Terrorist attacks, both large and small, are an unfortunate reality in today’s world. The proliferation of radical & extremist ideas through online platforms and social media channels has exponentially expanded the reach of terrorist organizations around the globe. On November 9, 2017, First Long Island Investors invited Dr. Tara Maller, Senior Policy Advisor and Spokesperson for the Counter Extremism Project, to discuss this epidemic with clients and friends of the firm. The terrorist attack in New York City on October 31st and December 11th made this topic only more timely and relevant.

Dr. Maller began the session by providing some background on the work of the Counter Extremism Project (CEP), a not-for-profit, non-partisan, international policy organization formed to combat the growing threat from extremist ideology. Led by a renowned group of former world leaders and former diplomats, it aims to combat extremism by pressuring financial support networks, countering the narrative of extremists and their online recruitment, and advocating for strong laws, policies, and regulations. You can learn more about CEP’s work at www.counterextremism.com.

She explained that through military efforts and cooperation with ally nations, we are in fact making progress against terrorist groups like ISIS and others on the battlefield. However, we are falling short with regard to interfering with their efforts to spread their message globally through social media and radicalize people with whom they have never had face-to-face contact. Terrorist activities like the October 2017 NYC attack, the September 2017 attack in London, the 2016 shooting in Orlando and many more are the result of ISIS and others using platforms like Facebook, Twitter, and YouTube (which is owned by Google) to reach, recruit, and radicalize people they have never met.

Online radicalization plays a significant role in terror attacks. In many ISIS-inspired terrorist attacks, the attackers have had minimal to no direct in person contact with ISIS nor have they travelled to places like Iraq or Syria, where ISIS had previously held significant territory. Instead, they are exposed to terrorist materials online and latch on to the propaganda. From the investigations made public we have seen that these individuals are consuming a massive amount of radical content online.

Tara shared that her organization has been part of the push in the last few years to get the social media companies (primarily focused on Google, Twitter, and Facebook) to more aggressively thwart the dissemination of radical terrorist and extremist propaganda (i.e. videos of beheadings) on their platforms. While there has been some progress, there is still significantly more that could be done by the tech community. CEP, and others, are lobbying the tech companies to simply enforce the terms and conditions that all users have agreed to when signing up for the platform which prohibit this activity.

Tara also discussed the more aggressive approach social media platforms take with regard to child pornography on their platforms. In the case of child pornography, there is a huge database of images determined to be child pornography catalogued by the National Center for Missing and Exploited Children and PhotoDNA technology is used to block anything in that database from being uploaded to these platforms. This PhotoDNA technology was Microsoft-backed and developed by Dr. Hany Farid, Chair of Computer Science at Dartmouth College. Dr. Farid is now also a Senior Advisor to CEP. CEP has been pushing for a similar approach to keep terrorist content off the sites. You can learn more about this technology here.

There has been a significant amount of attention paid to this issue recently, particularly in light of the recent tech company hearings on Capitol Hill. While the hearings were focused primarily on Russian activities on these platforms during the 2016 elections, the tech companies appear to be coming under increasing scrutiny regarding a range of problematic activity on their platforms. Hopefully, this continued pressure will lead to more progress in taking actions against terrorist content. One positive development was mentioned recently in a New York Times article regarding the removal of terrorist content, specifically Anwar al-Awlaki videos, on YouTube.

One of the major issues with these online platforms is the opportunity for complete anonymity. You can have a fake name online and you can have multiple accounts making it nearly impossible to locate and prosecute violators. Platforms like Twitter, Facebook, and YouTube were set up to be online communities and the application of these platforms by terrorists to incite violence and by Russia to involve itself in the 2016 election are unintended and problematic consequences. These platforms did not anticipate this and therefore were not set-up to initially track and monitor much of this activity. All three of these companies have recently been on Capitol Hill in hearings discussing how they address these issues today and how they intend to make reforms going forward. The hearings were predominantly centered on the Russia investigations, but also addressed other issues including terrorism.

Tara closed by discussing the challenges that surround this issue. There is the obvious debate that centers on the First Amendment and censorship. Having said that, Tara pointed out that these are companies with terms of service governing what is and is not acceptable on their platforms. Additionally, the tech companies are concerned about their user’s right to privacy, citing that many individuals are concerned with what information is being funneled to the government and others. Organizations like CEP are advocating to ensure that all users abide by the terms of service that govern these online communities and that these platforms do not provide virtual safe havens for terrorists.

About Dr. Tara Maller

Dr. Tara Maller is a national security expert with extensive media and communications experience. She serves as Spokesperson and Senior Policy Advisor for the Counter Extremism Project (CEP). Maller has appeared as a regular national security and foreign policy commentator on Bloomberg, CNN, MSNBC, Fox News, Fox Business, Al Jazeera America, and HuffPost Live. She has published and presented on a wide range of issues including sanctions, diplomacy, intelligence, nuclear proliferation, terrorism, Iraq, Iran, cybersecurity, homeland security, national service, and women in security. She was previously the Director of Strategic Communications for the newly formed Service Year Alliance, a joint venture of the Aspen Institute and Be The Change. The Franklin Project at the Aspen Institute, where Maller served as Associate Director of Strategic Communications, is now part of this new venture. She is also a research fellow in the International Security Program at New America. Maller previously served as a military analyst at the Central Intelligence Agency, where she focused on the Iraq insurgency. She has also worked in the private sector at a NY-based media startup, BrightWire Inc., where she served as Managing Director of Operations and Managing Editor. The company provided curated & custom international economic and political content to corporate clients. She has also done work in the private sector as a security consultant focused on cybersecurity & terrorism threat assessments.

Maller received her Ph.D. in Political Science from the Massachusetts Institute of Technology with a concentration in International Relations and Security Studies. She was also a predoctoral research fellow at the Belfer Center for Science & International Affairs at Harvard’s Kennedy School of Government. She received her M.A. in International Relations from the University of Chicago and she graduated with a B.A. in Government from Dartmouth College.

About The Counter Extremism Project (CEP)

The Counter Extremism Project (CEP) is a not-for-profit, non-partisan, international policy organization formed to combat the growing threat from extremist ideologies. Led by a renowned group of former world leaders and diplomats it combats extremism by pressuring financial and material support networks; countering the narrative of extremists and their online recruitment; and advocating for smart laws, policies, and regulations. For more information, please visit www.counterextremism.com

September 30, 2017

“If you can remember that stocks aren’t pieces of paper that gyrate all the time – they are fractional interests in businesses – it all makes sense.” Seth Klarman

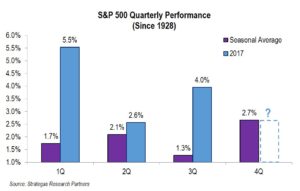

The third quarter proved to be a very successful one for our clients with all of our traditional and defensive strategies recording meaningful gains. Even the historically weak period of August and September proved to be positive for all of these strategies. Historically the outlook for the fourth quarter is positive:

Despite many investors waiting for the proverbial shoe to drop, strong earnings growth and the combination of low interest rates and low inflation provided the energy to drive equity prices higher for the third quarter and thus far this year. As the chart above demonstrates, at least from a historical standpoint, the fourth quarter has on average been the strongest performing quarter. Of note, international equities continue to make strong gains this year and are outpacing the S&P 500 for the first time in several years. Fortunately we have continued to increase our international exposure and this contributed to gains in several of our equity strategies. These international gains reflect the economic progress made in part in Europe and Japan as their economies are modestly growing and the companies in those regions are prospering. Thus, in our opinion, the apparent synchronized global growth is a major reason for the global stock market’s strength. How things have changed! Remember the days when the headlines out of Europe were quite disconcerting? (Greece going broke; Italy going broke; the EU disintegrating!)

All of our strategies are continuing a solid year of performance. This is especially noteworthy as indexing/passive strategies continue to gain favor, but have been left behind from a performance standpoint by many of our strategies this year. We believe this is important as we face the future with some growing clouds that give us cause for concern. The Federal Reserve’s continued path of raising interest rates and starting to taper its balance sheet should warrant at least some level of caution for investors in equities, real estate, private equity, and other asset classes. Money will get somewhat more expensive and the flood of cheap money driving up certain asset values is something to be watched. We are noting some weakness in commercial and residential real estate as too much supply comes to market in certain regions of the country. Additionally, in our opinion, many private equity managers have raised significant sums of money which they are now looking to invest somewhere. We are hearing of rich prices being paid for both some real estate and private equity investments. Also, geopolitical risks continue to be front and center with the aggressive actions of North Korea and the frequent verbal attacks from President Trump. This coupled with the continuing war in Syria as well as the fight against ISIS, is something that markets have shrugged off (thus far) but could create some volatility in the future. It is important to remember that volatility is at historical lows.

These clouds and others that exist, including the growing bifurcation of political ideology and wealth disparity, could impact the positive psychology that has given investors confidence. What has trumped (no pun intended) these clouds thus far has been the positive economic fundamentals mentioned earlier. Patience as an investor reflects faith in the spirit of America (even as it appears somewhat frayed right now) and a government that can be somewhat responsive, even if it appears to be dysfunctional at times. To sustain this long period of investment gains and economic prosperity, we need greater growth to support the somewhat high current valuations as well as assuaging investor anxiety. We continue to find, and ferret out, what we believe to be sound investment opportunities for the long term in each of our strategies even with markets making new highs on a regular basis. Make no mistake, we do not subscribe to the efficient market theory. Therefore through thorough research and inefficient markets, which typically view things through a short-term lens, we are still finding long-term opportunities in specific companies, real estate, and an occasional private equity idea.

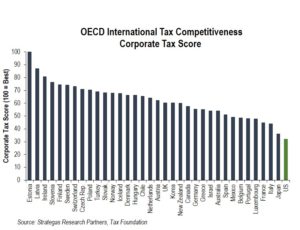

As investors feel nervous about various markets being at all-time highs yet again, the major tax cut/reform program recently announced by President Trump and his administration to enhance domestic growth is on their radar. This aggressive plan, the first such major reform in thirty years, if passed (in some form) would provide significant corporate tax relief and the potential for repatriation of foreign-sourced earnings. This may even garner bipartisan support based on how uncompetitive the United States is versus other developed nations from a corporate tax standpoint:

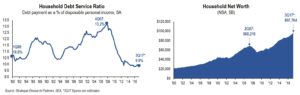

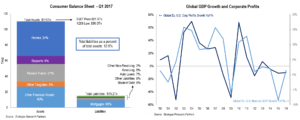

It is clear from the chart above that the United States needs to cut corporate taxes in order to be competitive with the rest of the developed world. It is obvious why many companies have sought to move operations overseas and it is apparent why we have lost jobs to these foreign countries. The combination of a lower corporate tax rate, bringing back significant foreign-sourced earnings to the U.S., and giving an incentive to domestic businesses to promptly invest in the U.S. would be a pro-growth platform that could result in faster and sustained domestic economic growth. These actions coupled with tax cuts for individuals and reform to help the beleaguered middle class would also push a domestic economy forward, of which 70% is based on consumer spending. By the way, the consumer has gotten into better financial shape since the “decession,” as you can see from the charts below, despite government policy that could be more helpful:

Tax cuts for individuals would also bring relief to those who have been facing increased medical costs from the flawed Affordable Care Act. This act has not been replaced, but is in need of surgery to make it more effective and affordable. Both sides of the aisle should see both corporate and individual tax reform as being essential to growing our economy at a faster pace than the past eight years. This would, in our opinion, give a boost to the earnings of many of the companies we invest in as well as many others. Increased earnings would make current valuations, which are somewhat on the high side, more reasonable. Of course, if nothing happens in this arena, there could be a let down on Wall Street as well as in investor psychology. That would set up a very difficult and contentious November 2018 election cycle for both investors and politicians.

Summary

Our third quarter was very good from an absolute standpoint. Our clients continued to see their mandates with us grow in value. The fourth quarter faces some clouds that we have outlined, while at the same time brings the anticipation of better earnings and possible significant tax reform. These two factors represent reasons for optimism. Interest rates remain low but with a slight upward bias. Bonds are still not attractive in our opinion and we remain underweight, especially as the Fed considers reducing its balance sheet which could increase interest rates. Traditional equity valuations are somewhat stretched by historical norms so we remain underweight. Low inflation and low interest rates make stocks more attractive but continued increased earnings are necessary to support these valuations and see them grow from here. For these reasons, we still remain biased to our defensive strategies which have delivered excellent results thus far this year. As compared to our other investment strategies, these results have only been equaled or outdone by several of our traditional equity strategies. However, we remain somewhat underweight to these traditional equity strategies given our concern that valuations have gotten somewhat ahead of themselves, and the chance that tax reform goes the way of the partisan gridlock in D.C. Although we believe that some tax reform will take place, we cannot guarantee it and therefore erring on the side of caution seems the prudent direction to take in our recommended asset allocations.

One of our consulting economists spoke at our June seminar. He made a point to tell our gathering that returns from this point will be less than what we have experienced in the past several years, in his opinion. He did not think we were facing a recession in the near-term (and neither do we). Nor did he think that corporate earnings were facing an imminent downturn (nor do we). He did cite the current higher starting valuation level after many years of market appreciation. As valuation is a very significant factor in the returns we can reasonably expect to achieve in the long run we believe this to be a prudent observation.

In the end, in our opinion, fundamentals drive valuations in all asset classes we invest in. Our approach is to invest piece by piece in each company, real estate opportunity, or private equity situation. As stated in our quarterly quote, we invest in specific companies based on their individual fundamentals. Over the long term this has worked. As we face an older bull market, potential “clouds” as mentioned earlier, some favorable factors still contributing to a growing economy, paying attention to the specifics of concentrated portfolios should be an advantage as opposed to hoping for entire markets to appreciate.

Again, we are grateful for your support and confidence in us. We are delighted to have achieved quite favorable results for the quarter and the year-to-date on clients’ behalf. Permitting us to invest for you in a concentrated but diversified manner has exposed your capital to meaningful gains this year. We are optimistic that this approach will continue to work for you over the long term.

Enjoy the upcoming holiday season. We hope to see you at our upcoming Thought Leadership Seminar with our special guest, Dr. Tara Maller, a former CIA Military Analyst, contributor to many cable TV stations, and an expert in the unfortunate subject of terror. Please call us with any questions you have on your asset allocation, your investments with us, and any other wealth management matters that we can be of assistance on.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending October 19, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2017 by First Long Island Investors, LLC. All rights reserved.

On October 5, 2017, Bruce A. Siegel, Executive Vice President and General Counsel of First Long Island Investors, LLC, co-led the Empire Ride for the DRI in the Hampton’s. In its second year, the ride raised more than $50,000 and had over 100 riders participate. Bruce along with the other event chairs have all been affected by diabetes, and wanted to take their passion for cycling to raise both awareness and funds for the DRI’s singular goal of finding a cure diabetes.

The full press release is available on the DRI website by clicking here.

Empire Ride for the DRI cyclists Bruce Siegel, his wife Rachel, (Far Right) and fellow team members are all smiles knowing they did their part for diabetes research.

On September 7, 2017, Robert D. Rosenthal, CEO and Chief Investment Officer, Edward C. Palleschi, SVP, Wealth Management, and Brian Gamble, VP, Wealth Management, shared with clients and business colleagues of First Long Island Investors our perspective on the current market and economic indicators during a web seminar. They discussed trends to watch and how we are positioning client portfolios for long-term growth.

June 30, 2017

“The future has a way of arriving unannounced.”

-George Will, Journalist

We are pleased to report that our clients enjoyed another very successful quarter. The majority of our investment strategies exceeded the performance of their respective benchmarks. This is particularly gratifying as our bias is to less risk and higher quality. That combination typically lags in good markets and outperforms in more difficult markets. Given our outperformance this quarter in some defensive as well as traditional equity strategies, we are quite pleased. However the one sour note, our investments with a deep-value manager, continue to be frustrating.

As the above quote suggests, the future comes upon us unannounced. Those who continued to be skeptical about equity markets because of the financial crisis of 2008/2009 missed a significant rally having not invested looking forward to a future of higher earnings and continued low interest rates. Some investors who participated in this rally are leery because of market highs being reached during the quarter. We know that at some point, probably when a recession hits, equity markets will suffer for a period of time. When this future recession and subsequent lower markets will occur is unknown. Thus future events, good or bad, do not ring a bell that they are about to occur. We urge prudent and diversified asset allocations with a defensive bias because market shifts (positive and negative) often come upon us without too much notice and in some instances unexpectedly.

Good performance and good markets happen for specific reasons. At least in the longer term there are many factors that form the foundation of companies and real estate increasing in value. Given the solid gains made in the quarter and thus far this year, we need to focus on some of them to explain why performance has been strong for many of our strategies and many market indices are at record levels. It will also explain why we believe, while still being cautious and defensive, that there might be more happiness to come.

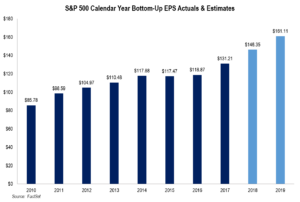

First, equity markets continue to climb the wall of worry as earnings for the S&P 500 Index continue to grow. To be even more specific, the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite Index all hit record highs during the quarter. We believe one of the major reasons for this was the earnings growth recorded in the first quarter (announced during the second quarter). The chart below shows the recent increase in S&P 500 earnings and the consensus forecast for the next two years:

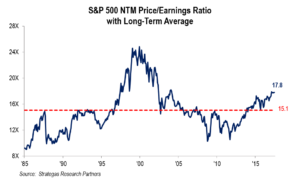

As you can see, the acceleration in earnings which began in the third quarter of 2016 is continuing. In our opinion, this in part supported the gain of 3.1% for the S&P 500 Index during the quarter (The other main indices, Dow and NASDAQ gained 3.3% and 3.9% respectively). Now, we would be unwise not to consider valuation to see if markets are overheated. We turn to the price earnings (P/E) multiple on the next twelve months projected earnings to see how it stacks up to the historical average. (This is a guide and not an exact measure of fair valuation, nor does it time when the markets will revert to “fair” value.) As you can see from the following chart, the P/E appears a bit high as compared to the historical average:

lthough it appears from this chart that the S&P 500 price earnings multiple is somewhat high, we must also consider interest rates, which in our opinion are a key component to valuation. In valuing businesses we have always used the 10-year Treasury as a value input for two reasons. One, in part we value businesses by discounting back the earnings in out years using the 10-year Treasury plus an equity risk premium. The lower the interest rate the less those future earnings are discounted. Two, that 10-year rate is what we can get as a return from buying the 10-year Treasury bond as an alternative to equity (stock) investments. The following chart suggests something quite important. Interest rates remain quite low by historical standards:

So, when considering that we believe interest rates will remain relatively low as compared to the last 71 years as shown on this chart (our projection is that the 10-year Treasury will remain below 4% for several years), the value of equities continues to be somewhat attractive despite P/E’s being above the historical average. Another way of looking at this is to take the earnings yield (EY) (divide the projected earnings of the S&P 500 for 2018 by the current price of the S&P 500) and compare it to the current 10-year Treasury bond yield. In our opinion, this earnings yield of 6.0% remains attractive versus a projected 10-year Treasury yield of even 3%. We also believe that these earnings will continue to grow as we do not see a recession through 2018 (GDP growth should continue at the current 2% rate, at least), the dollar has declined in value during the quarter leading to higher earnings for multi-national companies, and Congress and the President may cut the corporate tax rate which would benefit earnings for U.S. companies paying an effective tax rate above a newly legislated rate.

If you bundle growing corporate earnings, low unemployment rate (4.3% as of June 30, 2017), modest inflation (still forecasted at around 2%), low interest rates (10-year Treasury at 2.3% as of June 30, 2017), strong banks (all 34 major banks passed their stress tests and thus can distribute more capital to shareholders), a strong consumer (low levels of debt on their balance sheets, see left chart below), cheap oil (currently around $46 per barrel), and growing GDP in certain foreign economies (see right chart below), we have the makings of a good economy with earnings growth and the potential for more gains in global equity markets (we have increased our international equity weighting in several of our strategies for the second quarter in a row).

Despite our enthusiastic outlook mentioned above, we must consider what could derail our positive picture for equity markets. Perhaps, interest rates go higher sooner than expected. Unlikely, but it could happen. The President could decide to attack North Korea. It is becoming more of a distinct possibility as North Korea’s renegade regime gets closer to nuclear strike capability. The hoped for Congressional fiscal policy growth initiatives (tax cuts and repatriation of foreign earnings) do not happen. The Fed’s suggested decision to taper its quantitative easing of the past eight years brings much higher and unexpected volatility. Real estate values, particularly commercial real estate, decline as the result of low interest rates having led to overbuilding. All of these factors could contribute to a future that is not as rosy. These and other factors that we cannot project could come unannounced.

Our view remains that we are in a sweet spot for equity investing. Many of the traditional factors that typically mark the end of a bull market because of an impending recession have not happened yet (inverted yield curve, weakening upward earnings revisions, widening credit spreads, and several others). However, because the “future has a way of arriving unannounced,” and when coupled with the major gains we have made over the past eight years, we maintain our view that clients’ asset allocations should continue to be more defensively postured with an overweight to our defensive basket. Two of our three defensive strategies have been strong performers over the past two years despite being defensive. Also, we continue to underweight fixed income given low yields for quality bonds and slowly rising interest rates which could cause losses in longer-maturity bond portfolios. We are maintaining a modest underweight to our traditional equity strategies given somewhat stretched valuations. By the way, the second quarter witnessed another significant quarter for growth-oriented companies versus their value brothers and sisters. Again, diversification pays off.

In summary, we had a very good quarter for our clients. We believe in a prudent and diversified asset allocation which has paid off as we had good performance from both our growth and value equity strategies. Also, our modest increase in our international allocation within several of our strategies seems to be paying off. However, we recognize that the future can arrive unannounced and we need to prepare for this, even if we are somewhat premature. This requires attention to prudent asset allocation and going where the puck is going to be, not where it is right now. As you know, we review our clients’ asset allocations on a quarterly basis and will recommend changes where we believe they are appropriate.

In addition to good results for the quarter, the year-to-date results are gratifying as well. However, we must remain vigilant given the world we live in. As stated above, most if not all markets are not as cheap as they were. However, earnings are higher and interest rates remain low. We remain cautiously optimistic, but with an eye looking for the unannounced while maintaining a long-term perspective.

Have a wonderful summer and please do not hesitate to call any of us on the investment committee to discuss this letter, your asset allocation, estate, tax, and insurance planning, or any other wealth management matter.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending July 26, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2017 by First Long Island Investors, LLC. All rights reserved.