1st Quarter 2017 Report to Investors

April 26th, 2017March 31, 2017

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

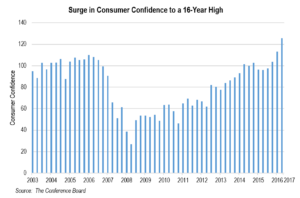

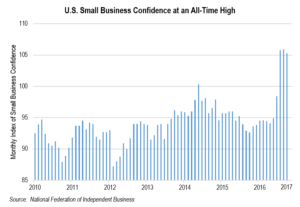

Virtually all domestic equity markets in the first quarter of the year reflected continued economic optimism that resulted post the contentious 2016 Presidential election. Small business and consumer confidence, important factors which support the markets in our opinion, continued to gather steam in the quarter as indicated in the charts below:

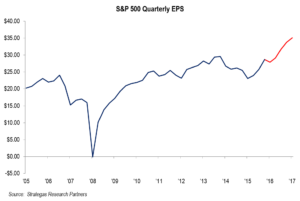

The domestic equity market, as measured by the S&P 500, recorded a 6.1% gain and reached an all-time high during the quarter. The NASDAQ also registered a new high with a gain of 10.1%. Other domestic equity indices did fairly well (mid and small-cap growth), and international indices showed some lift (the MSCI All-World ex US appreciated 7.9%). However, not all industry sectors followed suit with banks, transports, and energy companies giving back some gains since the November election. Small-cap value was actually the only domestic equity style that had a very slight decline (-0.1%). Oil continued to be range bound ($45-$55) ending the quarter at $50.54 per barrel. Not much of a spurt given the attempt by OPEC nations to cut production and raise prices. Housing was strong both from a sales price standpoint and the number of homes sold. Corporate earnings, represented by the S&P 500, grew in the fourth quarter of last year (4.9%) (we await results for the first quarter). Projections from our economic consultants indicate continued growth in S&P 500 earnings in this first quarter with perhaps a rise of as much as 10%.

If earnings continue to rise throughout the year (and we believe there is a good chance that will happen), valuations will become more reasonable which could bode well for equities. By the way, most major equity indices outperformed bonds. Quality bonds with shorter maturities continue to have very modest yields and in some cases yields below the current rate of inflation. Accordingly, we continue to underweight bonds for most clients.

Our defensive and traditional equity strategies (those in baskets two and three) all had strong first quarter results. Things sound and feel rather good. We at FLI remain with a defensive tilt and an overweight to our defensive strategies.

Our reasoning is based on a series of factors (some are concerning and some are constructive):

- As expected, the Federal Reserve raised rates by a quarter of one percent in March and is predicting an additional two raises this year. This is not necessarily a negative as we believe that the Fed intends to raise rates because it believes that economic conditions should improve, and rates remain historically low. However, the gradual rate increases and the slimming down of the Fed’s balance sheet could present some volatility later in the year.

- Politics in Washington remains contentious, and the Republican majority in both Houses has not resulted in any meaningful pro-growth legislation as of yet. The confidence gap in Washington (low approval ratings of both Congress and the President), felt by most Americans, remains in place. More on this later.

- Valuations are at the high side of reasonable, in our opinion. Nothing is cheap but better earnings and a possible corporate tax reduction would help to reduce the price-earnings multiple on the S&P 500 (currently projected at 18x 2017 earnings) and other indices.

- The yield curve is flattening somewhat, but still steep enough to promote healthy bank earnings in our opinion.

- North Korea and Syria remain geopolitical hot spots.

- Volatility remains unusually tranquil. There were only two days where the S&P 500 moved by 1% or more (in either direction) during the first quarter. Quite different from the first quarter of last year where volatility was much greater. We do not believe this will last.

- There is potential political instability in Europe. Populism is an issue.

- Trade policy out of Washington remains an unknown and a possible concern if we become more isolationist.

- Tax reform needs to become a reality in order to help boost GDP growth above the current sluggish 2% level.

- Employment remains strong.

- Banks and consumers are financially strong, for the most part.

The above economic and political factors paint a reasonable but cautious picture. We are in an environment where animal spirits are held back somewhat by continued political paralysis, but bearish sentiment is tempered by many positive economic factors. This presents a dilemma for investors who do not utilize a well formulated and prudent asset allocation. This yin and yang of investment sentiment is actually a positive as far as we are concerned. There is no unabashed optimism about anything right now. From a contrarian standpoint, that would suggest there is more good news to come.

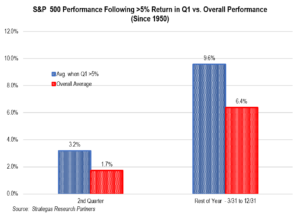

History is on our side based on the S&P 500 having just recorded a strong first quarter of 2017 with a return of 6.1%.

As the chart above indicates, a robust first quarter is historically followed by stock market happiness during the rest of the year. At least that has been the case over the past 66 years.

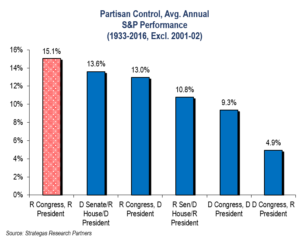

Another chart which gives cause for optimism is this political snapshot of stock market history:

Although we are students (disciples) of history, we know it is only a guide and not a guaranty. We need to see fiscal growth and reform initiatives take the baton from the monetary policy we have been relying on over the past eight years. That will require something better than we have seen in the last sixty-plus days out of Washington. The animus from the November election unfortunately continues. The leadership on both sides have yet to act in a bipartisan manner. This behavior is not in the best interests of America. Only time will tell if this changes. Meanwhile, we must invest prudently and rely on fundamentals to give us the best opportunity for long-term appreciation.

As Warren Buffett recommends in our quote of the quarter, we believe, for the most part, that we are paying a “fair price” for really good companies. Those companies that are really good but sell at prices we deem too high, we will not purchase, but we have little fear in owning really good companies that are fairly priced. Even with market setbacks, they should grow into their own over time especially as we and others believe that corporate earnings will continue to grow. The same holds true with other asset classes that we invest in. Our real-estate oriented investments are also made with a view towards quality (location) and realistic valuations. This is especially important when interest rates could trend higher. If rates were to ratchet up, this might impact real-estate valuations. It is unclear if the Fed will raise interest rates another two or three times this year. It will be data dependent and much will depend on what happens in Washington. The same holds true with art and other collectibles. As the cost of borrowing gets higher, and if economic growth remains anemic, quality and price has and will continue to matter.

As advisors to investors (including ourselves as we invest side by side with clients), we are mindful of the cumulative gains we have made over the past eight years. Fairly assessing the economic landscape and current valuations are critical to our advice. Reality has to pervade our thinking even if we tend to be cautious. Although we do not see a recession occurring in the near future, our defensive tilt results from some uncertainty about the pace of domestic and global growth. Adding to this is the business as usual lack of bipartisan cooperation in Washington, D.C. However, we remain bullish on America over the long term. Accordingly, we remain committed to an asset allocation that should give us returns that exceed inflation and taxes. Our portfolios in various asset classes are typically concentrated. We generally look for the best companies that are reasonably priced, the best investment managers that we can partner with, and the best hard assets that we can find of quality and fair valuation. American business is great at innovating while Americans are a hearty and productive society that does not permit temporary disappointments to become permanent set-backs.

As Warren Buffett stated in Berkshire Hathaway’s most recent Annual Report: “This economic creation will deliver increasing wealth to our progeny far into the future. Yes, the build-up of wealth will be interrupted for short periods from time to time. It will not, however, be stopped. I’ll repeat what I’ve both said in the past and expect to say in future years: Babies born in America today are the luckiest crop in history.”

We agree with Mr. Buffett. Never bet against America. Despite political bickering and geopolitical issues (all of which we have lived through before, time and time again) we invest for the long term with customized asset allocations for each of our clients to reflect their individual needs, goals, and circumstances. Let us help you evolve an asset allocation that keeps you moving forward in wealth creation over the long term through our experienced guidance in both wealth and money management.

At this time, we continue to underweight our security basket (bonds and cash), overweight our defensive basket, modestly underweight our traditional equity basket, and be opportunistic in our private investment basket as solid opportunities in private equity and real estate present themselves. Please call us with any questions you might have on wealth or money management issues for our advice.

Best regards and let’s look forward to a wonderful spring!

Robert D. Rosenthal

Chairman, Chief Executive Officer,

and Chief Investment Officer

Disclosures, Important Information

*The forecast provided above is based on the reasonable beliefs of First Long Island Investors, LLC and is not a guarantee of future performance. Actual results may differ materially. Past performance statistics may not be indicative of future results. Disclaimer: The views expressed are the views of Robert D. Rosenthal through the period ending April 24, 2017, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such.

References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Content may not be reproduced, distributed, or transmitted, in whole or in portion, by any means, without written permission from First Long Island Investors, LLC. Copyright © 2017 by First Long Island Investors, LLC. All rights reserved.