2021 thus far has been a good year for investors and the domestic economy. The post shut-down recovery has been robust and we expect that to continue into 2022. While this is good news, there are still many worries on the minds of investors. In this web seminar we will share our current outlook for the markets as well as how we are positioning client portfolios for long-term growth.

Fall 2021 Market Update Web Seminar

June 30, 2021

“With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” – Carlos Slim Helu

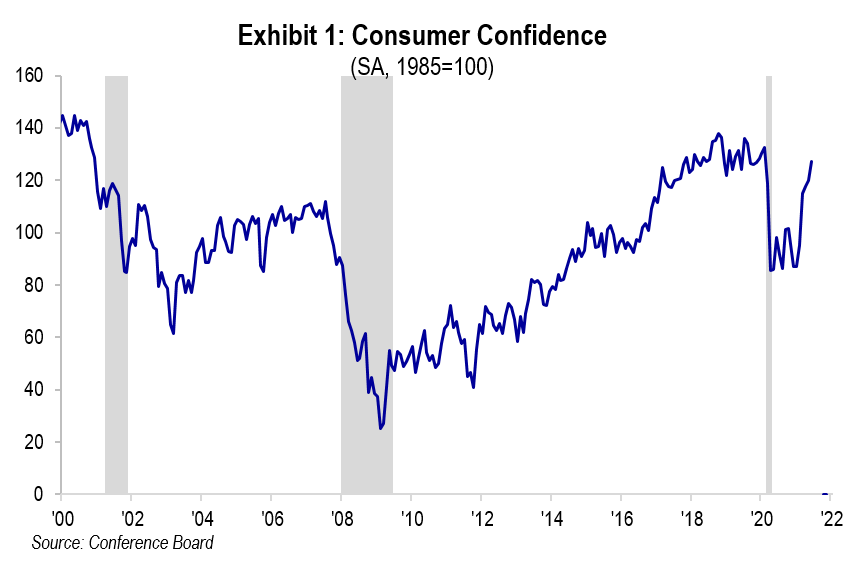

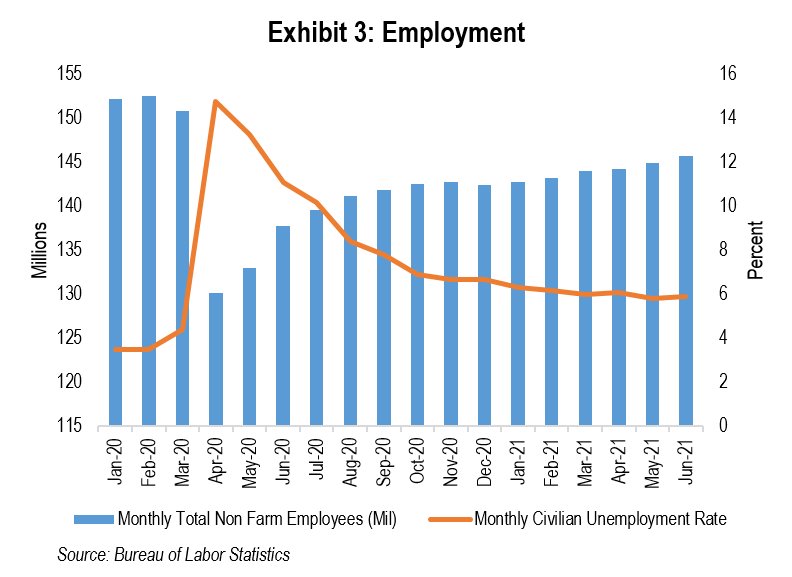

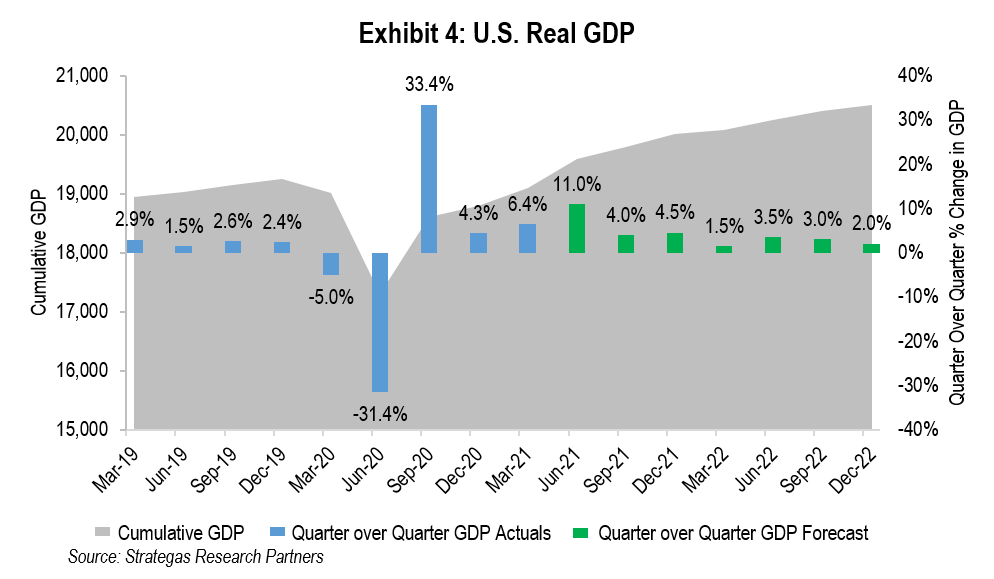

We are pleased to report that the second quarter, and for that matter year-to-date, have been very good for investors, the domestic economy, and the fight against the coronavirus at home. All of our strategies in our defensive and traditional equity baskets ended the quarter having produced substantial absolute returns following the robust economic recovery from nearly shut down domestic and global economies a year ago, while combatting the COVID-19 virus. Massive fiscal (five trillion dollars resulting in M2 growth of 32% since the start of the pandemic) and monetary policies (zero interest rates and asset purchases by the Fed) coupled with strong domestic consumer confidence led to a strong reopening of the domestic economy.

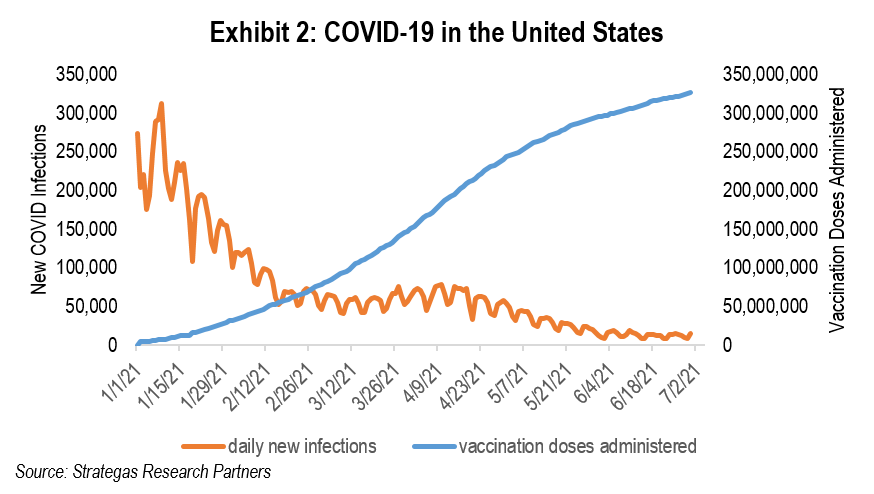

Examples of some positives in fighting the pandemic and the reopening of the economy can be seen in the exhibits here:

The essence of the above demonstrates the success of the vaccination rollout by the current administration using the three vaccines created during the previous administration, and the corresponding reopening of our economy. Strong GDP growth prior to the pandemic contributed to the robust reopening of the economy as a result of pent up consumer demand, as shown in Exhibit 4.

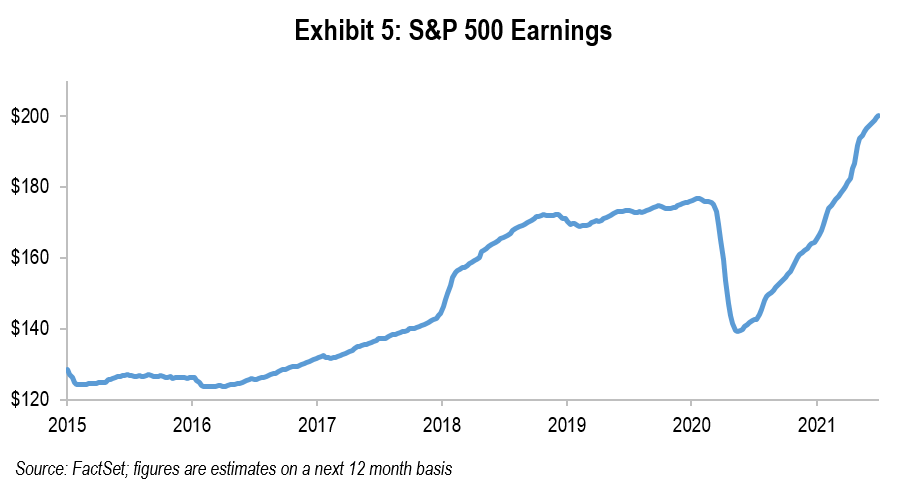

Meanwhile, the S&P 500 Index (as well as other key domestic indices) and the earnings of those companies have both achieved record levels:

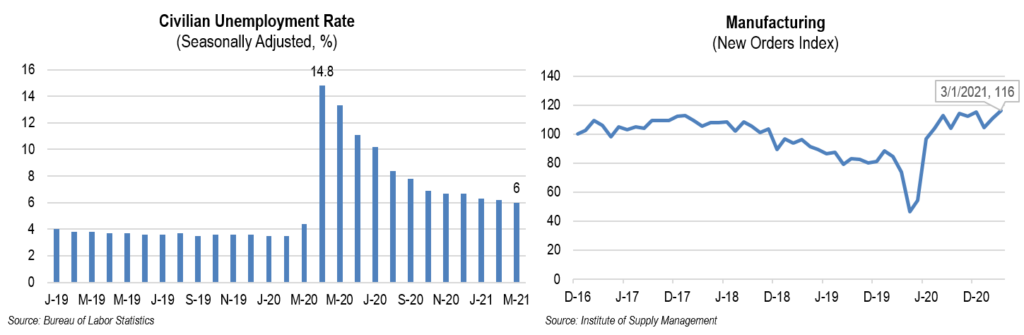

All of the above exhibits attempt to give substance to the thought that understanding history as well as the present can help us visualize the future. (Albeit, we know that history is only a guide and past performance is not a guarantee of future results.) The above strongly suggests that through a robust vaccination rollout the economy has reopened with velocity. The velocity is reflected in the economic growth led by the strong consumer and the growing employment evidenced by the declining unemployment rate. What we can observe is that there was a very strong economy prior to the pandemic; then that economy virtually shut down; employment and economic growth cratered; and with the rollout of the vaccination program and a strong (and pent-up) consumer, the economy has bounced back sharply!

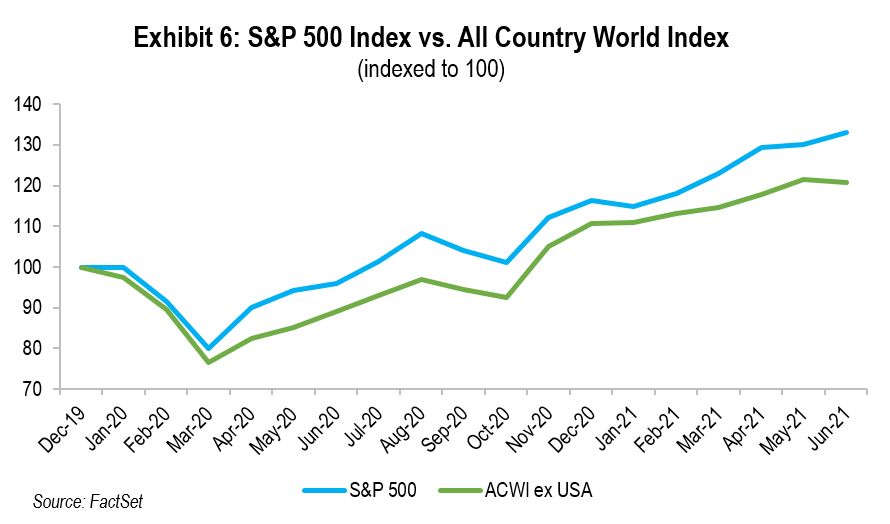

As shown above, domestic continues to outperform international. Additionally, we believe that depressed segments of real estate have also seen a recovery. (We witnessed this with the rebound in both apartment and hotel occupancy rates and performance in various markets throughout the country.) So all seems very good. With a pandemic on the run (except for the Delta variant and areas with low vaccination levels), stock markets at record levels, strong employment gains, robust earnings gains for the S&P 500 Index, still very low interest rates, and major banks having just passed their stress tests (and now permitted to raise dividends and buy back shares) where is the worry?

The Worry

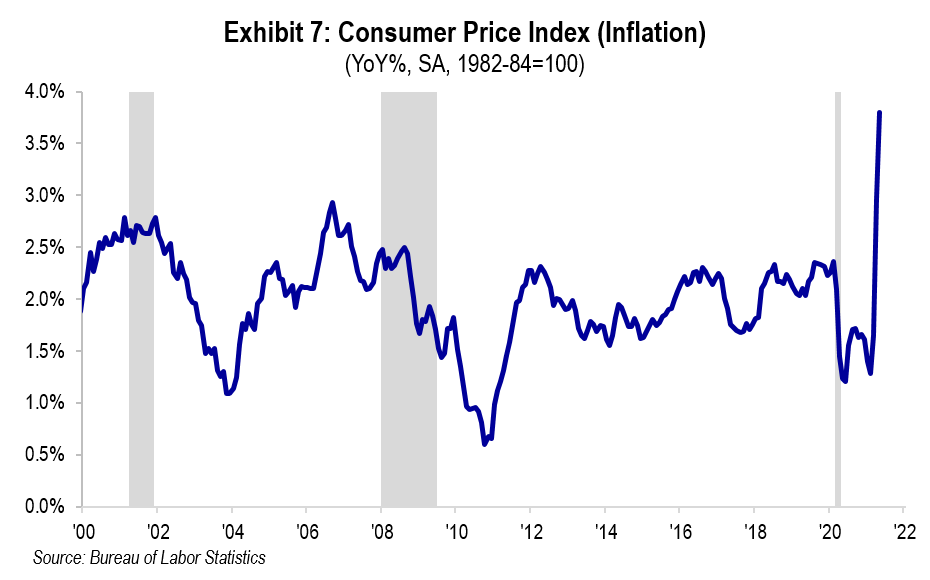

It would be imprudent for us not to worry when things appear so good and in many instances they are very good. However, the specter of higher inflation is a current worry, and one that is being felt by most (i.e. food, gas, home prices).

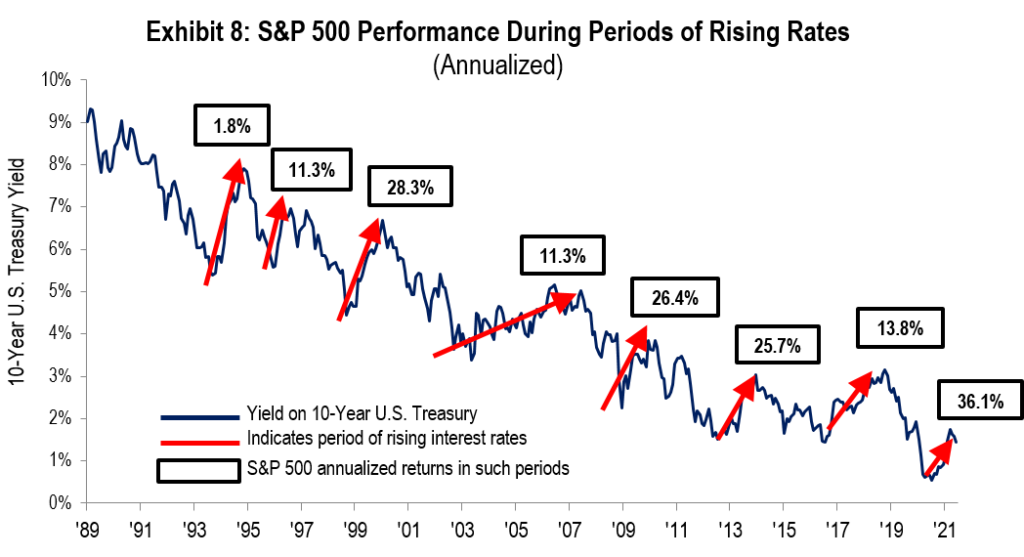

The concern about inflation has many suggesting that the Fed should act sooner rather than later to stem what could be higher inflation by raising interest rates and tapering its asset purchases (another worry). History tells us that should the Fed raise interest rates quickly it could result in a lower stock market through contracting P/Es (for example, when the Fed raised rates in the fourth quarter of 2018, the stock market fell sharply), and lower earnings resulting from higher interest costs for certain businesses. Others suggest that a moderate rise in interest rates over time does not disrupt equity markets. Exhibit 8 below depicts how the stock market has reacted to rising 10-Year U.S. Treasury yields.

The pace of potentially higher interest rates could derail some of our happiness. However, there is another factor to consider and that is the current debate on yet more government spending through both “traditional” infrastructure legislation (suggested at $1.2 trillion) and the other possibility of the President’s proposed American Families Plan (suggested at nearly $1.8 trillion). These are mere estimates being bandied about (extreme progressives in the Democrat Party would like even higher spending). But what is also being proposed are significant tax increases on both business and high-net-worth individuals. These possible tax changes would apply to ordinary and investment income, corporate income, and estates. These potential changes could slow our economy and negatively impact corporate earnings as well as investor behavior. Our existing bloated debt of $28 trillion most likely will increase with infrastructure spending (some of which both parties deem necessary). Bottom line, there are numerous serious factors to worry about which constitute the current “wall of worry.” Given these and other worries, unabashed optimism among investors is not a worry for us at this point, as it does not exist from what we can see and hear.

Summary and How to Invest

We enjoyed a great quarter and the year-to-date is most satisfying, especially after a robust 2020 despite the ravages of the pandemic. When Warren Buffett once said never bet against America, he was right. We closed down, worked to combat the virus with three vaccines, rolled them out with much success, and reopened our economy with vigor and at what many would consider “warp speed.” This recovery in the economy will continue into 2022 in our opinion.

Yet, the prospects of inflation and the eventuality of higher interest rates (in our opinion) are causing some to consider partially hitting the exits. Also, the unknowns revolving around infrastructure spending and tax increases are making many queasy. Addressing what is a fair amount to pay in taxes and how do we close the income and wealth gap is also on many minds in ones’ kitchens as well in Washington, DC among our lawmakers. How do we accomplish tax increases and social engineering without negatively impacting our economy in the long term? That is the ongoing debate.

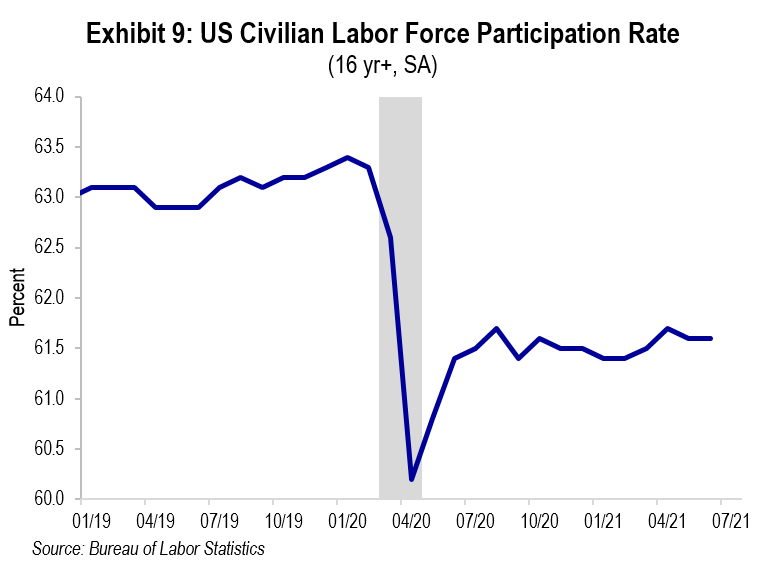

We know from history (fourth quarter of 2018) that missteps by the Fed in announcing monetary policy changes can hurt the stock market. Our view is that the Fed is watching the high number of people still unemployed and the low labor force participation rate.

Given the above and the Fed’s dual mandate of employment and price stability, we expect the Fed will continue to be accommodative while maintaining (until data suggests otherwise) that much of the inflation we are currently experiencing is probably “transitory.” Accordingly, we believe the Fed will err on the side of keeping rates low until mid to late 2022 while watching inflation closely and expecting employment to continue to rebound. A 2% 10-Year U.S. Treasury (it ended the quarter at 1.45%) by year end would not be disruptive in our opinion to equity markets and investing in general. We would expect rates to continue to moderately rise in 2022 driven by market forces in anticipation of some Fed change in policy.

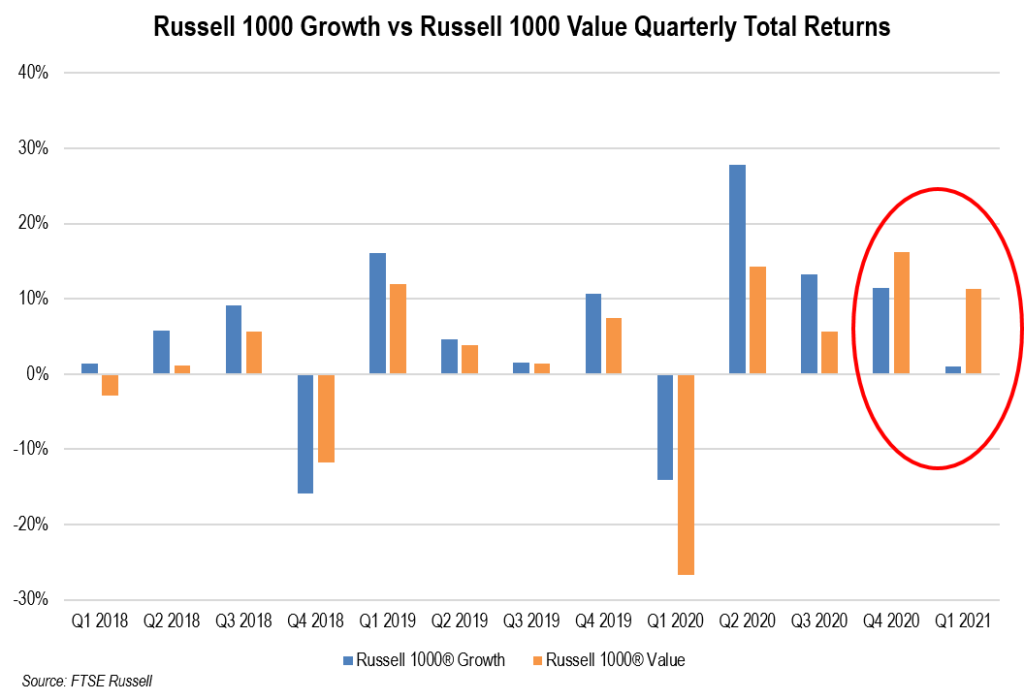

Given our concern about current valuations being on the somewhat high side (but not for all companies), and the potential impact of higher rates, we remain with a somewhat defensive tilt (our clients certainly did not suffer as our defensive basket of strategies made meaningful gains in the quarter and thus far in 2021). Traditional value strategies, typically more cyclical in nature, ended 2020 and started this year trouncing growth strategies for the first time in years but the second quarter was more about growth (large-cap growth advanced 1,193 basis points while large-cap value advanced 521 basis points). Thus, our view of having long-term allocations to both remains our conviction. It is also generally part of our investment process to seek out companies that have pricing power should input costs need to be passed through. Short duration bonds (despite their pitiful returns) are also part of our current conviction given our belief that the longer-term bias will be to somewhat higher interest rates and thus more attractive yields will present themselves at a later point (which would adversely affect the values of longer maturities). We continue to underweight allocations to fixed income as the real return after inflation for many bonds is still negative.

Finally, we all must remain vigilant against COVID-19. I would very strongly encourage those not vaccinated, other than for medical or religious reasons, to discuss their decision with their doctor as the CDC has repeatedly reported that the reward of being vaccinated vastly outweighs the risks. Of course this is not medical advice – so we urge anyone that is not vaccinated to consult with their doctor to make an informed decision. We should all feel more secure if we go through the next six months with limited outbreaks. With continued vaccine adoption there should continue to be a decline in infection rates and furthermore we will not have to worry about the economic impact from another shut down.

Always think long term with reasonable diversification when creating or altering one’s investment plan and consider maintaining a modest cash buffer for the inevitable volatility that has always characterized an investing environment with the predictable but unpredictable “wall of worry.” History would suggest that the long-term investor has been rewarded by taking prudent risk among proven asset classes characterized by quality and financial strength while avoiding areas of speculation, leverage, and too much cash (especially with rates as low as they are). We constantly monitor our clients’ asset allocations to reflect long-term thinking while having a view of the future.

Please enjoy the summer and feel free to call upon us at FLI for any of your wealth management needs. We remain available, and will certainly reach out to you with updates, seminars, and webinars, including a commentary on changes in tax legislation to both businesses and high-net-worth individuals should they become reality.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

P.S. Sorry for the length and number of exhibits, but given what we as investors have had to navigate this thorough explanation should be helpful as we view the future.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending April 26, 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2021 by First Long Island Investors, LLC. All rights reserved.

On Tuesday, June 15th First Long Island Investors held an online web seminar for clients and friends of the firm to discuss the very important topic of protecting yourself from pandemic scams and threats. Carrie Kerskie is the president of Kerskie Group LLC which offers identity theft prevention and restoration services through her VIP Managed Identity Membership program.

The session was structured as a conversation between Carrie and Brian Gamble who is a Vice President of Wealth Management at FLI and in addition to his investment work, heads our technology function.

Q: Given the pandemic, can you share with us what you are seeing in terms of scams?

A: The same way legitimate businesses came to a screeching halt early in 2020 due to the COVID-19 pandemic, so did the organizations the bad guys were using to launder money. So, they had to pivot as well and used some of the things the Federal government had put in place as relief as places to hide. The government put in place the CARES Act, expanded unemployment benefits, small business loans, and Payroll Protection Program (PPP), etc. For just $0.75 you can buy someone’s name, address, date of birth and social security number online. With this information, the scammers started filing fraudulent unemployment, PPP and EIDL (economic injury disaster loans) claims. This is happening even to people who are retired. Someone can file a claim with your information and get money from the government. The bad guys would go so far as to file business claims using the names of people who weren’t even business owners because they were able to manufacture fake business incorporation documents, bank documents, etc.

In addition to these specific scams, overall there is an increase in email, phone and text scams. Data breeches too. Everything has seen an uptick. I believe this is a result of bad guys taking advantage of a situation where there is a lot of fear, confusion, and misinformation.

Q: How has the landscape for fraudsters and scammers shifted? What are bad guys doing to target individuals and businesses?

A: Starting in 2019 we began to see an individual’s ID being used for money laundering. This is done when a bad guy opens a bank or brokerage account with your information and then moves money in and then back out. I have a client who got a letter from a bank and almost threw it out but decided to call the bank. She found out there was both a checking and savings account with her name, and each account had roughly $30,000. We dug further and found 15-20 other accounts (PayPal, Venmo, Robinhood, banks, etc.) and then spent months closing them all with the client. Having accounts open in your name that are fraudulent can cause issues with the IRS because banks have to file a SARs report for any activity that looks suspicious and that information goes to the FBI. Imagine if they think you are involved with money laundering.

Q: Following up on that, how did the client not know the accounts had been opened? Were they not monitoring their credit reports?

A: Great question. Credit monitoring is extremely useful, but it does not cover everything because not everyone pulls credit. Banks use systems such as EWS (Early Warning Services). The individual referred to above had been monitoring her credit and her credit report was clean. Virtual banking definitely does not check credit because those organizations are not under guidance of federal banking laws.

It’s important to understand that unfortunately not all identity theft can be prevented. No ID protection exists that would stop the PPP, unemployment, or EIDL fraud we discussed earlier. But there are things you can do.

New account fraud can be mitigated. This is when someone uses your identity to apply for a new credit account (mobile phone, loan, or mortgage). You can avoid this by putting a credit freeze in place. A credit freeze is free for life, as mandated by federal law. Basically a freeze says your credit report cannot be shown to a new creditor. It doesn’t stop someone from trying, but stops them from being successful. This can be set up online, phone, or mail. (I don’t recommend mail.) A credit lock is also offered by the credit bureaus and does the same as a freeze, however you are entering into an agreement with a bureau and could be giving up some of the rights afforded by a credit freeze. I strongly recommend you do not use a credit lock or a fraud alert and stick with the credit freeze. You have to set up a credit freeze with each bureau and there are many. Equifax, Experian, TransUnion are the big three. Innovis has become more popular recently and NCTUE is used heavily by the utility industry.

Q: Have you seen any uptick in property fraud?

A: No, except for the sale of insurance to protect yourself. That’s a scam. Ignore it if you see it. There is a nationwide program that allows you to register your name and all variation (e.g., James, Jim, Jimmy) with the local courts office. Once you are registered if there is a change to land records you can get alerted. No need to pay money for this service. Use the free version through your county courts office. This program has different names in different states with the most common being a property alert, property fraud alert, or risk alert.

Q: How else can people protect themselves?

A: First, the USPS. If you set up an online account with the United States Postal Service you can sign up for informed delivery which every day will email with the images of the first-class mail coming to you. This allows you to monitor for mail theft. (Yes, this still happens.) Additionally, it informs you of a change of address. (It is easy to change address by just going to a post office). With Informed Delivery activated in a USPS account, a letter goes to each of the new and the current address and if you see that someone fraudulently changed your address you can stop it.

The IRS has a program which was started when there was a lot of tax fraud, called IP PIN (identity protection pin). This program is now open to all taxpayers. You sign up at IRS.gov and it provides you with a PIN number to include on your tax return. Without the correct PIN the return is rejected. The IRS sends a new PIN each year in November/December for the next tax year.

Q: Shifting to the online space, we are always hearing about data breeches and what not. What are some tips? Things to do/not to do? How to limit exposure if there is a data breech?

A: There are so many things to talk about here, but let’s focus on some of the most important, including:

- Check out as a guest if the website is not a frequent place you shop. One less account to worry about and then they do not store your credit card number.

- For those sites where you do shop often (Amazon, EBay, etc.) you want to make sure the password is unique. You can create an account, but I still recommend you do not store your card information and just type it in each time. (Some websites might require you to store a credit card on file.)

- Passwords. This could be the topic of a whole separate session, but here are the key things. The longer the password, the stronger the password so try to make passwords a minimum of 12-14 characters. One tip is to use a phrase instead of a word. Maybe a line from a song. Then add upper/lower, numbers and/or symbols within. Swap some letters in the phrase out as necessary to meet the website’s requirements.

- Don’t recycle passwords and that means don’t use the same on multiple sites. Recently 3.2 billion user names and passwords were discovered online. The bad guys will do credential stuffing which means they will blast the userid/password combination at anything and see where they can get in. Banks, Amazon, Venmo, etc. Don’t make their lives easy.

- Being realistic, people cannot have a different password for every website/app they use. I recommend that you prioritize – bank, brokerage, credit card are sensitive – use unique passwords. If you have some sites where you are doing less and they have no sensitive information of yours, you could recycle a password. For most crucial – definitely have separate, unique passwords.

- Change passwords 1x per year. An easy way to remember is to change them all on your birthday. Also, if you think a password has been compromised, change it. When in doubt, change it.

- This can all be a hassle, but if it’s easy for you then it’s easy for bad guys. Privacy and convenience don’t live in same space. More of one, less of other. Bad guys will move on to an easier target if they are not getting anywhere with you.

Q: How do you recommend keeping track of passwords? We all know a sticky note on the screen is bad, but what is good?

A: Yes, a sticky note is bad and so is a piece of paper under your keyboard or on the bulletin board. If you want to use the pen and paper method, that is OK, it just needs to be in a locked cabinet where the key is nowhere near. You need to protect that document. If it’s out for someone to take a picture of it, then it is definitely not secure. I don’t recommend a spreadsheet or document, even if it is password protected.

Online password managers are a good idea, if you do your research and use a good one (I use one). You need to make sure there is both encryption at rest and encryption in transit. Encryption at rest means that your information is encrypted when it is being stored on the server in the cloud. Encryption in transit means that as the data is being pulled from the cloud to your device it is encrypted on the way and cannot be intercepted and stolen. Regardless of which password manager you use, look for encryption at rest and encryption in transit. Don’t fall for the hype of military grade encryption and don’t go with a free service.

Additionally, you do not want to store your passwords in the browser because what happens if computer is compromised? What happens if you fall for the IT support phone scam that has you go to a website and click on a link to remote access software? Those things give bad guys complete control of your device from anywhere. You go to bed, they go into your computer and log into everything you have – banks, paypal, venmo, etc.

Q: What about two-factor authentication?

A: Two-factor authentication (often written as 2fa) is great. It requires at log in that you have two things: something you know and something you have. What you know is your user id and password. What you have is a code that comes via email or text. The default for many is text because when this started people felt it was safer, but not anymore. If you have an option, get it emailed. If not, then the code over text is ok.

The bad guys have started to try and get around this by calling your mobile phone company and giving them your info (that they bought for 75 cents). Then, they tell the phone company that they have a new SIM card and ask for everything to be switched over. This includes incoming and outgoing calls and texts. Now bad guys initiate a password reset and the code gets sent to them because they have access. This is called SIM swapping. We are not seeing tons of it now, but it is still happening. To protect yourself you can call your mobile company and add extra security like a PIN and/or extra security questions.

Speaking of that, when you create a PIN, don’t use a number related to you. Birthday, anniversary, street address, social security number, etc. They are all a bad idea. Use random numbers. And, for security questions I’ll share a trick I got from a client. It’s called one-off method – answer as if you are one of your kids, or someone else. Use them as your answer key. E.g. hospital born in – not yours, but the person who is your answer key. It is enough of variation that bad guys cannot look online and find it. Often people put inadvertently provide their security questions on social media by participating in polls, surveys, and “let’s get to know each other” posts.

Q: You mentioned phone scams, text scams, and remote software scam. (We know remote software was set up for good reasons, but now it is being taken advantage of.) What else are you seeing?

A: For years we have talked about phishing emails and how to look out for them. Now we are seeing a few things. COVID-19 has people home, using personal devices for work, and nervous. The bad guys are preying on all of this. When it comes to text scams things are changing. Until recently texting was seen as only for your inner circle – friends, family, etc. So, bad guys shifted to areas of trust which was text messages or what is called smishing. The bad guys want you to click on a link or call a number. If you were not expecting it, delete it. Don’t respond. Be careful. Validate or eliminate. If you can’t validate, then delete. If legit, they will find another way to contact you.

Phone scams have been around as long as phones have been around. A few years back there was the fake IRS phone scam from India which before busted was taking in $100,000 per day. They can be a huge cash cow and that’s why they will continue to do it.

We no longer tell people to watch for a specific scam, but rather to focus on trends. There are three red flags that all scams have. (1) Sense of urgency- do this right now. Pay a bill, etc. (2) Severe consequence – fines, jail, family sent away, etc. (3) Demand a specific action – e.g. Amazon support scam is go to a website and download software. Most are buy gift cards. Businesses and federal agencies do not ask you to buy gift cards. If you hear gift cards – hang up. There is no need to be nice, because they will not be nice to you.

If you want to confirm legitimacy, go to company’s website and get the customer service number and call to validate. Don’t do a quick Google search. Go to the main website to find the phone number. Most of time they will say they don’t know what you are talking about because it was a scam. Validate or eliminate.

Another thing is to never believe caller ID. They can make it say whatever they want. Often the bad guys will use your local area code or a number 1-2 digits away from your number.

Q: Carrie, you have given us a lot to consider. What is the one thing you want people to walk away from today with?

A: I probably have 30, but if I had to pick one it would be to question everything. You can’t trust anyone in the digital age. Too easy to hide real identity. Think of motive. If I do this, what could happen? Then move to validate or eliminate.

At the end of the session, there was time for participants to send in questions. Many of those were requests to elaborate on something above and therefore responses have been incorporated above, but those that were different are summarized below.

Q: What is your impression of authenticator apps?

A: They are a great tool, but be careful. Try them on non-crucial accounts first. Most are tied to your device so if your device breaks and you get a new one, it may not move over. Make sure you know how to use it the right way. Have a backup, always good to have a backup but keep that under lock and key.

Q: With respect to the credit freeze discussed earlier, how do you turn it off? And should everyone do that or only once you have been compromised?

A: Everyone should put a credit freeze in place. The only exception would be if you know you need to apply for credit in the immediate future (e.g. car lease is up) then wait and do it after that. Once you have a freeze in place you can lift it online or by calling the credit bureau. It can be done quickly, even instantaneously in many cases. If you know you are going to be applying for credit, lift it 24 hours before and set it to be lifted for 7-10 days in case back office operations needs something. Then, when those 7-10 days are up, it will go right back in place. If you lift the freeze by using the bureau’s online sites it is instant. But by giving yourself a day or two will help in the event the website is down. You can ask the creditor who they work with and only lift that one.

Q: What about VPN connections. When should those be used and are they needed?

A: In my opinion, a VPN is not needed at home for regular home use if you have a secure router. Obviously, with more people working remotely they are using a company defined VPN to log into their office systems. Many of the free VPNs were created out of Russia and China and now all your info is bouncing off their server. Look at the reviews and look where company is based before you use. If you are at hotel or whatnot and on free Wi-Fi, then use VPN. But, better to use data plan and not free Wi-Fi. Or go buy a hotspot and use that.

Q: Is it recommended to pay an identity-theft protection service that offers to audit and fix your credit profile or your online presence, etc.?

A: No, most of the victims I have helped came to me after their identity theft protection service wouldn’t or couldn’t help them. These services CANNOT protect you. They can only tell you AFTER something has already happened. Being proactive as opposed to reactive is a better approach. With clients, we take a proactive approach by implementing a proven prevention process I have developed after working with victims for 15 years.

Q: How do you auditing or fixing your online presence?

A: It depends on what you expect. In my experience, it is impossible to remove something from the internet forever. It might disappear for a short time only to reappear later. Now if you are looking for a service to evaluate your digital footprint, I have a strategic partner that does this and does it well.

Q: What was the website for getting notified about home title changes?

A: It depends on your county. In most counties, the free service is offered through the Clerk of Courts office or the office responsible for managing official land records.

Q: What about phone app permissions?

A: Both app permissions AND phone privacy settings should be reviewed and adjusted regularly. I offer private online classes on how to adjust privacy (permission) settings AND app settings on iphones. I do not use other types of mobile phones for security purposes. However, there are numerous online videos on adjusting phone app permissions for Android and other phones.

Before wrapping up, Brian Gamble shared what FLI does to protect data for our clients. He shared that we have an information security program that is designed to protect user information, which includes secure email and our document portal, as well as regular user training. We also follow best practices for network security that utilizes two-factor authentication and strong passwords. In addition, since your assets are custodied at independent third party custodians, you get the additional security protections that those firms have in place as well as checks and balances between FLI and the custodians.

Carrie’s presentation was quite informative. If you would like additional insight you can visit kerskie.com and/or subscribe to Carrie’s podcast –Privacy Mentor. You can also reach her at ck@kerskie.com.

About our speaker:

Carrie Kerskie is the president of Kerskie Group LLC, founded in 2001 in Naples, Florida. Kerskie Group is the leading private investigation agency focused on identity theft prevention, restoration, consulting, and corporate training. She is also the host of the Privacy Mentor podcast.

Through her private investigation agency Carrie worked with thousands of victims for more than fifteen years. These cases enabled her to view identity theft, fraud, and cyber threats from all angles.

Being a highly sought-after national lecturer, author, and consultant on the topics of identity theft, fraud and cyber threats, Carrie is the author of two books, Your Public Identity; Because Nothing is Private Anymore and Protect Your Identity. She is a media favorite and was featured in numerous publications such as Consumer Reports, Huffington Post, KrebsOnSecurity.com, and MarketWatch. She appears regularly on NBC, ABC, and FOX.

The views expressed by Carrie Kerskie are hers and not those of First Long Island Investors, LLC.

March 31, 2021

“Investing money is the process of committing resources in a strategic way to accomplish a specific objective.” – Alan Gotthardt

The first quarter’s stock market performance reflected optimism for recovery from the pandemic which in turn suggests hope for economic recovery. The rollout in the U.S. of three vaccines with high efficacy fueled investor interest in equity markets. This optimism was further stoked with the economic stimulus of the COVID-19 relief package passed in December 2020 infusing about $900 billion into the economy followed up by the new Administration’s American Rescue Plan, which promises to add another $1.9 trillion to our already recovering economy (see charts below).

Emboldened by positive reported earnings for the fourth quarter (reported during the first quarter) released by the vast majority of companies in the S&P 500 Index, that equity market index reacted with a 6.2% gain and set new records. The Dow Jones Industrial Average as well as the Russell 2000 Index (small-cap index) and the NASDAQ all made gains. All FLI equity strategies enjoyed gains during the first quarter following the gains in the fourth quarter. However, what was decisively different was the performance of value-oriented companies as opposed to growth-oriented companies (more on this later). The striking performance of cyclical, financial, and energy companies suggests that an already recovering economy (aided by record stimulus from Congress and a Fed adhering to its commitment to maintain low short term interest rates) was the fuel for higher equity markets and that investors are anticipating a significant economic recovery and a return to more “normal” conditions. (The 10-year U.S. Treasury yield increased to 1.74% and most FLI bond portfolios were flat or somewhat decreased in value.)

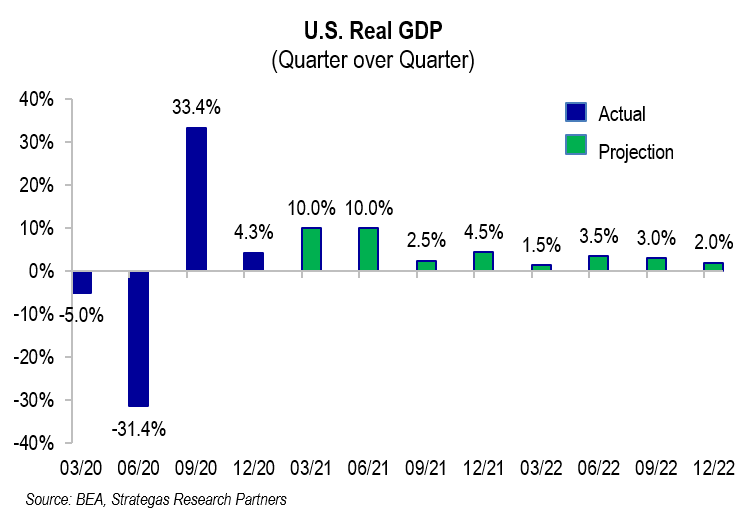

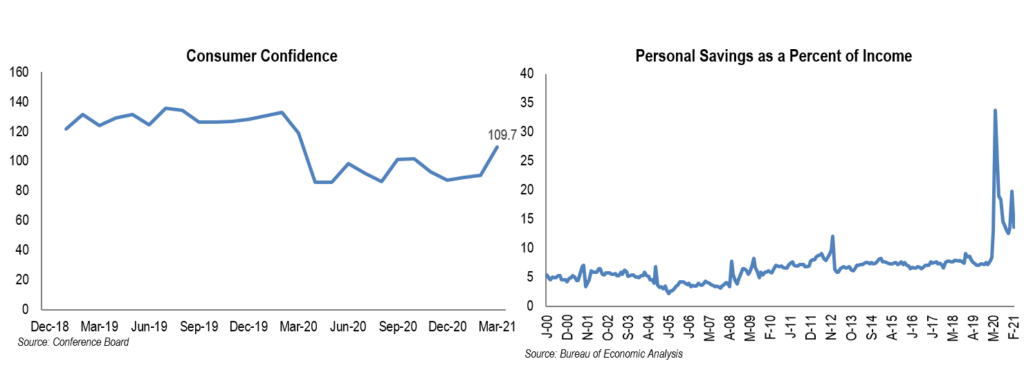

The charts on the following page depict some of the positive economic data for GDP growth, employment growth, manufacturing recovery, consumer confidence, and personal savings:

These charts suggest that between economic growth fueled by government stimuli, growing employment, a resurgence in manufacturing, and the strength of the consumer a robust economic recovery is underway! It should have legs given the support from Washington, D.C., which is now beginning to discuss a possible physical and social infrastructure bill earmarked at about $2 trillion. If passed, this could result in about $8 to $9 trillion dollars of government spending on COVID relief and infrastructure (physical, social, and green). An amazing but scary amount, representing more than 30% of GDP and pushing our national debt to more than $30 trillion.

We believe it is for the reasons above, that value stocks are beginning to outperform growth stocks as depicted in the following chart:

Fortunately, we at FLI offer our clients both growth- and value-oriented equity strategies and recommend that each client have a diversified asset allocation including both styles of equity investing. In addition, modest changes were made to several of our strategies to incorporate more value and economically sensitive stocks (financials aided by a steepening yield curve in particular) to give our clients more exposure to this developing trend. This is not to say that growth companies such as Microsoft, Amazon.com, Mastercard, Facebook, Alphabet, Visa, and others will not continue to perform well. All of these companies reflect earnings growth from secular growth trends.

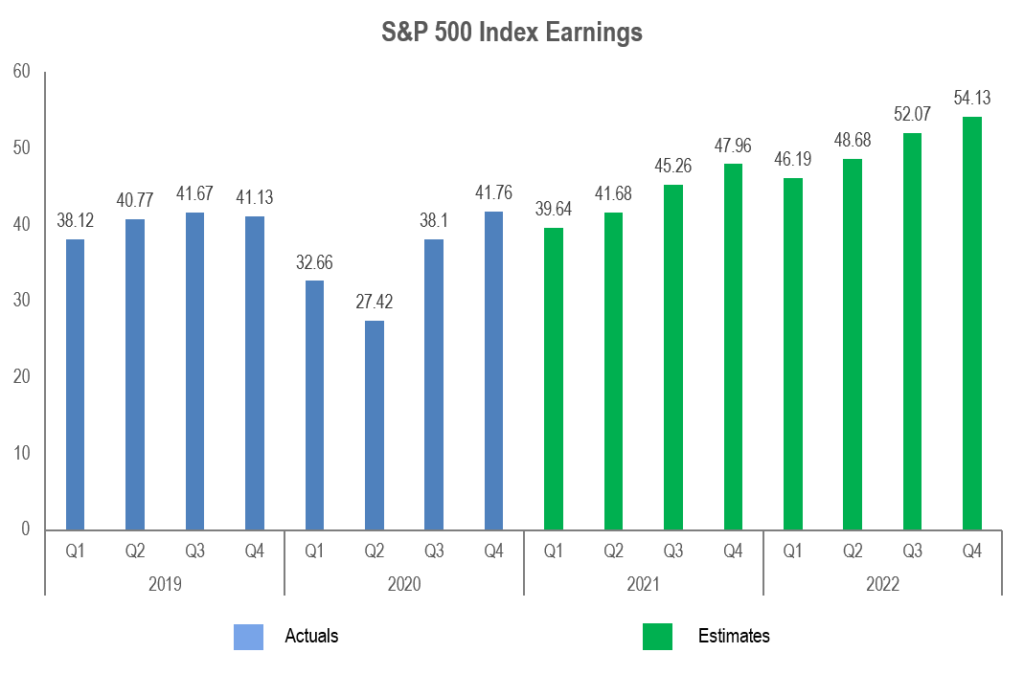

Of course, we continue to rely on growing earnings to be our beacon. The following chart projects earnings growth for the S&P 500 Index which should give some support to current and future valuations:

The above chart would suggest that earnings growth is on the rise given all of the factors that have already been mentioned led, in our opinion, by a reopening of much of the economy aided by the pent up needs of consumers, manufacturers rebuilding depleted inventories, fiscal stimuli from the government, increased liquidity (money growth), and the maintenance of low short-term interest rates by the Fed. However, one unknown factor that is being discussed by the current Administration is the raising of corporate income taxes to help pay for the various relief acts and the recommended infrastructure programs. One such proposed rate increase would raise the corporate tax rate from 21% to 28%. If this were to be enacted, it could reduce after tax earnings for the average company in the S&P 500 Index by an estimated 6% to 8%. This of course would hurt earnings and is not reflected in the chart above. This is far from law at this point, but it or something close to it is a distinct possibility. A potential negative at 28% is that it would make our corporate tax rate greater than that of China and many European countries.

Talking about tax increases, there is also the suggestion that high-net-worth individuals are not paying their fair share and numerous individual tax increases are being discussed. These could include increasing the maximum rate on ordinary income to 39.6%, increasing both the capital gains and dividend tax rates to the individual rate of 39.6% (plus the ACA tax of 3.8%), and various changes to the estate tax system. However, to be fair, some or all of these increases would only impact those households making $400,000 or more in some cases, and over $1,000,000 in others. Of course, this is all conjecture at this point, but it is what the current Administration is suggesting to Congress.

The road to passage of the above proposed both corporate and individual tax increases will not be easy. There is the slimmest majority in both the House and Senate. Already some Democrats in the House have gone on record that they will not agree to a tax package of increases unless there is the reinstatement of the full deduction for state and local taxes (SALT). In addition, the Minority Leader in the Senate, Mitch McConnell, has said the Republicans will fight this “every step of the way.” This lack of bipartisanship is nothing new. All we can do is wait and see.

On balance, we enjoyed a positive first quarter led by our flagship Dividend Growth strategy. Strategies that were more value-oriented did better than growth-oriented strategies, but all were positive. The uncertainty from a growing mountain of debt and the potential for inflation and the higher interest rates might result in some volatility at times. The worry about COVID-19 variants and infection rates are also some things we must watch carefully as they could delay a robust reopening of the economy. Additionally, the proposed tax increases, both corporate and individual, are something to be reckoned with if enacted as proposed.

There seems to be a lot to cheer with the first quarter’s market performance and the positive economic outlook going forward. However, as always, there are several areas of risk. We consider the impact of significant debt to be one, potentially higher interest rates needed to quell potentially higher inflation sooner than later, disruptive tax increases to be another, and the possible spiking of COVID-19 (should it happen) to be yet another major concern. So what do we do? As our quote states, investors, guided by FLI, are on a mission to allocate financial resources to diverse strategies designed to make a reasonable return over the long term by investing in solid companies characterized by durable earnings growth, a long-term stream of dividend increases, and/or reasonable valuations. Financial quality, strong management, competitive advantages, good governance, shareholder friendliness, and in many cases secular growth trends are characteristics that we look for in the companies that we own, either directly or through our outside managers. Our goal is to make reasonable appreciation over the long term while trying to somewhat mitigate risk. Of course, each client’s asset allocation is customized to reflect their individual situations.

As we enter this second quarter, I remind you to please continue practicing those habits that will keep COVID-19 at bay and get vaccinated if you have not already (please consult with your doctors as I am only a JD not an MD). Recognize that we are emerging from a horrible period of time because of COVID-19, but the companies and strategies (including real-estate related investments) that we invest in have done relatively well given the circumstances of these past twelve months.

Please call upon us for any of your wealth and investing needs. Enjoy the spring, we hope with more, but careful, personal freedom.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

2020 was a most unusual year and the COVID-19 pandemic as well as a new administration taking office will have vast impacts on 2021 and beyond. On February 11th the First Long Island Investors team reviewed the economic and investment landscape with an eye towards the future in a web seminar.