The investment process at First Long Island Investors involves many elements including company specific research and analyses, extensive dialogue with our outside managers on companies, sectors, and the markets overall, interaction with economists, both independent and those affiliated with large organizations, as well as the investment professional networks of our team members. Robert (“Bob”) Rosenthal, our Chairman, CEO, and Chief Investment Officer, is part of an investment “think tank” alongside longtime mentor and acclaimed investor, William P. Stewart, and other respected market analysts. Recently this group engaged in a conversation that was sparked by comments made by The Blackstone Group, one of the world’s largest private equity firms, and touches on the issues weighing heavily on many, including some clients. Bob’s perspective is below:

The current “wall of worry” is made up of concerns regarding: the timing of the next recession; the state of the (messy) political situation in Washington, including but not limited to the trade situation with China and ongoing impeachment proceedings; negative sovereign yields in Europe and Japan; IPOs of companies with no profits; income and wealth inequality; and other subjects.

While it is true that there is a fair amount to be concerned with, many (including Blackstone) are quick to ignore the strength of the consumer, continued GDP growth in the U.S., low unemployment, and growing corporate earnings. (We do not see a recession in the near future.) There is no distinction being made by Blackstone between high priced bonds and private equity versus a reasonably valued, but not cheap, stock market. And of course, their approach takes a “market” perspective instead of viewing the opportunity through the lens of a concentrated portfolio of fine growing businesses, which is what we at FLI utilize for client assets and our own assets.

Of the various concerns we are hearing, the biggest is the unknown effects of negative sovereign interest rates. These negative rates are also keeping our treasury rates lower as Europeans and Japanese investors buy our bonds to earn a positive return on their capital. The thought is that negative rates will boost economic growth in those regions. I do not know if this will prove true and we at FLI have underweighted foreign equity investment as we do not like the lack of growth and socialist tendencies in many countries (e.g. France). The outcome of these negative rates is one we will be sure to watch.

In looking at valuation excesses we reference late 1999/early 2000 when the S&P 500 was trading at a price-to-earnings ratioi of 31 and the ten-year Treasury was 6.5%. These numbers are quite different from today, but that is not to ignore the point that the equity market is not cheap today. Furthermore the great businesses that are leaders in secular growth including credit cards/electronic monetary transactions, cloud computing, and streaming of content (to name a few) do not typically trade at 100 times earnings as they might have back in 2000. Valuations are loftier for durable growing businesses perhaps, but not nose bleed by any stretch.

It is easy to find danger in a bull market lasting ten years. It is easy to worry about very low interest rates and central banks trying to stimulate growth and employment. It is easy to look at IPOs where the share price declines after going public at absurd valuations while they seek their first dollar of profit. It is easy to paint a bleak picture of business growth in the midst of a trade war. It is also easy to fear the unknown of a political situation that could lead to socialism in the greatest economy in the world. But it is harder to stay the course with a prudent allocation to fine businesses that can see growth for years to come or companies that have strong balance sheets and offer stability, growing dividends and market dominance. This, in our opinion, is the alternative to very low to negative interest rates on sovereign debt or bloated private equity funds chasing too few really good investments, especially when most consultants have for years shunned the domestic equity market and pushed clients into private equity and hedge funds.

At the end of the day, things have not changed. A prudent asset allocation reflecting current valuations for each asset class category coupled with the recognition of one’s age, goals, and risk profile, while never losing sight of needing to invest for the long term (which will vary for each individual), makes the most sense. But as we all know, there is always a “wall of worry” to be navigated.

So, we remain cautiously optimistic; we are somewhat defensive; and we are concentrated in our investments. We do not own a “deworsified” portfolio in any of our strategies. Third quarter earnings have come in very well for the market in general and specifically for the companies we invest in. Guidance is also quite reasonable. Our Dividend Growth strategy is enjoying a strong year with dividend growth increasing for the portfolio by 10.4% on average. (The strategy for the year is up over 22% which more than makes up for a slight loss last year of minus 4.4%.) The two-year average appreciation is not at a nosebleed level nor are the valuations. As for the market as a whole, currently the S&P trades at a P/E of 20.9i, which in an environment of a ten-year Treasury at 1.9% to us is also not nosebleed by any means. For perspective, the dotcom bubble in late 1999 traded at a P/E of almost 31i when you could buy a ten-year Treasury at 6.5%. That was considered nosebleed territory with a bond alternative that was attractive. That is not the case today.

In summary, we have a defensive tilt; we are long term investors; we invest in concentrated strategies with companies that are doing well and have financial strength. The environment of investing always has a wall of worry. Today is no different, but the fundamentals still suggest that gains can be achieved.

A synopsis of the Blackstone interview can be found here:

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Performance information for FLI Dividend Growth represents the performance of its composite. The views expressed are the views of Robert D. Rosenthal through the period ending December 10, 2019, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

Content may not

be reproduced, distributed, or transmitted, in whole or in portion, by any

means, without written permission from First Long Island Investors, LLC.

Copyright © 2019 by First Long Island Investors, LLC. All rights reserved.

i Price-to-earnings ratio is based on a trailing twelve-month basis

Philanthropy is one of the many topics we often find ourselves discussing with clients, especially as the holidays draw near and people want to have a positive impact on the community while ensuring they do so in the most beneficial way.

Charitable giving can be accomplished using cash, securities (appreciated securities are an excellent choice), or other assets. These assets can be given directly to a charity or indirectly through a donor advised fund or private foundation. In the last decade the use of donor advised funds (DAF) has risen significantly for a variety of reasons, most notably that a donor can make a contribution to a DAF and in most cases take an immediate tax deduction. The funds can then be invested for tax-free growth while deferring the decision of which charities will receive the monies and when. For example, if you set up a DAF in 2019 and immediately contribute $500,000 you can take that tax deduction (with certain limits) and then spread the giving over the next decade, distributing $50,000 or more per year to charities without further contributions to the DAF (assuming no net depreciation of the DAF’s assets).

Donor advised funds are gaining in popularity over private foundations because they streamline record keeping, are not subject to IRS annual minimum distribution requirements, have no legal or accounting costs to the donor, and typically allow the donor to choose the investment advisor to manage the DAF’s assets. DAF’s typically charge an administrative fee.

In response to the growing demand for donor advised funds and the desire of our clients to designate how their funds are managed before being distributed to the ultimate charitable beneficiary, FLI is pleased to share that FLI Dividend Growth and FLI Core are now approved strategies with both the Jewish Communal Fund and The UBS Donor-Advised Fund (each with a $500,000 minimum contribution). Both of the organizations are well-established donor advised funds whereby the donor can select any IRS-qualified public charity as a recipient from the DAF.

We look forward to discussing how donor-advised funds can play a role in your family’s charitable giving and would be happy to do so in conjunction with your tax advisor. Please keep in mind that the deadline for contributions to be income tax deductions this year is December 31st. These accounts take a little time to set-up, so if you would like to do so before year-end, we ask that you contact us by December 10th or we can help you set one up in 2020.

First Long Island Investors was honored to have Dr. Richard Barakat speak to clients at our recent Thought Leadership Breakfast. Dr. Barakat is Physician-in-Chief and Director of the Northwell Health Cancer Institute and Senior Vice President of Cancer Services at Northwell Health. Prior to joining Northwell Health, Dr. Barakat spent almost three decades at Memorial Sloan Kettering Cancer Center, serving as Head of Gynecology Cancer Services for 14 years before becoming the leader of the organization’s entire network. Dr. Barakat helped standardize practices across different locations and organizations, ensuring patients would have convenient access to cancer care without the need to travel to Manhattan. His successful integration and leadership put him on the radar of Northwell Health, which was in need of a physician-in-chief who could help expand the Cancer Institute’s programs and services.

Dr. Barakat began the conversation by shedding light on the brutal facts of cancer:

- In 2018, 9.6 million deaths were caused by cancer and 18.1 million new cases were reported globally.

- In the US alone, there will be approximately 1.7 million new cases this year and 600,000 deaths.

- One out of every eight women and one out of every ten males are diagnosed with some form of cancer in their lifetime.

- A third of cancer cases are either lung, breast or colorectal

- A third of cancer related deaths could be eliminated by dietary and lifestyle changes.

- Currently, there are 10.9 million cancer survivors in the US, and the cost of cancer is expected to reach $173 billion by 2020.

The conversation shifted to the treatment of cancer with a focus on the advancements being made in the treatment and quality of life care. Three areas of research are being emphasized at Northwell: precision medicine, immunotherapy, and CAR-T therapy.

Precision medicine is an approach where doctors treat patients based on a genetic understanding of the disease. All cancers have a genetic basis which can differ from patient to patient, even in the same affected organ. Tests can be conducted to determine which mutation is responsible for the cancer’s origin. Precision medicine involves the creation of drugs that target these mutations. This method is agnostic to the type of cancer and treatment is based on the cancer mutation rather than the tumor histology. One form of treatment in precision medicine is a PARP inhibitor. PARP is a protein found in our cells that helps damaged DNA repair itself. The inhibitor stops PARP proteins in cancer cells from repairing the cancer cells and the cells die off.

Immunotherapy treatments either help the immune system attack the cancer directly or stimulate the immune system in a targeted way. Cancer cells develop proteins that attach to and block the proteins on our body’s T-cells, the cells that defend our body from infectious germs and diseases. One form of immunotherapy is the use of checkpoint inhibitors. Some cancer cells make high levels of proteins. These can switch off T-cells, when they should really be attacking the cancer cells. Checkpoint inhibitor drugs stop the proteins on the cancer cells from switching off T-cells. This turns the immune system back on and the T-cells are able to find and attack the cancer cells. The drawback to checkpoint inhibitors is that the drugs are very potent with strong potential side effects.

CAR-T therapy, or chimeric antigen receptor T-Cell Therapy, is a treatment that alters T-cells to make them more effective at fighting cancer cells. CAR-T therapies induces complete remission in approximately 80% of patients. This therapy has been extremely effective for patients with leukemia and lymphoma. While effective, the therapy has been too expensive for many, costing near $400,000. Fortunately, Medicare is now covering treatment nationwide when it is administered at health care facilities enrolled in an FDA-mandated safety program requiring special training on handling side effects.

Dr. Barakat stated that recently the FDA has approved 13 new targeted therapies within precision medicine, 5 new checkpoint inhibitors, and the first adoptive cell immunotherapy. These are promising steps. An issue raised by Dr. Barakat was the insufficient attention given to survivorship post –cancer. More than 18% of the United States’ GDP is spent on health care (the highest of any developed country and the most per capita), yet our life expectancy is well below many countries. A primary reason for this is a lack of access to premier medicine around the country. Many of the country’s best hospitals and institutes are highly concentrated in certain areas leaving few choices for patients who are not fortunate enough to live in close proximity to dedicated cancer institutes.

For many, historically the best treatment available is in New York City. Traveling from Long Island into the city may not be a viable option for ill patients. Dr. Barakat believes Northwell is creating a leading Cancer institute on Long Island to help combat this issue. He cited that they are in the process of replacing Lenox Hill Hospital in NYC with a state-of-the-art 450 bed acute care hospital of the future. Northwell is also improving the quality and scope of cancer services delivered in its Long Island facilities. Dr. Barakat also pointed to Northwell’s ability to treat pregnant patients suffering from cancer at its Center for Cancer, Pregnancy and Reproduction, one of the nation’s first cancer programs dedicated specifically to pregnant women. 41,000 births occur at the Northwell location and one in every thousand pregnant women will be diagnosed with cancer. “No other center exists in the New York area that can offer this scope of services with experts working seamlessly together,” Barakat said.

Dr. Barakat brought a profound and stimulating conversation to clients that unearthed many oversights of cancer while sharing the encouraging advancements and steps being taken to fight off one of the world’s most deadly diseases.

September 30, 2019

“The future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.” – Warren Buffett

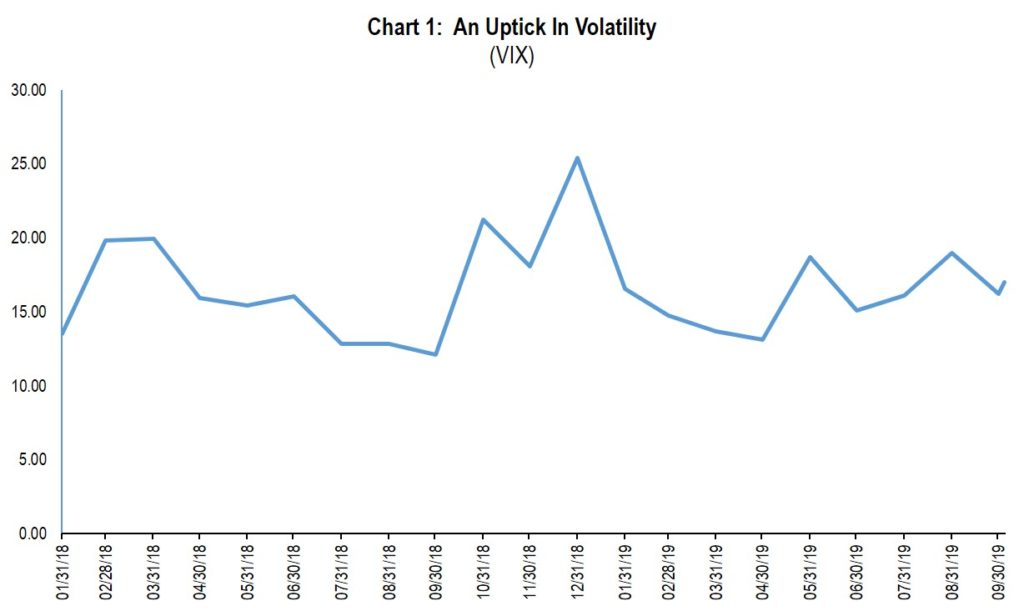

The third quarter ended on a higher note despite many uncertainties including the political maelstrom of potential impeachment of the President. This adds to an already long list of investor concerns including China trade, Iranian aggression in the Middle East, unknown proximity to a recession, an upcoming election cycle, and the future path of interest rates from the Federal Reserve. These factors increased volatility over the second quarter, as you can see in Chart 1.

Given the list enumerated above, it is no surprise that volatility picked up but probably not as much as one would have expected. As a matter of fact, up to this point, the volatility seen so far this year is not out of the ordinary from a historical standpoint. Of course, the year is not over and perhaps there is more to come.

The quote we have chosen this quarter suggests (and we agree) that when the consensus is too optimistic we as investors should be concerned. While the current environment is not “cheery” we are still concerned and our level of concern is somewhat heightened when many believe the end of the bull market is here because we are on the brink of recession; or we are about to go to war; or valuations for the companies we invest in are in nosebleed territory. We do not think we are on the brink of recession; we do not believe we will have an all-out war because of the Iranian actions in the Middle East; and we do not believe that valuations for the companies we invest in are foolishly high. In our opinion, we do not believe the market in general is in nose bleed valuation territory nor that the economy is rolling over, just slowing somewhat. So, let us look at some charts that will help guide us in terms of valuation and overall economic health:

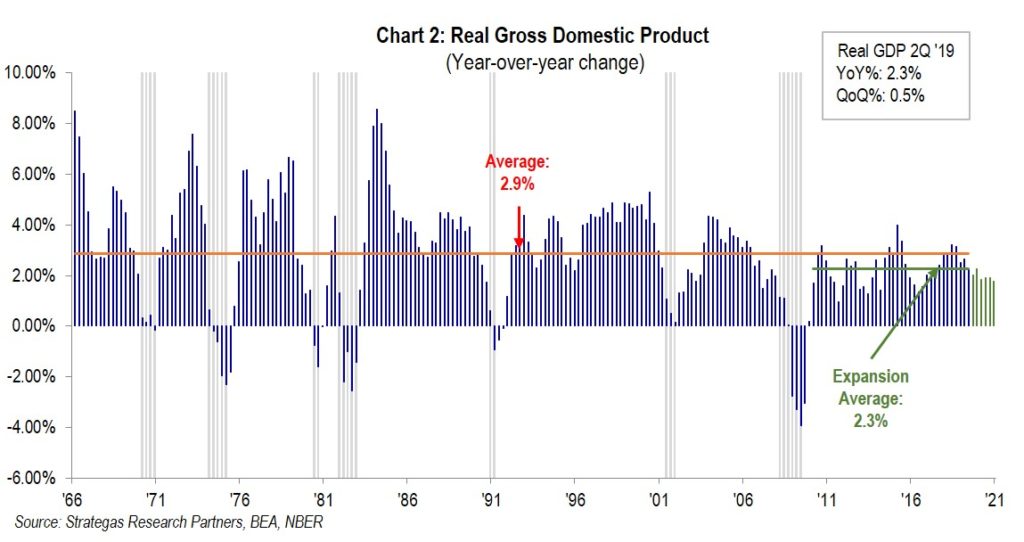

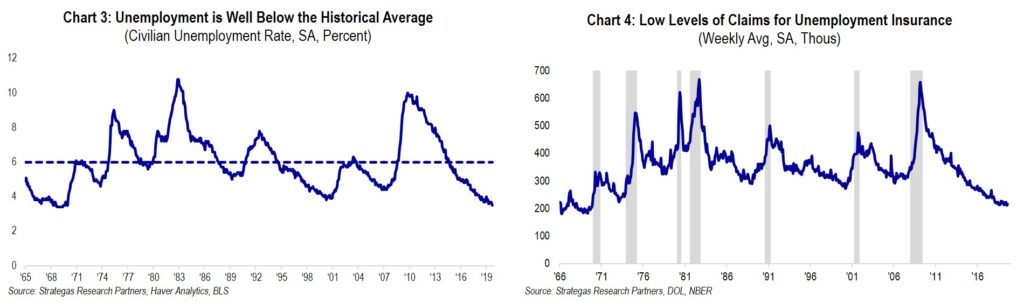

The above charts, measuring key economic data as the third quarter ends, indicate to us that the domestic economy continues to move forward, albeit at a slower pace, despite the concerns that currently prevail. GDP growth, coupled with strong employment, shows an underlying moderately growing and healthy economy. Chart 4 shows a very low level of weekly jobless claims which demonstrates a continued strong labor market and certainly is not a sign of imminent recession.

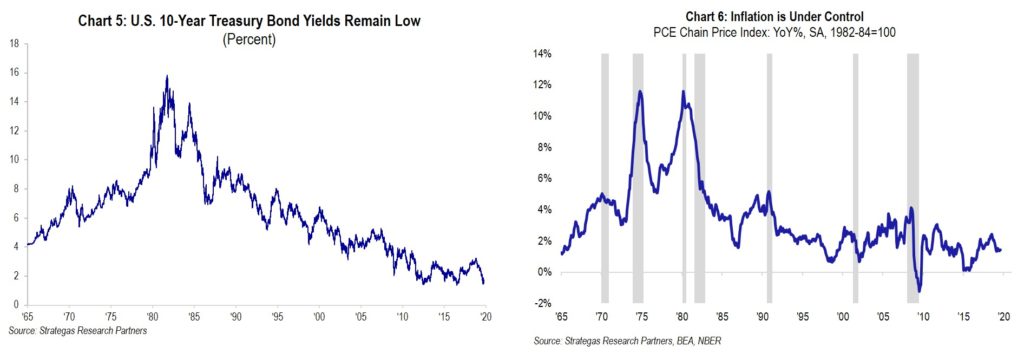

As for interest rates and inflation, the following charts indicate that at current levels both are supportive of a growing economy led by the consumer:

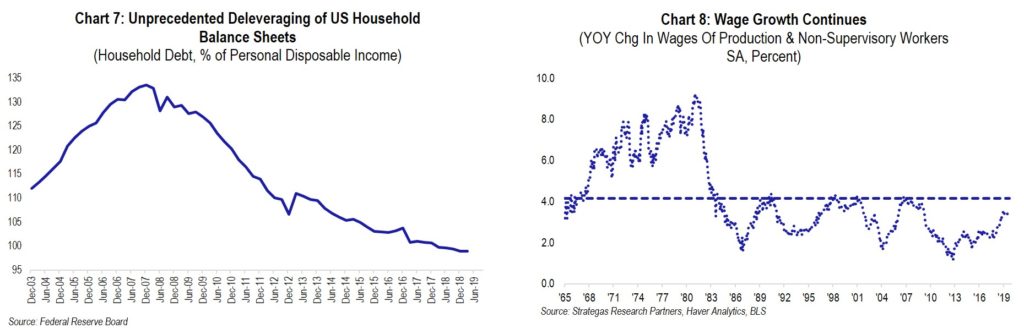

Charts 5 and 6 are both significant when focusing on the importance and health of the consumer. Low interest rates and low inflation are important factors, in our opinion, when determining the underlying strength of the consumer which makes up approximately 68% of the U.S. economy. Add to this the low level of consumer debt (Chart 7) as well as continued moderate wage growth (Chart 8), and this suggests to us that a meaningful driver of our economy remains strong:

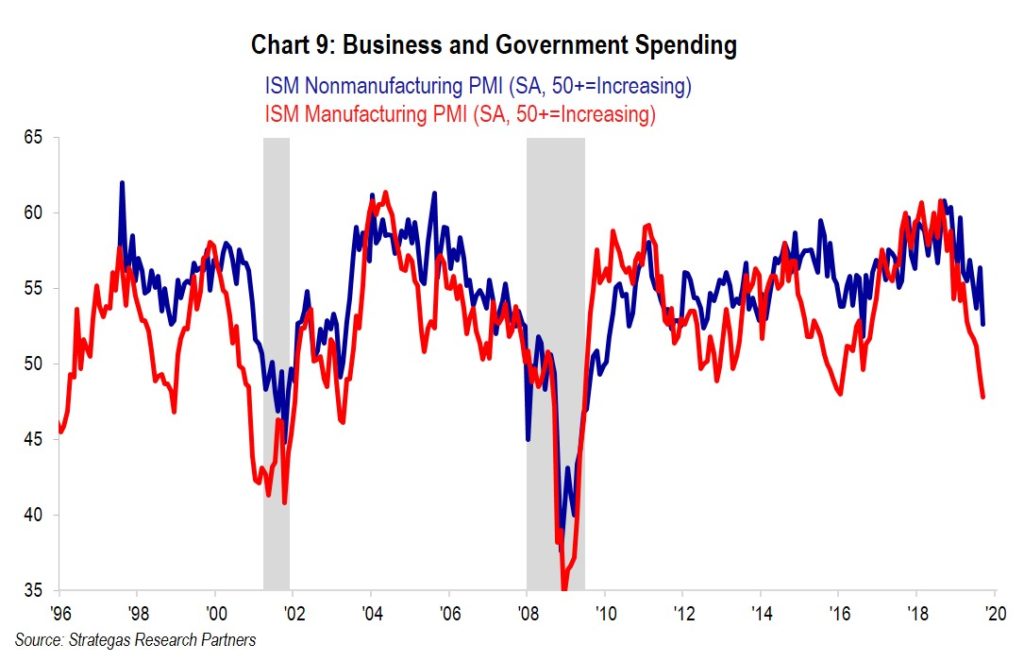

Other factors that contribute to our domestic economy include the strength of business and government spending. Here the picture is more mixed and presents a meaningful concern:

Chart 9 (above) shows that business spending has slowed, and in our opinion this reflects fallout from the trade war with China. It also could reflect the beginning of business concerns about the domestic political environment. The back and forth negotiations, which have been ongoing for more than a year, have resulted in harmful tariffs impacting the U.S. and China as well as other parts of the world, particularly Europe. Our economic consultants believe that this will likely shave one half of one percent from growth in our gross domestic product. On the other hand, as we enter an election cycle (which historically has been good for equities), it is well known that the incumbent administration attempts to spend more to help the economy along. Government spending has accelerated thus far this year and in our opinion will continue to. We are not sure that government spending can offset the reluctance of businesses to spend, but it will help. We will watch carefully to see if the slowdown in the industrial sector spending spreads to the service sector which would add to our worry about business output.

On the global scene, it appears that Europe’s economy is barely growing and has led to the EU reducing interest rates. We believe the continuing uncertainty regarding the UK’s exit from the EU only adds to European economic worries. China’s economy is also slowing as its government is trying to induce growth through fiscal stimuli. We believe that this is being done in an attempt to offset the impact of the trade war with the U.S. In all, these factors have led the World Trade Organization and the World Bank to modestly reduce their forecasts for global trade and global growth which was not robust to begin with, but certainly is not recessionary.

In our opinion, the slower global growth and the continuing concern over a trade war influenced the Federal Reserve’s recent decision to reduce interest rates by another 25 basis points. The investment community expects that the Fed will reduce rates at least one more time this year. We believe it is important for that additional decrease to happen, or equity markets will be very disappointed. (This could result in a rolling over of the equity markets at year end.) We will be watching the last two meetings of the Fed this year very carefully.

The politics of our country certainly make it easy for investors to not be too cheery. The imposing and impending vitriol of impeachment is of concern as it will bring Congress to a standstill (a Congressman told me that gridlock is now worse than ever). As the headlines fly from the media surrounding the President’s phone call with the President of Ukraine as well as alleged pay for play activities of former Vice President Biden and his son, we can expect increased volatility. Thus far, in general, this has not negatively impacted the equity markets. In fact, the quarter just ended resulted in the S&P 500 actually increasing 1.7% in the face of the trade war, an attack on the Saudi oil supply, and the initiation of an impeachment inquiry. Many of our equity investments had a positive quarter despite these factors and all have significant gains year-to-date.

Finally, one of our economic consultants, Strategas Research Partners, points to a nine factor checklist to estimate the likelihood of a bull market top. As of October 1, 2019, all nine do not have check marks next to them suggesting that we are not yet facing a market top and to reiterate, we do not see a recession in the foreseeable future. One of these boxes looks to a market top blow-off where investor optimism results in a buying frenzy. We certainly have not seen that lately. We have included that nine box survey in Appendix I for you to review.

Summary

We had a reasonably good quarter on balance. Equity investing paid off despite the growing wall of worry. Our internally managed defensive equity strategies both had positive quarters. Our Dividend Growth strategy led the way with a 2.8% net gain contributing to a year-to-date net return of nearly 18% (dividends for the strategy up to this point have grown approximately 10% on average). So, our continued bias to being somewhat defensive has certainly contributed to the net worth of our clients while taking less than market risk!

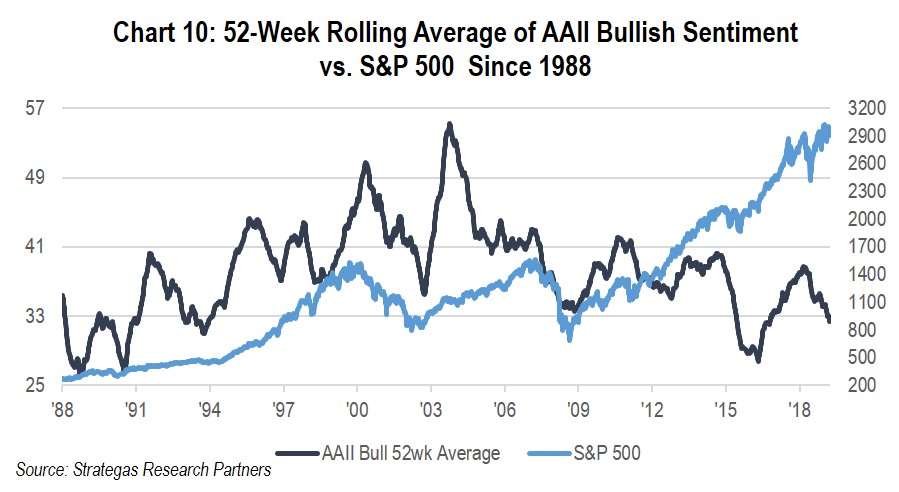

We pride ourselves on being conservative and prioritize return of capital as our most important concern. We also want to exploit the volatility and investor anxiety where we can find opportunity. As Buffett stated, when there is not a cheery market there just might be some opportunity. We do not believe we are in a “cheery market”. The following chart suggests that the individual investor has still not recovered in terms of market enthusiasm since the great “decession” of 2008/2009:

We believe chart 10 (above) suggests an unenthusiastic individual investor, and supports our belief that this has been the most unloved bull market in history. We do not share the same sentiment and will continue to look for high quality equity opportunities. But we can do it while continuing our bias to our defensive equity strategies.

Thus far this year, we have achieved strong performance for our clients with less risk by underweighting fixed income (although bonds have had good returns year-to-date) and overweighting our defensive equity strategies while somewhat underweighting our traditional equity strategies. Going forward, we still believe that recession is not imminent. However, we must take seriously the Democrat’s launch of an impeachment inquiry that could lead to articles of impeachment. Although, at this point, it appears to be a long shot that the Senate will vote to convict the President, the distraction and acrimony in Washington, D.C. could weigh on our economy. At the same time, the President will use whatever tools are available to him to fight the allegations of inappropriate behavior. He is known for being a counter puncher and will do whatever he can to ensure a strong economy which he believes is key to his reelection. History suggests a strong equity market in the final two years of a Presidential term (this being the third and next election year being the fourth). However, an impeachment inquiry possibly followed by articles of impeachment make it difficult to rely on history.

The fundamentals of low interest rates, low inflation, growing GDP, low unemployment, a vibrant consumer, as well as modestly growing corporate earnings should support a reasonable economy and equity market in the fourth quarter. However, anxiety and emotions will remain high given our current political turmoil and international complexities. We view one’s asset allocation to be critical to avoid being too aggressive on one hand or too conservative on the other. Our active management approach continues to focus on companies to invest in that we believe are either reasonably valued with growth opportunities or downright undervalued. We also believe that extremely low yielding fixed income does not present a capital appreciation opportunity or a way to earn after-tax returns above inflation, but remains an anchor in volatile times. So, a modest allocation remains our recommendation for most clients. Our defensive equity strategies, in our opinion, remain an overweight recommendation given their risk/reward profiles in what could be a more volatile fourth quarter and 2020.

Stay tuned! We look forward to reporting to you after year-end. In the meantime, have a wonderful fall and holiday season. We hope you can join us on November 7th for our next Thought Leadership Breakfast at the Garden City Hotel featuring Jon Ledecky, Co-Owner of the NY Islanders. Please call or visit with us for any of your wealth/money management needs.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Partnership returns are estimated and are subject to change without notice. Performance information for Dividend Growth, FLI Core and AB Concentrated US Growth strategies represent the performance of their respective composites. FLI average performance figures are dollar weighted based on assets.

The views expressed are the views of Robert D. Rosenthal through the period ending October 23, 2019, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2019 by First Long Island Investors, LLC. All rights reserved.

Investors often react emotionally, especially when the market is volatile. U.S. News and World Report recently interviewed our Senior Vice President, Wealth Management and Director of Research, Philip W. Malakoff as part of an article to take a deeper look at stock market corrections and what they really mean.