Robert D. Rosenthal and Philip W. Malakoff discuss First Long Island’s perspective on some current macro-economic factors, questions facing many investors and how FLI is positioning clients for the rest of 2015 and beyond in an hour-long web seminar.

“An argument is made that there are just too many question marks about the near future; wouldn’t it be better to wait until things clear up a bit? You know the prose: ‘Maintain buying reserves until current uncertainties are resolved,’ etc. Before reaching for that crutch, face up to two unpleasant facts: The future is never clear and you pay a high price for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.”

-Warren Buffett

For the second quarter, our clients made money on balance among our security, defensive, and traditional investment baskets. The many question marks facing us as investors, including when the Fed will begin to raise rates, how Greece and Europe will deal with the Greek debt default, if a nuclear agreement can be reached with Iran, and whether the war with ISIS is escalating, will all have to wait until the third quarter or beyond. Meanwhile, as I stated, the second quarter ended higher for most of our investment strategies.

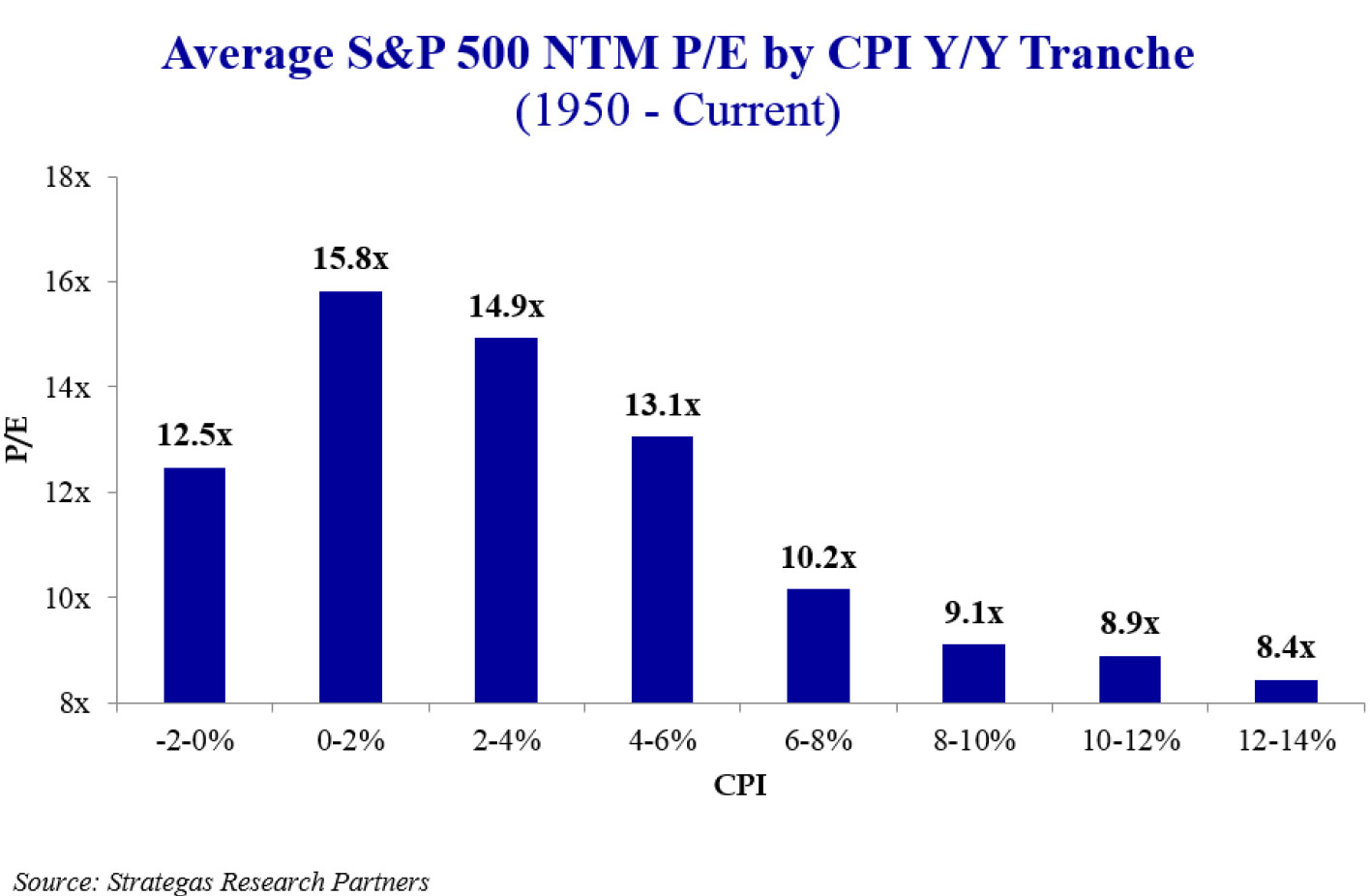

Uncertainty, to Buffett’s point, can be an opportunity if one attempts to focus on quality and reasonable valuations. Accordingly, we have spent significant time studying today’s valuation of the equity markets where interest rates remain very low, inflation is subdued, corporate earnings are growing slowly, and price earnings ratios for the S&P 500 Index are estimated to be between 15 and 16 times 2016 calendar year earnings. Our conclusion is that valuation is not a major headwind at this point for larger high-quality companies. This is confirmed by the best-of-breed outside managers we use in several of our investment strategies, who have been successfully investing over long periods of time. The following chart, in our opinion, demonstrates that, at least based on historical multiples, the current valuation for the equity market (the S&P 500 Index) is far from the nose bleed territory of 2000 when P/E’s were 25x earnings.

Based on the next 12-month price/earnings ratio of 16.5x and a low-interest-rate/low-inflation environment (CPI at 0.0% as of June 30, 2015), the equity market does not appear overvalued. These earnings are somewhat impacted from the rising dollar, which reduced the reported earnings of many multinational companies. Additionally, depressed oil prices are curtailing earnings and operations for many companies in the energy sector, which make up almost 8% of the S&P 500 Index. We focus our equity investing on highly concentrated portfolios across our defensive and traditional equity strategies. In other words, we try to invest selectively for the long term in companies that we believe will perform better than the average company; we do not invest in what we believe to be average companies. That gives us even greater confidence that hopefully our investments are undervalued and have greater potential for appreciation in the future.

Our cautious optimism is fueled by certain observations of the economy:

- The domestic economy continues to grow somewhat modestly between 2% and 3% per year (and one of our outside economic strategists suggests the potential for even higher growth through the end of next year).

- Employment continues to grow by 200,000+ jobs per month on average.

- Record corporate profits are expected to continue to grow, but at a slower pace in 2015 than in 2014.

- Very depressed energy prices, low interest rates, and the better employment picture mentioned above should continue to support growing consumer spending.

- The domestic housing market continues to improve, helping the consumer and the overall economy, through increased construction activity and improved consumer balance sheets

These economic positives do face some “question marks” or headwinds, which will result in some volatility going forward. In the immediate future, the world may have to deal with three events or situations that investors will have to digest:

- A possible exit from the Eurozone by Greece or the need for an onerous series of fiscal reforms for the people and businesses of Greece.

- A probable lift off by the Fed in raising interest rates in September.

- The debt problem facing Puerto Rico and the uncertainty related to its outstanding debt.

All of the above could lead to, in our opinion, short-term periods of indigestion or volatility that could last for months. Greece is a small economy (smaller than the economy of Connecticut) and Europe is well-equipped financially to deal with the Greek debt crisis. Unless there are unintended consequences that we do not currently anticipate, the Greek debt crisis should result in only short term volatility.

We view the fact that the Federal Reserve (“Fed”) is likely to raise rates as a positive. Our domestic economy is no longer in crisis! With expected record corporate earnings, many businesses flush with cash and carrying low levels of debt (for the most part), inflation low, and unemployment rates getting better with the most recent indication at 5.3% (although there is still a low level of participation), we believe the Fed should raise rates above zero percent. It is important to keep in mind that the fixed income market has already moved in anticipation of this. The 10-year Treasury, used as a benchmark for many mortgages, has moved from 1.9% at the start of the second quarter, to 2.3% on June 30th. This is still historically low and will probably move higher over the next few years. This should not materially impact the domestic economy in our opinion (it might help savers who will start to earn more than a nominal return on their cash investments) but it will hurt bond investors who have extended out maturities of their bond holdings (FLI fixed income portfolios have been purposely kept to shorter durations to avoid this). Prices of bonds with longer-term maturities will decline more than those with shorter-term maturities as interest rates go up. In our opinion, this could be fuel for the equity markets as burned bond investors may seek a liquid alternative in stocks, which are under owned by many retail and institutional investors. From a pure valuation standpoint, stocks remain cheap when compared to bonds based on an analysis of stocks earnings yield versus the yields of bonds. (Just compare the bond yield of the average corporate BBB+ bond to the probable growing earnings yield of the S&P 500 Index.) Bonds look very expensive on this basis and stocks look cheaper.

A restructuring of Puerto Rican bonds or the failure of insurance companies to make good on their insured Puerto Rican bonds could be disruptive to municipal bond markets. It also calls into question some of the fiscal issues confronting Puerto Rico that are festering in some of our states and local municipalities (such as unfunded pension liabilities). Accordingly, we focus on bond quality and purchase bonds with reasonable maturities for our clients.

On a global basis, we still have the European Central Bank in the early stages of its quantitative easing (bond buying) program which should modestly stimulate its economies. This assumes that Greece does not disrupt the economy and currency of the Eurozone. Additionally, China has just reduced its interest rates for the second time in the last few months. Meanwhile, its volatile stock market has declined 22% since the recent peak on June 12, 2015. Prior to that, it had increased 122% during the period from December 31, 2014 to June 12, 2015. This volatility is troubling. The fact that two large economies are trying to stimulate growth could be positive for many of the companies that we invest in. These central bank moves around the world should support a better level of global growth when coupled with improving economic activity in the U.S. Thus, in our opinion, we are not close to entering a recession. While we are encouraged by the progress in Europe and Asia, we still prefer the domestic equity market but have slightly increased our international allocation in certain FLI strategies while continuing to remain underweight.

Real estate markets are also prospering as both residential and business demand in the U.S. remains strong. Low interest rates, household formations at a robust level, employment growth, and wage increases are all helping residential housing appreciate. This helps confidence and bolsters consumer balance sheets. On the commercial front, the same low interest rates and business growth continue to support low cap rates/high valuations. The prospects of modestly higher interest rates could somewhat dampen this picture.

In summary, the investment environment has some real positives while facing at least three major “questions” (that we know of at this time), each of which could cause volatility and a possible market correction. Accordingly, since our mandate and mission is to first preserve our clients’ capital, we maintain a bias to our defensive basket. These strategies should offer some protection from the volatility that we expect from the problems in Greece, the uncertainty over the impact of the Fed finally raising rates, the debt crisis in Puerto Rico, and the ongoing conflicts in the Middle East with both the Iranian negotiation and the war against ISIS. At the same time, these strategies have the potential to appreciate once the volatility has subsided and the economic merits of each are realized.

Melding this quarter’s quote from Warren Buffett with last quarter’s quote from Daniel Kahneman, we see progress from an improving economy running head on into several “questions” that will give many investors pause. Buffett’s point is that this uncertainty (for thirty plus years we have called this the “wall of worry”) should not stop long-term investors from seeking out value, opportunity, and potential appreciation. We do not anticipate that these uncertainties will derail the improving economy or growth that we expect from the investments we have allocated our money to over the longer term. (Remember, we invest side by side with you.)

Our asset allocation recommendation remains pretty much the same. We are maintaining modest allocations to quality bonds with short- to medium-term maturities; we are continuing to recommend that clients overweight our defensive strategies; our commitment to traditional equity strategies is modestly underweighted; and where suitable, we are allocating some capital to a new mezzanine/mortgage lending investment strategy. This new strategy seeks to produce an above-average return from lending to real estate projects around the country and will result in a diversification of our current investments.

We see investment progress being made over the longer term. However, we most likely will have to weather some volatility from the current “questions” that are confronting us in the immediate future. We do not believe that sitting on the sidelines waiting for the “all clear” signal will make investment sense. As Buffett suggests, when everything seems rosy one will pay a very high price for stocks.

We are pleased to announce that Ebonie Hazle has joined the First Long Island Investors team as Assistant General Counsel. Among her other experience, Ebonie was an associate at Gibson, Dunn and Crutcher, LLP. She received her JD from Columbia University School of Law and a Bachelor of Arts from Harvard University. We will be sure to introduce you to Ebonie the next time you are in the office.

Please do not hesitate to call any of us on the investment committee should you have any questions. Also, by the way, enjoy the summer!

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

P.S. It looks like Greece and the European Union have a tentative agreement. However, this still might not be the last we hear of problems from Greece. Additionally, China continues to be very volatile.

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending July 30, 2015, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2015 by First Long Island Investors, LLC. All rights reserved.

On June 25, 2015, clients and friends of First Long Island Investors came together to learn more about cybersecurity. Robert DeStefano, Executive Vice President, and Chief Information Officer at Astoria Bank, and Bhavesh Chauhan, Security Solutions Engineer at Verizon, led a discussion on the information security landscape and provided ideas and strategies for reducing the impact a cyberattack could have on individuals and businesses.

From left, Bhavesh Chauhan, Ralph Palleschi, and Robert DeStefano.

Bob DeStefano led off the conversation with an overview of cybersecurity. Some of his points included:

- A cyber-security threat is any action that may result in unauthorized access to or manipulation/destruction of, the integrity, confidentiality, or availability of an information system

- The security landscape has changed dramatically over the past few years and continues to change. Newer and more sophisticated threats are availing themselves daily

- Completely preventing all cyber threats is next to impossible, but both individuals and organizations should focus on how to (a) minimize the impact of an attack (b) ensure they have the best identification and remediation possible and (c) respond quickly in the event of an attack. Having a firewall is not enough to protect yourself. Multiple layers and strategies of security control from different vendors should be combined to prevent and monitor potentially damaging breaches.

- The potential of a cyber-security threat needs to be taken seriously because it can significantly impact the reputation and financial position of a company or an individual

- Cybercrime is increasing due to the ability of cybercriminals to operate from countries where they risk little intervention from law enforcement, and cybercriminals are beginning to make substantial money for their efforts

- Recent studies estimate the average cost of a data breach to a major company/financial institution to be approximately 3.8 million dollars. This is up 8.5% from the previous year. This hard-dollar cost is in addition to the reputation risk and customer confidence risk that an organization faces

- A good cyber-security plan includes risk management and mitigating strategies including adequate resources and support from the board and executive management, development and implementation of cyber-security policies, use of multiple layers of security controls from different vendors, third party oversight, education and awareness of all employees, risk assessments and penetration tests, cyber-security insurance coverage, ensuring computer/mobile devices and preventative software stays updated, and having an incident response plan

Bhavesh Chauhan then shared with the group some highlights of Verizon’s 2015 Data Breach Investigation Report.

- The Data Breach Investigation Report is put together annually by Verizon to review the types of vulnerabilities that many companies are seeing and provide insight and perspective on how companies can best allocate resources and dollars in the prevention and response to cybercrime. The report brings together information from 70 contributing organizations and analyzes nearly eighty thousand security incidents across 61 countries for events happening in the 2014 calendar year

- One of the primary challenges of the security industry is that in 60% of cases, attackers are able to compromise an organization within minutes. Additionally, there is a wide gap between the time it takes a cybercriminal to compromise and organization and the time it takes a defender to detect a compromise. In 2014 this gap started to shrink, but it is still significantly wider than the information security community would consider acceptable.

- For two years in a row, more than two-thirds of incidents that comprise the Cyber-Espionage pattern have featured phishing. Even with the increased awareness of phishing, 23% of recipients open phishing messages and 11% click on the attachments. Of those who open the email, nearly 50% open the email and click on the phishing links within the first hour of receipt

- Software and hardware companies regularly issue patches and updates to fend off common vulnerabilities and exposures (CVEs). From the analysis, Verizon found that 99.9% of the vulnerabilities exploited in a cyber-attack were compromised more than one year after the CVE was published. Bhavesh reiterated the importance for both individuals and organizations to ensure that they update all of their devices (computers, tablets, mobile phones, etc.) with patches as soon as they become available

- Somewhat surprisingly to the information security community, mobile devices are not a preferred vector in data breaches. Only a negligible 0.03% out of tens of millions of mobile devices were infected with truly malicious exploits

- The most common types of cyber-attacks in 2014 were point of sale (POS) intrusions, crimeware, and cyber-espionage. In looking back over the last 10 years, the top three have changed, but overall there are still only 9 core intrusion types

- While there are a vast number of strategies organizations can use to protect themselves and their customers from cyber-attacks, being able to focus efforts is key. Organizations should use this report to see how their industry and companies of their size are being attacked and then build a plan that can most effectively protect them from attacks

- A copy of the report can be downloaded at the following link: http://www.verizonenterprise.com/DBIR/2015/

Bruce A. Siegel, Executive Vice President and General Counsel of First Long Island Investors, and his wife, Rachel were presented with the Gillin Family Humanitarian Award at the 17th Annual Crystal Ball benefiting the Diabetes Research Institute (DRI). The evening raised more than $520,000. Mr. Siegel has served on the DRI Foundation’s regional board since 2011 and is currently Co-chairman of the Northeast Board. He also serves on the National Board of Directors and the National Planned Giving Committee. A recap of the event is available by clicking here.

“One thing we have lost, that we had in the past, is a sense of progress, that things are getting better. There is a sense of volatility, but not of progress.”

Daniel Kahneman (Winner of the 2002 Nobel Memorial Prize in Economic Sciences)

The first quarter ended with a whoosh of volatility reflected in a second to last day gain of more than 200 points for the Dow, only to be followed by a loss of 200 points on the last day of the quarter. This sort of volatility permeated the entire quarter, and at the end of the period, the S&P 500 was ever so slightly higher while the Dow suffered a slight loss. International indices did somewhat better on average this quarter, but after underperforming the S&P 500 from January 1, 2008 through December 31, 2014, that is a welcome improvement.

Other markets also suffered from uncomfortable volatility. Oil was down another 10% (falling by more than 50% in the last nine months) while the yield on the 10-Year German Bund (government bond) suffered a drop of almost 60% (declining to a jaw dropping 18 bps). Currency markets also witnessed continued volatility with the Euro dropping to about €1.08 to the U.S. Dollar. Equity markets reached all-time highs while domestic interest rates stayed at very low levels. Unemployment continued to fall, although wage growth remained somewhat anemic. So, what does this all mean and is the volatility overshadowing economic progress?

First, in our opinion, volatility is being caused by the following:

- The inevitable increase in short-term interest rates by the Federal Reserve continues to be a source of constant speculation and thus volatility. However, an increase in rates will be slow and probably will not be disruptive to the economy or corporate earnings. It will signify that the U.S. economy has almost fully recovered from the great recession.

- The strengthening dollar is adversely impacting earnings for U.S.-domiciled companies with significant overseas operations. The speed with which the strengthening has occurred and its uncertain impact on earnings is contributing to volatility but does not reflect the strength of operations in local currencies.

- The precipitous drop in oil and natural gas prices has impacted the earnings projections of oil and gas-related companies. It has also led to layoffs and reduced exploration expenditures in a number of companies. This will have a somewhat negative effect on this sector of the economy. This drop has yet to lead to increased spending by consumers.

- The terrorist wars in Syria, Iraq, Yemen, and Libya as well as the murders of Christians in parts of Africa coupled with the ongoing negotiations with Iran, which is sponsoring terror throughout the Middle-East, is causing serious uncertainty and domestic political infighting. The headlines of atrocities are affecting the attitudes of retail investors and causing volatility.

- The impact of Europe’s attempt at stemming possible deflation while stimulating the Eurozone through its version of quantitative easing, utilizing bond purchases, has yet to be understood by investors. At the same time, Europe’s old economic nemesis, Greece, has once again changed its political leader and is on the cusp of leaving the European Union.

- Many pundits are worried about stock market valuations and, coupled with slowing earnings growth and a downturn in growth in China, is leading to concerns about virtually all markets.

- In Washington, the newly elected Republican majority in both Houses of Congress has not relieved the paralysis that has plagued Washington since President Obama took office. So far, the U.S. has not implemented strong fiscal policy to complement our monetary policy, which has been on steroids, leaving us with a continuation of financial repression and little happiness for the average saver and less than optimal economic growth.

- After six years of a rising stock market, there is skepticism whether equity markets can continue rising. Thus, any bad news, economic or geopolitical, gives rise to fears that the long-awaited correction (or worse, a bear market) is upon us. This is causing volatility.

All of the above gives one cause for concern and certainly explains the current volatility, but one would need to have blinders on to not realize the progress that is begrudgingly being made:

- The U.S. economy is growing slowly and does not appear to be facing recession anytime soon. Slow GDP growth of 1.5 to 2.5 percent per year, which also reduces inflation risks, seems to be what is in store for us given the lack of fiscal policy initiatives and the strong dollar slowing our exports. Slow growth, low inflation, and continued low interest rates are a sound formula for stock, real estate, and private equity markets to continue to perform reasonably well.

- Employment continues to grow at a moderate pace. Wage growth, especially for the middle class, is still somewhat anemic, but there are signs of growth at a pace better than inflation. Additionally, many large employers are unilaterally raising minimum salaries paid and several states have passed legislation to raise their state’s minimum wages. This is progress, any way you slice it, and will support economic growth.

- The precipitous drop in gasoline and heating oil prices is a big benefit to virtually all consumers and many businesses. This should more than offset the pain inflicted on oil-related companies. However, up until now there has been very little to no corresponding increase in consumer spending. It is our understanding from our consulting economists that consumer spending increases lag reduced oil prices by at least six months. Thus, we believe there will be a pickup in consumer spending later this year. This will contribute to economic growth and should there be a nuclear arms deal with Iran, more oil supply will come to market down the road as economic sanctions against Iran are lifted. (We have little faith in the Iranians adhering to any deal so this increase in supply might be short lived.)

- There continues to be monetary easing in Europe, China, and Japan, while in the U.S. we expect some liftoff to short-term interest rates in late summer or early fall. Those policies reflect the fight against deflation, stimulation of economic growth, and the recognition that economic conditions in the U.S. have improved. We would expect a rise in interest rates to increase consumer confidence and, if consumers are more optimistic, that should lead to aggregate demand that would be positive for the businesses and real estate we invest in.

- Equity values, in our opinion, remain fair and do not resemble the bubble markets of 2000 and 2007. One could argue that some regions of the country are facing unreasonably high real estate valuations, and smart investors are seeking better opportunities in other areas. We also believe that stronger demand for office and residential housing is yielding higher prices. Low interest rates remain a driving force in somewhat higher stock market valuations and support higher real estate values.

- Bond valuations seem very stretched and that is reflected in unusually low yields. As of March 31, 2015 the 10-year Treasury was at 1.9% and a triple-A 5-year municipal yielded 1.3%. A rise in the short-term rate target from the Federal Reserve may gradually increase those rates, but not by much in our opinion. Our view is that rates will slowly increase. Therefore, low rates might be here for a while unless inflation picks up and that does not seem likely.

So, we believe that volatility is based more on speculation and anticipation, not on well-founded information or Federal Reserve policy at this point.

Investors’ concern about many of the issues outlined above, in and of itself, is a source of volatility. At the same time, the improvement of corporate balance sheets since 2007, slow growth, low interest rates, accommodative central bank policy, reasonable stock market valuations, cheap oil, and better employment globally seems to be what will carry the day on a longer-term basis in our opinion.

In considering asset allocations for our clients, we remain tilted towards our defensive strategies, where a significant part of clients’ asset allocations should be directed. Defensive strategies seek to reduce the volatility of our investments and help clients weather equity market volatility while still seeking to achieve reasonable appreciation and income. Some bond allocation remains necessary, but with shorter duration. In pursuing real estate-oriented investments, we continue to look for some current return as well as potential appreciation. In all cases, valuation in each asset class is critical. In equity-oriented strategies we continue to focus on high active share (concentrated portfolios) given the slower global growth and the increase in volatility. We never forget that preservation of capital is paramount. This is especially the case in a world where there are many geopolitical and economic factors impacting our investments.

At the end of the day, there are legitimate issues causing volatility but as our quote from a Nobel laureate for economic sciences suggests, the progress being made is not being given the attention it deserves. We believe this will prove to be an opportunity and we expect that the slow but persistent progress, despite the volatility, will make 2015 a positive year for our clients.

Please contact any member of our investment team with any questions you might have or to discuss your asset allocation or any other wealth management needs you may have.

Best Regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results.

Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending April 23, 2015, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC.

Copyright © 2015 by First Long Island Investors, LLC. All rights reserved.