“All investment returns are not created with equal risk. Investors should recognize this, and evaluate each investment they make to determine the risk undertaken to achieve the gain they made.” Robert D. Rosenthal, CEO and CIO of First Long Island Investors

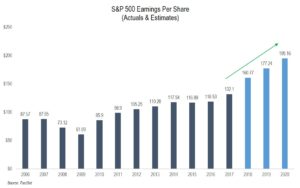

A strong economy characterized by accelerated corporate earnings growth as well as robust consumer and business confidence led to record highs for the S&P 500, Dow Jones Industrial Average, and NASDAQ during the quarter.

This was in spite of significant political acrimony over the confirmation of Judge Kavanaugh for the Supreme Court seat vacated by Justice Kennedy, as well as the approaching mid-term elections. The continued headlines regarding Special Counsel Robert Mueller’s investigation into Russian interference with the 2016 Presidential Election also continued to weigh on Washington as well as the general population.

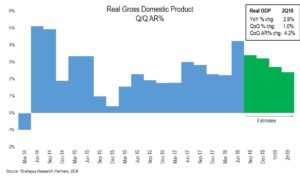

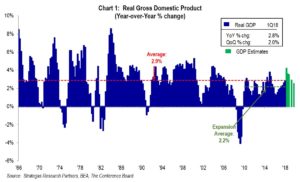

Meanwhile, the gross domestic product for the U.S. grew at an accelerating rate of 4.2% for the second quarter (see chart below) reflecting in part the fiscal growth initiatives recently enacted in the Tax Cuts and Jobs Act of 2017, as well as the current Administration’s efforts to eliminate certain regulations it viewed as hindering business growth.

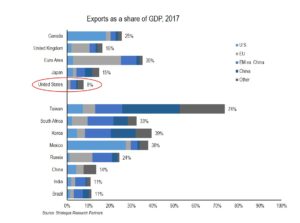

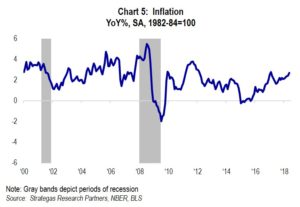

Despite this significant economic growth, fears of the growing trade war with China and to a lesser extent with Mexico, Canada and Europe, were also headline grabbing. It remains to be seen the extent to which these escalating trade skirmishes (or wars) will impact our economy. (The Administration has now been successful in renegotiating trade agreements with both Mexico and Canada.) The next chart shows the relative importance of exports for the U.S. and our trading partners. It suggests that the U.S. has the least to be concerned with as compared to our trading partners as foreign exports represent only 8% of our GDP. However, an all out trade war, in our opinion, could possibly crimp GDP growth. In addition, new and increased tariffs put on imports by the U.S. could also result in somewhat higher domestic inflation.

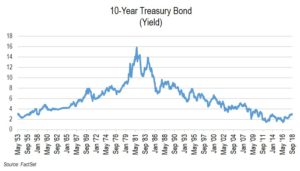

This higher rate of domestic economic activity and the beginning of higher wage growth has allowed the Federal Reserve to continue its policy of normalizing interest rates by raising the short-term rate by another 25 basis points in September. This has led the 10-year Treasury to break the 3% barrier and was 3.1% as of the end of the quarter. The following chart shows the yield on 10-year Treasury beginning to rise, but history suggests this is not anything near an alarming rate:

Additionally, investors should not be fearful that the stock market cannot continue to prosper when interest rates are rising. The chart below suggests just the opposite.

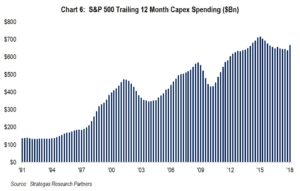

In fact, slightly higher interest rates, higher wage growth, and the threat of a trade war has not yet slowed the investment activity of U.S. businesses. Capital expenditures are at a very high level as you can see from the chart below. This suggests, in our opinion, potential productivity gains, as well as a continuation of economic growth:

From an equity market standpoint, despite the concerns of some about valuation, U.S. equity indices continue to appreciate. So far this year, growth-oriented shares continue to outpace value-oriented shares by a wide margin.

Our clients have benefitted so far this year from such outperformance as we have maintained our bias to growth shares. Our view is based on the actual and multi-year projected earnings growth of growth companies. This remained the case in the third quarter although our Dividend Growth strategy (which is more value-oriented) had an outsized gain of 9.5% net during the quarter, as it played catch up from earlier lackluster results this year. In fact, all of our equity strategies, both defensive and traditional, appreciated for the quarter and are performing well year-to-date. Furthermore, domestic equity markets continue to dramatically outpace foreign markets (as seen when you compare the blue lines to the green lines in the chart below).

Many pundits continue to argue the valuation case for foreign equities, particularly emerging markets. However, we have continued to underweight foreign equities for years now and this has proven to be beneficial for our clients. At some point this may change, but for now we continue to favor domestic equities based on the strength of the U.S. economy and the pro-growth fiscal policies recently put in place.

So where does this all leave us as investors? Without question, there are strong economic fundamentals reflected in GDP growth, a very low level of unemployment, increased capital spending by business, consumer and business optimism, reasonable inflation, and continued below average interest rates. However, the following weigh on investors: the ongoing investigations, trade issues, the age of this bull market, and concerns about rising interest rates as well as equity valuations. These represent the “wall of worry.” Let us not forget the upcoming mid-term elections, which could possibly see the House and Senate flip to the Democrats while the President is a Republican. This is a formula for potentially even greater gridlock.

The above could result in some increased volatility, however, we continue to believe that the policies that have led to our economic strength will continue for a while at least and push off a potential recession into 2020 at the earliest. Corporate earnings are projected to increase next year and we believe that corporate spending will also continue to increase given the increased after-tax earnings from the new tax law as well as continued repatriation of offshore cash from that same law. We expect a tug of war between these two sides with economic optimism built upon earnings growth, low unemployment, wage growth, and business and consumer optimism versus the wall of worry outlined above. Accordingly, we continue to underweight fixed income, overweight our defensive strategies (where robust dividend growth and above average earnings growth have led to strong gains for our clients), and modestly underweight traditional equities. We will also look for opportunistic real-estate-type investments as we still believe that space will benefit from the improved economic activity. This somewhat defensive posture might result in us leaving some gains on the table but should insulate us from the worries that seem to be piling up. It should be noted that one is able to now get a bit over 2% (pre-tax) from rolling over short term U.S. Treasury Bills which we do for many clients. This is an improvement from where we were a year ago when short-term rates were even lower.

Risk seems to be growing with the “wall of worry.” Accordingly, we as investors must always carefully measure the gains we are achieving, and evaluate those gains based on the risks we are taking. At FLI we do not use leverage in any of our fixed-income or equity strategies. Our quality bias and annual growth in dividends (13.3% so far in 2018) in our Dividend Growth strategy makes it stand out from other similar strategies. The below average beta (measure of risk) in some of our strategies means they should be less prone to swings from volatility. In other words, we believe that we have taken less risk for our clients (and for ourselves, as we invest side-by-side) to generate the positive results in our strategies and for that we are very proud.

The third quarter and year-to-date have had greater volatility as compared to last year (do not forget the 10% drop this past February), but thus far we continue to make gains this year in our defensive and traditional equity strategies. We would expect this to continue in the fourth quarter if earnings continue to grow as expected and the Fed raises short-term interest rates in December, as expected. This could at some point in the future cool down equity markets, but we still feel it is too early for that. Additionally, real-estate valuations in many markets have yet to be significantly impacted by the somewhat higher interest rates.

We recommend staying the course as investors with a diversified asset allocation tilted to our defensive strategies given potential volatility in the months to come as well as the potential that earnings growth will moderate in 2019.

Please call us with any questions you might have regarding your asset allocation or wealth management matters. On Tuesday, October 30th we will be hosting our next Thought Leadership Breakfast with Lawrence Levy, Executive Dean, National Center for Suburban Studies at Hofstra University. We hope you can join us. For those of you who could not join us for our inaugural Family Wealth Roundtable, we will be posting aspects of it on our website in the very near future.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending October 18, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.

On September 6, 2018, members of the First Long Island Investors Investment Committee held a web seminar where they shared with clients and business colleagues of First Long Island Investors our perspective on the key market drivers and things to watch for the future. The event also covered our current approach to asset allocation for long-term growth.

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” Warren Buffett, Chairman and Chief Executive Officer, Berkshire Hathaway

In our opinion, the second quarter was characterized by accelerating domestic economic growth while also reflecting angst over an aggressive trade posture taken by President Trump as well as a Federal Reserve Board intent on raising interest rates. This tug of war between the reality of economic/profit growth (please see Charts 1 and 2), versus the potential fallout from threats of tariffs by the U.S. as well as threats by trading partners, impacted investors thus far by way of increased volatility. Adding to this “wall of worry” (which may have gotten a bit lower from the seemingly civil North Korean Summit), the Fed raised interest rates by 25 basis points in June and hinted that we could have two more increases later this year. This also added to investor concern as the easy monetary policy of the past eight years is coming to an end. Serious trade concerns with allies and non-allies alike, as well as higher interest rates reflecting a strong economy, presented a new environment for investors to digest. Add in some political and economic uncertainty in the European Union from Italy and the pace of Brexit, and investors were distracted from focusing on fundamentals. Meanwhile, the two charts below show the underlying strength of the domestic economy and extremely strong corporate earnings:

The strong domestic GDP growth of 2.0% in the first quarter along with the projected growth of somewhat greater than 3% for the second quarter, coupled with accelerating earnings growth for the average large company (S&P 500 earnings were up 27% for the first quarter) supported the general equity market appreciating in the second quarter in the face of the growing trade concerns and somewhat higher interest rates. The fundamentals won out in the second quarter led by small-cap companies (strong earnings growth, lower taxes, and less concern about potential tariffs) and large-cap growth companies that reflected above-average earnings growth during the quarter (examples include companies such as Amazon.com, Netflix, and Mastercard). Large-cap value companies, while appreciating overall, did not keep pace with large-cap growth companies despite growing dividends from a number of them. The Russell 1000 Growth Index appreciated by 5.8% during the quarter while the Russell 1000 Value Index only advanced by 1.2% for the quarter. Year-to-date, the difference in performance for large-cap growth versus large cap value is almost 900 basis points or nine percent. (This follows last year’s pattern where large-cap growth outpaced large-cap value by nearly 1700 basis points or 17%!) Fortunately, in almost all cases our clients have adequate exposure to growth companies in several of our investment strategies populating our defensive and traditional equity baskets.

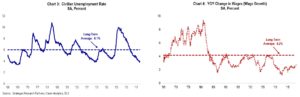

In addition to the aforementioned trade concerns and increasing interest rates, other economic factors must be watched carefully including the tight labor market, increasing wages, and inflation. The very low unemployment rate potentially indicates a tight labor market, which coupled with wages that are trending higher, has the potential to drive inflation higher.

Besides the tight labor market, we believe that the new, lower corporate tax rate is also driving wages up. A tighter labor market can lead to higher inflation unless productivity mitigates the higher wages. That would require, in our opinion, greater corporate investment in equipment and infrastructure that will lead to enhanced productivity down the road. Capital expenditures (incentivized by changes to the tax law and less regulation) by business seem to be picking up as seen in Chart 6 below.

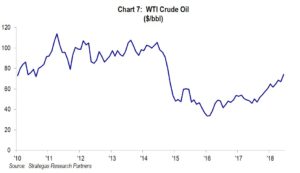

Additionally, higher energy costs facing both consumers and business could result in rising inflation. The price of crude oil has increased and, in our opinion, seems to be the result of a number of factors including a growing global economy and new sanctions on Iran (see Chart 7):

We, as investors, are trying to make sense of growing domestic and global economies with strong corporate earnings while facing trade issues, a Fed raising interest rates, a tight domestic labor market, higher energy costs, and some geopolitical issues let alone a mid-term election confronting us in November (mid-term elections have in the past led to positive results in equity markets following election day). Not an easy picture for investors, and that just might be the reason we have experienced much more volatility than in 2017.

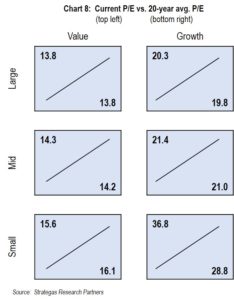

Another critical factor is the very important question of VALUATION. As we are in what many believe to be the later innings of this bull market (despite growing earnings and fiscal growth initiatives through deregulation and tax reform), we at FLI are always using the lens of valuation to adjust our asset allocations. The chart below gives us some comfort that most asset classes ARE NOT in “nose bleed” territory from a price-earnings multiple standpoint.

It is our opinion that the chart above demonstrates that valuations, while not cheap by any measure, are not stretched for the vast majority of asset class categories that we invest in and are trading at price/earnings multiples consistent with those for the last twenty years. The one exception is small-cap growth where we have appropriately adjusted our allocation downward to this segment in our diversified strategy. In addition, we believe that earnings growth for many companies, on average, will continue to increase in 2019, suggesting that valuations will continue to be reasonable.

Summary

Our clients weathered the second quarter volatility and on balance did reasonably well with modest gains for the most part (Our strategies were about flat to plus 4% for the quarter). This resulted from asset allocations that included exposure to growth, which continues to outpace value. Our value exposure should benefit from companies paying higher dividends (dividends have increased, on average by 12% so far this year in our Dividend Growth strategy) despite lackluster stock performance thus far.

The asset allocations we recommend to clients continue to trend towards a more defensive bias based on our belief that earnings growth will eventually slow in 2019, and we might face a modest recession, perhaps sometime in 2020. However, until then we believe that gains can be made through our defensive and traditional equity baskets, while underweighting fixed income as we still believe that interest rates will continue to trend up based on the Fed’s guidance of interest rate increases and the continued rising of inflation. As for private investments, we believe that investing in the mezzanine real estate lending area continues to make sense.

As the quote from Warren Buffett indicates, volatility should not be a cause for losing sight of or faith in prudent and diversified long-term investing. Volatility should be viewed as an opportunity to add to sound long-term investments within a well thought out asset allocation.

Please call upon us with any questions you might have as to your wealth and money management needs. We hope you have a great summer and look forward to you joining us on our next webinar in September.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending July 24, 2018, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2018 by First Long Island Investors, LLC. All rights reserved.

The Internal Revenue Code recently underwent its first major tax overhaul since 1986. In an attempt to stimulate the national economy, The Tax Cuts and Jobs Act of 2017 was passed in December of 2017 and impacts taxpayers starting in 2018. On May 23, 2018 First Long Island Investors invited three prominent tax accountants, Charles A. Barragato, Lance D. Christensen, and Raymond Kelly, to share with clients and friends of the firm their perspectives on how the new tax reform will affect high net worth individuals going forward.

Raymond Kelly, a partner at RSM US, LLP, began the session by speaking about how the tax reform will impact businesses. Corporate tax reform can be highlighted by a tax rate reduction to 21%, down from a previous rate of 35%. This reduction is significant as it puts the United States at a corporate tax rate that is closer to the worldwide average, making the United States corporate tax rates competitive with the rest of the developed world. Companies were able to reduce their taxable income in 2017 by accelerating expenses that would otherwise have been deferred to 2018 or later. The acceleration of such expenses allowed corporations to reduce their tax in the year that had a higher tax rate, effectively providing a greater tax benefit.

Certain partnerships are also receiving a tax benefit under the new tax law. Partners of certain qualified businesses are eligible for a 20% deduction on pass-through income. Qualified businesses generally exclude service industries, except for engineering and architectural firms. In order to utilize this tax advantage partnerships may consider using techniques such as spin-offs in order to segregate their administrative and sales businesses from their service businesses. The tax community expects the Internal Revenue Service to issue further guidance on the 20% deduction on qualified businesses over the next few months.

Charles Barragato, a partner at BDO, continued the conversation by discussing the estate and gift tax provisions of the Tax Cuts and Jobs Act. He shared that the estate tax was initially established in 1916 and continues to this day except for the year 2010, when it was temporarily repealed. The IRS maintains a unified estate and gift tax system which means the two are treated as one and the same for the purposes of removing assets from ones estate. Under the prior law an individual was able to gift $5.4 million tax free over the course of his/her lifetime. Under the new law the exemption has been increased to $11.18 million, more than double the previous law. In addition to the lifetime gift exclusions, the allowable annual exclusion by which any individual can gift up to $15,000 (up from $14,000 in 2017) per recipient to an unlimited number of recipients tax free each year remains part of the tax code. Medical expenses and tuition payments continue to be considered non-taxable gifts if they are paid directly to the respective institutions.

While the new law provides for this lifetime exclusion limit to be significantly larger than in the past, that provision is set to sunset in 2025. Therefore wealthy individuals and families should still be engaging in dialogue with their wealth management and accounting advisors on tax-efficient estate planning and wealth transfer strategies. Some of the estate planning techniques Chuck touched on include the utilization of valuation discounts, grantor retained annuity trusts (GRATs), and sales to intentionally defective grantor trusts. Valuation discounts allow for illiquid assets, such as partnership interests, to be discounted on estate or gift tax returns. Individuals can consider using family limited partnerships in order to transfer wealth to their beneficiaries at a reduced gift tax cost. GRATs are used to transfer assets out of an estate. Using a GRAT, the taxpayer (the “grantor”) contributes assets such as securities to an irrevocable trust while receiving an IRS specified rate of return. Appreciation in excess of the IRS stated rate is given to the beneficiaries of the trust free of gift tax. Finally, an individual can make a sale to an intentionally defective grantor trust. This will move assets out of an individual’s estate while including all taxable income on the grantor’s income tax return. This will allow the beneficiaries to be entitled to the assets (net of any purchase note) while the grantor remains responsible for the income tax liability from the assets.

Lance Christensen, a partner at Margolin Winer & Evens, LLP, took the group through the impact the tax reform will have on individuals. The top tax rate has been reduced from 39.6% to 37% which may not seem substantial but after factoring in the 20% potential pass-through rate, effective taxes can fall below 30%. Although the standard deduction is increasing to $24,000 for married individuals, the tax reform is tightening up on the allowable itemized deductions for individuals. State and local tax deductions are being capped at $10,000, and allowable mortgage interest is being limited to interest on future borrowings of $750,000 (down from $1,000,000 in 2017) (existing loans are grandfathered at current limits). In addition, home equity interest may no longer be deductible under the new law (however, such interest may be deductible if the loan proceeds were used to purchase, construct, or improve the home). These limitations are especially burdensome for New York residents who pay some of the highest real estate and state income taxes in the country. Lance shared that when these provisions were first announced there was concern that the cap on these deductions would negatively impact home values in areas like Long Island. Thus far, that has not happened based on a report Lance quoted during the session. It may still be too early to tell as the tax cuts were enacted less than a half year ago.

The states are attempting to help individuals from being burdened by these losses in deductions by passing new regulations. New York for example has created an 85% charitable contribution credit if donations are made to two state authorized charitable gift trust funds: The Health Care Charitable Fund and The Elementary and Secondary Education Charitable Fund. New York has also proposed a 5% unincorporated business tax which will be paid at the partnership level for flow through entities and flow through to the partners’ Schedule K-1’s. This will be interesting as the IRS may act to disallow the benefits resulting from such state tax workarounds.

Robert D. Rosenthal, Chairman, Chief Executive Officer and Chief Investment Officer of First Long Island Investors, concluded the seminar by explaining how the tax reform has and will continue to impact the investment marketplace. He emphasized that the new tax law is a fiscal growth initiative with a goal of boosting the overall United States economy. Over the past eight years GDP growth averaged roughly 1.8% per quarter. Over the two most recent quarters GDP was reported at 2.9% and 2.3%, respectively. He shared that many corporations have excess cash, due to lower tax rates, which they are using for reinvestment and in some cases to fund dividend increases for investors. The team at FLI believes the new tax law will strengthen companies financially and help continue to drive stock prices higher.

For more information on the effects of the tax reform law please refer to How Does the Tax Reform Bill Apply to You? Tax planning varies greatly based on an individual’s specific circumstances and we encourage each of our clients to reach out to us and/or their tax professional to review the strategies which would be most beneficial based on their needs. We look forward to the opportunity to work with you and your tax professional to discuss how the techniques discussed could be implemented for you and your family.

FLI is neither an attorney nor accountant, and no portion of this presentation should be interpreted as providing legal, accounting, or tax advice. Please contact your tax advisor.

Peconic Bay Medical Center honored the late Robert Entenmann, a founding client of First Long Island Investors, LLC, by naming the new administrative campus after him. After Mr. Entenmann died in 2016, his children Jackie and Robert, through the Robert Entenmann Advisory Committee, recommended to New York Community Trust that a gift of $5 million be made to PBMC’s New Era Campaign benefitting cardiac care for the region.

Robert D. Rosenthal who is Chairman and CEO of FLI as well a Trustee of Northwell Health (of which Peconic Bay Medical Center is a part) along with Ralph F. Palleschi, President and COO of FLI, and Edward Palleschi, Senior Vice President at FLI, attended the dedication with Robert’s daughter Jackie and members of the community. In his address to attendees at the event, Bob Rosenthal said “He [Robert Entenmann] was a man of conviction, a patriot, a man who believed in business ethics and most importantly he believed in quality – whether it was quality in a boxed cake we’ve all eaten for God knows how many years or whether it was quality in the wine he made at Martha Clara Vineyards, or his desire to have quality health care on Long Island.”

Read full press release here