Bruce A. Siegel, Executive Vice President and General Counsel at First Long Island Investors, works with clients to develop strategies that enable their estates to be structured in ways that will meet their investment, philanthropic, and legacy goals. He recently took his own advice in support of the Diabetes Research Institute Foundation. Bruce and his wife, Rachel, have been supporters of the Diabetes Research Institute and other diabetes causes since their daughter Sara was diagnosed with diabetes nearly twenty-eight years ago. Bruce established a Charitable Remainder Unitrust (CRUT) to benefit DRIF. “I have recommended CRUTs to clients, and thought ‘Hey, this would make sense for me!’ I get the diversification I want without having to pay a substantial tax today, and DRIF receives the assets remaining in the CRUT after my wife and I are no longer here. On top of that, we get a tax deduction, too” Bruce explained when recently interviewed by DRIF.

Charitable Remainder Unitrusts have many benefits including:

- Income for life which is often greater than the yield of the contributed assets

- A considerable tax deduction

- Avoid paying capital gains tax on long-term appreciated securities

- Make a significant gift to the charity of your choice

To read the complete interview and learn more about CRUTs, please click here

With the markets at all-time highs, many investors are wondering when the next recession will be and what the economic and investment landscape looks like going forward. To help address these concerns, First Long Island Investors invited Bob DeLucia, CEO and founder of Veritas Economic Analysis, LLC to join clients and friends of the firm for a breakfast seminar on June 21, 2017. Bob DeLucia is an independent consulting economist who held senior economist positions at Prudential Financial and CIGNA before starting his own firm.

Bob began the session by sharing his point of view on investor sentiment, the economy, and the markets.

- He believes we are living in a complex and confusing time in history and much of the confusion comes from misinformation provided by the media, politicians, and Wall Street.

- Historically the most important concerns for investors have been inflation and interest rates, but more recently the greatest concern involves gauging the timing of the next recession.

- We are entering the ninth consecutive year of an economic expansion cycle, which started in June of 2009. This is the third longest business expansion since 1850 with the longest being the 10-year expansion cycle of the 1990s. Given current underlying conditions, the current expansion should surpass that one.

- Business cycles approach maturity based on underlying conditions including high inflation, restrictive monetary policy, worsening credit conditions, and shortages of materials, capacity, and labor. Market conditions today are not consistent with those of an impending recession and Bob does not expect a recession to occur in 2017 or 2018, at a minimum. However, Bob is concerned with our economy being near full employment

- With the unemployment rate at a 16-year low, one would expect to see accelerating growth in wages. This has not yet happened, but will likely happen soon

- The best forward indicator of a recession is the slope of the yield curve. An inverted yield curve has never failed to predict a recession in the post-war era. Once inverted, the typical lead time to a recession is usually 12-15 months. Currently the yield curve has flattened somewhat, but is not close to being flat and will most likely steepen again before it becomes inverted.

- Bob reiterated that given all of these factors, there is a low probability of a recession occurring anytime in the next 18 months.

- Bob feels we are most likely in store for an acceleration of growth over the next year or so based on the assumptions of GDP growth of 2.5% to 3.0% over the next four quarters. His forecast also assumes an inflation rate of around 2% in 2017 and 2.5% in 2018 (which will be driven by wages), corporate profit growth of approximately 10-12% over the next four quarters, and continued low unemployment.

- Equity Market View:

- 3-6 months: It is nearly impossible to say what will happen because markets are unpredictable and random in the short-term.

- 12-18 months: We are currently in the sweet spot of the business cycle: Over the next 12 months, GDP growth should accelerate; corporate profits should increase at a rate in excess of 10%; inflation should remain below 2%; and the Federal Reserve will likely raise short-term rates at a moderate pace.

- Long-term: Bob expressed some long-term concern over the high valuations on earnings. Currently the price-earnings ratio on S&P 500 companies is 18, while the historical average is 16 to 16.5. Investors must keep in mind their entry point when gauging expected rates of return. Assets invested when valuations are high (like today) will earn less annually than those that were first invested when multiples were lower.

- Bond markets are currently in a bubble, especially government bonds. Too many people are comfortable in bonds and the price of all fixed-income assets are divorced from fundamental reality.

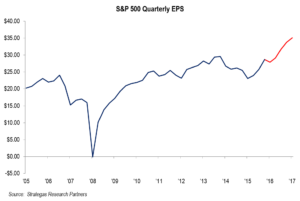

- Companies are reporting high earnings and high revenues which is good and should continue to help performance of their stocks.

After sharing his initial views, there was a question and answer session led by Robert D. Rosenthal, Chief Investment Officer of First Long Island Investors.

Question: The Fed has been talking about raising rates and reducing its balance sheet. How will this deleveraging affect markets?

Answer: The Fed has stated that it will continue to raise rates and so far the market has reacted positively to the increases. In addition to raising rates, the Fed will begin to shrink its inflated balance sheet of $4.5 trillion of government bonds. While the markets may have an initial negative knee-jerk reaction, the gradual and measured unwinding of the Fed’s bond holdings will have a significant impact on the markets overall. The current composition of the Fed is dovish and Fed officials do not want to take economic risks.

Question: How much does your forecast rely on the administration’s proposed tax reform and other pro-business agenda items being passed? How much of it is already baked into the market?

Answer: My models do not incorporate any pro-growth legislation from Congress. My assumption for future stock price gains are not based on price-earnings expansion but rather based on earnings per share growth. In my opinion there is a low likelihood of comprehensive tax reform being passed in the next year. Specific tax cuts, for both individuals and corporations, are likely within the next six to nine months.

Question Housing has been resilient. How is housing doing? How is it affecting the economy?

Answer: Underlying demand for housing is very strong while supply is and will continue to be constrained by limitations on land, labor, and building materials. House prices are rising at a 7% annual rate, and could increase by 5% per year over the next few years.

Question: What are your thoughts on active versus passive investing?

Answer: Right now many passive investors are doing well and performing better than active managers. Passive investing is buying the index and everything in that index, which includes companies with strong fundamentals as well as those with poor fundamentals. When the markets begin to reverse direction, companies with poor fundamentals will decline more rapidly and active managers who focus on fundamentals will have the advantage.

March 31, 2017

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

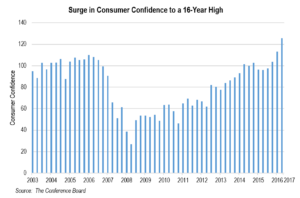

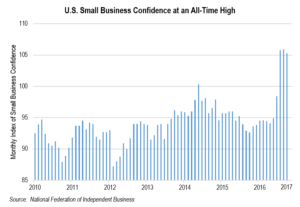

Virtually all domestic equity markets in the first quarter of the year reflected continued economic optimism that resulted post the contentious 2016 Presidential election. Small business and consumer confidence, important factors which support the markets in our opinion, continued to gather steam in the quarter as indicated in the charts below:

The domestic equity market, as measured by the S&P 500, recorded a 6.1% gain and reached an all-time high during the quarter. The NASDAQ also registered a new high with a gain of 10.1%. Other domestic equity indices did fairly well (mid and small-cap growth), and international indices showed some lift (the MSCI All-World ex US appreciated 7.9%). However, not all industry sectors followed suit with banks, transports, and energy companies giving back some gains since the November election. Small-cap value was actually the only domestic equity style that had a very slight decline (-0.1%). Oil continued to be range bound ($45-$55) ending the quarter at $50.54 per barrel. Not much of a spurt given the attempt by OPEC nations to cut production and raise prices. Housing was strong both from a sales price standpoint and the number of homes sold. Corporate earnings, represented by the S&P 500, grew in the fourth quarter of last year (4.9%) (we await results for the first quarter). Projections from our economic consultants indicate continued growth in S&P 500 earnings in this first quarter with perhaps a rise of as much as 10%.

If earnings continue to rise throughout the year (and we believe there is a good chance that will happen), valuations will become more reasonable which could bode well for equities. By the way, most major equity indices outperformed bonds. Quality bonds with shorter maturities continue to have very modest yields and in some cases yields below the current rate of inflation. Accordingly, we continue to underweight bonds for most clients.

Our defensive and traditional equity strategies (those in baskets two and three) all had strong first quarter results. Things sound and feel rather good. We at FLI remain with a defensive tilt and an overweight to our defensive strategies.

Our reasoning is based on a series of factors (some are concerning and some are constructive):

- As expected, the Federal Reserve raised rates by a quarter of one percent in March and is predicting an additional two raises this year. This is not necessarily a negative as we believe that the Fed intends to raise rates because it believes that economic conditions should improve, and rates remain historically low. However, the gradual rate increases and the slimming down of the Fed’s balance sheet could present some volatility later in the year.

- Politics in Washington remains contentious, and the Republican majority in both Houses has not resulted in any meaningful pro-growth legislation as of yet. The confidence gap in Washington (low approval ratings of both Congress and the President), felt by most Americans, remains in place. More on this later.

- Valuations are at the high side of reasonable, in our opinion. Nothing is cheap but better earnings and a possible corporate tax reduction would help to reduce the price-earnings multiple on the S&P 500 (currently projected at 18x 2017 earnings) and other indices.

- The yield curve is flattening somewhat, but still steep enough to promote healthy bank earnings in our opinion.

- North Korea and Syria remain geopolitical hot spots.

- Volatility remains unusually tranquil. There were only two days where the S&P 500 moved by 1% or more (in either direction) during the first quarter. Quite different from the first quarter of last year where volatility was much greater. We do not believe this will last.

- There is potential political instability in Europe. Populism is an issue.

- Trade policy out of Washington remains an unknown and a possible concern if we become more isolationist.

- Tax reform needs to become a reality in order to help boost GDP growth above the current sluggish 2% level.

- Employment remains strong.

- Banks and consumers are financially strong, for the most part.

The above economic and political factors paint a reasonable but cautious picture. We are in an environment where animal spirits are held back somewhat by continued political paralysis, but bearish sentiment is tempered by many positive economic factors. This presents a dilemma for investors who do not utilize a well formulated and prudent asset allocation. This yin and yang of investment sentiment is actually a positive as far as we are concerned. There is no unabashed optimism about anything right now. From a contrarian standpoint, that would suggest there is more good news to come.

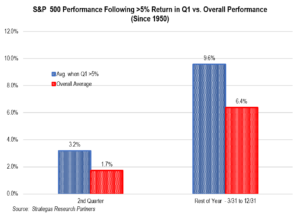

History is on our side based on the S&P 500 having just recorded a strong first quarter of 2017 with a return of 6.1%.

As the chart above indicates, a robust first quarter is historically followed by stock market happiness during the rest of the year. At least that has been the case over the past 66 years.

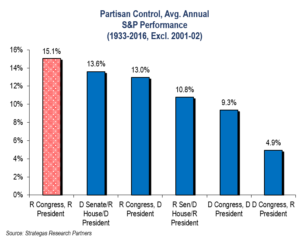

Another chart which gives cause for optimism is this political snapshot of stock market history:

Although we are students (disciples) of history, we know it is only a guide and not a guaranty. We need to see fiscal growth and reform initiatives take the baton from the monetary policy we have been relying on over the past eight years. That will require something better than we have seen in the last sixty-plus days out of Washington. The animus from the November election unfortunately continues. The leadership on both sides have yet to act in a bipartisan manner. This behavior is not in the best interests of America. Only time will tell if this changes. Meanwhile, we must invest prudently and rely on fundamentals to give us the best opportunity for long-term appreciation.

As Warren Buffett recommends in our quote of the quarter, we believe, for the most part, that we are paying a “fair price” for really good companies. Those companies that are really good but sell at prices we deem too high, we will not purchase, but we have little fear in owning really good companies that are fairly priced. Even with market setbacks, they should grow into their own over time especially as we and others believe that corporate earnings will continue to grow. The same holds true with other asset classes that we invest in. Our real-estate oriented investments are also made with a view towards quality (location) and realistic valuations. This is especially important when interest rates could trend higher. If rates were to ratchet up, this might impact real-estate valuations. It is unclear if the Fed will raise interest rates another two or three times this year. It will be data dependent and much will depend on what happens in Washington. The same holds true with art and other collectibles. As the cost of borrowing gets higher, and if economic growth remains anemic, quality and price has and will continue to matter.

As advisors to investors (including ourselves as we invest side by side with clients), we are mindful of the cumulative gains we have made over the past eight years. Fairly assessing the economic landscape and current valuations are critical to our advice. Reality has to pervade our thinking even if we tend to be cautious. Although we do not see a recession occurring in the near future, our defensive tilt results from some uncertainty about the pace of domestic and global growth. Adding to this is the business as usual lack of bipartisan cooperation in Washington, D.C. However, we remain bullish on America over the long term. Accordingly, we remain committed to an asset allocation that should give us returns that exceed inflation and taxes. Our portfolios in various asset classes are typically concentrated. We generally look for the best companies that are reasonably priced, the best investment managers that we can partner with, and the best hard assets that we can find of quality and fair valuation. American business is great at innovating while Americans are a hearty and productive society that does not permit temporary disappointments to become permanent set-backs.

As Warren Buffett stated in Berkshire Hathaway’s most recent Annual Report: “This economic creation will deliver increasing wealth to our progeny far into the future. Yes, the build-up of wealth will be interrupted for short periods from time to time. It will not, however, be stopped. I’ll repeat what I’ve both said in the past and expect to say in future years: Babies born in America today are the luckiest crop in history.”

We agree with Mr. Buffett. Never bet against America. Despite political bickering and geopolitical issues (all of which we have lived through before, time and time again) we invest for the long term with customized asset allocations for each of our clients to reflect their individual needs, goals, and circumstances. Let us help you evolve an asset allocation that keeps you moving forward in wealth creation over the long term through our experienced guidance in both wealth and money management.

At this time, we continue to underweight our security basket (bonds and cash), overweight our defensive basket, modestly underweight our traditional equity basket, and be opportunistic in our private investment basket as solid opportunities in private equity and real estate present themselves. Please call us with any questions you might have on wealth or money management issues for our advice.

Best regards and let’s look forward to a wonderful spring!

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

Disclosures, Important Information

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending April 24, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2017 by First Long Island Investors, LLC. All rights reserved.

Knowing when and how to start transferring wealth is an important topic for most high net worth individuals. Philip W. Malakoff, Senior Vice President, Wealth Management, was recently asked for his insight on this topic by LI Pulse Magazine.

http://lipulse.com/2017/03/07/5-steps-transferring-wealth/

On February 8, 2017, Robert D. Rosenthal, CEO and Chief Investment Officer, Ralph F. Palleschi, President and COO, and Philip W. Malakoff, SVP, Wealth Management, shared with clients and business partners First Long Island Investors’ 2017 market outlook during a web seminar. They covered the firm’s expectations for 2017 and how we are positioning client portfolios.