On May 12, 2014, Robert D. Rosenthal, the Chairman, Chief Executive Officer, and Chief Investment Officer of First Long Island Investors, LLC (FLI), was honored at the 24th annual United Hospital Fund Tribute to Hospital Trustees. Mr. Rosenthal was presented with the United Hospital Fund’s Distinguished Trustee Award.

“Discipline is the bridge between goals and accomplishment.”

– Jim Rohn, American entrepreneur, author, and motivational speaker

The first quarter of 2014 resulted in equity markets, on average, being about flat and the market for long-term Treasuries rallying with yields declining. We expected to give something back temporarily in equities. At the same time, to our surprise, bond yields actually declined in the first quarter, with the 10-year Treasury falling to 2.7% from 3.0%. This reflected an economic slowdown resulting in part from the adverse weather impacting parts of the U.S. At the same time, growth in China appeared to slow, there remain concerns about China’s shadow banking system and modest economic gains were made in Europe. Other international factors affecting investor sentiment included the Russian annexation of Crimea and Russian troop movements on the Ukrainian border. Cold war-type feelings are rising, although this has not impacted the U.S. economy, nor has it roiled the equity markets yet. Further acts of aggression by Russian President Vladimir Putin could impact markets, depending on U.S. and NATO responses. This situation must be watched carefully both from an economic and market sentiment standpoint. A cold war environment may not be good for market multiples that expanded last year.

Also, volatility increased in the first several months of the year. More significant swings in the equity markets occurred because of the transition to Janet Yellen (from Ben Bernanke) as Chairperson of the Federal Reserve, as well as concerns about domestic and global corporate earnings and GDP growth. These factors are making investors a bit nervous about stock market valuations. The proverbial stock market correction (typically at least a 10% drop) is anticipated, but yet to happen. Add to this mix the upcoming midterm elections, and you have the potential for a jittery market. History (since World War II for midterm election years), which is an imprecise guide but worth noting, suggests that the equity markets are volatile for at least two quarters of the year, followed by appreciation towards the end of the year. Meanwhile, the bond market suggests that the economy, although modestly improving, remains somewhat fragile.

Our view at FLI has not changed. We believe GDP will grow in the 2% to 3% range this year. This in turn should help employment improve, but not quite at the level of improvement that would turn heads. Interest rates and inflation should remain low for the foreseeable future reflecting this modest growth. Fed Chairperson Yellen made it clear that she supports rates remaining low despite the tapering of bond purchases by the Fed. We expect rates might be increased starting in mid-2015. We believe this accommodative stance is helpful to businesses and real estate owners, but it continues the financial repression that altered consumer spending and reduced wealth for retirees.

Meanwhile, corporate earnings continue to increase and profit margins remain high. We believe that this increase in earnings will support current valuations. However, the equity markets are no longer cheap, although we believe they are reasonably valued. From here, we believe prospective gains will mostly come from astute stock picking. In other words, we think the tide will not lift all stocks as in 2013 (appreciation resulted from an earnings increase and meaningful multiple expansion). In some cases, there might be pockets of overvaluation. We view this as an opportunity for us as our concentrated approach to investing relies on selecting those companies that have the most attractive growth or value characteristics. This is the case with our directly managed strategies and the strategies that use among best-of-breed managers. In addition, the companies making up our Dividend Growth strategy continue to increase dividends in the 7% to 10% range on average annually. On balance, the equity market environment of a 10-year Treasury at 2.7% and price earnings multiple of approximately 16 for the S&P 500 is not expensive, but it is not as cheap as it was before last year’s excellent performance (our forward looking view uses a 3.5% to 4% range for the 10-year Treasury bond).

Certain events could negatively impact our outlook, including an economy growing slower than outlined, an unexpected pickup in inflation, an outbreak of greater hostility in the Ukraine and/or the Middle East (perhaps relating to Iran), or something completely unforeseen. One factor that could boost chances for a better investment outcome would be a faster growing economy without rising inflation. This would have the tendency to see an even better stock market because corporate earnings would grow faster than we anticipate and would help make valuations more attractive. On the other hand, this would trigger rising longer-term interest rates that could foster even greater interest in buying quality stocks as bond portfolios would suffer even greater losses. We believe, based on our research and experience, that the stock market would not be negatively impacted (except for short-term blips) by gradual interest rates increases until the 10-year Treasury exceeds 5% (this seems like a long way from today’s rate of 2.6%).

Our advice is to stay the course, continuing to underweight fixed income. The long-term bias, in our opinion, is to higher rates. At current levels, bonds (i.e., 5-year AAA municipal bonds at approximately 1.2% and 10-year Treasuries at approximately 2.6%) are not attractive in our opinion, and higher rates will cause paper losses for longer-term maturities. Also, high-yield fixed income seems very expensive as spreads between high quality and junk are tight. In light of this, we continue to overweight our defensive basket. Dividend Growth, thus far, continues to perform well with dividends expected to rise in the 7% to 10% range on average for 2014. We believe that our recommended defensive strategies appear poised to deliver a reasonable risk-adjusted return while reducing volatility. Additionally, we would continue to have some exposure, or an average weighting, to our traditional equity strategies. We see potential appreciation through our primarily concentrated portfolios where we still see ample opportunity to own fine growth and value companies at attractive valuations. However, these strategies could be more prone to the increased volatility we expect to see this year. For these reasons, we continue to overweight our defensive basket, especially given the significant gains made by the equity markets last year.

Asset allocations are unique to each individual investor and should encompass all of your investable assets. We always remain available to engage in a discussion about your current asset allocation. Please keep in mind, our investment committee reviews your individual asset allocation on a quarterly basis (based on available information). We make recommendations to you for change where necessary.

Finally, we have several important announcements. First, please join us at our next Thought Leadership Breakfast on June 3 at The Garden City Hotel. We will be discussing the future development of the Nassau Coliseum site with the 2015 departure of the New York Islanders. Visiting with us will be Ed Blumenfeld of Blumenfeld Development Group, a partner in the new development, and Bobby Nystrom, the Islander legend. We look forward to seeing you. Second, please be advised that First Long Island Investors is now a part of the LinkedIn Network, and we urge you to visit us on our site to keep abreast of our events, news, and thoughts.

We are also pleased to announce two new hires. Karen Weiskopf joined our company as Director of Marketing. Karen will lead our efforts to better service our clients, liaise with our centers of influence, and help us advance our social media platform. Matthew Cohen joined FLI as Assistant General Counsel. Matt will reinforce our legal and compliance areas, as well as assist with our wealth management, estate planning, and real estate advisory services. With Karen and Matt as great additions to the FLI team, we are growing to better serve our existing clients. Hopefully, you will get to meet them both in the near future.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results.

Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending March 31, 2014, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Content may not be reproduced, distributed or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC . Copyright © 2014 by First Long Island Investors, LLC. All rights reserved.

Our performance for both the fourth quarter and the full year was excellent. Our individualized asset allocation (which we regularly review) permitted our clients to participate in a great year for the equity markets. Our equity based strategies appreciated in a range from approximately 20% to almost 38%! One defensive strategy, Dividend Growth, through December 31, 2013 ranked in the top 15% of large-cap investment strategies since its inception on March 31, 2010.

The bottom line is that we participated in a strong, but somewhat unexpectedly robust, equity market while focusing on preservation of capital. We urged clients over the past several years to maintain their participation in the equity markets by investing in our defensive and traditional equity baskets. This allocation has worked out very well with this strong performance in contrast to the weak performance of fixed income. As we have suggested in past letters, bonds offered little return, and the Barclay’s U.S. Aggregate Bond Index declined slightly for the year (-2.0%) without taking into account inflation. Short-term rates remain low, reflecting the financial repression suffered by savers and investors alike. This has not been a great place to be overallocated. Meanwhile, real estate and private equity also continued their recoveries. Our investments in these areas provided us with returns over the past year. It is important to point out that the returns noted above were accomplished despite some troubling events and factors. Political paralysis resulted in a partial overnment shutdown during the fourth quarter, tapering of quantitative easing commenced in December, and long-term interest rates continued to tick up. Despite this, the apparent healing of the global financial system mitigated these negative factors and price-earnings multiples expanded, which were responsible for a significant part of the stock market appreciation for the quarter and year. Earnings growth for the average large company failed to keep pace with stock prices, but still contributed to overall stock market appreciation. Domestic markets outperformed most developed international markets, while emerging markets continued to struggle with negative returns. Fortunately, we have been underweight international markets and remain so.

Our year-end thought piece, which you received earlier this year, put forth what we believe to be a prudent asset allocation for the foreseeable future: underweight fixed income, overweight defensive strategies, and equal-weight traditional equity strategies. We believe this formula of diversified defensive and traditional equity allocations will weather what we expect to be greater volatility this year. We believe this will be caused by an environment characterized by a more mature bull market for equities, rising interest rates on the long end of the yield curve, geopolitical strife surrounding Iran, mid-term elections, and the uncertainty and higher consumer costs associated with the Affordable Health Care Act, to name several areas of concern. On the other hand, we continue to see global economic growth, including a slightly improved performance from Europe. Corporate earnings, both domestically and internationally, should also continue to grow and help support current valuations. As always, we believe the way to invest in equities is in quality companies and seasoned strategies, where concentration of positions and valuation discipline are paramount. Furthermore, due to last year’s stellar equity market, good stock pickers should perform well this year. We do not think we will have the rising tide that lifted virtually all companies’ share prices as we did last year. We also believe that there will be a continuing outflow from the existing mountain of cash on the sidelines and the over allocation to fixed-income positions into the global equity markets. This too would support current valuations, as well as some appreciation, especially for those companies that achieve better than average results.

Before we turn to the actual performance for the fourth quarter and the year for each of our strategies, we should mention that we have changed the name of our “defensive equity” basket to “defensive.” This reflects our addition of a new investment strategy with less equity exposure than our other two strategies in this basket. . We believe this diversification makes sense and will have more to say about this strategy in a separate letter to suitable clients.

There is very little time to celebrate the accomplishments of 2013 as we have already set sail in 2014. Minor adjustments to asset allocations were recommended to some clients, where we believed necessary, towards the end of last year. We encourage you to call or visit us should you wish to make further changes or have cash to deploy. Our entire investment team stands ready to work with you. In the meantime, we wish you a happy, healthy, and prosperous New Year.

Best regards,

Robert D. Rosenthal Ralph F. Palleschi

Chairman, Chief Executive Officer President and

and Chief Investment Officer Chief Operating Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results.

Disclaimer: The views expressed are the views of Robert D. Rosenthal and Ralph F. Palleschi through the period ending December 31, 2013, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Content may not be reproduced, distributed or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC .

Copyright © 2013 by First Long Island Investors, LLC. All rights reserved.

On January 30, 2014, First Long Island Investors (FLI) Senior Vice President Edward Palleschi was presented with the Long Island Business News 40 Under 40 Award for his dedication and commitment to both his profession and community. The ceremony was held at the Crest Hollow Country Club, where Mr. Palleschi was joined by 39 other honorees from various industries who also received this honor.

“The underlying principles of sound investment should not alter from decade todecade, but the application of these principles must be adapted to significant changes in the financial mechanisms and climate.”

Benjamin Graham (father of modern security analysis)

First, 2013 was a surprisingly good year. In our thought piece for 2013, we suggested that domestic equity markets would be robust, however, even we were pleasantly surprised. Our asset allocation of overweighting defensive and traditional equity strategies paid off handsomely.

Several of our strategies exceeded their benchmarks, as well as delivered substantial absolute returns. Our concern about fixed income also came true, with very modest losses suffered by most who followed our advice while those who stretched out maturities to achieve somewhat higher income suffered larger losses. Also, we believed that housing would recover and that was the case. Private equity also saw solid returns as the initial public offering market came to life and there was an increase in debt deals and merger activity. Thus, the net result for 2013 was quite positive for our clients who followed our direction and sought a return on capital, as opposed to those still paralyzed from 2008 and early 2009 seeking just a return of capital. Those investors who over allocated to cash and fixed income continued to be victims of their own fear and the financial repression currently thrust upon us by our Federal Reserve Bank and central bankers around the world.

The essence of the quote from renowned investor Ben Graham is that the basic principles of sound investing by owning quality companies with earnings and cash flow growth, dividend streams, and reasonable valuations continues to make sense. We have routinely put this to work, doing so in 2013, and will continue to do so in 2014. We adjust our asset allocation recommendations for the prevailing financial environment and current economic climate.

Unprecedented (but necessary) monetary stimuli, financial repression with zero short-term interest rates, political paralysis, foreign economic uncertainty, and untested new financial regulations all contributed to our shift to underweighting fixed income and overweighting domestic defensive equities. This worked out quite well in 2013 and we believe it will continue to do so in 2014.

It is worth noting that the robust wealth creation of 2013 from the stock market and housing occurred despite the following:

- A government shut down

- Political paralysis

- Disruption from the onset of the Affordable Care Act

- The first tapering of Quantitative Easing

At the same time, the following worries seem to have faded (at least for now): - European fiscal and monetary crisis

- Iranian nuclear development

- Record U.S. national debt exceeding 17 trillion dollars

- Continuing domestic bank legal settlements for the misdeeds of the subprime and other crises

And the following factors contributed to some optimism:

- Domestic banks’ balance sheets are strong and getting stronger

- Corporate America achieved record earnings with abundant cash on their balance sheets

- Inflation remains stubbornly low despite accommodative fed monetary policy

- Consumers have delevered and are beginning to spend

- Housing is on an upswing

- America has become a major producer of energy and is heading towards energy

independence.

So, what do we, as investors, look forward to in 2014?

We believe that the following trends and factors will drive results for this year:

1. Short-term interest rates will remain low while longer-term rates will trend somewhat higher but remain well below historical levels. Fed tapering will be tolerated as long as the resulting somewhat higher rates do not impede economic progress. This doesn’t bode well for longer-duration fixed-income investments.

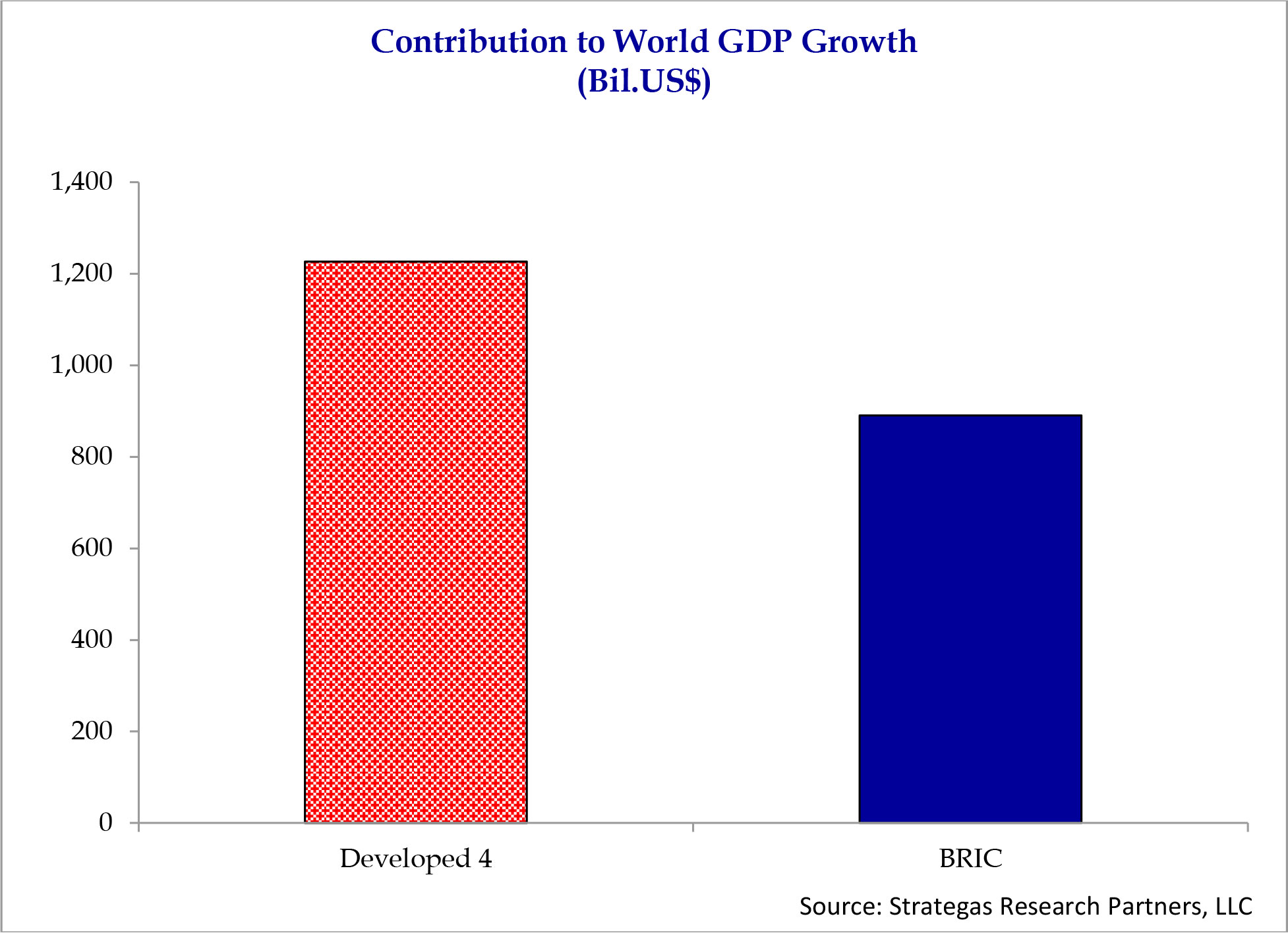

2. Corporate earnings will continue to grind higher supported by modest global economic growth. The U.S. should have real economic growth in the 2.5% to 3.5% range. Europe should achieve some economic growth after having recently emerged from recession (although some banking issues relating to loans are still a concern). Japan is working to inflate its way out of deflation. Finally, developing markets, led by China, will continue to grow at a somewhat slower rate than past years (while trying to control reckless borrowing). The importance of these growth estimates is depicted in the following chart, which shows that the biggest contributor to global growth will come from four of the largest developed countries (U.S., Japan, Britain, Germany), not the BRIC countries (Brazil, Russia, India, China):

This is important as we will continue to overweight domestic equities which we believe still represent the most consistent growth and have reasonable valuations.

3. As mentioned above, the increased domestic production of oil and gas using fracking and other high-tech methods of extraction will bring jobs and lower energy costs to our country. (Mexico is also promoting outside investment in the development of its offshore oil.) This has other benefits including reducing the cost of manufacturing, which we believe will boost domestic manufacturing and bring back some higher-paying jobs. Of course, environmental concerns will have to be considered and, given the increased

regulations coming out of Washington, we do not have to worry.

4. U.S. unemployment will continue to decline. However, the nature of the jobs being

created is in many cases part-time or lower-paying jobs. This will need to be addressed by fiscal policy initiatives coming out of Washington. We believe that increasing the minimum wage is a Band-Aid and not the answer. A bipartisan approach to some tax

Developed 4 BRIC

Contribution to World GDP Growth

(Bil.US$)

Source: Strategas Research Partners, LLC

4. reform and a pro-growth legislative agenda is the answer. We believe this will happen in small steps.

5. Mid-term elections will cause some religion in Washington. Both parties have much to gain or lose. The bipartisan budget deal (modest in size) accomplished by Congressman Ryan and Senator Murray will be a pattern for the future. Do not be shocked to see some improvement through small deals on immigration and tax reform. Extremists in both

parties are not going to have their way and cooler heads will prevail as 2014 is an

important election year. This bipartisan cooperation could be quite positive for the stock

market when coupled with the modest earnings growth we expect.

6. State and municipal spending will actually trend up in some states. This is in contrast to the austerity at state and local governments that we have seen since the “decession.” Also, the reduction in sequestration at the Federal level will help the domestic economy grow.

This increase in spending could be another positive for both the economy and the equity markets. On the “wall of worry” side, we have the following which we believe will cause some volatility for sure:

1. The full implementation of the Affordable Care Act is apt to cause disruption and higher costs as it expands coverage. The shaky start technologically will be followed by more disenfranchised Americans. High deductibles, loss of choice regarding doctors and hospitals, and doctors opting out of serving many due to cuts in pay, and other factors will counterbalance some of the positive elements of the law. In addition, because many states did not expand their Medicaid offerings, millions of Americans will still not be covered by the new law. It is estimated in the Economist that 40,000,000 Americans will still not be covered while only 11,000,000 will gain insurance coverage in 2014.

2. The mid-term elections will bring to the surface many long-term systemic issues that have faded, including the impending financial crises surrounding Social Security, Medicare, and the U.S.’s huge fiscal deficit. In particular, the future funding of Medicare is a big issue that must be addressed, especially as it is now being strained by the Affordable Care Act. Republicans need only six Senate seats to regain a majority. Of note, six Democratic Senators up for reelection are from states where a majority voted for Governor Romney in 2012. These, and other seats in Congress, will be bitterly contested. As a result of this, neither party will want to be viewed as obstructionist, thus fostering some level of bipartisanship on immigration, tax reform and infrastructure spending.

3. The U.S., Israel, and other nations will continue to deal with Iran and its nuclear ambition. The recent temporary agreement entered into by the U.S. and Iran expires in a matter of months. Critics are skeptical that anything of substance will be accomplished. This is worrisome to say the least and could lead to a military confrontation. This is especially worrisome as Syria, Lebanon, Libya, and Iraq face terror or are at war.

4. The gap between the middle and upper class continues to be worthy of much discussion. The increased cost of health care and education are factors weighing heavily on the middle class of this country. We don’t believe the answer is just raising taxes or engaging in class warfare. Encouraging business investment and retraining of the unemployed needs to be encouraged while infrastructure investment needs to be made and paid for. These and other factors must be addressed to give the middle class a way to achieve better jobs, higher pay and greater financial security. However, the income inequality rhetoric at the city, state, and federal level will continue to cause angst and chill job creation.

5. Price-earnings ratios expanded significantly last year and much of the gains in equity markets resulted from this expansion. Earnings growth provided a smaller portion of the gain. 2014 should be a year of continued earnings growth, but we would be surprised if P/E’s continued to expand. Any disappointment in earnings growth, or the growth in global GDP, could cause a contraction in price-earnings multiples that could cause a

market decline. Stock picking will be increasingly important.

6. There will always be issues and factors that we cannot forecast, but can cause disruption.

We are somewhat worried about the growing consensus by financial gurus advising

investing in the stock market while predicting doom for the bond market (you might recall our letter from October 28, 2010 urging stock market investing before you could “see a bandwagon”). We worry a bit when the herd is echoing our advice.

Our Strategy for 2014

We believe the following asset allocation makes sense:

1. Underweight fixed income – We expect that long-term interest rates will trend up, with the Fed tapering and eventually eliminating quantitative easing. This will cause paper losses for those who have extended out their bond maturities. At the same time, with Janet Yellen taking over the helm of the Fed, there will be an even greater focus on employment and wage gains as a measure of the health of the economy. Given this bias, we expect short-term rates to stay quite low until significantly more sustainable progress is made by the job market. Investors holding cash and short-term fixed income will likely be losers with returns less than the rate of inflation. Accordingly, we will recommend t hat our clients continue to underweight fixed income and keep duration/maturities reasonably short. Our clients do not like seeing paper losses even though they profess that they will hold to maturity and ignore the red ink. We will continue to only buy high-quality investment-grade bonds in a laddered manner (except for institutional clients with broader investment guidelines).

2. Overweight defensive strategies – We have two strategies that we believe are somewhat defensive. One strategy is concentrated in fine growth companies providing clients with above-average earnings growth, in addition to selling call options to capture an additional cash stream, which helps performance in low growth or declining markets. The other strategy relies on financially-strong, large companies that have a culture of returning cash in the form of dividends to its shareholders as part of its DNA. These companies, on average, have raised dividends for more than twenty years and we believe will continue to raise dividends annually. We believe that these two strategies give clients significantly better returns than fixed income for the foreseeable future. Both provide transparency, invest in high-quality businesses and provide some downside protection from either a growing dividend stream or from more rapid earnings growth coupled with the collection of cash premiums from selling call options. Given the significant increase in the stock market last year and the wall of worry that confronts us, these strategies make a lot of sense for every suitable investor in the event 2014 turns out to be a more challenging environment.

We will be adding a third strategy to this defensive basket (renamed “defensive” from

“defensive equities” to account for this addition) that will make sense for some of our

suitable clients. This investment will be less correlated to the equity markets. We have

been conducting due diligence on this investment for over a year. We will send out a

separate letter to those suitable clients regarding this with a full explanation of its merits for their consideration. Our pension fund and some of us at FLI (including me) have already made investments in this strategy.

3. Sensible allocation to traditional equities – Our traditional equity strategies did extremely well last year. Our primary focus on among best of breed managers with concentrated portfolios produced excellent results. Given our view that the global economy and corporate earnings will reasonably grow with the greatest contribution coming from the U.S., we believe that a full allocation to traditional equities makes sense. We are overallocating to domestic U.S. strategies. We believe that these strategies will provide us with ample exposure to Europe and Japan as well as modest exposure to emerging markets through the global footprint of U.S. companies. This should provide us with the safest investment opportunities (in the equity arena) with the least disruption from government instability and currency issues. Over the long term, we still believe that equities make great sense through investment in high-quality, well-managed businesses. Since the “decession,” we have implored clients to invest in both traditional and defensive equities and we believe this makes sense again this year. The mountain of money on the sidelines, as well as individual and institutional investors over-allocated to bonds, will likely continue to provide a source of funds to be invested in high-quality companies. This, along with growing earnings, should help this asset class reasonably appreciate. We believe that this allocation makes sense for all clients. However, the rising tide of 2013 will probably not be with us to the same extent in 2014. Thus, investing carefully in concentrated portfolios made up of the best companies backed by growing earnings and/or growing dividends at extremely attractive valuations is essential. We are confident that we can provide that to you in our various traditional equity strategies.

4. Modest allocation to private equity/real assets – Private equity should benefit from an improving economy, a more robust merger environment, and a better stock market supporting a greater number of initial public offerings. At the same time, the remnants of the financial crisis still represent some significant investment opportunities especially in the credit and distressed asset areas. We continue to look for reasonable investment opportunities to participate in this asset class. In addition, the recovery in real estate may also be a sustainable and fertile area for investment. However, pricing and available liquidity present challenges to finding attractive investments. We will continue to pursue this area and bring to our clients investments that we find attractive.

In summary, 2014 is a year where we advise staying the course with some defensive shift of one’s asset allocation based on the success of 2013 and the changing financial and political climate (as we believe Ben Graham would have suggested). The proverbial wall of worry still exists but the wall seems to have gotten shorter. Long-term equity investing is paying off and should continue to do so as domestic financial institutions are stronger, corporate earnings are growing and valuations are no longer cheap but reasonable in our opinion. Those pundits, who several years ago suggested that one could no longer be a long-term investor in great companies, did not know what they were talking about. Those who believed that the bull market in bonds would last forever are facing an uphill battle. Investing prudently, while considering the economic, political and geopolitical challenges, makes sense with a goal of achieving a fair return on capital as opposed to just a return of capital.

As asset allocations should be individualized, we look forward to working with you to help you achieve a prudent asset allocation for this year and years to come.

Best regards and best wishes for a healthy, happy and prosperous New Year,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may

differ materially. Past performance statistics may not be indicative of future results.

Disclaimer: The views expressed are the views of Robert D. Rosenthal and Ralph F. Palleschi through the period ending January 15, 2014, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Content may not be reproduced, distributed or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC .

Copyright © 2013 by First Long Island Investors, LLC. All rights reserved.