2017- A big change is coming, maybe! – Investment Outlook

January 17th, 2017“Change is the law of life. And those who look only to the past or present are certain to miss the future.” – John F. Kennedy

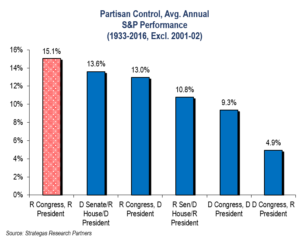

Change typically is not necessarily accepted well in the short term by financial markets. However, the unexpected (for most) election of President-elect Donald J. Trump and the control of both houses by Republicans represents significant change from what had been expected by many to be a Presidential win for Hillary Clinton and the potential that the Senate would flip to Democrat control. The unexpected, like Brexit, occurred and President-elect Trump will be accompanied by both a Republican House and Senate. Initially, domestic financial markets responded well. By the way, historically when the presidency and both houses of Congress have been controlled by Republicans, equity markets have done well (this is a historical guide and not a guaranty):

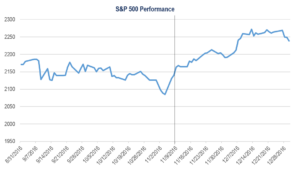

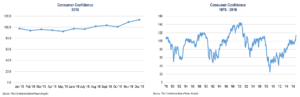

Stock market performance and consumer confidence jumped right after the election anticipating tax reform, less regulation, and the repeal or major modification of the Affordable Care Act. Notably, consumer confidence is finally at close to pre-“decession” levels.

The knee jerk reaction was a very positive one. However, we believe this was driven by certain campaign promises plus the potential to reverse aspects of the Obama administration’s policies that many believe have held our economy somewhat hostage. Specifically the following promises made could provide a significantly changed domestic economic environment worthy of the current optimism:

- Major corporate tax reform with an emphasis on reducing the corporate tax rate to make the U.S. more competitive globally, along with encouraging domestic business investment should lead to productivity gains and economic expansion at a faster pace than the eight Obama years. This private sector investment has been missing and is needed.

- Individual tax reform to simplify the tax code should deliver some economic benefit to the middle class while eliminating certain loopholes for the well-to-do, which will keep the cost of reform reasonable.

- Investment in the country’s infrastructure is long overdue. This can be paid for in part through repatriation legislation that will impose a tax on corporate funds brought back from overseas. This lower rate of tax (than what has been paid previously on earnings repatriated from overseas) can be used to fund an infrastructure program, mitigating some of the cost. The balance of the infrastructure program funding will require some borrowing and an increase in the national debt.

- A reduction in the number and scope of countless unnecessary (in our opinion) regulations at every level of business, both big and small should reverse conditions that have stifled business growth and in turn lead to better paying jobs. From the financial sector to everyday small businesses, companies face overly burdensome regulations that are costly and time consuming that need to be lifted or reduced. This will stimulate growth from a more confident private sector in our opinion.

- Modification/repeal of the Affordable Care Act should recognize its costly deficiencies but maintain certain beneficial aspects of the plan. Insuring more Americans and providing for those with pre-existing conditions is absolutely necessary. However, the cost to do such must be controlled through greater efficiency, larger pools of healthy participants, increased competition, and the reduction of Medicare/ Medicaid fraud. Additionally, expansion of health savings accounts or similar vehicles can also help.

- Border control is a must to stem the tide of illegal immigrants and stop the destructive pathway for illegal/harmful drugs. This does not mean the mass deportation of people living here peacefully but without proper documentation. It means stem the illegal tide, rid the country of violent illegals, and create a better system for peaceful, constructive illegals to remain but not with guaranteed citizenship.

- The proper use of Congress in a bipartisan way is necessary so that the overuse of executive action no longer takes the place of legislation. We are not suggesting that the legislative paralysis caused by partisan politics did not lead to some of the executive actions. It probably did. This has to change for the good of all Americans.

Now, the above will take time, perhaps a lot of time, and a lot of negotiating if there is going to be some bipartisanship and therein lies the potential for disappointment and volatility in the equity markets. President Obama learned the hard way that there really were no projects for his fiscal stimulus program. President-elect Trump must be patient for well thought out national and local infrastructure projects, should spending be approved. Cooperation at all levels of government and partnership with the private sector is essential to plan and implement this much needed rebuild of our roads, trains, bridges, airports, and other aspects of our infrastructure. This will promote an expansion of better paying jobs, in our opinion.

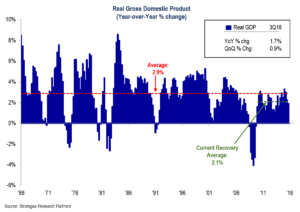

If the tax reform and infrastructure can be coupled with repatriation and some deficit spending financed in part with debt, our economy could grow at something more than the current anemic pace of the last eight years. The following chart shows the slow recent growth despite the benefit of extremely low interest rates. Although enabled by a Federal Reserve operating on steroids, global growth supported by low interest rates as well as monetary stimuli without fiscal growth initiatives, was below that of other recoveries:

Although the above lackluster domestic growth enabled the economy to avoid recession since 2008 –2009, middle class wages in the U.S. have barely made any progress and some have been further compromised by burdens caused by the Affordable Care Act. Thus, more rapid growth as well as tax reform is needed to spur on consumers (about 70% of the domestic economy) and encourage businesses to invest in order to drive productivity and economic growth. If this does not happen in the early stages of this new administration, the result could be a very disappointed equity market.

Meanwhile, while we wait for some magic to happen in Washington, our job is to assess the valuation and prospects for the investments we make for our clients. This is complicated by a world in some turmoil. The Middle East is ablaze; Russia is acting in a predatory fashion in some areas outside their borders; China is arming all seven of the artificial islands it has built in the South China Sea; and North Korea’s dictator banned Christmas and continues to develop an aggressive nuclear capability. Special mention must be given to ISIS, which continues to plague the world with its special breed of terror aimed at Christians, Jews, and some moderate Muslims whose societies they view as infidels.

As the world struggles with cyber-attacks; half a million killed in Syria; war and massacres plaguing Yemen, Libya, and the Sudan; terrorist attacks in Germany, France, Turkey and the U.S.; the world community, as represented by the inept UN, found the time to condemn some settlements being built in disputed territories in the democratic country of Israel (its favorite punching bag).

Now, back to the foundation of what we do— investing in a prudent way driven by diversified opportunity based on reasonable valuation, quality, and always with a view towards preservation of capital. In 2016 we believe clients did reasonably well as all of our traditional equity and defensive strategies achieved positive results. In our private investments we believe progress was made in all but one of several different investment vehicles (and that one exception we believe continues to have significant upside although it continues to take more time than we envisioned). Our leading strategy in 2016, Dividend Growth, netted more than 12% on average despite being labeled defensive. Its value and dividend growth orientation outpaced growth strategies, which had been superior performers in 2014 and 2015.

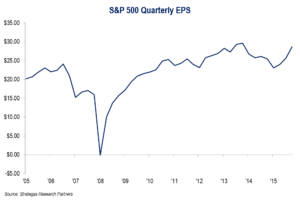

For 2017, equity markets in general appear to be fairly to slightly more than fairly valued while waiting for earnings growth from the average company to reaccelerate should the general economy pickup. This, in our view, depends on the success of “Trumpenomics.” S&P earnings had stalled until the last two quarters where a slight pickup was registered/is expected. (Third quarter grew by about 3% and fourth quarter is projected to do about the same.)

As the chart above shows, earnings growth stalled, declined a bit, and has started to grow again. As a result, price earnings multiples rose to 19x on trailing twelve month earnings and 16.9x on the consensus projected earnings for 2017. This is not terribly worrisome unless you believe a recession is imminent. We do not! The yield curve for bonds is not inverted, which when it occurs historically has been a sign of a forthcoming recession. With the Federal Reserve on the move with a forecasted three interest rate increases in 2017, one can assume that the economy and inflation are picking up somewhat along with decent employment growth. One can also make the case that those bond investors who extended maturities to garner more yield are in for some paper losses in their portfolios. This could lead to sales of bonds and bond funds by investors and a flight to equities, as occurred towards the end of 2016. We continue to be cautious about bond investing in general and have an under-weight allocation to fixed income for our clients.

Our view going forward is that it is not an easy environment to invest in and one must be cautiously opportunistic, as well as realistic, in terms of what returns to expect. I have already stated that we are under-weighting bonds because as rates increase, even slowly, longer maturity bond portfolios will not earn much if anything with the ten-year treasury at 2.5% pretax, and five-year triple A munis yielding about 1.8%. These figures are pre-fee and are not very attractive versus inflation targeted by the Fed at about 2%. Of course, if you believe that we are facing a recession or some systemic disruption, then a bond allocation should provide an anchor. Even so, we would still underweight this allocation for the long-term investor seeking better risk-adjusted returns as bonds may keep pace with inflation at best from current levels.

Given the uncertainty with the new President-elect as well as a Republican House and Senate, coupled with global unrest, we remain cautious, selective, and concentrated in the vast majority of client portfolios. This fits nicely with our three defensive strategies, which we believe provide better upside than bonds and cash over the longer term and less volatility than traditional equity markets. For example, FLI Dividend Growth is concentrated in stocks that have above average yields and consistently growing dividends (average of 23 consecutive years). We believe that concentrated portfolios will have a better chance of outperforming the averages in what could be a more volatile environment driven by changing tax policy, changes to the Affordable Care Act, and immigration policy implementation as well as possible disruptions from geopolitical events. Also, we must not leave out possible economic disruption and resulting volatility from President-elect Trump’s stance on global trade as well as possible punitive tariffs. This is a wild card where differences exist between the President-elect and both sides of the aisle in Congress.

We remain cautiously constructive on real estate as the economy improves and we will continue to seek out appropriate investment opportunities in this space. However caution is the operative word as the real estate community has to deal with both increasing interest rates (although still very low from a historical standpoint) and new supply coming to market as developers have taken advantage of low interest rates. In areas of private equity, we continue to look for high-quality opportunities. We have no opinion on commodities except that oil should be less volatile and probably be range bound between $45 and $65 per barrel. It is not an area we are comfortable in given its volatility, speculative appeal, and difficulty in evaluating based on fundamentals.

In summary, our view for 2017 is cautious optimism given the espoused economic agenda of the new administration. In particular, we believe that tax reform, infrastructure, and less regulation will unharness the productive, creative, and entrepreneurial characteristics of Americans and American business. However, the obvious lack of political experience by a group of extremely successful business people and former distinguished military leaders making up much of President-elect Trump’s cabinet, and his lack of political experience, will cause fits and starts as well as possible volatility. This, coupled with a Fed on the move with higher interest rates and a difficult geopolitical environment, leads us to underweight fixed income, overweight our three defensive strategies, somewhat underweight our traditional equity strategies, and look opportunistically at private investments that have superior return potential despite higher risk and less liquidity than our other strategies. Over the long term, fundamentals ALWAYS matter in each asset class we invest in. Our disciplined long-term approach in evaluating fundamentals is our beacon in protecting your capital and providing you with the opportunity for reasonable long-term appreciation. We believe opportunity exists in our defensive, traditional, and private investments to reap solid returns over the long term. However, selectivity and concentration are likely to be important going forward.

The above recommendations are what we suggest to our clients on a quarterly basis as we review their asset allocations. Our advice was pretty much the same last year and it worked out reasonably well despite significant volatility in the first quarter. One had to have a diversified asset allocation in 2016 as demonstrated with value equities coming into vogue, while some great growth companies lagged despite superior earnings growth for the most part. Do not let your emotions or “likes” dictate your asset allocation. Let us help guide your allocation to insure exposure to areas that, over time, have rewarded long-term prudent investors with a quality bias. Finally, as JFK’s quote suggests, change is a necessary ingredient to a successful future. We believe the political stage is now set to encourage economic change leading to better growth, entrepreneurialism, and private sector confidence in America. However, there will be bumps along the way.

We wish you all a very happy and healthy New Year. We are here to help you with your wealth management needs beyond the investment of your liquid funds. Please call upon any member of our investment team to discuss our perspective in greater detail, or if you would like to discuss your asset allocation. Additionally, we will be hosting a web seminar on February 8th at 2 p.m., EST to review our outlook for 2017 and take questions from participants. We hope you will dial in.

Best regards,

Robert D. Rosenthal

Chairman, Chief Executive Officer

and Chief Investment Officer

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending January 13, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2016 by First Long Island Investors, LLC. All rights reserved.