year-end tax planning strategies: In addition to planning for the current tax law changes, individuals should also take a look at traditional year-end tax planning techniques. One traditional technique is to defer the recognition of taxable income and to accelerate the payment of deductible expenses. This may come into play for individuals who are able to postpone year-end bonuses or maximize deductible retirement contributions. Individuals should also consider the prepayment of real estate taxes (if they are not subject to AMT, as discussed earlier) or prepayment of mortgage interest (regardless of AMT status). Deferring income or accelerating deductions will be especially valuable for this year’s round of year-end planning, since income tax rates will generally be lower in 2018 as compared to 2017.

Another technique to consider is to make charitable donations prior to year-end. This technique may be especially beneficial this year if you anticipate itemizing your deductions in 2017, but taking the increased standard deduction in 2018. In addition to making cash gifts to qualified charities, there are other creative ways to make use of the charitable contribution deduction. We have assisted clients in making use of donor advised funds and family foundations to secure a current tax benefit for charitable gifts intended to be made over several future years.

Another tax efficient way to make a charitable contribution is to donate appreciated securities. We have assisted many clients in donating appreciated securities to charity. As long as the securities have been held for more than one year, you can generally claim a deduction for the full market value, while avoiding the capital gains tax that would apply if you sold the securities first and then donated the sales proceeds as a cash contribution. Please be aware of the time required for transfers when initiating this process before year-end.

Gift-making, in general, should also be part of a year-end review. Individuals can make an unlimited number of tax-free gifts of $14,000 per recipient during 2017. Married couples may combine their gift-tax exclusion amounts and make tax-free gifts per recipient of up to $28,000 during 2017. There is also an important and often over-looked provision affecting gifts. An individual can make unlimited tax-free gifts used for qualified tuition or medical expenses of another person. The qualified tuition or medical expenses must be paid directly to an educational or medical institution.

Gifts which are not otherwise excludable can be offset by any unused remaining lifetime exclusion amounts. This lifetime exclusion is indexed for inflation and has increased by $40,000 to $5,490,000 for 2017. Individuals who had utilized their lifetime exclusion in gifts made prior to or during 2016 can make $40,000 of additional gifts in 2017 gift tax free. Also, beginning in 2018 the exemption amount would increase to approximately $11 million. As stated earlier, we recommend that those clients who have assets above $11 million (couples with above $22 million) consider doing additional estate planning in 2018 to reduce the size of their taxable estate at no gift tax cost.

Additionally, we at FLI are aware that our clients are doing year-end planning and we try to do our part to help. When managing your investments, we, and the outside investment managers we utilize in some strategies, are sensitive to the tax consequences of our investment decisions. We are mindful that by timing the recognition of capital gains and losses, we can, in some cases, defer your capital gains tax and/or accelerate deductible capital losses.

Life changes can also impact traditional year-end tax planning. Individuals who got married or divorced, changed jobs, retired, or experienced other life events in 2017 need to review how these events may impact their tax planning. A change in employment, for example, may bring about severance pay, sign-on bonuses, stock options, moving expenses, and COBRA health benefits, which all must be taken into account in year-end tax planning. At FLI, we specialize in working with clients who have experienced life changes to ensure that their financial approach is properly adjusted to reflect these changes. We are happy to discuss with you and your advisors whether any changes or additions are needed for your insurance or your estate planning. It is always a good idea to review these items periodically to be sure that they are current, regardless of whether you have had any recent life changes.

For more information about the new tax law and year-end planning ideas discussed, please call us at 516-935-1200 or your tax professional. We stand ready to work with you and your tax professional to discuss how the tax law affects you. We believe that every individual has a unique tax situation, and that personal attention to your individual circumstances could help to reduce or defer your income tax expense.