As part of the June 2016 issue, LI Pulse magazine profiled Ralph F. Palleschi, President and Chief Operating Officer of First Long Island Investors, in its philanthropy section. Ralph has been involved with child-focused charities for over 20 years and believes strongly in giving back. The complete story can be found here.

LI Pulse Magazine Profiles Ralph F. Palleschi in its June 2016 Issue

On May 19, 2016, Ralph F. Palleschi, our President and Chief Operating Officer, was the lifetime honoree at the Viscardi Center’s 50th Celebrity Sports Night. The event raised a record-breaking $4.4 million dollars and was presented by the Ralph & Lucy Palleschi Family Foundation. Sports Night is a premier charitable event on Long Island which raises funds to enrich the lives of children and adults with disabilities. Headlining this year’s golden anniversary was New York Giants quarterback, Eli Manning and Bryant Gumbel, Host of HBO’s “Real Sports.” Ralph has been involved with the Viscardi Center since 1994 and is currently a director, as well as chairman of its Investment Committee.

For a recap of the event click on the link below:

www.viscardicenter.org/news-events/news/milestone-fundraiser.html

Lawrence J. Waldman will join First Long Island Investors, LLC, a wealth management company established in 1983, as a Managing Director on May 2, 2016. At FLII, Larry will focus his time on being part of the team which advises current and prospective high net worth individuals, families, and select institutions on the benefits and value of FLII’s investment and wealth management services. He will also play a key role in creating as well as furthering strategic relationships with professional services firms on Long Island. FLII, which was founded in 1983, oversees in excess of $1.3 billion dollars in assets.

“I have been associated with FLII for many years and am delighted to join it in a full time capacity. I hope to use my breadth of experiences to help FLII grow its client base and advise its investment committee utilizing my extensive financial background” said Mr. Waldman. “This is a natural progression for me that builds upon my career in public accounting, serving public and private companies across various industries as well as my relationships with and knowledge of the Long Island business community. I look forward to this challenge and hope to contribute to the growth of FLII in the New York metropolitan area.”

Until 2006, Larry was the Managing Partner of the Long Island office of KPMG, the international accounting firm, where he began his career in 1972 and was responsible for the direction and operating of its Long Island practice. Larry currently serves as an advisor to the accounting firm EisnerAmper LLP, and as a board member and audit committee chairman for several public and private companies.

Robert D. Rosenthal, FLII’s Chairman, CEO and Chief Investment Officer, said: “Throughout his distinguished career, Larry has continuously worked with and been a trusted colleague of the firm and our clients. We are proud to add such a prominent and well-respected member of the Long Island business community to our team.”

Larry is an active leader in the Long Island business community, currently serving as Chairman of the Board of the Long Island Association, which is the region’s leading business organization. Kevin Law, President and CEO of the Long Island Association said “We are fortunate to have Larry as our Chairman and congratulate him on his new role at First Long Island Investors. He is a respected business leader who has served on the LIA Board for more than two decades and helps support our efforts to grow Long Island’s economy, create jobs, and improve the business climate for our region.”

Additionally, Governor Andrew Cuomo appointed Larry to serve as Chairman of the Long Island Power Authority in the wake of Hurricane Sandy, a position he held for more than a year following the devastating storm where he oversaw what was at the time the second largest public power utility in the nation. He currently serves on the Board of Trustees for the State University of New York and serves as Treasurer and Board Member of the Long Island Angel Network. He also serves on the Board of Directors and as the Treasurer of the Advanced Energy Research and Technology Center at Stony Brook University. Larry also serves on the Dean’s Advisory Council of the Zarb School of Business at Hofstra University, where he is an adjunct professor in the graduate program.

INVESTMENT PERSPECTIVE

“Traders can cause short-term volatility. In the long run, markets must revert to a sensible price/earnings multiple.”

Ben Stein (noted economist)

The confluence of instant communications, high-frequency trading, algorithmic trading, and various index and exchange traded funds have all led to the potential for greater volatility. These factors coupled with the following economic and investment questions/issues posed by some investment pundits created a very volatile first quarter:

- Was the United States already in a recession?

- Would corporate earnings decline?

- Would the plummeting price of oil lead to some sort of financial crisis?

- Would the slowdown in China lead to economic strife in developed (except the U.S.) and emerging countries?

- Would interest rate increases by the Federal Reserve roil equity and real estate markets?

The result was a tumultuous start to this first quarter with equity markets declining by 10% through the middle of February. It was the worst January for common stocks in the history of the S&P 500. This required our steady hand in providing guidance to our clients that this market downturn was overdone and not justified by fundamentals.

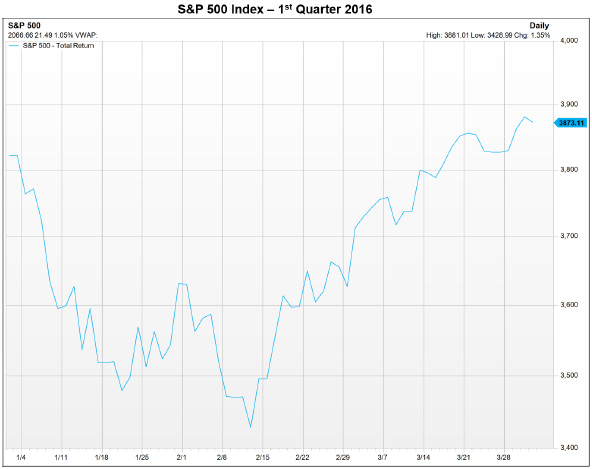

Although we hesitate to ever look at one quarter as being meaningful in a long-term investment plan, we offer the following chart to depict just how volatile the first quarter was on both the downside and upside:

Given this concentrated volatility (we have been forecasting volatility for the past year), we had to reexamine our view of the economic and investing world to ensure it was still intact. We wanted to confirm that something did not happen to the economy that we somehow missed. We checked the employment gains of the last twelve months to make sure they were still intact, and they were (2.45 million new jobs in 2015). We reviewed inflation to make sure that it was still benign and trending a bit below 2% (it was 0.7% for 2015). We had conversations with economic consultants and investment colleagues to make sure that China was still in business and that its economy was still growing, albeit at a slower rate than recently. It is, and in our opinion it seems to be headed for between 4% and 6% annual growth. We debated the issue of much cheaper oil. Were there benefits to the global consumer? Yes. Would this outweigh, in our opinion, the damage to oil producing and related companies as well as to those countries that are net exporters of energy? Also, would some banks be severely compromised by their exposure to borrowers hurt by cheaper oil? On balance, we concluded that cheaper oil was a net positive (and still believe that). We also debated how many rate increases would be implemented by the Fed, ranging from none to four in 2016, and the impact of each scenario on the different asset classes we mainly invest in: stocks, bonds, hedge funds, and real estate. In our opinion, added volatility would occur especially if there were more than one or two, but valuations would not be changed dramatically.

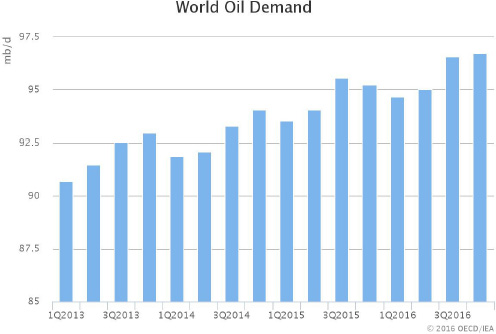

We came to the conclusion, as we faced declining equity markets, investor fear, and volatility, that not a lot had changed from the end of last year. Valuations for stocks were far from cheap but not terribly expensive (about 16 to 17 times projected S&P 500 earnings for 2016). Possible increases in interest rates by the Federal Reserve would be modest and not harmful to the economy, in our opinion. If anything, these rate increases would reflect a better economy characterized by employment growth and modest wage increases. China is in fact slowing but would still provide economic growth to the global economy (and is transitioning from manufacturing/infrastructure to more consumer/services-based growth). Declining oil prices would benefit global consumers, although declining prices would hurt oil producing companies and countries as it did last year. We reviewed oil demand and it is actually growing. Thus, the problem causing cheap oil prices was supply growing faster than demand, which created surplus inventories, and not one of falling demand. It would be more serious if it was a problem of falling demand which could indicate a global recession. We provide the following chart to show that demand for oil is still increasing:

Finally, we believe that the U.S. is not in recession, just growing slower than the average economic expansion and slower than we need to grow. Slow growth is not good for earnings growth for the average company. We believe that our politicians in Washington have let us down by not providing much needed fiscal policy to promote better economic growth. Accommodative monetary policy, that is easy money, must be complemented by fiscal policy of pro-growth initiatives to foster efficient economic growth, which increases employment and capital investment. Business investment is much less than desirable so far, and that is why we have anemic economic growth without the type of corporate capital investment that bodes well for the long term. This leaves corporate America with too much cash and not enough economy-building investments.

What the first quarter demonstrated is that fundamentals can be overlooked in the short term. The quote from Ben Stein implies that investors should look to what any asset’s reasonable valuation is. So, when we go through periods of concentrated volatility, we check the fundamentals and valuations. We did just that and came away with the conclusion that economic and investment conditions did not warrant the sharp selloff of the first month and a half. Accordingly, we stayed the course and our clients did as well. We believe they will be pleasantly surprised when they receive their first quarter asset allocation statements.

Looking Ahead:

We survived the first quarter’s volatility with either very small losses or modest gains in our investment strategies. However, economic conditions are still handcuffed by slow growth or no growth economies. Central banks around the world continue to be accommodative (evidenced by negative interest rates in Germany and Japan) with the U.S. tilting towards some modest tightening, but in a slow and measured way in our opinion. Corporate earnings and revenue growth is challenged and will be modest at best this year. Even this will require some help from the weakening U.S. dollar for U.S. domiciled multi-national companies which will reverse the strong dollar head winds of the past few years that compromised earnings growth for many companies. Oil prices have rebounded from the lows seen early in the first quarter, and perhaps a bottom is approaching. It will take some time for the recent production cut-backs to bring demand and supply into a position where pricing will increase more significantly. As an example, the rig count in the U.S. is down by more than 50% from last year evidencing the cut-back in drilling activities.

On another front, the political situation in the U.S. will likely cause some uncertainty and volatility throughout 2016. The inability of politicians in Washington to agree on fiscal growth initiatives via tax reform and infrastructure spending has hampered domestic economic growth. This and other factors have led to widespread frustration among both individuals and business and is adding to the anger we read about on a daily basis. This lack of pro-growth fiscal policy is the major link missing in what could foster a faster growing domestic economy. My contacts in Washington suggest it is being worked on. I have heard this before, and given the stage of the election cycle, one can assume that such reform will not take place this year. This environment has both individuals and businesses acting defensively, leaving excess cash on the sidelines.

Given all of the above, we expect continued volatility, modest domestic economic growth (therefore no recession in 2016), disappointing global growth, investor hesitation pending moves by the Federal Reserve, and anxiety over the coming election in November. Add to this, the seemingly weekly terror attacks around the world that chill investment and spending appetites.

In this economic and investment environment, we remain positioned with an overweight to our defensive strategies. In our opinion, they provide the best opportunity to achieve a reasonable return over the longer term, while being defensively positioned to weather what we expect to be continued volatility and disappointing economic growth. One strategy provides a growing cash stream of dividends while another provides hedged access to a concentrated portfolio of what we believe to be reasonably valued growth companies that will be successful in achieving above-average earnings growth in this environment. We continue to underweight our international exposure in our traditional equity basket. We simply do not see compelling valuations yet overseas given the murky growth picture, despite the incredibly accommodating central banks.

Cash and fixed income at the current levels of return are not attractive to the long-term investor whose goal is to grow one’s net worth several percent above the modest current inflation rate of roughly 1%. Thus, we are not adding exposure and remain underweight to fixed income. Cash has never been a good long-term asset allocation, and one should only hold cash necessary for spending, taxes, other obligations, and to sleep at night.

Finally, we maintain our recommendation that for suitable investors, an appropriate portion of assets should be allocated to private equity and/or real estate investments where there is a greater potential for returns than our traditional equity investments. These investments typically carry a higher degree of risk as well as a longer period of illiquidity. During the first quarter we made available to suitable clients a private equity opportunity through an investment in a very interesting four-year-old medical products company. Like other investments in our fourth basket of private investments, it is illiquid and has a higher degree of risk. However, we believed the opportunity was worth pursuing and it added to asset diversification for those clients both suitable and interested.

Thus, not a lot has changed, as our first goal is to always preserve capital and not have clients whipsawed emotionally causing potential poor investment decisions. As we have always clearly stated, a well thought out asset allocation with a view to the long term should insulate most clients, if not all, from making emotionally driven short term investment decisions that will rob one of long-term compounding returns.

We have a few pieces of news to share this quarter. First, we are excited to share that Lawrence J. Waldman will be joining the firm as a Managing Director on May 2, 2016. Larry has a long history in public accounting and has been a friend of the firm for quite some time. He will be part of the team which advises current and prospective clients on the benefits and value of FLII’s investment and wealth management services. He will also play a key role in creating as well as furthering strategic relationships with professional services firms on Long Island. Additionally, his financial background will be a helpful contribution to our investment committee. Virginia Umbreit, Vice President – Portfolio Administration and a Member of the Investment Committee, has been appointed to the Board of Directors of the United Way of Long Island. We hope that you will join us in congratulating Virginia.

We look forward to reporting to you after the end of the second quarter. In the meantime, please do not hesitate to call or visit with any member of our investment team to discuss our investment views as well as your individual investment allocations and wealth management needs.

Best regards,

![]()

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending March 31, 2016, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.

Robert D. Rosenthal, Philip W. Malakoff, and Brian Gamble discuss the factors causing market volatility and provide perspective on our approach to long-term investing in 2016 and beyond in an hour-long web seminar.