3rd Quarter 2016 Report to Investors

November 1st, 2016“Investing is the intersection of economics and psychology”

Seth Klarman (famous investor)

Despite significant uncertainty during the third quarter, most equity markets prospered while bond markets were mixed with corporates appreciating and municipals declining slightly. Commodities (gold and oil) were flat to slightly lower and residential real estate seemed to continue its upward trajectory in many markets. Yet investor uncertainty remains centered around what the Fed might do at the end of the year and beyond; who will win the election between two contentious and disliked Presidential candidates; will Italy (after Great Britain) be the next to leave the Eurozone (vote in December); can corporate earnings and the general domestic economy reaccelerate in the last months of the year; are we facing an imminent recession; and what is a prudent path for the long-term investor?

Our quote, from the very successful investor Seth Klarman, gets to the crux of the dilemma facing our clients, especially after a positive quarter for all of our equity strategies (both defensive and traditional). Equity markets are near record highs while the domestic economy muddles along making many stocks seem not cheap and some outright expensive. High-quality bonds, including the 10-year Treasury and the 10-year triple A municipal, are still yielding near record lows and do not seem to be very appealing, especially given their negative returns after taxes and inflation. Additionally, cash is providing horrible returns (peanuts) at this point and is not the right place for a significant portion of assets unless you think we are facing an imminent recession (we do not) or some exogenous event that will send markets plummeting. So, we need to look at both the economics, today and in the foreseeable future, and the fear, which seems to be in everyone’s mind that we are facing something bad given the uncertainties mentioned above.

The current economy is best characterized by the following positive factors:

- Growing employment (average of more than 150,000 new jobs per month)

- Modest growth of real gross domestic product somewhere between 1% and 2%, annualized

- Stabilization in oil pricing in the $45 bbl to $50 bbl range

- Slightly lower corporate earnings overall, impacted by lower earnings from oil companies; non-oil-related companies are growing slightly and could benefit in the fourth quarter from a more stable dollar

- Auto sales continuing at a high rate

- Home sales seeing an annual increase in price of about 5% for the last year

- Interest rates remaining near historic record lows

- Modest growth in international economies, as a whole, with China showing stable growth of about 6% to 7% (if you believe the numbers)

- Domestic banks, on balance, seeming to be in strong financial shape based on the results of rigorous federal stress tests

However, from a negative economic standpoint the following are weighing on us:

- Productivity is low

- Business investment in plant and equipment is weak

- Our national debt is nearly twenty trillion dollars and growing

- Food stamp usage continues to grow

- The struggling middle class is facing higher medical insurance costs from the Affordable Care Act

- Equity markets are trading at relatively high levels to earnings

- This bull market in equities has lasted a long time (7+ years) and fund flows have been out of equities (despite rising markets)

- Terror and the war torn region of the Middle East weigh on investors’ minds and are exacting a tax (both human and otherwise) on the developed world

The above positives and negatives bring to the surface the strong psychological forces of both fear and greed. Many fear markets will decline in the short term (they have been wrong up until now). Selling out and holding cash or bonds as a safety net will provide meager to negative returns after inflation. What if equity markets continue to climb the wall of worry and make reasonable gains (the average investor historically gets this timing wrong) if slow growth and the low interest rate environment persists? Our analysis must consider how we deal with a not terrible domestic economy while channeling our fear and greed into a rational investment strategy. I will use a quote by Robert Allen (a well-known investor) to frame the issue:

“How many millionaires do you know who have become wealthy by investing in savings accounts?”

If you are already very wealthy then you could preserve your wealth through savings accounts, however you would lose value after inflation and not earn a reasonable return on which you can live. So, that alone makes no sense to us especially if you are living on income from your assets.

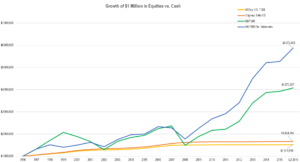

We offer the following chart to highlight how, over long periods of time, having an exposure to both traditional and defensive equities (e.g. – those bearing growing dividends) have rewarded the patient and battle-weary investor who can endure the periodic pain of equity market downturns (that in some cases can last a year or longer) over those with assets just sitting in cash and cash equivalents:

Being a long-term investor with an allocation to equities paid off in a big way if you were able to withstand the periodic severe downturns over the past twenty years. We chose the last twenty years because that period included the dramatic downturn from the undoing of the tech bubble in 2001 and 2002 and also reflected the horrible “decession” of 2008. The comparison has also been aided by the horrendously low interest rates of the past eight years as we have endured the financial repression of a Federal Reserve operating on steroids, as Congress could not provide any pro-growth initiatives. The period we have chosen is reasonable in addressing the emotions of fear and greed as investors. True it is a long period of time, however Americans today live into their 80’s and 90’s. This is especially the case for most of our clients who have access to the best medical technology, medication, and medical facilities. We should all think long term by having some allocation to both traditional and defensive equities. Of course history is no guaranty for the future, but it certainly provides us with some direction.

The Intersection of Economics and Psychology – What do we do?

Being a long-term investor with an allocation to equities has been a smart thing to do in the past. We at FLI believe that our advice to have a significant defensive equity allocation still makes sense and perhaps even more sense given the economic negatives we have outlined. Cash or its equivalents are a horrible returning asset class, although it can provide comfort to help you sleep at night during these uncertain times. Therefore, we recommend that you determine the amount of cash you need to be able to sleep at night and set it aside. Then permit us to craft an asset allocation that recognizes today’s uncertainty but also allocates a portion of your liquid assets to asset classes that should conservatively grow your wealth over long periods of time, with a bias to quality and what we perceive to be of lower risk.

The prudent asset allocation we advise our clients to have should help them balance their emotions of fear and greed. Keeping those in balance should provide not only a return of capital but a return on capital over the long term. This is necessary to battle the recently higher tax burden we face, today’s financial repression of very low interest rates, and the creeping inflation that reduces purchasing power.

As we approach the end of the year with much uncertainty, we believe with certainty that longer-term investors will benefit from an asset allocation that includes some risk assets (including traditional equities) with a bias to our defensive strategies that have delivered solid returns while providing some shelter from the downturns that we are bound to face. Never bet against entrepreneurial and innovative America over the long term; an America that is still the best democracy in the world, irrespective of the current political nonsense that only serves to make us underachieve from what our national capabilities are. Perhaps the next Administration and Congress will get it right.

We would also like to let you know that two of our younger investment professionals, Brian Gamble, Vice President, and Drew Wray, Assistant Vice President, have each recently obtained their CERTIFIED FINANCIAL PLANNERTMi certification. The rigorous financial education that goes into achieving and maintaining this designation will help them and FLI provide in-depth wealth management solutions to our clients. We congratulate them on this achievement and look forward to their greater interaction with, and service to, our clients.

As we approach the end of the year, we want to wish all of our clients and the professional network we work with, a joyous and safe holiday season. Please call upon us with any asset allocation and wealth management issues or questions you might have. Year-end is always a time to reflect on asset allocations, passing assets to the next generation in a tax effective manner, and considering some possibly tax-efficient philanthropic bequests. Let us help you.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

Disclosures, Important Information

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal as of September 30, 2016, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.

i Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.