“In investing, what is comfortable is rarely profitable.” Robert Arnott

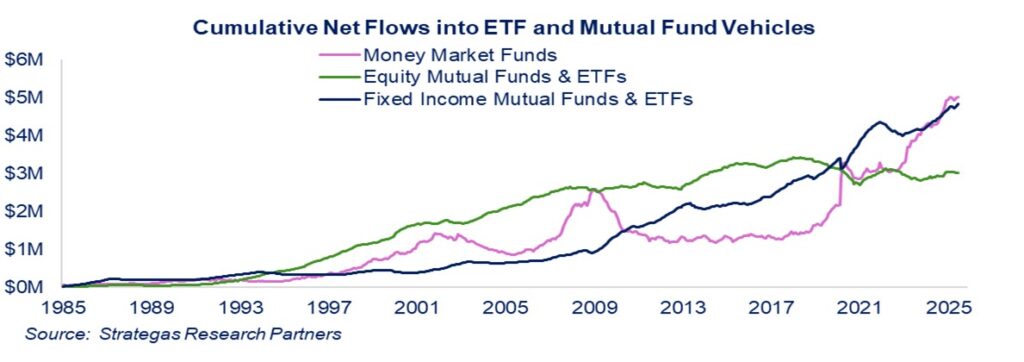

Reasonable gains were achieved across all of our strategies in the third quarter despite crosscurrents from tariffs, uncertainty about the number of Federal Reserve interest rate cuts, a weakening labor market, and continued geopolitical strife. Growing corporate earnings, modest increases in inflation, largely caused by significant tariff increases, and the trend toward lower short-term interest rates all played a part in the gains achieved across different asset classes as did the unfolding growth story of artificial intelligence (AI). Bonds, large-cap growth and value stocks, international equities, gold, Bitcoin, and segments of the real estate market all participated in what proved to be a good quarter from an investor’s standpoint. Positive money flows also impacted segments of the market, as the third quarter recorded the strongest inflows so far this year and the second strongest quarter since 2020.

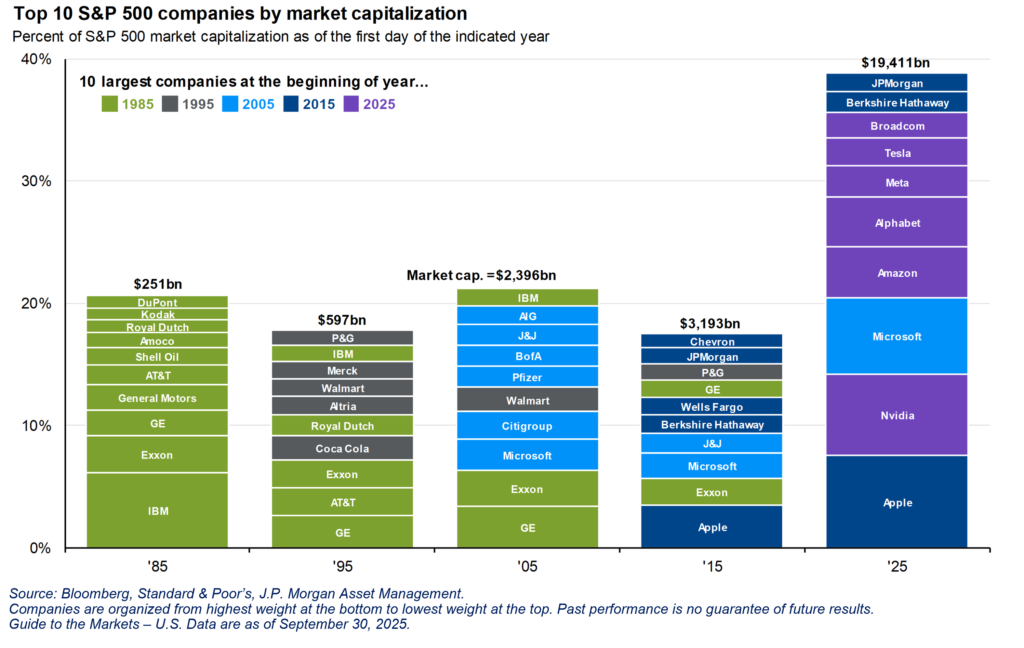

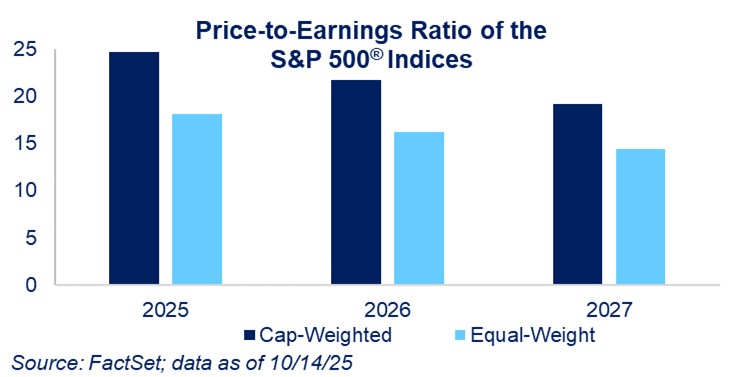

These gains for the quarter and year-to-date, however, do not come without a meaningful level of uncertainty. The continued narrowness of stock market gains (seven companies represent more than 35% of the S&P 500® Index), the depreciating dollar, seemingly high valuations for growth stocks, the full extent of inflationary forces from tariffs, and the potential economic return of the AI arms race are all contributing to an “unloved bull market” in investing. Gold and Bitcoin have achieved new record highs, making us wonder whether the growing national debt, new government policies, or a government shutdown are having a negative impact on our domestic currency. Historically, government shutdowns have not had a negative impact on equity markets. Add to this the continued political divide across our nation, which causes angst among investors.

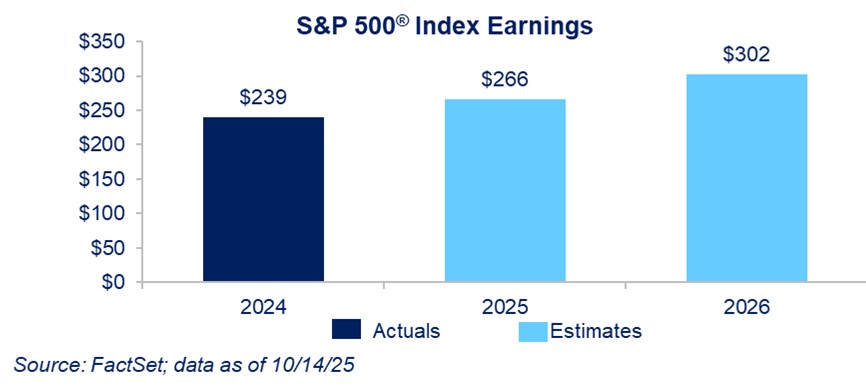

On the positive side, S&P 500® Index earnings continue to grow as profit margins expand:

As you know from reading our reports over our almost 42 years of being in business, we rely on earnings and cash flow growth to be the backbone of capital appreciation. Whether it is the earnings of a company or the cash flow of real estate, that growth is required for sustainable appreciation, in our opinion, along with a reasonable level of interest rates, a combination essential for capital appreciation. Additionally, money flows can affect which asset class performs better over shorter periods:

We believe that, over the past few years, investors globally have allocated capital to various asset classes in differing amounts. Certainly, the disruptive technology of AI has led to certain growth companies seeing huge buying interest. Chipmaker NVIDIA has appreciated almost fifteen-fold over the past few years, and other companies in the AI space have followed suit, including Oracle and Broadcom (up 70% and 43% this year, respectively). Companies with cloud capabilities, including Amazon.com and Microsoft, have also been part of this tech revolution. These and other companies in the Magnificent Seven plus have contributed to significant appreciation in certain FLI strategies over the past two-plus years. Most recently, as referenced in our Annual Thought Piece in January, international investing has also seen strong money flows, contributing to the MSCI ACWI ex USA Index appreciating 23% year-to-date. We believe this strong international performance can be attributed in part to valuation, our depreciating dollar, uncertain and often erratic U.S. government policies (such as tariffs), and declining interest rates abroad, while certain European countries increase their defense spending leading to local economic growth.

Now the uncertainty we reference includes the following:

- How many rate cuts will the Federal Reserve implement?

- What direction will the interest rate on the 10-year U.S. Treasury take?

- How much inflation will result from the ultimate tariff rates?

- How high will unemployment rise, reflecting some economic slowdown and uncertainty?

- What benefits will the economy derive from the recent tax legislation passed by Congress?

- How and when will the geopolitical hotspots in Europe and the Middle East be resolved?

- Are valuations stretched for certain segments of the equity market?

The uncertainty described above makes it difficult for investors to navigate the current investment landscape. We believe the Fed will continue to reduce short-term interest rates several times over the next year. At the same time, history suggests that does not mean the 10-year U.S. Treasury will decline, unless inflation really abates. The direction of the 10-year U.S. Treasury is very important to the housing market, as it is what the interest rates for mortgages are based on. It is our opinion that the Fed’s prediction of lower inflation in 2026 and 2027 (Personal Consumption Expenditures Price Index (PCE) advancing 2.6% and 2.1%, respectively) in large part depends on the accuracy of the Fed’s prediction of slower gross domestic product growth of 1.6% this year and 1.8% next year. The current Administration would expect somewhat higher growth and, perhaps, the recent tax bill will help achieve that. At the same time, the Fed expects unemployment to reach 4.5%, which would not be too harsh. In our view, the comprehensive tax bill of 2025 will benefit business by inducing investments in technology and manufacturing, given depreciation incentives. Perhaps this will aid employment, although the labor supply has diminished due to the country’s current immigration policies. We are sure both sides of the aisle would love to see legal immigration reform, but it has been elusive for decades.

Regarding the geopolitical turmoil in both the Middle East and Europe, despite President Trump’s attempts to seek peace, that too has been elusive. At this point, Russia’s President Putin seems uninterested in a cease-fire or peace deal with the country he illegally invaded. This assertion is based on the 1994 Budapest Memorandum on Security Assurances treaty signed by Russia, in which Ukraine gave up its nuclear weapons. This ongoing war has cost the U.S. significantly, while also boosting our exports of munitions. The other war, in the Middle East, has seen Iran’s nuclear ambitions set back by a joint American/Israeli attack and the severe weakening of two of Iran’s terrorist proxies, Hezbollah and Hamas. Meanwhile, innocent hostages remain captive; Israel remains at war with Hamas; and the people of Gaza continue to suffer. Neither of these two wars is good for the world. (See P.S. for update)

Given these positives (growing earnings, potentially lower short-term interest rates, no recession in sight, and favorable tax policy), we continue to see an economy growing but at a slower pace; positive S&P 500® Index earnings growth; inflation somewhat above the Federal Reserve’s goal of 2%; and, unfortunately, a continuation of geopolitical strife. Add to this our own political divisiveness and rising extremism, which shows no signs of abating and has most recently led to violence in the form of political attacks and assassinations across the political spectrum.

As investors, we remain cautiously optimistic as the AI revolution fuels not only certain growth companies, but much of our daily lives; international investing remains robust; more value-oriented companies, as reflected in our Dividend Growth strategy, remain a safer harbor in our opinion (+12.1% net* year-to-date); and we would not be surprised to see small- and mid-cap companies play catch-up to large-cap growth and value companies if interest rates moderate:

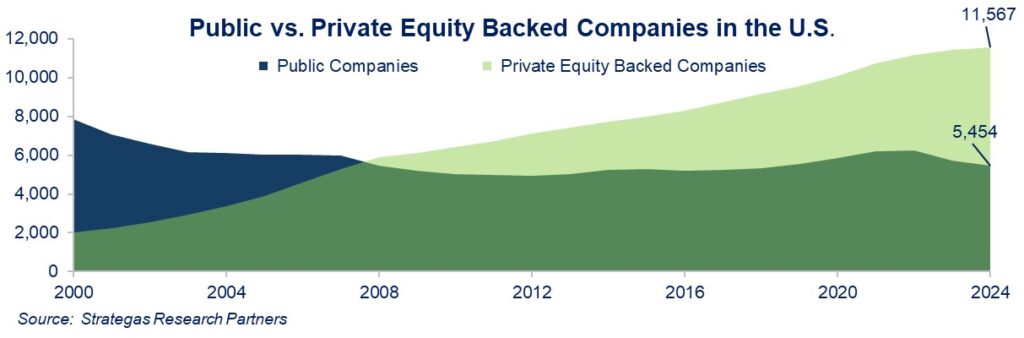

Another factor that we consider a positive from a long-term standpoint is the above chart showing the reduced number of public companies as compared to twenty years ago. At the same time, the proliferation of exchange-traded funds and index funds offer investors different ways to invest in the smaller pool of public companies. Private equity backed companies, on the other hand, have grown in number significantly. They are illiquid but might offer handsome returns.

The bottom line continues to be, in our view, maintaining our bias to high-quality, financially strong companies, through the book ends of both large-cap dividend growing companies along with large-cap growth companies, especially those participating in the cloud computing and booming AI trends. Having exposure to both quality international-domiciled companies and small- and mid-cap companies also makes sense as short-term interest rates are expected to decline. Of course, in this latest allocation, we emphasize companies with real earnings. We also believe that nearly every client should have some exposure to fixed income and alternatives (including real estate), especially as some believe equity valuations are stretched. It is this multifaceted asset allocation that will make investing, when it is somewhat uncomfortable given the enumerated uncertainties, profitable for the long term.

Our various investment strategies allow each of you to work with us to customize your asset allocations to achieve your long-term goals. Within the asset classes we have mentioned, we believe we can find quality opportunities with attractive earnings growth, cash flows, and reasonable valuations for the long-term investor.

We are pleased to announce two significant achievements. FLI has been awarded a 5-Star rating from InvestmentNews as one of the top 27 registered investment advisers in the United States in 2025! Additionally, we are proud to share that Thérèse C. Vobis, our Senior Vice President of Finance & Administration and Chief Financial Officer, has been selected as a recipient of the Long Island Business News Top 50 Women in Business award. Both honors reflect our dedication to you, our clients, and friends of the firm, as well as your confidence and loyalty, making this very special recognition possible.

Please enjoy the upcoming holiday season and stay healthy. Of course, do not hesitate to contact us should you or members of your family or friends have any wealth management needs, whether that includes investing, asset allocation, liquidity needs, insurance, tax or estate planning.

P.S. As of October 13, 2025, all living Israeli hostages have been returned to Israel, while only several of the deceased hostages have been repatriated. Approximately two-thousand Palestinian detainees have been emancipated, and a 20-point Trump peace plan is currently under consideration by a large number of Western and Middle Eastern countries. Whether this marks the end of the war between Hamas and Israel remains to be seen.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of October 24, 2025 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of September 30, 2025, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2025 by First Long Island Investors, LLC. All rights reserved.

We are proud to share some exciting news—First Long Island Investors, LLC (FLI) has been recognized as a 5-Star RIA Firm for 2025 in the inaugural report published by InvestmentNews, an online news source for wealth-management professionals. Read the full announcement about the 2025 InvestmentNews 5-Star RIA Firms InvestmentNews 5-Star RIA Firms 2025. We are honored to be recognized as a leading wealth manager and feel it is a strong validation of the strategy and values that guide our work every day.

This prestigious award spotlights twenty-seven registered investment advisers across the country that demonstrate meaningful client impact, exceptional scale, and sustained growth based on metrics verified by InvestmentNews. The list recognizes the nation’s top-performing wealth management firms managing at least $1 billion in assets under management (AUM) in 2024.

This recognition belongs not only to our team but also to you—our valued clients. Your trust, partnership, and continued confidence in us make achievements like this possible. Thank you for being a valued client. We look forward to building on this momentum by continuing to provide a high level of service and supporting your long-term financial success.

About the 5-Star RIA InvestmentNews Award: InvestmentNews evaluated self-reported, key performance indicators provided by FLI in response to a survey conducted in April 2025. The data relied upon for this evaluation included assets under management (AUM), AUM growth, organic client acquisition, client retention, and charitable and community involvement. The “5-Star RIA Firm” designation was awarded on September 10, 2025 and based on an evaluation period of January 1, 2024-December 31, 2024. FLI did not compensate InvestmentNews directly or indirectly through paid advertising prior to receiving this recognition.

Best Regards,

Bob, Ralph & the First Long Island Investors team

First Long Island Investors, LLC is proud to announce that Long Island Business News has selected Thérèse C. Vobis as a recipient of the 2025 Top 50 Women in Business Award.

Celebrating its 25th anniversary this year, the Top 50 Women in Business Awards recognize Long Island’s top women professionals for their business acumen, mentoring, and community involvement.

All of us First Long Island Investors, LLC congratulate Thérèse C. Vobis on this prestigious accomplishment!

“The first rule of compounding is to never interrupt it unnecessarily.” Charlie Munger

Looking back at the first quarter, we endured a 4.3% decline in the S&P 500®, driven largely by a significant drop in the Magnificent Seven (which saw an average decline of 15.7% among the seven companies). Value stocks significantly outpaced growth shares.

As the second quarter commenced, investor uncertainty intensified following President Trump’s April 2nd Liberation Day tariff policy announcement. This unexpected move shocked markets and raised concerns that global trade, as we have known it, was being upended. Many feared the policy shift would drive inflation higher, delay the Federal Reserve’s ability to reduce interest rates, and potentially lead to a recession.

Despite reporting solid first-quarter earnings, several companies were reluctant to issue forward guidance or offered cautious outlooks, as the market tried to make sense of the daily twists and turns in the administration’s tariff strategy–ranging from off, to on, to delayed, and then modified.

At FLI, we shared the broader market’s concerns, but chose not to take any precipitous actions. Instead, consistent with our disciplined approach, we avoided reacting prematurely. We continued to evaluate the fundamentals of our investments while patiently assessing the President’s broader economic agenda, not just tariffs, but also his so-called “big beautiful tax bill” and his efforts to deregulate certain sectors of the economy (which we view as the three legs of the Trump economic stool).

This “pause” on our part, has thus far, proven to be prudent. Our investments rallied through the end of the second quarter, recovering earlier losses and delivering reasonable year-to-date gains across all of FLI’s strategies.

An index we often reference that tracks investor fear and greed in the stock market registered its worst reading in recent memory, 3 (extreme fear), on April 8th. The Dow fell a whopping 4,580 points from April 3rd through April 8th. Yet, just 83 days later, the Dow was 6,449 points higher nearing an all-time high and the Fear & Greed Index had rebounded meaningfully to 65 (greed).

Over our almost 42 years as professional investors, we have learned the importance of evaluating the shifting ground beneath us and reverting to investment fundamentals. Earnings, interest rates, cash flows, and dividend growth suggested to us that the extreme fear of April 8th seemed excessive, just as the apparent greed reflected in today’s level may now be equally unwarranted as we try and assess the future investment environment.

Inflation appears tame. Corporate earnings remain resilient. AI is disruptive and transformative. A tax bill containing incentives for corporate growth is nearing passage. The Federal Reserve is still projecting two interest rate cuts by year-end.

We have also seemingly weathered a 12-day war between Israel and Iran. The combined efforts of the U.S. and Israel appear to have pushed back Iran’s nuclear program, potentially for years. Encouragingly, this joint military action, at this point, has not resulted in a widening of the regional war. In fact, some countries, including Syria, are reportedly considering normalization with Israel, as Iran becomes increasingly isolated.

Notably, energy prices did spike but quickly returned to normal levels during this brief, yet intense, Middle Eastern war. This reflects both strong global supply and the apparent energy independence of the U.S. The relative stability of oil prices supports our belief that inflation will remain manageable.

The ongoing conflict in Europe persists and, as a result, President Trump has successfully persuaded NATO to increase its defense commitments, while the U.S. has reaffirmed its membership and commitment to Article 5, which ensures collective defense against Russian aggression.

Wow, look at what we have experienced in just three months! Both equity and bond markets have responded to this volatility with optimism as evidenced by record high equity markets and tepid bond yields. The 10-year U.S. Treasury yield hovers around 4.25%. U.S. banks just passed their “stress tests” with flying colors, prompting several of them to increase their dividends.

If the “big beautiful tax bill” passes, a major tax increase in 2026 for most U.S. families will be avoided, as the prior tax cuts are set to sunset at year-end. Businesses stand to benefit from new incentives to invest in the U.S., including the ability to expense capital investments, measures that promote productivity and innovation, especially as AI continues to transform industries.

However, serious concerns remain about the bill’s potential to increase the national debt and its broader effects on the medical system, including both care delivery and research. Many critics question the bill’s merits, especially since it uses reconciliation to achieve Senate passage with a simple majority.

Given today’s uncertainty across economic, tax, geopolitical, societal, and environmental factors, here is a brief review of key indicators from our perspective:

When considering all of these factors, we remain cautiously optimistic. The economy appears solid and not on the brink of recession. Inflationary effects from tariffs seem manageable, especially if the tax bill passes as currently proposed. The bill is designed to offset tariff impacts and, in the meantime, the government is deriving substantial revenue from tariffs.

Hopefully, all of this will help stimulate consumer confidence, which has weakened under inflation concerns and geopolitical tensions. Valuations are not cheap, suggesting this is a stock picker’s market where earnings growth, quality, and cash flows will matter most.

Employment remains reasonably strong. That said, we do not expect surprises from the Federal Reserve, such as a rate hike. We believe the Federal Reserve will reduce short-term rates by year-end, which should benefit well-located real estate, especially properties that may support the government’s push to stimulate onshore manufacturing.

At the same time, real estate is being gobbled up by hyperscalers intent on building data centers to support AI. This, in turn, should benefit companies either directly or indirectly involved in AI and data centers across the country.

We also see some opportunity in small- and mid-cap company valuations, as confirmed by our outside managers, which have not benefitted recently from a stock price perspective. We made a similar point about international domiciled companies in our Annual Thought Piece, and their share prices led the way for the first six months of the year. At least three of FLI’s strategies have international exposure and have benefitted.

We have stayed the course in advising our clients to stay put and remain invested. This approach worked well during the tumultuous second quarter, and we have since seen a resurgence in several of the Magnificent Seven with the growth index now nearly matching the performance of the value index. Our “bookend” approach of offering both value- and growth-oriented strategies continues to serve our clients well. Bonds have also provided a safe haven, delivering modest returns and less volatility than FLI’s equity-oriented strategies. I’m pleased to report that, having weathered a very volatile first six months of the year, we are achieving positive returns across every strategy.

We continue to urge our clients to stay the course (and virtually all have) rather than attempt to time the markets. In our opinion, TIME IN THE MARKETS BEATS TRYING TO TIME THE MARKETS. This is key to compounding returns, and we believe it holds true whether investing in bonds, stocks, real estate, collectibles, or even private equity.

Incurring taxes unnecessarily and trying to guess when to get back in simply does not work, as evidenced by the dramatic swings in investor sentiment during the second quarter. Uncertainty has always been the road that long-term investors have traveled. Now is no different. Prudent, diversified asset allocations can help temper volatility.

Enjoy the summer, and we look forward to reporting to you again in October. Of course, we will stay in touch and keep you informed about the progress of the “big beautiful tax bill” as some have called it. Whether it passes or not, there will be ramifications either way. We also hope to see peace expand in the Middle East, even as attention turns back to the conflict between Russia and Ukraine. In the meantime, we expect a solid U.S. economy and remain cautiously optimistic for the rest of the year.

Wishing everyone a wonderful summer!

Robert D. Rosenthal

Chairman, Chief Executive Officer and Chief Investment Officer

Organizational Announcement:

It is with mixed emotions that we announce the departure of Joseph Libretti, Investment Analyst, who has decided to pursue other opportunities. While we are sorry to see him go, we are proud of his achievements and wish him continued success in his new role.

On a positive note, we are pleased to welcome Simon Ferris as our new Junior Investment Analyst. He recently graduated from the University of Miami with a B.S. in Business Administration, majoring in Finance, and earned recognition on both the Provost’s Honor Roll and Dean’s List. Simon joins our Investment Committee with a strong analytical foundation and great enthusiasm.

Please join us in welcoming Simon to the FLI team!

Overview of the One Big Beautiful Bill Act

On July 4th, President Trump signed into legislation a comprehensive tax bill that was narrowly passed in both the House and Senate along party lines. This legislation included several provisions that may be of particular interest to our clients:

Individual Income Tax:

- The individual income tax rates have been permanently extended, notably retaining the top rate of 37%. Great news for high-income individuals!

- The deduction for the State and Local Taxes (SALT) has been increased from $10,000 to $40,000. This change will benefit many residents of high-tax states such as New York. However, for those individuals with income between $500,000 and $600,000, there will be a phaseout of the increased SALT deduction down to the existing $10,000 annual cap.

- Deductible mortgage interest for loans limit was scheduled to revert to $1 million after 2025, but this bill makes the $750,000 cap permanent.

Estate and Gift Tax:

- The lifetime exemption on federal estate and gift taxes will increase to $15,000,000 per individual or $30,000,000 per couple. These amounts will be indexed for inflation.

Business Tax:

- The Pass-Through Entity Tax (PTET) deduction remains fully available under current law—a relief for many business owners and professional service firms that rely on PTET regimes to mitigate the federal SALT deduction cap.

- Incentives for businesses to invest in manufacturing plants and other capital projects have been included and may benefit some of our client base.

Energy Tax Credits:

- There are phase-outs of clean energy credits, impacting electric vehicles and other projects, in an effort to save money and reduce the annual deficit.

This legislation is designed to promote economic growth and maintain tax benefits for many. Still, there are serious concerns that if sufficient economic growth is not achieved, the legislation could add to the annual deficit and long-term national debt. It is also possible that growing deficits will necessitate tax increases in the future. Accordingly, we recommend considering both tax and estate planning given the pros and cons of this legislation. In addition, there are some concerns relating to the future availability of Medicaid for some current recipients. This remains to be seen.

We are always available to discuss how this bill may affect you and your family.

DISCLAIMER

The views expressed herein are those of Robert D. Rosenthal or First Long Island Investors, LLC (“FLI”), are for informational purposes, and are based on facts, assumptions, and understandings as of July 24, 2025 (the “Publication Date”). This information is subject to change at any time based on market and other conditions. This communication is not an offer to sell any securities or a solicitation of an offer to purchase or sell any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Nothing herein should be construed as a recommendation to purchase any particular security. The companies and securities described herein may not be held in every (or any) FLI strategy at any given time. Investment returns will fluctuate over time, and past performance is not a guarantee of future results.

This communication may not be reproduced, distributed, or transmitted, in whole or in part, by any means, without written permission from FLI.

All performance data presented throughout this communication is net of fees, expenses, and incentive allocations through or as of June 30, 2025, as the case may be, unless otherwise noted. Past performance of FLI and its affiliates, including any strategies or funds mentioned herein, is not indicative of future results. Any forecasts included in this communication are based on the reasonable beliefs of Mr. Rosenthal or FLI as of the Publication Date and are not a guarantee of future performance. This communication may contain forward-looking statements, including observations about markets and industry and regulatory trends. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect the views of the author as of the Publication Date with respect to possible future events. Actual results may differ materially.

FLI believes the information contained herein to be reliable as of the Publication Date but does not warrant its accuracy or completeness. This communication is subject to modification, change, or supplement without prior notice to you. Some of the data presented in and relied upon in this document are based upon data and information provided by unaffiliated third-parties and is subject to change without notice.

NO ASSURANCE CAN BE MADE THAT PROFITS WILL BE ACHIEVED OR THAT SUBSTANTIAL LOSSES WILL NOT BE INCURRED.

Copyright © 2025 by First Long Island Investors, LLC. All rights reserved.

Brian Gamble (left), Michael Rogers (center), Robert D. Rosenthal (right)

First Long Island Investors, LLC recently welcomed Michael Rogers, senior staff editor at The New York Times, as the featured guest for our Thought Leadership Breakfast at The Garden City Hotel on May 16, 2025. Rogers, a veteran journalist and author, recently completed two years as the futurist-in-residence for The New York Times and is also a columnist for NBC.com. He led an engaging discussion on “The Unstoppable Rise of AI”, exploring its wide-ranging impacts on business, health, and society.

Rogers opened by mapping out today’s artificial intelligence (AI) landscape, noting the explosive growth of generative AI technologies since ChatGPT’s public debut in November 2022. While AI has been in development for decades, he argued, it has now reached a true inflection point and is touching nearly every part of the economy.

Tracing the history of AI from its academic origins to the present, Rogers explained how neural networks, deep learning, and the use of vast datasets (like those powering ChatGPT) are fundamentally reshaping industries. He offered examples such as seismology, where neural networks now help identify earthquakes with over 98% accuracy.

A central theme of Rogers’s talk was that AI is unlike any previous technology. AI improves as it scales, is already woven into everyday life, and is advancing faster than past innovations. Despite its longstanding roots, the recent surge in applications—from customer service to healthcare diagnostics—has brought new and pressing challenges around ethics, regulation, and workforce adaptation.

Humanoid robots, AI medical assistants, and even AI-generated TV scripts and music are now realities. In radiology, Rogers highlighted, AI is being used to assist (but not replace) doctors in reading X-rays. In the business world, companies like Amazon.com are using AI to run warehouses more efficiently, with robots operating at a cost of just $10 per hour. Robots can work 24 hours a day, 7 days a week without taking any vacation or sick time.

Rogers also addressed the risks and limitations of AI, including issues with the accuracy of AI-generated content, the rise of deepfakes, algorithmic bias, and the spread of misinformation. He warned against assuming AI’s answers are always reliable, noting that AI can sound confident while being wrong. He also stressed that while AI can boost productivity, it still lacks essential human qualities like empathy, contextual understanding, and creativity.

To close, Rogers urged leaders to focus on the “3 Cs” that AI cannot emulate: empathetic communication, collaboration, and creative problem-solving. These distinctly human skills, he said, will be crucial as society adapts to an AI-driven world.

FLI remains committed to offering clients timely insights from top industry experts and thought leaders through the FLI Thought Leadership Breakfast series. We thank Michael Rogers for sharing his perspective and expertise on the topic of AI.