“Change is the law of life. And those who look only to the past or present are certain to miss the future.” – John F. Kennedy

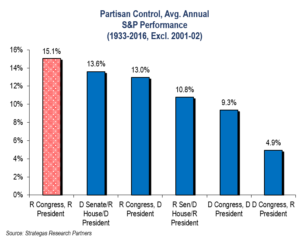

Change typically is not necessarily accepted well in the short term by financial markets. However, the unexpected (for most) election of President-elect Donald J. Trump and the control of both houses by Republicans represents significant change from what had been expected by many to be a Presidential win for Hillary Clinton and the potential that the Senate would flip to Democrat control. The unexpected, like Brexit, occurred and President-elect Trump will be accompanied by both a Republican House and Senate. Initially, domestic financial markets responded well. By the way, historically when the presidency and both houses of Congress have been controlled by Republicans, equity markets have done well (this is a historical guide and not a guaranty):

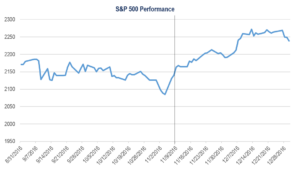

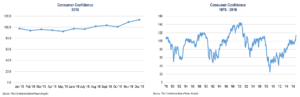

Stock market performance and consumer confidence jumped right after the election anticipating tax reform, less regulation, and the repeal or major modification of the Affordable Care Act. Notably, consumer confidence is finally at close to pre-“decession” levels.

The knee jerk reaction was a very positive one. However, we believe this was driven by certain campaign promises plus the potential to reverse aspects of the Obama administration’s policies that many believe have held our economy somewhat hostage. Specifically the following promises made could provide a significantly changed domestic economic environment worthy of the current optimism:

- Major corporate tax reform with an emphasis on reducing the corporate tax rate to make the U.S. more competitive globally, along with encouraging domestic business investment should lead to productivity gains and economic expansion at a faster pace than the eight Obama years. This private sector investment has been missing and is needed.

- Individual tax reform to simplify the tax code should deliver some economic benefit to the middle class while eliminating certain loopholes for the well-to-do, which will keep the cost of reform reasonable.

- Investment in the country’s infrastructure is long overdue. This can be paid for in part through repatriation legislation that will impose a tax on corporate funds brought back from overseas. This lower rate of tax (than what has been paid previously on earnings repatriated from overseas) can be used to fund an infrastructure program, mitigating some of the cost. The balance of the infrastructure program funding will require some borrowing and an increase in the national debt.

- A reduction in the number and scope of countless unnecessary (in our opinion) regulations at every level of business, both big and small should reverse conditions that have stifled business growth and in turn lead to better paying jobs. From the financial sector to everyday small businesses, companies face overly burdensome regulations that are costly and time consuming that need to be lifted or reduced. This will stimulate growth from a more confident private sector in our opinion.

- Modification/repeal of the Affordable Care Act should recognize its costly deficiencies but maintain certain beneficial aspects of the plan. Insuring more Americans and providing for those with pre-existing conditions is absolutely necessary. However, the cost to do such must be controlled through greater efficiency, larger pools of healthy participants, increased competition, and the reduction of Medicare/ Medicaid fraud. Additionally, expansion of health savings accounts or similar vehicles can also help.

- Border control is a must to stem the tide of illegal immigrants and stop the destructive pathway for illegal/harmful drugs. This does not mean the mass deportation of people living here peacefully but without proper documentation. It means stem the illegal tide, rid the country of violent illegals, and create a better system for peaceful, constructive illegals to remain but not with guaranteed citizenship.

- The proper use of Congress in a bipartisan way is necessary so that the overuse of executive action no longer takes the place of legislation. We are not suggesting that the legislative paralysis caused by partisan politics did not lead to some of the executive actions. It probably did. This has to change for the good of all Americans.

Now, the above will take time, perhaps a lot of time, and a lot of negotiating if there is going to be some bipartisanship and therein lies the potential for disappointment and volatility in the equity markets. President Obama learned the hard way that there really were no projects for his fiscal stimulus program. President-elect Trump must be patient for well thought out national and local infrastructure projects, should spending be approved. Cooperation at all levels of government and partnership with the private sector is essential to plan and implement this much needed rebuild of our roads, trains, bridges, airports, and other aspects of our infrastructure. This will promote an expansion of better paying jobs, in our opinion.

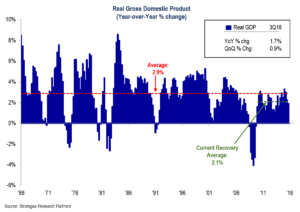

If the tax reform and infrastructure can be coupled with repatriation and some deficit spending financed in part with debt, our economy could grow at something more than the current anemic pace of the last eight years. The following chart shows the slow recent growth despite the benefit of extremely low interest rates. Although enabled by a Federal Reserve operating on steroids, global growth supported by low interest rates as well as monetary stimuli without fiscal growth initiatives, was below that of other recoveries:

Although the above lackluster domestic growth enabled the economy to avoid recession since 2008 –2009, middle class wages in the U.S. have barely made any progress and some have been further compromised by burdens caused by the Affordable Care Act. Thus, more rapid growth as well as tax reform is needed to spur on consumers (about 70% of the domestic economy) and encourage businesses to invest in order to drive productivity and economic growth. If this does not happen in the early stages of this new administration, the result could be a very disappointed equity market.

Meanwhile, while we wait for some magic to happen in Washington, our job is to assess the valuation and prospects for the investments we make for our clients. This is complicated by a world in some turmoil. The Middle East is ablaze; Russia is acting in a predatory fashion in some areas outside their borders; China is arming all seven of the artificial islands it has built in the South China Sea; and North Korea’s dictator banned Christmas and continues to develop an aggressive nuclear capability. Special mention must be given to ISIS, which continues to plague the world with its special breed of terror aimed at Christians, Jews, and some moderate Muslims whose societies they view as infidels.

As the world struggles with cyber-attacks; half a million killed in Syria; war and massacres plaguing Yemen, Libya, and the Sudan; terrorist attacks in Germany, France, Turkey and the U.S.; the world community, as represented by the inept UN, found the time to condemn some settlements being built in disputed territories in the democratic country of Israel (its favorite punching bag).

Now, back to the foundation of what we do— investing in a prudent way driven by diversified opportunity based on reasonable valuation, quality, and always with a view towards preservation of capital. In 2016 we believe clients did reasonably well as all of our traditional equity and defensive strategies achieved positive results. In our private investments we believe progress was made in all but one of several different investment vehicles (and that one exception we believe continues to have significant upside although it continues to take more time than we envisioned). Our leading strategy in 2016, Dividend Growth, netted more than 12% on average despite being labeled defensive. Its value and dividend growth orientation outpaced growth strategies, which had been superior performers in 2014 and 2015.

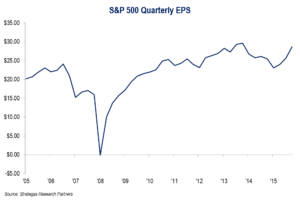

For 2017, equity markets in general appear to be fairly to slightly more than fairly valued while waiting for earnings growth from the average company to reaccelerate should the general economy pickup. This, in our view, depends on the success of “Trumpenomics.” S&P earnings had stalled until the last two quarters where a slight pickup was registered/is expected. (Third quarter grew by about 3% and fourth quarter is projected to do about the same.)

As the chart above shows, earnings growth stalled, declined a bit, and has started to grow again. As a result, price earnings multiples rose to 19x on trailing twelve month earnings and 16.9x on the consensus projected earnings for 2017. This is not terribly worrisome unless you believe a recession is imminent. We do not! The yield curve for bonds is not inverted, which when it occurs historically has been a sign of a forthcoming recession. With the Federal Reserve on the move with a forecasted three interest rate increases in 2017, one can assume that the economy and inflation are picking up somewhat along with decent employment growth. One can also make the case that those bond investors who extended maturities to garner more yield are in for some paper losses in their portfolios. This could lead to sales of bonds and bond funds by investors and a flight to equities, as occurred towards the end of 2016. We continue to be cautious about bond investing in general and have an under-weight allocation to fixed income for our clients.

Our view going forward is that it is not an easy environment to invest in and one must be cautiously opportunistic, as well as realistic, in terms of what returns to expect. I have already stated that we are under-weighting bonds because as rates increase, even slowly, longer maturity bond portfolios will not earn much if anything with the ten-year treasury at 2.5% pretax, and five-year triple A munis yielding about 1.8%. These figures are pre-fee and are not very attractive versus inflation targeted by the Fed at about 2%. Of course, if you believe that we are facing a recession or some systemic disruption, then a bond allocation should provide an anchor. Even so, we would still underweight this allocation for the long-term investor seeking better risk-adjusted returns as bonds may keep pace with inflation at best from current levels.

Given the uncertainty with the new President-elect as well as a Republican House and Senate, coupled with global unrest, we remain cautious, selective, and concentrated in the vast majority of client portfolios. This fits nicely with our three defensive strategies, which we believe provide better upside than bonds and cash over the longer term and less volatility than traditional equity markets. For example, FLI Dividend Growth is concentrated in stocks that have above average yields and consistently growing dividends (average of 23 consecutive years). We believe that concentrated portfolios will have a better chance of outperforming the averages in what could be a more volatile environment driven by changing tax policy, changes to the Affordable Care Act, and immigration policy implementation as well as possible disruptions from geopolitical events. Also, we must not leave out possible economic disruption and resulting volatility from President-elect Trump’s stance on global trade as well as possible punitive tariffs. This is a wild card where differences exist between the President-elect and both sides of the aisle in Congress.

We remain cautiously constructive on real estate as the economy improves and we will continue to seek out appropriate investment opportunities in this space. However caution is the operative word as the real estate community has to deal with both increasing interest rates (although still very low from a historical standpoint) and new supply coming to market as developers have taken advantage of low interest rates. In areas of private equity, we continue to look for high-quality opportunities. We have no opinion on commodities except that oil should be less volatile and probably be range bound between $45 and $65 per barrel. It is not an area we are comfortable in given its volatility, speculative appeal, and difficulty in evaluating based on fundamentals.

In summary, our view for 2017 is cautious optimism given the espoused economic agenda of the new administration. In particular, we believe that tax reform, infrastructure, and less regulation will unharness the productive, creative, and entrepreneurial characteristics of Americans and American business. However, the obvious lack of political experience by a group of extremely successful business people and former distinguished military leaders making up much of President-elect Trump’s cabinet, and his lack of political experience, will cause fits and starts as well as possible volatility. This, coupled with a Fed on the move with higher interest rates and a difficult geopolitical environment, leads us to underweight fixed income, overweight our three defensive strategies, somewhat underweight our traditional equity strategies, and look opportunistically at private investments that have superior return potential despite higher risk and less liquidity than our other strategies. Over the long term, fundamentals ALWAYS matter in each asset class we invest in. Our disciplined long-term approach in evaluating fundamentals is our beacon in protecting your capital and providing you with the opportunity for reasonable long-term appreciation. We believe opportunity exists in our defensive, traditional, and private investments to reap solid returns over the long term. However, selectivity and concentration are likely to be important going forward.

The above recommendations are what we suggest to our clients on a quarterly basis as we review their asset allocations. Our advice was pretty much the same last year and it worked out reasonably well despite significant volatility in the first quarter. One had to have a diversified asset allocation in 2016 as demonstrated with value equities coming into vogue, while some great growth companies lagged despite superior earnings growth for the most part. Do not let your emotions or “likes” dictate your asset allocation. Let us help guide your allocation to insure exposure to areas that, over time, have rewarded long-term prudent investors with a quality bias. Finally, as JFK’s quote suggests, change is a necessary ingredient to a successful future. We believe the political stage is now set to encourage economic change leading to better growth, entrepreneurialism, and private sector confidence in America. However, there will be bumps along the way.

We wish you all a very happy and healthy New Year. We are here to help you with your wealth management needs beyond the investment of your liquid funds. Please call upon any member of our investment team to discuss our perspective in greater detail, or if you would like to discuss your asset allocation. Additionally, we will be hosting a web seminar on February 8th at 2 p.m., EST to review our outlook for 2017 and take questions from participants. We hope you will dial in.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending January 13, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.

First Long Island Investors, LLC is pleased to announce that Brian Gamble, Vice President, Wealth Management, and Drew Wray, Assistant Vice President, Wealth Management, have both obtained their CERTIFIED FINANCIAL PLANNERTM certification.

Brian has been part of the First Long Island Investors team for over 10 years. He is a member of the investment committee and is a member of sub-committees for many of our investment strategies. Brian is responsible for identifying and vetting potential investments and the ongoing evaluation of current investments/holdings. Brian is part of the team which develops initial and ongoing asset allocation recommendations for clients.

Drew joined First Long Island Investors in 2015. His responsibilities at the firm include research of prospective investments, ongoing evaluation of existing positions, and trading. Drew is also a member of the investment committee as well as the sub-committees for several FLI strategies. Drew has worked in the wealth management industry for four years and held an analyst role at Morgan Stanley prior to joining our team.

“We are excited to add this new set of tools and education to our team, as we develop comprehensive wealth management solutions for our clients,” said Chairman, CEO and CIO, Robert D. Rosenthal. “The education Brian and Drew have received complements their other work at FLI and brings to the table a new set of ideas and strategies for developing a customized approach for each of our clients based on their situation, risk tolerance, and goals.”

The CFP® marks identify those individuals who have met the rigorous experience and ethical requirements, have successfully completed financial planning coursework, and have passed the CFP® Certification Examination covering the following areas: the financial planning process, risk management, investments, tax planning and management, retirement and employee benefits, and estate planning. CFP® certificants also agree to meet ongoing continuing education requirements and to uphold the Certified Financial Planner Board of Standards Inc.’s Code of Ethics and Professional Responsibility, Rules of Conduct, and Financial Planning Practice Standards.

With less than a week to go before Election Day, First Long Island Investors invited Dr. Meena Bose, Executive Dean for Public Policy and Public Service Programs in Hofstra University’s Peter S. Kalikow School of Government, Public Policy, and International Affairs, and Director of Hofstra’s Peter S. Kalikow Center for the Study of the American Presidency, to speak with clients and friends of the firm about the upcoming election.

Robert D. Rosenthal and Meena Bose in front of the electoral map

Dr. Bose began her discussion with where the Presidential race is today (as of November 2, 2016). She reminded the group that while the popular vote is important, it is the Electoral College that determines our next president. 270 electoral votes are needed to win the election – this map explains where the electoral votes are currently and which states are still considered swing states. After the release of the controversial Access Hollywood tape on October 7th, it appeared as if Hillary Clinton was clearly going to win, but the race has been tightening over the past few days as more information is hitting the media (Wikileaks, potential new FBI investigation into Hillary Clinton’s emails). Dr. Bose still believes that Clinton will win in the end. From looking at the above electoral map, you can see that all she has to do is win one or two swing states, while Donald Trump would need to almost run the table.

Dr. Bose discussed campaign strategy and touched on the differences between the Clinton and Trump campaigns as well as shared her views as to how each approach has helped or harmed their chances.

- The Clinton campaign has been mounting a strong get out the vote effort, as voter turnout for the Democrats may be an issue.

- Trump is trying to win Michigan (which she believes is out of reach) when he should be concentrating on the closer swing states such as Florida and North Carolina.

- Trump is good at coming up with slogans and statements (i.e. “Make America Great Again”, “Make America Safe Again”, “Make America Work Again”) that sum up people’s frustration with the political system, but he has little party support or public endorsements.

- Hillary is the establishment candidate with bountiful party support and endorsements, although the Democratic National Committee has come under fire for giving her more support than Sanders during the primaries.

- One of Trump’s mistakes is that he has not been able to keep the message positive. He attacks Hillary without ending on a positive note describing how he would fix problems. Bose showed this campaign ad from Bill Clinton’s 1992 campaign where he begins with a negative against Bush and then pivots to the positive and how he would make things better.

- This is a challenging election, as both candidates have their flaws and much of the country sees issues with them both. Donald Trump’s unfavorable rating is currently at 62% and Hillary Clinton’s is at 56%. These are the highest of presidential candidates when you look historically. Additionally, a recent poll showed that only 11% of voters think that Hillary Clinton is trustworthy.

A portion of the discussion focused on the primary races that led to a Clinton vs. Trump general election.

- If it had not been for the super delegates, Hillary Clinton would have had a much more difficult time securing the nomination over Bernie Sanders. This map shows how close that race was. Once the nomination was secured, the leadership in the Democratic Party focused on uniting the base, starting with Bernie Sanders at the convention.

- On the Republican side, the contest began with 17 candidates and Donald Trump ultimately had the most primary votes in history, as seen on this map. As he transitioned from the primaries to the general election, he has struggled with gaining broader support, as it is difficult without endorsements from party elites, such as previous Republican presidential candidates and presidents. Additionally, he is not getting the crossover voters that Reagan did.

During the Q&A Dr. Bose was asked if Hillary Clinton does become president, how will she move forward given potential investigations around her email server and/or the Clinton Foundation. She shared that we should expect a Hillary Clinton presidency will come with it scandal and controversy, much in the same way Bill Clinton’s presidency had. The focus on her email server situation will make it difficult for her to govern. Hopefully the country can put the past in the past, and focus on the future.

Dr. Bose was also asked if she felt that the country needed a new political party, given that the current Democratic Party is leaning so far to the left and the current Republican Party is so leaning so far to the right. She does not think a new, third party is likely, as one has never garnered significant support, due to the structure of the American political system (plurality voting and winner-take-all elections), but she agreed that we need a “new” party. She shared that it is rumored that if the Republicans lose this election, they will clean house and work to redefine the party so that they can come back very strongly in 2020.

“Investing is the intersection of economics and psychology”

Seth Klarman (famous investor)

Despite significant uncertainty during the third quarter, most equity markets prospered while bond markets were mixed with corporates appreciating and municipals declining slightly. Commodities (gold and oil) were flat to slightly lower and residential real estate seemed to continue its upward trajectory in many markets. Yet investor uncertainty remains centered around what the Fed might do at the end of the year and beyond; who will win the election between two contentious and disliked Presidential candidates; will Italy (after Great Britain) be the next to leave the Eurozone (vote in December); can corporate earnings and the general domestic economy reaccelerate in the last months of the year; are we facing an imminent recession; and what is a prudent path for the long-term investor?

Our quote, from the very successful investor Seth Klarman, gets to the crux of the dilemma facing our clients, especially after a positive quarter for all of our equity strategies (both defensive and traditional). Equity markets are near record highs while the domestic economy muddles along making many stocks seem not cheap and some outright expensive. High-quality bonds, including the 10-year Treasury and the 10-year triple A municipal, are still yielding near record lows and do not seem to be very appealing, especially given their negative returns after taxes and inflation. Additionally, cash is providing horrible returns (peanuts) at this point and is not the right place for a significant portion of assets unless you think we are facing an imminent recession (we do not) or some exogenous event that will send markets plummeting. So, we need to look at both the economics, today and in the foreseeable future, and the fear, which seems to be in everyone’s mind that we are facing something bad given the uncertainties mentioned above.

The current economy is best characterized by the following positive factors:

- Growing employment (average of more than 150,000 new jobs per month)

- Modest growth of real gross domestic product somewhere between 1% and 2%, annualized

- Stabilization in oil pricing in the $45 bbl to $50 bbl range

- Slightly lower corporate earnings overall, impacted by lower earnings from oil companies; non-oil-related companies are growing slightly and could benefit in the fourth quarter from a more stable dollar

- Auto sales continuing at a high rate

- Home sales seeing an annual increase in price of about 5% for the last year

- Interest rates remaining near historic record lows

- Modest growth in international economies, as a whole, with China showing stable growth of about 6% to 7% (if you believe the numbers)

- Domestic banks, on balance, seeming to be in strong financial shape based on the results of rigorous federal stress tests

However, from a negative economic standpoint the following are weighing on us:

- Productivity is low

- Business investment in plant and equipment is weak

- Our national debt is nearly twenty trillion dollars and growing

- Food stamp usage continues to grow

- The struggling middle class is facing higher medical insurance costs from the Affordable Care Act

- Equity markets are trading at relatively high levels to earnings

- This bull market in equities has lasted a long time (7+ years) and fund flows have been out of equities (despite rising markets)

- Terror and the war torn region of the Middle East weigh on investors’ minds and are exacting a tax (both human and otherwise) on the developed world

The above positives and negatives bring to the surface the strong psychological forces of both fear and greed. Many fear markets will decline in the short term (they have been wrong up until now). Selling out and holding cash or bonds as a safety net will provide meager to negative returns after inflation. What if equity markets continue to climb the wall of worry and make reasonable gains (the average investor historically gets this timing wrong) if slow growth and the low interest rate environment persists? Our analysis must consider how we deal with a not terrible domestic economy while channeling our fear and greed into a rational investment strategy. I will use a quote by Robert Allen (a well-known investor) to frame the issue:

“How many millionaires do you know who have become wealthy by investing in savings accounts?”

If you are already very wealthy then you could preserve your wealth through savings accounts, however you would lose value after inflation and not earn a reasonable return on which you can live. So, that alone makes no sense to us especially if you are living on income from your assets.

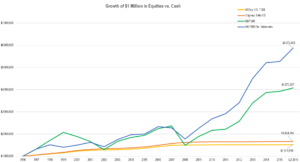

We offer the following chart to highlight how, over long periods of time, having an exposure to both traditional and defensive equities (e.g. – those bearing growing dividends) have rewarded the patient and battle-weary investor who can endure the periodic pain of equity market downturns (that in some cases can last a year or longer) over those with assets just sitting in cash and cash equivalents:

Being a long-term investor with an allocation to equities paid off in a big way if you were able to withstand the periodic severe downturns over the past twenty years. We chose the last twenty years because that period included the dramatic downturn from the undoing of the tech bubble in 2001 and 2002 and also reflected the horrible “decession” of 2008. The comparison has also been aided by the horrendously low interest rates of the past eight years as we have endured the financial repression of a Federal Reserve operating on steroids, as Congress could not provide any pro-growth initiatives. The period we have chosen is reasonable in addressing the emotions of fear and greed as investors. True it is a long period of time, however Americans today live into their 80’s and 90’s. This is especially the case for most of our clients who have access to the best medical technology, medication, and medical facilities. We should all think long term by having some allocation to both traditional and defensive equities. Of course history is no guaranty for the future, but it certainly provides us with some direction.

The Intersection of Economics and Psychology – What do we do?

Being a long-term investor with an allocation to equities has been a smart thing to do in the past. We at FLI believe that our advice to have a significant defensive equity allocation still makes sense and perhaps even more sense given the economic negatives we have outlined. Cash or its equivalents are a horrible returning asset class, although it can provide comfort to help you sleep at night during these uncertain times. Therefore, we recommend that you determine the amount of cash you need to be able to sleep at night and set it aside. Then permit us to craft an asset allocation that recognizes today’s uncertainty but also allocates a portion of your liquid assets to asset classes that should conservatively grow your wealth over long periods of time, with a bias to quality and what we perceive to be of lower risk.

The prudent asset allocation we advise our clients to have should help them balance their emotions of fear and greed. Keeping those in balance should provide not only a return of capital but a return on capital over the long term. This is necessary to battle the recently higher tax burden we face, today’s financial repression of very low interest rates, and the creeping inflation that reduces purchasing power.

As we approach the end of the year with much uncertainty, we believe with certainty that longer-term investors will benefit from an asset allocation that includes some risk assets (including traditional equities) with a bias to our defensive strategies that have delivered solid returns while providing some shelter from the downturns that we are bound to face. Never bet against entrepreneurial and innovative America over the long term; an America that is still the best democracy in the world, irrespective of the current political nonsense that only serves to make us underachieve from what our national capabilities are. Perhaps the next Administration and Congress will get it right.

We would also like to let you know that two of our younger investment professionals, Brian Gamble, Vice President, and Drew Wray, Assistant Vice President, have each recently obtained their CERTIFIED FINANCIAL PLANNERTMi certification. The rigorous financial education that goes into achieving and maintaining this designation will help them and FLI provide in-depth wealth management solutions to our clients. We congratulate them on this achievement and look forward to their greater interaction with, and service to, our clients.

As we approach the end of the year, we want to wish all of our clients and the professional network we work with, a joyous and safe holiday season. Please call upon us with any asset allocation and wealth management issues or questions you might have. Year-end is always a time to reflect on asset allocations, passing assets to the next generation in a tax effective manner, and considering some possibly tax-efficient philanthropic bequests. Let us help you.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

Disclosures, Important Information

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal as of September 30, 2016, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.

i Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Ideas and Considerations for Passing Wealth to the Next Generation Before the IRS Makes a Change

One of the biggest questions that our clients frequently ask us is “How can we pass on our family’s wealth to our children, and minimize the portion that is lost to estate and gift taxes?” At First Long Island Investors, we have worked with many clients and their outside professionals to answer that question, and we have developed different and creative ways to reduce the estate tax burden so that more wealth is passed on to the next generation. Valuation discounts, one of many estate planning strategies that we have successfully implemented for clients are being threatened by proposed new government regulations. Now is the time to consider if this strategy is right for you and to take action before year-end.

Many wealthy taxpayers have contributed real estate or a family business into a family controlled entity (e.g. a family limited partnership), and have taken advantage of these available (and legal) discounts, to reduce the gift tax value of the interests in the entities that have been transferred to the next generation. The valuation discounts are based on the lack of control and illiquidity of interests in these family controlled entities, which are caused by restrictions that are built into the shareholder or partnership agreements.

Here is an example of how discounts can translate into real tax savings. A husband and wife have a $15 million estate which includes $5 million of real estate. The couple contributes the real estate to a family limited partnership (“FLP”) and then gifts a 40% limited partnership interest to each of their two children, retaining a 19% limited partnership interest and a 1% general partnership interest for themselves. Since a limited partner cannot force the FLP to sell its interest in the real estate or even make any cash distributions to partners, the minority limited partnership interests in the FLP holding a non-controlling interest in the real estate are each worth less and should be valued accordingly. The 80% of limited partnership interests transferred to the children might be appraised, net of discounts, at $2.4 million, even though they hold real estate with an underlying value before discounts of $4 million. The discount has reduced the taxable estate by $1.6 million from this one transaction. This translates to approximately $640,000 of federal estate tax savings, not to mention the state tax benefits that may also be derived, if they live in New York or any other state that imposes an estate tax.

The IRS is working to prevent taxpayers from utilizing valuation discounts like these in the near future and has proposed regulations which would limit the ability of taxpayers to use valuation discounts on transferred interests in closely held family entities. Not all proposed regulations get adopted, but if these do get adopted they will be effective for all transfers made 30 or more days after the regulations are finalized.

The earliest that these new regulations could go into effect is December 31, 2016, so the time to take action is now. If you are considering making a gift of this type (utilizing a family entity and taking a discount), then you should try to get it done by December 31st. There are several steps to this process:

- First you would need to determine if you are subject to gift or estate taxes, so that you would benefit from any available valuation discounts. Typically, clients who expect to pay any gift or estate tax (all individuals with assets over $5.45 million or married couples with assets over $10.9 million (under current law), or anyone who has already made large (million dollar plus) lifetime gifts) would be a candidate for this type of gift.

- Second, you would need to be comfortable making a lifetime transfer of a portion of your wealth to your children (i.e. – you can live without the income that the gifted assets generate). This can be done in trust if you prefer not to make an unrestricted gift.

- Third, you would need to be able to contribute real estate or a family business to a family entity (if you haven’t already done so) and gift a portion of it to your children. You can also contribute marketable securities to this entity, but it is best if the entity does not contain only marketable securities. This gift can be discounted for tax reporting purposes, and that is the benefit of this structure.

Investors who meet the above criteria, should talk with their wealth management, legal and accounting professionals in evaluating this tax saving estate planning strategy.